Poultry Outlook

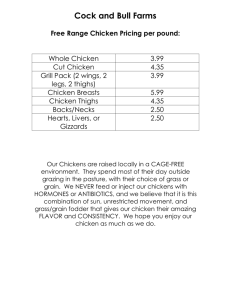

advertisement

Situation and Outlook of the US Chicken industry Presented to : Southern Region Agricultural Outlook Conference Presented by : Hugues Rinfret Senior Industry Analyst SunTrust Bank September 25, 2000 1 Outline • Introduction • Demand Conditions – Foreign markets (exports) – US situation • Supply Conditions – Breeding inventories – Prices – Industry Structure – Feed costs – Environmental issues 2 Fast Export Growth Eluding the Industry? • Slower export flow caused re-focus on domestic market – Export ratio plateau – Foreign incomes rising faster – Low but rising chicken demand in foreign markets • Focus on new products year-over-year % change • But huge potential remains Chicken Production Relative to Exports 50 20% 45 18% 40 16% 35 14% 30 US demand - left axis exports - left axis export-to-production ratio 25 12% 10% 20 8% 15 6% 10 4% 5 2% 0 0% 1987 3 1989 1991 1993 1995 1997 1999 2001 Diversification of Exports Occurring Slowly US Chicken Exports by Destination • Sales to the FSU are bouncing back 11% 1,500,000 53% 82% 1,000,000 500,000 1% 16% 25% 67% 1998/99 1999/00 % change Russia, Latvia 1,042,493 1,706,677 64% Hong Kong 1,182,518 1,307,536 11% Other 2,070,766 2,325,816 12% 4 er tv ia Total Chicken Exports - pounds O th R La us si a a ad C an re ng ap o Si H on g Ko ng - M ex ic o • Need for new markets 2,000,000 Ja pa n – Direct exports to Mainland China still a novelty 27% 2,500,000 pounds • Hong Kong is No.2 market and still gaining July 1999 to June 2000 Export Market Assessment • Russia: US Chicken Exports pounds per month 450,000 – Political stability to support export demand FSU 400,000 Other 350,000 – But at risk when Russia gets its act together 300,000 – With uniform tariffs, indirect exports de-emphasized 200,000 ruble devaluation 250,000 150,000 100,000 • Hong Kong: 50,000 M Ja n98 ar -9 8 M ay -9 8 Ju l-9 8 Se p98 N ov -9 8 Ja n99 M ar -9 9 M ay -9 9 Ju l-9 9 Se p99 N ov -9 9 Ja n00 M ar -0 0 M ay -0 0 – Strong economic comeback from the 1997crisis – But re-exporting to China is booming - more with WTO – Self-sufficiency in China is a dream 40 Cents/lb. • Mexico: Chicken Leg Quarters (4/10) 35 – Solid economy, offers greatest short-term potential 30 25 • Canada: 20 15 – Profitable but mature 19 9 9 10 Jan 5 Jan F eb M ar A p r M ay Jun Jul 2000 A ug Sep Oct N o v D ec US Demand Dip but Rebound Expected • Red meats gained in ‘98 & ‘99 – Strong disposable incomes – Food service gained ground – Diminishing health concerns • Turning Point in 2000? • Chicken comes back in 2001? Changes in Capita Meat Consumption % change over previous year 10 beef pork chicken 8 6 4 2 0 1998 -2 -4 – Poultry relatively inexpensive – Potential dip in consumer confidence – New chicken products to the rescue? 6 1999 2000 2001 US Supply - Breeding Inventories on the Right Track • Pullet Chicks placed dropped 11% in July – Positive but delayed impact on chicken production – Favorable impact on prices 2000 Pullet Chicks Placed (in 000s) 8000 19 9 9 19 9 8 7500 7000 6500 • Issues: 6000 Jan Fe b Mar – Must contain production for several months in a row – Fragmented industry supports value transfer to consumers 7 A pr May J un J ul A ug Sep Oc t N ov Dec Chicken Prices on the Rise but... • Breast meat posted a strong 30% gain since July 2 50 Cents/lb. 235 Chicken Breast (Boneless/Skinless) 220 205 19 0 – Encouraging but careful: • Heat wave is a factor • Consumers’ buying habits do not change overnight 175 16 0 14 5 13 0 115 Jan • A look at Tyson stock price provides a glance at current investors’ perception – Need to keep supply growth below trend – Need successful new products 8 19 9 9 Jan F eb M ar A p r M ay Jun Jul A ug Sep 2000 Oct N o v D ec Industry Structure Favorable to Consolidation • Concentration ratio relatively low in chicken – CR-4 is 0.49 relative to 0.70 in beef and 0.57 in pork • Factors keeping consolidation at bay: Market Share of Top-Four Processors – Historically: Fast demand growth 80 60 – Now: record low feed costs % 40 • Outlook: 20 0 – Pressure to consolidate set to increase beef pork • Slower market growth will require focus on product innovation • Market for brands is limited • Feed costs will eventually rebound • Consolidation up the value chain (e.g., retailers) 9 chicken Steadily Low Feed Costs Behind Meat Glut • Grain prices remain lowest in recent history – Huge inventories keep corn well below $2.00/cwt – Moderate export demand • But careful, low costs... – Encourage chicken production – Limit current incentives for consolidation • Expect flat costs in 2001 2 .75 $US/Bu. Corn (Central Illinois) 2 .5 2 .2 5 2 1.75 1.5 1.2 5 Jan 19 9 9 Jan F eb M ar A p r M ay Jun – Large inventories downplay weather risk on grain prices in 2001 10 Jul A ug Sep 2000 Oct N o v D ec Need to Address Environmental Issues • Non-point source pollution status: – Building pressure to hold everyone accountable • State environmental policy taking the lead – EPA limited resources – Grass-root movement supporting States’ initiative – Ability to create uniform standards later • Other livestock sectors facing similar pressure – Chicken not at a competitive disadvantage 11 Conclusion - 2001 Outlook • Surprising fast recovery in several export markets but need diversification to reduce risk • New product development to capture the benefit of strong economics • Record low feed costs again in 2001 is good, but put production containment at risk • Environmental issues addressed early unlikely to rattle the industry 12