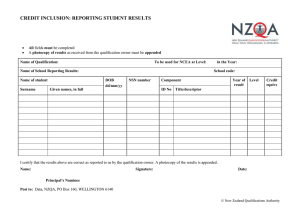

Qualification details

advertisement

Qualification details Title New Zealand Certificate in Personal Financial Capability and Financial Services (Level 3) Version 1 Qualification type Certificate Level 3 Credits 60 NZSCED 081199 DAS classification 2124 Management and Commerce > Banking, Finance and Related Fields > Banking, Finance and Related Fields not elsewhere classified Core Generic > Core Generic > Personal Financial Management Qualification developer The Skills Organisation Next review December 2016 Any person or organisation may contribute to the review of this qualification by sending feedback to the qualification developer at reviewcomments@skills.org.nz. Approval date 20 March 2014 Strategic purpose statement The purpose of this qualification is to provide individuals with knowledge and understanding of money management within personal and financial sector contexts. It is designed for individuals who wish to advance their skills and knowledge in personal financial management, and may also provide a credential to support individuals wishing to enter employment within financial services and related industries. New Zealand, individuals, and their communities will benefit from an increase in participation in quality financial education and increasing financial literacy. Graduates will gain knowledge and understanding in financial management, setting goals and budgeting, managing income, spending and debt, saving and investing, protecting assets and wealth and a broad knowledge of financial institutions, services and products within a New Zealand context. Outcome Statement Graduate profile Qualification Reference 2249 © New Zealand Qualifications Authority 2014 Graduates of this qualification will be able to: – Budget and set goals to manage money and review regularly. – Apply knowledge of planning tools and strategies to manage own income and debt level as life and financial. circumstances change. – Use appropriate money management strategies and tools to monitor saving and spending. Page 1 of 7 Education pathway – Identify potential saving and investment opportunities. – Apply knowledge of tools and strategies to create and protect assets and wealth as life and financial circumstances change. – Identify and understand products, services, roles, and functions of advisers and institutions in the financial services sector. This qualification recognises a range of financial capabilities that provide a foundation for further learning across a range of Level 4 qualifications, including but not limited to: Business, Business Administration, Small Business Management and First Line Management. On completion of this qualification graduates may progress to the New Zealand Certificate in Financial Services (Level 4) with strands in Banking, Family/Personal Budgeting, and Insurance [Ref: 2247]. Employment pathway Graduates may be qualified to work in a variety of entry level roles across a range of financial services and related industries. Qualification specifications Qualification award The candidate shall be awarded the qualification by the accredited Tertiary Education Organisation (TEO) where the programme has been completed. The formal document certifying the award of this qualification includes the full qualification title, the date of award, and the logos of The Skills Organisation, the accredited TEO, and the NZQF. As the qualification developer, The Skills Organisation will maintain a list of graduates of this qualification. The TEO will annually report the names of all graduates awarded the qualification to The Skills Organisation. Evidence requirements for assuring consistency All TEOs offering this qualification (either arranging training or delivering programmes) must participate in the Consistency Review. TEOs are to seek feedback from the financial capability sector regarding their graduates meeting the qualification graduate profile outcomes. Evidence may come from: – Regular monitoring of trainee progression within either the TEO or the workplace including liaising with employers, teaching staff, training supervisors, and industry managers about the value of the training, graduates, and qualification, to the business. – Feedback from major employers, employers' associations, and relevant industry bodies to ensure their members involved in the financial capability sector Qualification Reference 2249 © New Zealand Qualifications Authority 2014 Page 2 of 7 – – – are satisfied with the qualification graduates. Regular cross-industry meetings (Industry Advisory Groups) where the changing training needs of the industry can be discussed in light of technology changes, workplace practices, and graduate capabilities. Surveys of graduates and employers to determine if the graduates are appropriate for the workplace. Providing an alignment of programme outcomes or unit standards against the qualification outcomes. Guidelines for managing consistency are available and should be referred to on the NZQA website. Credit transfer and recognition of prior learning arrangements TEOs delivering programmes that lead to the award of this qualification may transfer credit and recognise prior learning in accordance with their own credit recognition policies and procedures. These policies and procedures, and information about associated fees, must be available to the applicant prior to enrolment. To facilitate credit transfer, education organisations must clearly demonstrate the equivalency or comparability between each of the outcomes in the graduate profile, and the assessment components of their programmes. Credit transfer will be automatic where standards on the Directory of Assessment Standards are used for assessment within programmes of study or training leading to this qualification. Minimum standard of achievement and standards for grade endorsements The minimum standard of achievement required for the award of the qualification will be the achievement of all graduate outcomes in the graduate profile through successful completion of an approved programme. There are no grade endorsements for this qualification. Entry requirements (including prerequisites to meet regulatory body or legislative requirements) There are no regulatory body or legislative requirements. Qualification conditions Overarching conditions relating to the qualification Conditions for programme structure TEOs delivering programmes that lead to the award of this qualification must maintain current knowledge of the FLCF. This qualification is aligned to the FLCF advanced knowledge and expected behaviours, and programmes