Getting a Grip on GRIP ( Iowa presentation) (November 2005)

Getting a Grip on GRIP

Gary Schnitkey

Agricultural

Economist

University of Illinois

1

Topics

1. Illinois versus Iowa experience

2. How GRIP works

3. Risks/Returns

4. Situations where it works

2

GRIP

GRIP (Group Risk Income Plan) is revenue insurance based on county yields

– GRIP-NoHR (No Harvest Revenue option) – much like RA with base price option

– GRIP-HR (Harvest Revenue option) – much like CRC or RA with harvest price option

GRIP is the revenue counterpart to the county-level yield insurance GRP (Group Risk

Plan)

3

Group

GRP

GRIP-NoHR

GRIP-HR

Group Products Akin To

Akin to

APH

Insurance Type

Yield

IP, RA with base price

Revenue – no guarantee increase

CRC, RA with Revenue harvest price guarantee increase

4

Introduced in I states

Introduced

GRP (Group Risk Plan)

GRIP-NoHR

1995

1999

(Group Risk Income Plan -- No Harvest

Revenue option)

GRIP-HR 2004

(GRIP -- Harvest Revenue option)

5

Group Product Use, Corn,

Illinois

12

10

8

6

4

2

0

Iowa 2005 Use

GRP – 1.2%

GRIP – 3.6%

GRP

GRIP

1997 1998 1999 2000 2001 2002 2003 2004 2005P

Year

6

Group Product Use,

Soybeans, Illinois

14

12

10

4

2

0

8

6

Iowa 2005 Use

GRP – 1.9%

GRIP – 4.7%

GRP

GRIP

1997 1998 1999 2000 2001 2002 2003 2004 2005P

Year

7

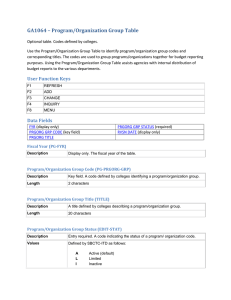

Percent of Iowa Counties

Receiving GRIP-NoHR Payments for Corn, 1999 -2004

---------- Coverage Level ------------

Year 90% 85% 80% 75% 70%

1999 54% 30% 11% 4% 2%

2000 66 22 2 1 0

2001 72 49 25 11 1

2002 3 3 3 1 1

2003 3 0 0 0 0

2004 82 72 41 16 1

AVG 47% 29% 13% 6% 1%

8

Percent of Iowa Counties

Receiving GRIP-NoHR Payments for Soybeans, 1999 -2004

---------- Coverage Level ------------

Year 90% 85% 80% 75% 70%

1999 19% 9% 4% 2% 2%

2000 69 57 31 18 6

2001 46 19 8 4 1

2002 0 0 0 0 0

2003 30 15 9 7 5

2004 95 85 71 51 23

AVG 43% 31% 21% 14% 6%

9

How GRIP Works

Marshall County, Iowa

2005 Example

10

Parameters in 2005

County: Marshall County, Ia

Crop: Corn

Expected Yield: 164.3 *

Expected Price: $2.38 **

* County specific, set by RMA

** Settlement prices during February

(Next year for entire month)

11

Farmer choices

Protection Level

Choice from within range

Max

GRP

$579

Min $323

GRIP

$587

$346

Max varies by year, based on formula

Max results in highest premiums and highest payments, when they occur

12

Farmer choices

Coverage Level

70% to 90%

Suggestion:

Take highest coverage level

Change payment/premium by lowering protection level

13

2005 Per Acre Premiums,

Marshall County, Iowa

(100% Protection Level, Corn)

Coverage

Level

70%

75%

80%

85%

90%

GRP

$3.96

4.80

6.17

6.89

8.60

GRIP-NoHR

$2.96

4.24

6.90

10.00

15.92

GRIP-HR

$5.51

7.22

10.58

13.85

20.25

14

Per Acre Guarantees,

90% Coverage Level

Type

GRP GRIP-NoHR GRIP-HR

Yield

Coverage level .90

x Expected yield 164.3

Revenue

.90

164.3

Revenue

.90

164.3

x Price

Guarantee xxx $2.38

147.9 bu $352

$2.38 @

$352 @@

@ Higher of expected or harvest price

@@ Will be higher when harvest price > expected price

15

Payment example

“Typical” Year

Actual yield = 170 bu.

Harvest price = $2.00

Guarantees on previous slide (90% cov level)

Shortfall = (Guarantee – Actual)/Guarantee when Guarantee > Actual

GRP: .000 (147.9 guarantee < 170 actual)

GRIP-NoHR: ($352 - (170*2)) / $352 = .034

GRIP-HR: ($352 - (170*2)) / $352 = .034

16

Payments (Max Protection

Level, 90% Coverage Level)

GRP

Prot. level $579

GRIP-NoHR GRIP-HR

$587 $587

X shortfall .000

.034

.034

X price factor xxx xxx 1.00 *

Payment $0 $20 $20

* Higher of (harvest price / expected price) or 1

17

Payment example

“Drought” Year

Actual yield = 130 bu.

