Chapter 34 G P

advertisement

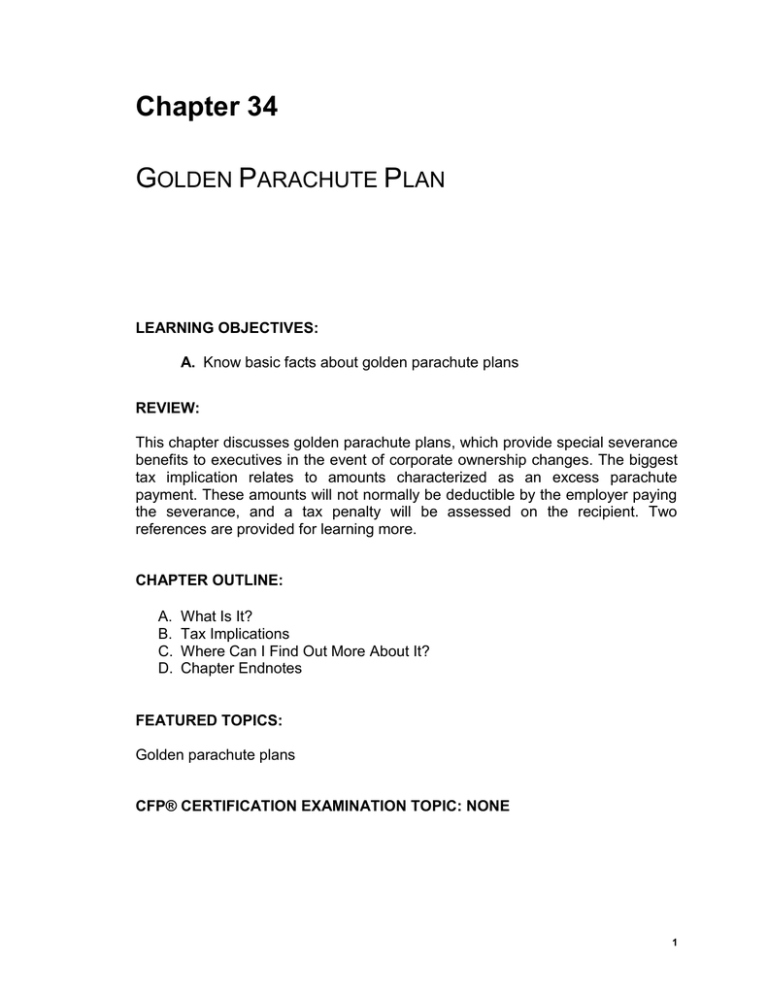

Chapter 34 GOLDEN PARACHUTE PLAN LEARNING OBJECTIVES: A. Know basic facts about golden parachute plans REVIEW: This chapter discusses golden parachute plans, which provide special severance benefits to executives in the event of corporate ownership changes. The biggest tax implication relates to amounts characterized as an excess parachute payment. These amounts will not normally be deductible by the employer paying the severance, and a tax penalty will be assessed on the recipient. Two references are provided for learning more. CHAPTER OUTLINE: A. B. C. D. What Is It? Tax Implications Where Can I Find Out More About It? Chapter Endnotes FEATURED TOPICS: Golden parachute plans CFP® CERTIFICATION EXAMINATION TOPIC: NONE 1 Chapter 34 COMPETENCY: Upon completion of this chapter, the student should be able to: 1. Know basic facts about golden parachute plans KEY WORDS: golden parachute, parachute payment, base amount DISCUSSION: 1. Discuss why executives may demand parachute payments. 2. Discuss problems related to these parachute payments. QUESTIONS: 1. Which of the following are tax sanctions on amounts characterized as parachute payments? (1) no employer deduction is allowed on excess amounts (2) the person receiving the payment is subject to a penalty tax equal to 20% of the excess payment (3) the entire severance payment will be deemed nondeductible by the employer (4) excess amounts must be repaid within 24 months a. b. c. d. (1) only (1) and (2) only (2) and (3) only (3) and (4) only Chapter 34, p. 285 2. Parachute rules generally do not apply when payments are received from which of the following entities? (1) S corporations (2) qualified retirement plans (3) simplified employee pensions plans (4) SIMPLE IRAs Chapter 34 a. b. c. d. (1) and (3) only (1) (2) and (3) only (2) (3) and (4) only (1) (2) (3) and (4) Chapter 34, p. 286 ANSWERS: 1. b 2. d