Test 1A

advertisement

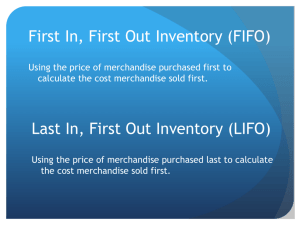

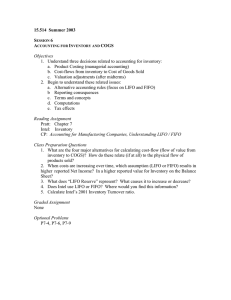

Acct5312 Test 1A Summer 2011 Chapters 1-5 Name:___________________________________ The following are data available for Blue Grass for the month of June: (a.) Calculate cost of goods sold and ending inventory under the following cost flow assumptions: (1.) Weighted average (2.) FIFO (3.) LIFO (b.) Assume net income using the weighted average cost-flow assumption was $6,400. Calculate net income under FIFO and LIFO. Using the column headings provided below, show the effect, if any, of the transaction entry or adjusting entry on the appropriate balance sheet category or on the income statement by entering the account name, amount, and indicating whether it is an addition (+) or subtraction (-). Column headings reflect the expanded balance sheet equation; items that affect net income should not be shown as affecting owners' equity. (1.) The firm borrowed $2,000 from the bank; a short-term note was signed. (2.) Merchandise inventory costing $750 was purchased; cash of $200 was paid and the balance is due in 30 days. (3.) Employee wages of $1,000 were accrued at the end of the month. (4.) Merchandise that cost $350 was sold for $450 in cash. (5.) This month's rent of $700 was paid. (6.) Revenues from services during month totaled $6,500. Of this amount, $2,000 was received in cash and the balance is expected to be received within 30 days. (7.) During the month, supplies were purchased at a cost of $520, and debited into the Supplies (asset) account. A total of $400 of supplies were used during the month. (8.) Interest of $240 has been earned on a note receivable, but has not yet been received. 1. If a firm borrowed money on a six-month bank loan, the firm's working capital immediately after obtaining the loan, relative to its working capital just prior to the loan, would be: A. Higher. B. Lower. C. The same. D. Would depend on the amount borrowed. 2. Which of the following accounts is part of working capital? A. Retained Earnings B. Sales C. Merchandise Inventory D. Common Stock 3. A firm's net income for the year was $200,000. Average assets totaled $1.5 million, and average liabilities totaled $0.3 million. Return on equity was: A. 13.3% B. 16.7% C. 10% D. 20% 4. A current ratio of 6 is usually an indication that the firm: A. Has a low degree of liquidity. B. Has a reasonable degree of liquidity. C. Has not made the most productive use of its assets. D. Has made the most productive use of its assets. 5. For a firm that presently has a current ratio of 2.0, the effect on this ratio of paying a current liability is: A. Raises the current ratio. B. Lowers the current ratio. C. Doesn't affect the current ratio. D. Depends on the amount paid. Listed below are a number of financial statement captions. Indicate in the spaces to the right of each caption (1) the category of each item, and (2) the financial statement(s) on which the item can usually be found.