Harvest price = $3.00

Shortfall = (Guarantee – Actual)/Guarantee when Guarantee > Actual

GRP: (147.9 – 130) / 147.8 = .121

GRIP-NoHR: .000 Guarantee < actual ($390)

GRIP-HR: ( $443 - (130x3)) / $443 = .120

18

Per Acre Guarantees, Revised

90% Coverage Level

Type

GRP GRIP-NoHR GRIP-HR

Yield

Coverage level .90

x Expected yield 164.3

Revenue

.90

164.3

Revenue

.90

164.3

x Price

Guarantee xxx $2.38

147.9 bu $352

$3.00 @

$443 @@

@ Higher of expected or harvest price

@@ Will be higher when harvest price > expected price

19

Payments (Max Protection

Level, 90% Coverage Level)

GRP

Prot level $579

GRIP-NoHR GRIP-HR

$587 $587

X shortfall .121

.000

.120

X price factor xxx xxx 1.26 @

Payment $70 $0 $89

@ Higher of (harvest price / expected price) or 1

(3.00 harvest price / 2.38 expected price) = 1.26

20

Year

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

GRP Shortfalls, Marshall County,

Iowa, Corn (90% coverage level)

Expected Final

Yield

131.1

133.2

133.7

139.4

GRP

Yield Shortfall (90%)

0

0

133.2

135.3

136.5

137.6

146.7

136.4

144.5

153.8

144.0

150.5

0

0

0

0

0

146.7

150.1

158.4

181.8

175.9

183.2

0

0

0

21

Marshall County, Corn

Yields

200

180

160

140

120

100

80

60

40

20

0

19

72

19

75

1977

19

78

19

81

1988

1993

19

84

19

87

19

90

Year

19

93

19

96

19

99

20

02

22

GRIP Shortfalls, Marshall County,

Iowa, Corn (90% coverage level)

Year

1999

2000

2001

2002

2003

2004

Expected Harvest GRIP

Price Price Shortfall (90%)

2.40

2.54

1.96

2.11

0

.034

2.45

2.30

2.38

2.93

2.05

2.43

2.37

1.99

.046

0

0

.127

Shortfalls the same for GRIP-NoHR and GRIP-

HR.

23

Year

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

GRP Shortfalls, Marshall County, Iowa,

Soybeans (90% coverage level)

Expected Final

Yield

45.2

46.6

50.6

49.2

GRP

Yield Shortfall (90%)

0

0

46.6

47.7

51.8

52.6

50.4

51.6

50.3

45.2

53.4 49.7

0

0

0

.045

0

52.5

53.1

53.6

53.5

31.7

51.6

0

.336

0

24

GRIP Shortfalls, Marshall County,

Iowa, Corn (90% coverage level)

Year

1999

2000

2001

2002

2003

2004

Expected Harvest GRIP

Price Price Shortfall (90%)

4.95

5.36

4.85

4.72

0

.129

4.59

4.53

5.23

7.27

4.37

5.45

7.32

5.26

.013

0

.058

.183

Shortfalls the same for GRIP-NoHR and GRIP-

HR.

25

Risk/returns www.farmdoc.uiuc.edu/cropins/index.html

26

Crop Insurance Evaluator:

For an example farm in each county for corn and soybeans shows the following for different insurance product:

Frequency of payments

Premiums

Average payments

Net costs

Ability to prevent disasters

27

Marshall County, Corn

“Average” farm for county

159 bu. APH yield, average variability

Evaluations shown for 2005 year

Evaluations based on maximum protection level

28

Frequency of payments

Example of tables from Evaluator

29

1% VAR

A 1% VaR of $200 means that

1% of the time revenue will be below $200

Measure of risk reduction

Want VaRs to be as high as possible

30

1% VaR from Evaluator

$ per acre, Corn

Level APH CRC

65% 203 212

GRP GRIP-NoHR GRIP-HR

75% 221 231 198 205 204

85% 243 247 205 216 217

90% 213 223 226

Group products lower risk less than Individual products

Low coverage Individual not as “good” as high coverage Group

31

Net Costs

Average payments over time minus premium

High levels indicate high costs, negative levels mean expect more insurance payments than premium over time

32

Net Costs from Evaluator

$ per acre, Corn

Level APH CRC GRP GRIP-NoHR GRIP-HR

65% 1.45 2.26

75% 1.74 2.04 .78 -3.94

-4.65

85% 3.76 4.77 -4.65 -12.50 -17.87

90% -9.77 -17.13 -26.47

Individual products have higher costs than Group products

33

Marshall County, Soybeans

“Average” farm for county

50 bu. APH yield, average variability

Evaluations shown for 2005 year

Evaluations based on maximum protection level

34

1% VaR from Evaluator

$ per acre, Soybeans

Level APH CRC GRP GRIP-NoHR GRIP-HR

65% 166 174

75% 183 192 159 162 164

85% 203 207 165 173 175

90% 168 179 180

Group products lower risk less than Individual products

Low coverage Individual not as “good” as high coverage Group

35

Net Costs from Evaluator

$ per acre, Soybeans

Level APH CRC GRP GRIP-NoHR GRIP-HR

65% .57 1.06

75% .81 .93 -.56 -2.66

-2.68

85% 1.48 2.89 -3.18 -7.96 -8.95

90% -5.31 -10.52 -12.60

Individual products have higher costs than Group products

36

Risk/Returns Summary

Group products cost less than individual products. Over time, group products may average more in payments than paid in premiums

Group products reduce risk less than individual farm products

37

Situations Where Group

Products Work:

Farm-yields either:

1. Closely follow county-yields (i.e., large farm), or

2. Are above county-yields

Farm has low APH

Farm is in relatively strong financial position

Tend to work best in “good” producing counties

38

Situations Where Group

Products Do Not Work as

Well:

Highly leveraged farms

Farms where re-planting occurs often

Hail is a major concern

Farms with high-risk farmland

39

Summary

GRIP does fit certain situations

Represent another option in the risk management tool kit

40