Microeconomics ECON 2302 Spring 2011 Marilyn Spencer, Ph.D.

advertisement

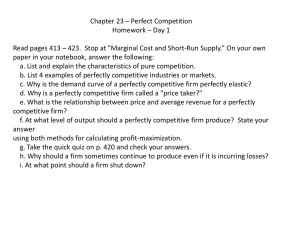

Microeconomics ECON 2302 Spring 2011 Marilyn Spencer, Ph.D. Professor of Economics Chapter 11 CHAPTER 11 Firms in Perfectly Competitive Markets The market for organically grown food has expanded rapidly in the United States. CHAPTER 11 Firms in Perfectly Competitive Markets Chapter Outline and Learning Objectives 11.1 Perfectly Competitive Market Explain what a perfectly competitive market is and why a perfect competitor faces a horizontal demand curve. 11.2 How a Firm Maximizes Profit in a Perfectly Competitive Market. Explain how a firm maximizes profit in a perfectly competitive market. 11.3 Illustrating Profit or Loss on the Cost Curve Graph Use graphs to show a firm’s profit or loss. Firms in Perfectly Competitive Markets Chapter Outline and Learning Objectives, cont. 11.4 Deciding Whether to Produce or to Shut Down in the Short Run Explain why firms may shut down temporarily. 11.5 “If Everyone Can Do It, You Can’t Make Money at It”: The Entry and Exit of Firms in the Long Run Explain how entry and exit ensure that perfectly competitive firms earn zero economic profit in the long run. 11.6 Perfect Competition and Efficiency Explain how perfect competition leads to economic efficiency. Firms in Perfectly Competitive Markets Table 11-1 The Four Market Structures MARKET STRUCTURE CHARACTERISTIC PERFECT COMPETITION MONOPOLISTIC COMPETITION OLIGOPOLY MONOPOLY Number of firms Many Many Few One Type of product Identical Differentiated Unique Ease of entry High High Identical or differentiated Low Examples of industries • Growing Wheat • Apples • Clothing Stores • Restaurants • Manufacturing computers • Manufacturing automobiles • First-class mail delivery • Tap water Entry blocked 11.1 LEARNING OBJECTIVE Explain what a perfectly competitive market is and why a perfect competitor faces a horizontal demand curve. Perfectly Competitive Markets Perfectly competitive market A market that meets these conditions: 1. Many buyers and sellers 2. Identical products 3. No barriers to new firms entering the market and no barriers to firms choosing to leave the market 4. Very low cost information A Perfectly Competitive Firm Cannot Affect the Market Price! Price taker A buyer or seller that is unable to affect the market price. Perfectly Competitive Markets The Demand Curve for the Output of a Perfectly Competitive Firm FIGURE 11-1 A Perfectly Competitive Firm Faces a Horizontal Demand Curve A firm in a perfectly competitive market is selling exactly the same product as many other firms. Thus, it can sell as much as it wants at the current market price, but it cannot sell anything at all if it raises the price by even 1 cent. As a result, the demand curve for a perfectly competitive firm’s output is a horizontal line. In the figure, whether the wheat farmer sells 6,000 bushels per year or 15,000 bushels has no effect on the market price of $4. Perfectly Competitive Markets: The Demand Curve for the Output of a Perfectly Competitive Firm FIGURE 11-2 The Market Demand for Wheat versus the Demand for One Farmer’s Wheat In a perfectly competitive market, P is determined by the intersection of market D and market S. In panel (a), the D and S curves for wheat intersect at a P of $4 per bushel. An individual wheat farmer like Farmer Parker cannot affect the market P for wheat. Therefore, as panel (b) shows, the D curve for Farmer Parker’s wheat is a horizontal line. Don’t Let This Happen to YOU! Don’t Confuse the D Curve for Farmer Parker’s Wheat with the Market D Curve for Wheat! Explain how a firm maximizes profit in a perfectly competitive market. 11.2 LEARNING OBJECTIVE How a Firm Maximizes Profit in a Perfectly Competitive Market Profit Total revenue minus total cost. Profit = TR – TC Revenue for a Firm in a Perfectly Competitive Market Average revenue (AR) Total revenue divided by the quantity of the product sold. Marginal revenue (MR) The change in total revenue from selling one more unit of a product. Marginal Revenue Change in total revenue TR , or MR Change in quantity Q How a Firm Maximizes Profit in a Perfectly Competitive Market Revenue for a Firm in a Perfectly Competitive Market Table 11-2 NUMBER OF BUSHELS (Q) 0 1 2 3 4 5 6 7 8 9 10 Farmer Parker’s Revenue from Wheat Farming MARKET PRICE (PER BUSHEL) (P) TOTAL REVENUE (TR) $4 4 4 4 4 4 4 4 4 4 4 $0 4 8 12 16 20 24 28 32 36 40 AVERAGE REVENUE (AR) $4 4 4 4 4 4 4 4 4 4 MARGINAL REVENUE (MR) $4 4 4 4 4 4 4 4 4 4 How a Firm Maximizes Profit in a Perfectly Competitive Market Determining the Profit-Maximizing Level of Output Table 11-3 Farmer Parker’s Profits from Wheat Farming QUANTITY (BUSHELS) (Q) TOTAL REVENUE (TR) TOTAL COST (TC) PROFIT (TR-TC) 0 1 2 3 4 5 6 7 8 9 10 $0.00 4.00 8.00 12.00 16.00 20.00 24.00 28.00 32.00 36.00 40.00 $2.00 5.00 7.00 8.50 10.50 13.00 16.50 21.50 28.50 38.00 