fsr15dec3

advertisement

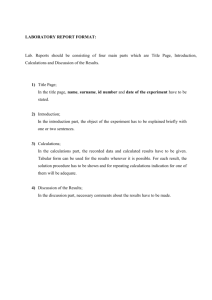

Part A: UK current account Chart A.17 The UK current account deficit has widened since 2011 Decomposition of the UK current account(a) Sources: ONS and Bank calculations. (a) Primary income mainly consists of compensation of employees and net investment income. Secondary income consists of transfers. Chart A.18 Differential rates of return likely explain a small part of the deterioration in the current account International ten-year government bond yields(a) Sources: Bloomberg, ONS and Bank calculations. (a) Measured as ten-year zero-coupon yields derived from prices of conventional government bonds covering a broad range of maturities. (b) (b) Proxy for the yield received by UK investors in overseas government bonds. Combination of euro-area (France and Germany) and US ten-year zero-coupon yields, weighted by the proportions of UK external assets accounted for by those countries. Table A.19 UK inward investment has picked up but remains low by historical standards Inward investment to the United Kingdom(a) Sources: ONS and Bank calculations. (a) Net acquisition of foreign liabilities by UK residents, four-quarter moving average. (b) Other investment consists mostly of loans and deposits. Table A.1 The composition of recent financing flows is not a major source of vulnerability Financing flows behind the current account deficit, 2014 Q3 — 2015 Q2 Sources: ONS and Bank calculations. (a) This is the change in UK foreign liabilities, less the change in UK foreign assets, for each category of investment. The total net inward financing flow is equal in magnitude to the current account deficit (plus net errors and omissions). (b) ‘Other investment’ consists mostly of loans and deposits. Chart A.20 The United Kingdom’s external liabilities as a share of GDP have been falling UK gross external liabilities by type(a) Sources: ONS and Bank calculations. (a) Derivatives are excluded. Chart A.21 UK financial institutions have reduced their foreign currencydenominated debt Changes in UK-resident financial institutions’ foreign currency-denominated debt liabilities by type(a) Sources: Bank of England and Bank calculations. (a) The chart shows the net incurrence of foreign currency-denominated debt liabilities in each class in each period. Building societies are excluded from the MFI data before 2008 but their contribution to the total is small. Data are not seasonally adjusted. Chart A.22 The private sector financial balance has fallen Net lending as a share of GDP by sector Sources: ONS and Bank calculations. (a) Includes households, non-profit institutions serving households, private non-financial corporations and financial corporations. (b) General government plus public corporations.