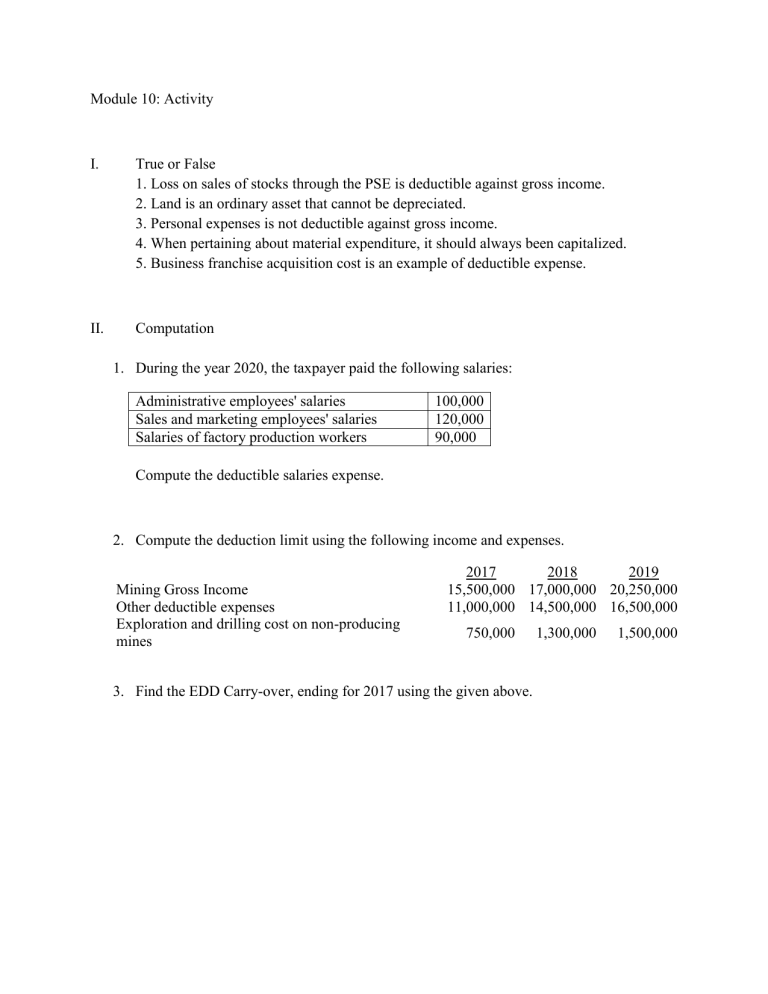

Module 10: Activity I. True or False 1. Loss on sales of stocks through the PSE is deductible against gross income. 2. Land is an ordinary asset that cannot be depreciated. 3. Personal expenses is not deductible against gross income. 4. When pertaining about material expenditure, it should always been capitalized. 5. Business franchise acquisition cost is an example of deductible expense. II. Computation 1. During the year 2020, the taxpayer paid the following salaries: Administrative employees' salaries Sales and marketing employees' salaries Salaries of factory production workers 100,000 120,000 90,000 Compute the deductible salaries expense. 2. Compute the deduction limit using the following income and expenses. Mining Gross Income Other deductible expenses Exploration and drilling cost on non-producing mines 2017 2018 2019 15,500,000 17,000,000 20,250,000 11,000,000 14,500,000 16,500,000 750,000 3. Find the EDD Carry-over, ending for 2017 using the given above. 1,300,000 1,500,000