50.50 -$2.00 -1.00 1.00 3.50 5.50 7.00 7.50 6.50 3.50 -2.00 -10.50 MARGINAL REVENUE (MR) MARGINAL COST (MC) — $4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 — $3.00 2.00 1.50 2.00 2.50 3.50 5.00 7.00 9.50 12.50 How a Firm Max’es p in a Perfectly Competitive Market: Determining the Profit-Maximizing Level of Output In panel (a), Farmer Parker maximizes his profit where the vertical distance between TR and TC is the largest. FIGURE 11-3 The Profit-Maximizing Level of Output Panel (b) shows that Farmer Parker’s MR is equal to a constant $4/bushel. Farmer Parker maximizes profits by producing wheat up to the point where MR of the last bushel produced is equal to its MC. How a Firm Max’es p in a Perfectly Competitive Market: Determining the Profit-Maximizing Level of Output From the information in Table 11-3 and Figure 11-3, we can draw the following conclusions: 1. The profit-maximizing level of output is where the difference between total revenue and total cost is the greatest. 2. The profit-maximizing level of output is also where marginal revenue equals marginal cost, or MR = MC. 11.3 LEARNING OBJECTIVE Use graphs to show a firm’s profit or loss. Illustrating Profit or Loss on the Cost Curve Graph Profit = (P x Q) TC ( P Q ) TC Profit Q Q Q or Profit P ATC Q Profit = (P ATC) x Q Illustrating Profit or Loss on the Cost Curve Graph Showing a Profit on the Graph A firm maximizes p at the level of Q at which MR = MC. The difference between P and ATC equals p/unit of Q. FIGURE 11-4 Total p equals p/unit multiplied by the number of units produced. Total p is represented by the area of the greenshaded rectangle, which has a height equal to (P - ATC) and a width equal to Q. The Area of Maximum Profit Solved Problem 11-3 Determining Profit-Maximizing Price and Quantity OUTPUT PER DAY TOTAL COST 0 $10.00 1 20.50 2 24.50 3 28.50 4 34.00 5 43.00 6 55.50 7 72.00 8 93.00 9 119.00 Illustrating Profit or Loss on the Cost Curve Graph Don’t Let This Happen to YOU! Remember That Firms Maximize Their Total Profits, Not Their Profits per Unit Illustrating Profit or Loss on the Cost Curve Graph Illustrating When a Firm Is Breaking Even or Operating at a Loss 1. P > ATC, which means the firm makes a profit. 2. P = ATC, which means the firm breaks even (its total cost equals its total revenue). 3. P < ATC, which means the firm experiences losses. Illustrating When a Firm Is Breaking Even or Operating at a Loss In panel (a), P equals ATC, and the firm breaks even because its TR will be equal to its TC. In this situation, the firm makes zero economic profit. FIGURE 11-5 A Firm Breaking Even and a Firm Experiencing Losses In panel (b), P is below ATC, and the firm experiences a loss. The loss is represented by the area of the red-shaded rectangle, which has a height equal to (ATC - P) and a width equal to Q. Making the Losing Money in the Medical Screening Industry Connection 11.4 LEARNING OBJECTIVE Explain why firms may shut down temporarily. Deciding Whether to Produce or to Shut Down in the Short Run In the short run, a firm experiencing losses has two choices: 1. Continue to produce 2. Stop production by shutting down temporarily Sunk cost A cost that has already been paid and that cannot be recovered. Making the When to Close a Laundry Connection Keeping a business open even when suffering losses can sometimes be the best decision for an entrepreneur in the short run. 11.4 LEARNING OBJECTIVE Explain why firms may shut down temporarily. Deciding Whether to Produce or to Shut Down in the Short Run The Supply Curve of a Firm in the Short Run Total revenue < Variable cost, or, in symbols: (P × Q) < VC If we divide both sides by Q, we have the result that the firm will shut down if: P < AVC Shutdown point The minimum point on a firm’s average variable cost curve; if the price falls below this point, the firm shuts down production in the short run. Deciding Whether to Produce or to Shut Down in the Short Run The Supply Curve of a Firm in the Short Run For any given P, we can determine the Q of output the firm will supply from the MC curve. In other words, the MC curve is the firm’s supply curve. The firm will shut down if the price falls below average variable cost. The marginal cost curve crosses the average variable cost at the firm’s shutdown point. This point occurs at output level QSD. FIGURE 11-6 The Firm’s Short-Run Supply Curve For prices below PMIN, the S curve is a vertical line along the P axis, which shows that the firm will supply zero output at those prices. The red line in the figure is the firm’s short-run S curve. The Market Supply Curve in a Perfectly Competitive Industry We can derive the market S curve by adding up the Q that each firm in the market is willing to supply at each P. FIGURE 11-7 Firm Supply and Market Supply In panel (a), one wheat farmer is willing to supply 15,000 bushels of wheat at a P of $4/bu. Panel (b): If every wheat farmer supplies the same amount of wheat at this P and if there are 167,000 wheat farmers, the total amount of wheat supplied at a price of $4 will equal 15,000 bushels/farmer × 167,000 farmers = 2.5 billion bushels of wheat. 