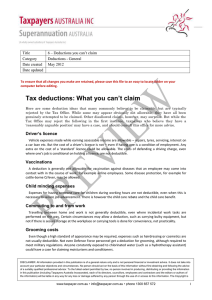

—Overview Computing Income Tax

advertisement