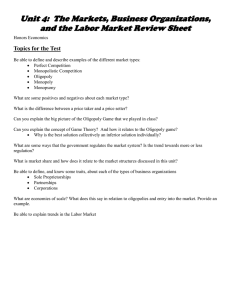

Microeconomics ECON 2302 Summer I, 2011 Marilyn Spencer, Ph.D.

advertisement

Microeconomics ECON 2302 Summer I, 2011 Marilyn Spencer, Ph.D. Professor of Economics Chapter 13 CHAPTER 13 Oligopoly: Firms in Less Competitive Markets Today, in the software and computer industries, fewer than 10 firms account for the great majority of sales. CHAPTER 13 Oligopoly: Firms in Less Competitive Markets Chapter Outline and Learning Objectives 13.1 Oligopoly and Barriers to Entry Show how barriers to entry explain the existence of oligopolies. 13.2 Using Game Theory to Analyze Oligopoly Use game theory to analyze the strategies of oligopolistic firms. 13.3 Sequential Games and Business Strategy Use sequential games to analyze business strategies. 13.4 The Five Competitive Forces Model Use the five competitive forces model to analyze competition in an industry. Oligopoly: Firms in Less Competitive Markets Oligopoly A market structure in which a small number of interdependent firms compete. 13.1 LEARNING OBJECTIVE Show how barriers to entry explain the existence of oligopolies. Oligopoly and Barriers to Entry Table 13-1 Examples of Oligopolies in Retail Trade and Manufacturing RETAIL TRADE MANUFACTURING FOUR-FIRM CONCENTRATION RATIO INDUSTRY FOUR-FIRM CONCENTRATION RATIO INDUSTRY Discount department stores 95% Cigarettes 95% Warehouse clubs and supercenters 92% Beer 91% 72% Aircraft 81% Athletic footwear stores 71% Breakfast cereal 78% College bookstores 70% Automobiles 76% Radio, television, and other electronic stores 69% Pharmacies and drugstores 53% Hobby, toy, and game stores 75% Computers Dog and cat food 64% Oligopoly and Barriers to Entry Barrier to entry Anything that keeps new firms from entering an industry in which firms are earning economic profits. Barriers to Entry: 1. Economies of Scale An industry will be competitive if the minimum point on the typical firm’s long-run average cost curve (LRAC1) occurs at a level of output that is a small fraction of total industry sales, such as Q1. The industry will be an oligopoly if the minimum point comes at a level of output that is a large fraction of industry sales, such as Q2. FIGURE 13-1 Economies of Scale Help Determine the Extent of Competition in an Industry Barriers to Entry, cont. 1. Economies of scale The situation when a firm’s long-run average costs fall as it increases output. 2. Ownership of a Key Input If production of a good requires a particular input, then control of that input can be a barrier to entry. 3. Government-Imposed Barriers Patent The exclusive right to a product for a period of 20 years from the date the product is invented. Other government-imposed barriers? 13.2 LEARNING OBJECTIVE Use game theory to analyze the strategies of oligopolistic firms. Using Game Theory to Analyze Oligopoly Game theory The study of how people make decisions in situations in which attaining their goals depends on their interactions with others; in economics, the study of the decisions of firms in industries where the profits of each firm depend on its interactions with other firms. Using Game Theory to Analyze Oligopoly All games share three key characteristics: 1. Rules that determine what actions are allowable 2. Strategies that players employ to attain their objectives in the game 3. Payoffs that are the results of the interaction among the players’ strategies Business strategy Actions taken by a firm to achieve a goal, such as maximizing profits. Game Theory to Analyze Oligopoly HP’s profits are in blue, and Apple’s profits are in red. HP and Apple would each make profits of $10 million per month on sales of desktop computers if they both charged $1,200. However, each firm has an incentive to undercut the other by charging a lower price. If both firms charge $1,000, they would each make a profit of only $7.5 million per month. A Duopoly Game: Price Competition between Two Firms FIGURE 13-2 A Duopoly Game Using Game Theory to Analyze Oligopoly Duopoly Game: Price Competition between 2 Firms Payoff matrix A table that shows the payoffs that each firm earns from every combination of strategies by the firms. Collusion An agreement among firms to charge the same price or otherwise not to compete. Dominant strategy A strategy that is the best for a firm, no matter what strategies other firms use. Nash equilibrium A situation in which each firm chooses the best strategy, given the strategies chosen by other firms. Using Game Theory to Analyze Oligopoly Firm Behavior and the Prisoner’s Dilemma Cooperative equilibrium An equilibrium in a game in which players cooperate to increase their mutual payoff. Noncooperative equilibrium An equilibrium in a game in which players do not cooperate but pursue their own self-interest. Prisoner’s dilemma A game in which pursuing dominant strategies results in noncooperation that leaves everyone worse off. Solved Problem 13-2 Is Advertising a Prisoner’s Dilemma for Coca-Cola and Pepsi? Given that Coca-Cola is advertising, Pepsi’s best strategy is to advertise. Therefore, advertising is the optimal decision for both firms, given the decision by the other firm. Making Is There a Dominant Strategy Connection for Bidding on eBay? the On eBay, bidding the maximum value you place on an item is a dominant strategy. Using Game Theory to Analyze Oligopoly Can Firms Escape the Prisoner’s Dilemma? Wal-Mart and Target can change the payoff matrix for selling PlayStation 3 game consoles by advertising that they will match their competitor’s P. This retaliation strategy provides a signal that one store charging a lower P will be met automatically by the other store charging a lower P. In the payoff matrix in panel (a), there is no matching offer, and each store benefits if it charges $300 when the other charges $500. In the payoff matrix in panel (b), with the matching offer, the companies have only 2 choices: They can charge $500 and receive a p of $10,000/month, or they can charge $300 and receive a p of $7,500/month. The equilibrium shifts from the prisoner’s dilemma result of both stores charging the low P and receiving low p to both