Recommendations of f..

advertisement

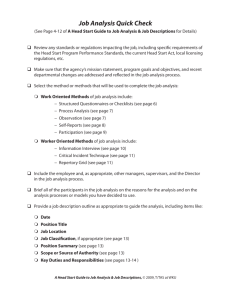

Recommendations of Financial Analysts Ideally, analysts should be providing objective advice to investors on what stocks to buy, using their expertise to help their firm's clients make money. Do they have incentives to do so? The answer appears to be “NO.” Empirical Facts Analysts follow & recommend stocks of good (highly rated) companies, not good (i.e., undervalued) stocks. • Marketing aids to brokers • Investor cognitive bias • Safety-net for their recommendations in case bad times come • Stocks of highly rated companies do not provide high returns Figure 1. Average Number of Analysts for Each S&P Stock Ranking 20 18 NYSE/Am ex com panies 16 Nasdaq com panies Number of Analysts 14 12 10 8 6 4 2 0 A+ A A- B+ B B- S&P's Common Stock Rankings C D NR Annual Holding Period Returns Geom. Arith. Series Mean% Mean% Sm Stk 12.6 18.8 Lg Stk 11.1 13.1 LT Gov 5.1 5.4 T-Bills 3.8 3.8 Inflation 3.1 3.2 Stan. Dev.% 39.7 20.2 8.1 3.3 4.5 Annual Holding Period Risk Premiums and Real Returns Series Sm Stk Lg Stk LT Gov T-Bills Inflation Risk Premiums% 15.0 9.3 1.6 --- --- Real Returns% 15.6 9.9 2.2 0.6 --- Asymmetry between buy and sell recommendation frequencies Marketing considerations Less than 1% of the recommendations by brokerage firm analysts during the 2000 market plunge recommended that investors sell shares. Even during December 2000, when the Nasdaq was way down, 2.1 percent of recommendations were to sell and 71 percent of the ratings were to buy. Optimistic recommendations to help investment banking business Analysts are working side-by-side with investment bankers whose main interest is in pushing the IPO, helping a firm with a merger, or arranging a bond sale. Analysts are under pressure to say only good things about the company because it's the investment banking end of the business that brings in the most money. A Morgan Stanley internal memo “Our objective . . . is to adopt a policy, fully understood by the entire firm, including the Research Department, that we do not make negative or controversial comments about our clients as a matter of sound business practice.” Analysts and investment bankers are supposed to be kept apart by a "Chinese Wall," but the wall is full of holes, allowing analysts to become cheerleaders for their firm's investment banking clients. Analysts offer more favorable long-term earnings forecasts and recommendations on companies that are underwriting clients to their brokerage firm. Sell-side analysts’ long-term growth forecasts are overly optimistic around seasoned equity offerings and analysts affiliated with the lead underwriter make the most optimistic forecasts. Both regional and national brokerage firms, which have conflicts of interest emerging from their activities in both underwriting securities and making investment recommendations, produce more optimistic recommendations than non-brokerage firms. Underwriters support the aftermarket of their client companies through positive analyst coverage and that buy recommendations by underwriter analysts contain significant bias. Lead underwriter is almost always the primary market maker in aftermarkets. Underwriters sponsor new issues by arranging analyst coverage, promote the stock through marketing efforts, and provide liquidity by acting as the brokerdealer in subsequent secondary market trading. Vertical integration of brokerage and dealer function Internalzation and preferencing Dealers are more likely to make markets for stocks that are tracked by the analysts affiliated with the same company Analysts issue earnings forecasts more proactively for stocks that are handled by affiliated market makers Regulatory Actions The US SEC issued an "investor alert" in June 2001 Examine a company's financial reports. Find out whether the analyst's brokerage firm financed a company's recent stock offerings, especially IPOs. Learn as much as you can about a company by reading independent news reports. US Congress hearings House Financial Services subcommittee on capital markets held a hearing in June 2001 to examine whether analysts have become cheerleaders for companies the analysts' investment firms own stock in or do business for, giving investors biased advice. Reactions from industry groups Industry groups are weighing in with suggestions for "best practices" to help make sure that analysts are working with the best interests of investors in mind, not the investment banking clients that can bring millions in fees to their companies. The Securities Industry Association (SIA) unveiled new voluntary guidelines for analysts Require analysts to clearly disclose their holdings in companies they cover and prohibit them from trading against their own recommendations. Analysts should not have their pay directly linked to the investment banking transactions handled by their firms for companies they cover. The National Association of Securities Dealers (NASD) Proposed rules that would require analysts to disclose potential conflicts of interest when they recommend stocks on television or in other public appearances. Association for Investment Management & Research (AIMR) Calls for better disclosure of potential conflicts of interest. Cut ties between analysts and investment bankers. Ban analysts from trading against their own recommendations to clients. Reactions from individual companies Prudential Securities Began requiring analysts to reveal whether they or family members have $10,000 or more invested in companies they cover. Merrill Lynch (July 2001) Bans analysts from trading stocks they cover. Also applies to spouse and family members. Analysts can keep already owned shares, but have to disclose them in research reports. Securities Investors Association of Singapore (SIAS) welcomes the Merrill Lynch decision. Roots of the problem and possible remedies Different sources of income Corporate financing, brokerage services, and proprietary trading. Create conflicts of interest within the company and with its clients. Compensation structure for analysts Analysts’ compensation is determined by their “helpfulness” to the bank’s investment banking business. Analysts’ compensation is also determined by their “helpfulness” to the company’s brokerage and market-making operations. This incentive may outweigh their concerns for reputation capital. To regain investor confidence, Sell-side analysts’ compensation may not be tied to investment banking profits. Sell-side analysts may not be allowed to make comments and recommendations on stocks underwritten by their companies. How long? Sell-side analysts may be encouraged to issue balanced buy and sell recommendations. Educate investors that most analysts know no more than what they do about the TRUE value of stocks and that they are just sales/marketing people. Focus more on L-T asset allocation than S-T market timing and/or stock selection.