2010.22 - Accounting (ACC) 125: Principles of Accounting II, Course Outline

advertisement

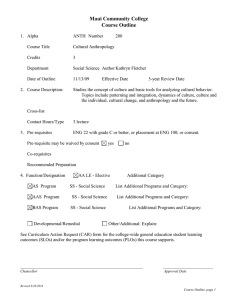

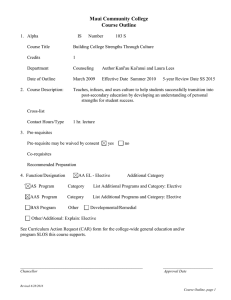

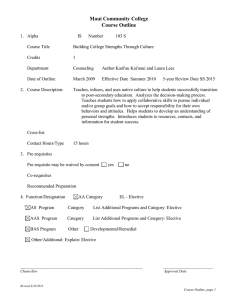

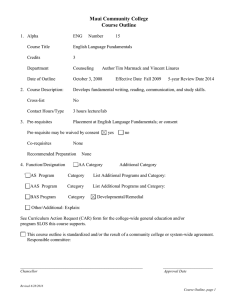

University of Hawaii Maui College Course Outline 1. Alpha ACC Number 125 Course Title Principles of Accounting II Credits 3 Department Business/Hospitality Date of Outline Oct. 19, 2010 Effective Date 10/19/10 2. Course Description: Author Jan Moore 5-year Review Date 2015 Continues the study of financial accounting procedures. Areas include: longterm assets, accounting for partnerships and corporations, statement of cash flows, financial statement analysis, in-depth study of specific balance sheet accounts. Cross-list Contact Hours/Type 3. Pre-requisites Three (3) hours/Lecture ACC 124, and MATH 18 or 22 either with grade C or better or placement at least MATH 23 or 82; or consent. Pre-requisite may be waived by consent yes no Co-requisites Recommended Preparation 4. Function/Designation AS Program AAS Accounting BAS Program AA Category Category Additional Category List Additional Programs and Category: PR - Program Requirement Category Developmental/Remedial List Additional Programs and Category: List Additional Programs and Category: Other/Additional: Explain: ______________________________________________________ ______________________ Chancellor Approval Date Revised 6/28/2016 Course Outline, page 1 2 See Curriculum Action Request (CAR) form for the college-wide general education student learning outcomes (SLOs) and/or the program learning outcomes (PLOs) this course supports. This course outline is standardized and/or the result of a community college or system-wide agreement. Responsible committee: Program Coordinators, all UH System Community Colleges and Maui College 5. Student Learning Outcomes (SLOs): List one to four inclusive SLOs. For assessment, link these to #7 Recommended Course Content, and #9 Recommended Course Requirements & Evaluation. Use roman numerals (I., II., III.) to designate SLOs On successful completion of this course, students will be able to: I. Complete the accounting cycle from source documents to financial statements with emphasis on practical application of accounting principles for a partnership and corporation. II. Analyze financial statements using horizontal analysis, vertical analysis, and financial statement ratio techniques. III. IV. 6. Competencies/Concepts/Issues/Skills For assessment, link these to #7 Recommended Course Content, and #9 Recommended Course Requirements & Evaluation. Use lower case letters (a., b.…zz. )to designate competencies/skills/issues On successful completion of this course, students will be able to: a. journalize transactions involving notes and interest, including adjusting entries for bad debts; b. prepare schedules of accounts receivables and accounts payables; c. value ending inventory using FIFO, LIFO, weighted-average cost, and specific identification methods using perpetual and periodic methods of inventory control; d. calculate depreciation using straight-line, units of output, double-declining balance, and sum-of-theyears methods; e. prepare journal entries affecting acquistion, depreciation, and disposal of plant and equipment; f. allocate partnership profit and losses using various methods; g. prepare journal entries and financial statements for a partnership; h. prepare journal entries and financial statements pertaining to a corporation; i. prepare journal entries for sinking funds and corporate bonds; j. prepare the statement of cash flow using the indirect method; k. analyze corporate financial statements using horizontal and vertical analysis and financial ratio techniques. 7. Suggested Course Content and Approximate Time Spent on Each Topic Linked to #5. Student Learning Outcomes and # 6 Competencies/Skills/Issues 1-4 Weeks: 1-2 Weeks: 1-2 Weeks: 1-3 Weeks 1-2 Weeks 1-3 Weeks 1-2 Weeks Revised 6/28/2016 Notes payable and notes receivable (I,a, b) Uncollectible accounts (I, a, b) Merchandise inventory valuation (I,c) Property and equipment (I, d,e) Partnerships (I, g) Corporate organization, capital stock, dividends and retained earnings (I, h) Corporate bonds (I, i) course outline 3 1-2 Weeks 1-2 Weeks 1-3 Weeks Statement of Cash Flow (I, j) Comparative financial statements and analyses (I, d, e)) Financial Statements and Closing Entries for a Merchandising Company (II, k) 8. Text and Materials, Reference Materials, and Auxiliary Materials Appropriate text(s) and materials will be chosen at the time the course is offered from those currently available in the field. Examples include: McQuiag, Douglas, Patricia Bille, Tracie Nobles. College Accounting. South Western Cengage Learning. Weygandt, Jerry J., Paul D. Kimmel, and Donald E Keiso. Accounting Principles. John Wiley & Sons, Inc. Appropriate reference materials will be chosen at the time the course is offered from those currently available in the field. Examples include: Curent events from various newspapers Business trade journals Magazines Appropriate auxiliary materials will be chosen at the time the course is offered from those currently available in the field. Examples include: Text(s) may be supplemented with Accompanying practice sets if available Articles and/or handouts prepared by the instructor Magazine or newspaper articles Appropriate films, videos, or Internet sites Guest speakers Other instructional aids 9. Suggested Course Requirements and Evaluation Linked to #5. Student Learning Outcomes (SLOs) and #6 Competencies/Skills/Issues Specific course requirements are at the discretion of the instructor at the time the course is being offered. Suggested requirements might include, but are not limited to: 30 - 90% 0 - 20% 0 - 50% 0 - 30% 0 - 20% 0 - 20% 0 - 20% Written or oral examinations (I, II a-k)) In-class exercises (I, II, a-k) Homework assignments (I, II. a-k) Accounting practice set(s) (I, II. a-k) Quizzes (I, II. a-k) Projects or research (I, II, a-k) Attendance and/or class participation (I, II, a-k) 10. Methods of Instruction Instructional methods will vary considerably by instructor. Specific methods are at the discretion of the instructor teaching the course and might include, but are not limited to: Revised 6/28/2016 course outline 4 Lecture, problem solving, and class exercises or readings Class discussions, student class presentations, or guest lectures Audio, visual or presentations involving the Internet Group or individual projects Other contemporary learning techniques (e.g., Service Learning, Co-op, School-to-Work, self-paced, etc.) 11. Assessment of Intended Student Learning Outcomes Standards Grid attached 12. Additional Information: Revised 6/28/2016 course outline