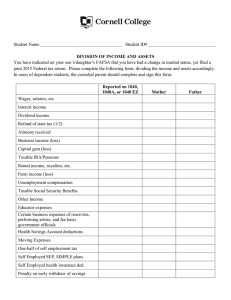

1 I. Unit I

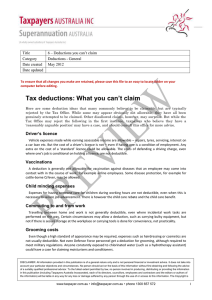

advertisement