must reflect this. Conditions for programme context N/A Qualification Reference 2249 © New Zealand Qualifications Authority 2014 Page 3 of 7 Other conditions TEOs using unit standards may find additional literacy, numeracy and or digital literacy standards useful, or standards in other relevant domains. Unit standards in the Personal Financial Management domain listed on the Directory of Assessment Standards can contribute towards the completion of each outcome of this qualification. Additional resources for financial capability are: http://www.cflri.org.nz/financial-literacy/about-financialliteracy/financial-literacy-competency-framework https://www.sorted.org.nz/a-z-guides/kiwisaver. Specific conditions relating to the Graduate profile Qualification outcomes Conditions Mandatory or Optional 1 Budget and set goals to manage money and review regularly. Programmes may include but are not limited to: Optional – own attitude and habits towards money and the impact on financial decisions Level 3 Credit 15 – short to long-term financial goals are set by preparing a budget that is reviewed and adjusted as required – external factors that impact on personal finances Consider: 2 Plan for changing life and financial circumstances to manage own income and debt level and review regularly. natural disasters, political decisions, employment – a range of tools to manage money effectively – how to evaluate different services and sources of financial advice to achieve life goals. Programmes may include but are not limited to: – implications associated with home ownership – various types of bank accounts and their uses – established net worth is regularly reviewed Level 3 Credit 12 Consider: – income, assets, debt money management systems and strategies to balance income and spending commitments to meet changing life circumstances Consider: changing life stages, taxation, balancing spending over time, spending priorities, servicing debt, impacts of not servicing debt – different taxes and their impact on spending and income – ‘good’ and ‘bad’ debt and its impact on different Qualification Reference 2249 © New Zealand Qualifications Authority 2014 Optional Page 4 of 7 situations – need for good credit rating and the implications of moving from bad to good debt – strategies to regularly evaluate and balance financial obligations and to service debt in relation to a budget Consider: - cost of borrowing from different lenders comparisions before making decisions Consider: 3 Use appropriate money management strategies and tools to monitor saving and spending. Level 3 Credit 8 4 Identify potential saving and investment opportunities. individual, family, cultural, religious obligations high interest vs low interest, cost of debt in relation to original loan, calculation of interest – debt reduction plan to reduce debt - paying off high-interest debt first – sustainable level of debt in relation to a budget and regularly review – dangers of debt security and guarantees – forms of personal debt. Programmes may include but are not limited to: – how to plan and budget to allow for variable income or expenditure throughout changes in life – importance of checking all spending options to make savings before spending – need to prioritise spending and keeping track of all spending by using appropriate money management strategies/tools – money management strategies to plan for a large expenditure. Programmes may include but are not limited to: – need for retirement planning, the impact of inflation and key features of New Zealand Super, KiwiSaver and other superannuation products – difference between various asset classes and the volatility and risks involved Level 3 Credit 10 Consider: Optional bonds, shares, property – changing role of individual risk and investment profile throughout life and the need for diversification in an investment portfolio – historical versus future performance of a financial product – financial institutions Qualification Reference 2249 © New Zealand Qualifications Authority 2014 Optional Page 5 of 7 Consider: – different investment products and options available according to own risk profile Consider: a savings plan – professional advisers, their roles and qualifications and complaint process – general investment terminology and key concepts derivatives, diversification, bull market, initial public offering. Apply knowledge of tools and strategies to create and protect assets and wealth as life and financial circumstances change Programmes may include but are not limited to: Level 3 Credit 10 – – Consider: changing life needs, reviewing regularly, income level how local, national and global finances can influence personal and family finances and plan appropriately risk reduction, finance protection, emergency funds, enduring power of attorney – how to recognise scams through research and identify ways of avoiding them – plan to increase income over time is in place – a will is prepared or in place Consider: Identify and understand products, services, roles, and functions of advisers and institutions in the financial services sector. safe storage, easily accessible, solicitor’s services – tools used to protect and grow assets and wealth including insurances, trusts, estate planning, solicitor’s services, home ownership – leveraging assets to create wealth. Programmes may include but are not limited to: – Level 3 Credit 5 Qualification Reference 2249 © New Zealand Qualifications Authority 2014 Optional role of insurance in reducing financial risks and plan appropriately Consider: 6 bonds, property, shares, cash, futures contract, call and put options, risk, return, interest paid, access to funds – Consider: 5 services, products, investment opportunities Optional key sectors within the Financial Services industry within New Zealand Consider: insurance, banking, building societies, trustees, investment, residential property lending, personal lending, financial advice, Page 6 of 7 credit unions, funds management – key features of services and products Consider: superannuation, KiwiSaver, insurance, investment, residential property lending. Unit standard 28155 is recommended. Optional Transition information Replacement information This qualification replaced the Certificate in Money Management [AI2070]. For last dates of entry and last dates of award of the replaced qualification please contact Te Wānanga o Aotearoa. Republication Information Version 1 of this qualification was republished June 2015 to update the Evidence requirements for managing consistency. Qualification Reference 2249 © New Zealand Qualifications Authority 2014 Page 7 of 7