1 I. Unit I

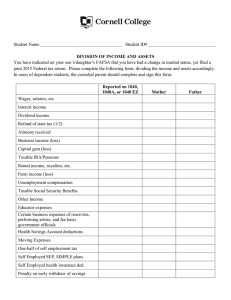

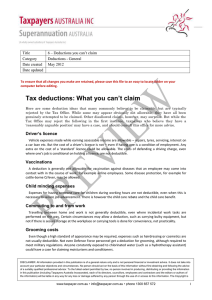

advertisement