stores charging the high P and receiving high p. FIGURE 13-3 Changing the Payoff Matrix in a Repeated Game Using Game Theory to Analyze Oligopoly Can Firms Escape the Prisoner’s Dilemma? Yes, by engaging in cooperative strategies Price leadership A form of implicit collusion in which one firm in an oligopoly announces a price change and the other firms in the industry match the change. Tit for tat A form of implicit collusion in which all firms in an oligopoly cooperate – on price or territory or warranty or some other aspect of the product or service, instead of competing If any one firm makes a competitive move, then other firms reciprocate to undercut the one who competes. Making American Airlines and Northwest Airlines Connection Fail to Cooperate on a Price Increase the Airlines therefore continually adjust their prices while at the same time monitoring their rivals’ prices and retaliating against them either for cutting prices or failing to go along with price increases. The airlines have trouble raising the price that this business traveler pays for a ticket. Using Game Theory to Analyze Oligopoly Cartels: The Case of OPEC The blue line shows the P of a barrel of oil in each year. The red line measures the P of a barrel of oil in terms of the purchasing power of the $ in 2009. By reducing oil production, OPEC was able to raise the world P of oil in the mid-1970s and early 1980s. Sustaining high Ps has been difficult over the long run, however, because members often exceed their output quotas. Cartel A group of firms that collude by agreeing to restrict output to increase prices and profits. FIGURE 13-4 Oil Prices, 1972 to mid–2009 Because Saudi Arabia can produce much more oil than Nigeria, its output decisions have a much larger effect on the P of oil. In the figure, Low Output corresponds to cooperating with the OPEC-assigned output quota, and High Output corresponds to producing at maximum capacity. Saudi Arabia has a dominant strategy to cooperate and produce a low output. Game Theory to Analyze Oligopoly Cartels: The Case of OPEC FIGURE 13-5 The OPEC Cartel with Unequal Members Nigeria, however, has a dominant strategy not to cooperate and instead produce a high output. Therefore, the equilibrium of this game will occur with Saudi Arabia producing a low output and Nigeria producing a high output. 13.3 LEARNING OBJECTIVE Use sequential games to analyze business strategies. Sequential Games and Business Strategy Deterring Entry HP earns its highest return if it charges $600 for its netbook and Apple does not enter the market. But at that P, Apple will enter the market, and HP will earn only 16%. If HP charges $275, Apple will not enter because Apple will suffer an economic loss by receiving only a 5% return on its investment. Therefore, HP’s best decision is to deter Apple’s entry by charging $275. FIGURE 13-6 The Decision Tree for an Entry Game HP will earn an economic profit by receiving a 20% return on its investment. Note that the dashes indicate the situation where Apple does not enter the market, and so makes no investment and receives no return. Solved Problem 13-3 Is Deterring Entry Always a Good Idea? Deterrence is worth pursuing only if the payoff is higher than for other strategies. In this case, expanding the market for netbooks by charging a lower price has a higher payoff, even given that Apple will enter the market. Dell earns the highest p if it offers a contract price of $20/copy and TruImage accepts the contract. TruImage earns the highest p if Dell offers it a contract of $30/copy and it accepts the contract. TruImage may attempt to bargain by threatening to reject a $20/copy contract. But Game Theory to Analyze Oligopoly Bargaining FIGURE 13-7 The Decision Tree for a Bargaining Game Dell knows this threat is not credible because once Dell has offered a $20/copy contract, TruImage’s profits are higher if it accepts the contract than if it rejects it. 13.4 LEARNING OBJECTIVE Use the five competitive forces model to analyze competition in an industry. The Five Competitive Forces Model Michael Porter’s model identifies 5 forces that determine the level of competition in an industry: 1. competition from existing firms, 2. the threat from new entrants, 3. competition from substitute goods or services, 4. the bargaining power of buyers, and 5. the bargaining power of suppliers. FIGURE 13-8 The Five Competitive Forces Model The Five Competitive Forces Model 1. Competition from Existing Firms Competition among firms in an industry can lower prices and profits. Competition in the form of advertising, better customer service, or longer warranties can also reduce profits by raising costs. 2. The Threat from Potential Entrants Firms face competition from companies that currently are not in the market but might enter. We have already seen how actions taken to deter entry can reduce profits. The Five Competitive Forces Model 3. Competition from Substitute Goods or Services Firms are always vulnerable to competitors introducing a new product that fills a consumer need better than their current product does. 4. The Bargaining Power of Buyers If buyers have enough bargaining power, they can insist on lower prices, higher-quality products, or additional services. The Five Competitive Forces Model 5. The Bargaining Power of Suppliers If many firms can supply an input and the input is not specialized, the suppliers are unlikely to have the bargaining power to limit a firm’s profits. Making Can We Predict Which Firms Connection Will Continue to Be Successful? the Is it possible to draw general conclusions about which business strategies are likely to be successful in the future? Unfortunately, Circuit City’s excellence as a company didn’t last. AN INSIDE LOOK >> Hewlett-Packard Uses New Technology to Boost Sales of Personal Computers Dell decides whether to sell touch-sensitive personal computers. KEY TERMS Barrier to entry Business strategy Cartel Collusion Cooperative equilibrium Dominant strategy Economies of scale Game theory Nash equilibrium Non-cooperative equilibrium Oligopoly Patent Payoff matrix Price leadership Prisoner’s dilemma