11.5 LEARNING OBJECTIVE Explain how entry and exit ensure that perfectly competitive firms earn zero economic profit in the long run. “If Everyone Can Do It, You Can’t Make Money at It”: The Entry and Exit of Firms in the Long Run Economic Profit and the Entry or Exit Decision EXPLICIT COSTS Table 11- 4 Farmer Moreno’s Costs per Year Water Wages Organic fertilizer Electricity Payment on bank loan $10,000 $15,000 $10,000 $5,000 $45,000 IMPLICIT COSTS Foregone salary Opportunity cost of the $100,000 she has invested in her farm Total cost $30,000 $10,000 $125,000 “If Everyone Can Do It, You Can’t Make Money at It”: The Entry and Exit of Firms in the Long Run Economic profit A firm’s revenues minus all its costs, implicit and explicit. Economic Losses Lead to Exit of Firms Economic loss The situation in which a firm’s total revenue is less than its total cost, including all implicit costs. Long-Run Equilibrium in a Perfectly Competitive Market: Long-run competitive equilibrium The situation in which the entry and exit of firms has resulted in the typical firm breaking even – in terms of economic costs. “If Everyone Can Do It, You Can’t Make Money at It”: The Entry and Exit of Firms in the Long Run: Economic Profit and the Entry or Exit Decision Economic Profit Leads to Entry of New Firms FIGURE 11-8 The Effect of Entry on Economic Profits “If Everyone Can Do It, You Can’t Make Money at It”: The Entry and Exit of Firms in the Long Run: Economic Profit and the Entry or Exit Decision Economic Losses Lead to Exit of Firms FIGURE 11-9 The Effect of Exit on Economic Losses “If Everyone Can Do It, You Can’t Make Money at It”: The Entry and Exit of Firms in the Long Run: Economic Profit and the Entry or Exit Decision Economic Losses Lead to Exit of Firms FIGURE 11-9 The Effect of Exit on Economic Losses, cont. Making the Easy Entry Makes the Long Run Pretty Short in Connection the Apple iPhone Apps Store Economic profits are rapidly competed away in the iPhone apps store. In a competitive market, earning an economic profit in the long run is extremely difficult. And the ease of entering the market for iPhone apps has made the long run pretty short. 11.6 LEARNING OBJECTIVE Explain how perfect competition leads to economic efficiency. Perfect Competition and Efficiency Productive Efficiency Productive efficiency The situation in which a good or service is produced at the lowest possible cost. Solved Problem 11-6 How Productive Efficiency Benefits Consumers In the long run, firms only break even on their investment in producing high-technology goods. That result implies that investors in these firms are also unlikely to earn an economic profit in the long run. Perfect Competition and Efficiency Allocative Efficiency Allocative efficiency A state of the economy in which production represents consumer preferences; in particular, every good or service is produced up to the point where the last unit provides a marginal benefit to consumers equal to the marginal cost of producing it. Perfect Competition and Efficiency: Allocative Efficiency Firms will supply all those goods that provide consumers with a marginal benefit at least as great as the marginal cost of producing them. 1. The price of a good represents the marginal benefit consumers receive from consuming the last unit of the good sold. 2. Perfectly competitive firms produce up to the point where the price of the good equals the marginal cost of producing the last unit. 3. Therefore, firms produce up to the point where the last unit provides a marginal benefit to consumers equal to the marginal cost of producing it. AN INSIDE LOOK >> It Isn’t Easy - or Cheap - to Be Green Figure 1 The D for a product increases after it is “green certified.” The graph assumes that the firm did not spend money to acquire certification for its product. Figure 2 The D for a product increases after it is “green certified.” The marginal cost and average total cost curves shift up due to the cost of certification. KEY TERMS Allocative efficiency Perfectly competitive market Average revenue (AR) Price taker Economic loss Economic profit Productive efficiency Profit Long-run competitive equilibrium Shutdown point Sunk cost Long-run supply curve Marginal revenue (MR) Pre-read Ch. 12 before we start going over it in class, including: Review Questions: 3rd ed. p. 422, 1.1—1.3; p. 426, 4.1, 4.2; p. 6.1, 6.2 (2nd ed., p. 432, 1.1 – 1.3; p. 436, 4.1 & 4.2; p. 438, 6.1 & 6.2; 1st edition: 1, 2, 3, 7 8 & 10 on pp. 406-407); and Problems and Applications: 3rd ed. p 422 1.4; p 423, 2.5; p424, 2.11; p 425, 3.3 (2nd ed., p. 432, 1.4; p. 433, 2.5; p. 435, 3.3; & p. 4.34, 2.11; 1st edition: 1, 3, 5 & 17 on pp. 407-410).