Recharge Center Training PPT

advertisement

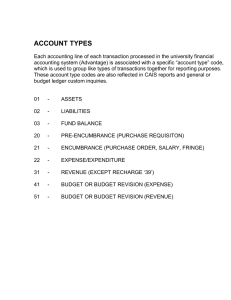

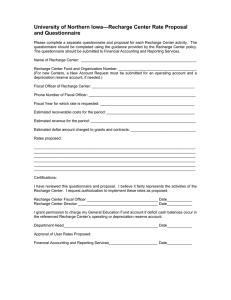

Recharge Center Policy and Procedure Training By Managerial Accounting Services Patty Whaley – Cost Accounting Mgr. Jamaal L. Smith – Cost & Rate Accountant Andrew McManus – Cost & Rate Accountant 1 Target Audience The target audience for this training: Recharge Center training is recommended for all business managers and support staff who have recharge responsibilities such as setting rates, preparation of rate requests and monitoring whether fund balances are within tolerance. 2 Course Outline • Introduction • General Information • Types of Recharge Centers • Internal Vs. External Customers • Fund Balance • Rate Setting Cycle • Preparation of the Rate Request • Special Rate Setting Considerations • Subsidies • Capital Equipment and Depreciation • Submission Requirements & Routing • Unique Situations • Closing Comments 3 Training Objective The Recharge Center policy will be defined as well as underlying concepts, processes and documentation necessary for the successful management of Recharge Center Operations. 4 Introduction • What is a recharge center or service center? • Why do we need a recharge policy and procedure manual? • Where do I find a copy of the recharge policy and procedure manual? http://www.purdue.edu/business/mas/BPM/Recharge_Center/ 5 Introduction ALL SALES OF GOODS OR SERVICES MUST HAVE: • Approval to engage in the activity • Approval of the rates to be charged to users 6 Introduction: Key Concepts • Fully costed rate • External customers should be charged the fully costed rate. • Facilities and administrative costs must be included for external customers. • Rates should not discriminate between federal and non federal customers. 7 Introduction: Activities Not Covered • Housing and Food Service • Vice President for Student Services Auxiliaries – Student Health Center – Recreational Sports – Convocations • Intercollegiate Athletics • Credit Courses with Special Fees; Short Courses • Conferences 8 General Recharge Information • Types of Recharge Centers • Internal vs. External Customers • Fund Balance 9 General Recharge Information Types of Recharge Centers • Departmental Recharge • General Service Center • Specialized Service Facilities 10 Types of Recharge Centers Departmental Recharge • Instruction or departmental function • Organized activity • Public service 11 Types of Recharge Centers Instruction or Departmental Function • Support instruction, research, or specific departmental function • Distribute charges primarily within the University • Achieve break-even over time – Revenue should (approximately) equal expenses Examples: Specialized scientific testing and services, departmental shops and storerooms, and unique departmental activities 12 Types of Recharge Centers Organized Activities • Established to provide training and/or lab experience to students as part of their educational requirements AND • Have high dollar volume activity Examples: Vet Teaching Hospital, the Pharmacy and University Theatre 13 Types of Recharge Centers Public Service • Provide goods and services primarily to the public Examples: Agriculture Extension, community outreach programs 14 Types of Recharge Centers General Service Center • Established centrally to provide cost-effective services to University departments • Recover the costs of goods and services provided Examples: Transportation, University Stores, Telephone Operations 15 General Recharge Information Specialized Service Facilities (SSF) • Highly complex or specialized facilities • Must have revenues of at least $1 million per year • Costs include facilities and administrative costs Examples: Computing centers, nuclear reactors, etc. As of May 2013, there are no Specialized Service Facilities at Purdue University. 16 Determining Type of Recharge Center Please reference the handout in your packet titled ‘Identification of Recharge Center Type’. 17 Internal vs. External Customers Internal Customers: • Person or organization with a direct relationship to the University – Purdue departments, including regional campuses – Student organizations approved by the dean of students – Professional organizations for students and staff – Professional associations in which staff serve as officers 18 Internal vs. External Customers External Customers: • Person or organization with no direct relationship to the University – PU alumni and former students – Colleges, universities, school corporations – Municipal and state supported institutions 19 Fund Balance • Represents the operating position of the recharge center based on the balance of working capital within the recharge 20 Fund Balance • Working Capital = Current Assets – Current Liabilities • Current Assets – assets that are reasonably expected to be realized in cash during the normal operating cycle of the recharge – Examples: Cash, Accounts Receivable, Inventory, etc • Current Liabilities – obligations that are reasonably expected to liquidate with the use of current assets during the normal operating cycle of the recharge – Examples: Accounts Payable, Payroll Liabilities, etc. 21 Fund Balance • To calculate the working capital fund balance: – Start with cash – Add other current assets – Subtract liabilities owed • Please note: Equipment and Accumulated Depreciation are NOT current assets. These amounts should be left out of fund balance calculation. – Equipment will be found on the 155xxx type G/Ls. – Accumulated Depreciation will be found on the 156xxx type G/Ls. 22 Assessing Current Fund Balance • A departmental recharge center fund balance should: – Remain above -$5,000 – Not exceed +$5,000 or 10 percent of revenue or two months of cash expenses, whichever amount is larger • The procedure manual refers to these parameters as “The Tolerance Zone.” The Tolerance Zone -$5,000 +$5,000 or 10% of revenue or two months of cash expenses 23 Assessing Current Fund Balance - Tools • Demo: Use GR55-Report Group ZRCH. • Important Tips: – Run the report From Period 0!! – Run the report for your operating funds only. 24 Assessing Current Fund Balance • A general service center fund balance should: – Have a Target Fund Balance of two months of cash expenses – Lower limit of fund balance tolerance zone = 90% of Target Fund Balance – Upper limit of fund balance tolerance zone = 110% of Target Fund Balance The Tolerance Zone 90% of Target Fund Balance 110% of Target Fund Balance • The procedure manual refers to these parameters as “The Tolerance Zone” 25 Assessing Current Fund Balance - Tools • Demo: Use GR55-Report Group ZRSC. • Important Tips: – Run the report From Period 0!! – Run the report for your operating funds only. 26 Fund Balance – Management Action • If the current month fund balance is not within the tolerance zone, we need to ask: – Does our financial position fit the pattern of prior years at this same time? – Is our financial position approximately what was projected at this time? – Are there unusual income or expense items this period? – Where will we be at year end? 27 Fund Balance – Management Action • At year end, fund balance must be within the tolerance zone. • Carry forward of out of tolerance balances requires approval from the Comptroller or her designee. • Memo should indicate: – Circumstances behind the out of tolerance position – Management plans to address the situation 28 Fund Balance – Management Action • 2013 Annual Fund Balance Review: – Conducted at year-end – Based on June 30th fund balances – Covers funds that have been identified as recharges • Formal request will be sent to DFAs on Aug. 1st. • Follow-up to the Annual Fund Balance Review will be conducted in October to ensure that recharges are taking the actions outlined in the memos returned to the Costing Office. 29 Review • Name the three types of recharge centers covered by the recharge policy – Departmental – General Service Center – Specialized Service Facilities • Purdue Alumni and former students are considered what type of customer? – External • What is the allowable fund balance range for Recharge Centers? – From negative $5,000 up to positive $5,000 or 10% of income or two months of cash expenses, whichever is greater 30 Rate Setting Cycle • Ongoing cycle of monitoring fund balance and adjusting rates. • Rate year is twelve months in length and begins the first of any month. • A new rate year can begin before the end of the twelve month cycle. • Fund balance should be monitored monthly. • New rates should be submitted when the fund balance will be out of tolerance at the close of a rate year. 31 Rate Setting Cycle Annual Rate Review • Even if fund balance remains within tolerance, a rate analysis. should be conducted at least once a year. • It is important to periodically validate the cost assumptions. used in developing each rate. 32 Rate Setting Cycle 33 Preparation of the Rate Request New Activity Things to consider: – Do I need a rate? – Is the activity appropriate for the mission of the University? – Is the amount of the activity material? • Should it be absorbed on department funds? – Who are my customers? 34 Preparation of the Rate Request Existing Activity with Rate Things to consider: – Is the activity still appropriate? – Is the fund balance within tolerance? – Are your customers still the same? • Has there been a change in customer base that would impact your rate or one main customer adversely? – Are there any changes that you can anticipate that would impact your rate? 35 Preparation of the Rate Request Preparation of the Rate • Project rate year expenditures • Project fund balance • Calculate the rate • Calculate external rates • Prepare the Rate Approval Memorandum 36 Preparation of the Rate Request Preparation of the Rate • Example Rate Calculation – Statement of Income and Expense – Salary and Wage Schedule • Example 1 – One composite rate per hour • Example 2 – Separate rate per staff member – Supplies & Expense Schedule (optional) – Break-even Rate Per Unit 37 Preparation of the Rate Request Statement of Income & Expense • New Rate – Meet with individuals involved in the operation. – Ask questions to obtain information about the operation. – Develop best estimates for use in rate development. – Once approved, review fund balance monthly. • Ensure estimates are relatively accurate • Avoid extreme over or under recovery of costs from users • Adjust rates if necessary 38 Preparation of the Rate Request Statement of Income & Expense • Existing Rate – Run GR55 (Report Group Z100) for the operating fund(s). • Obtain historical data needed for the Statement of Income and Expense Worksheet. – Review for operational changes that may impact the current or future rate period. 39 Preparation of the Rate • Example Rate Calculation – Statement of Income and Expense Worksheet A template of the Statement of Income and Expense Worksheet can be found on the Costing website at the following address: https://www.purdue.edu/costing/BPM/Recharge_Center/recharge. html Recharge Forms, Transaction Codes and Tools/References Link 40 Preparation of the Rate • Example Rate Calculation – Salary and Wage Schedule • Example 1 – One composite rate per hour • Example 2 – Separate rate per staff member 41 Preparation of the Rate • Example Rate Calculation – Supplies & Expense Schedule 42 Preparation of the Rate • Example Rate Calculation – Break-even Rate Per Unit • Example (Polyclonal Antibody—Rabbits from handout) Total S&W/Fringes: Total S&E: $10,220 3,416 Total Depreciation: Total Annual Cost: 633 $14,269 Less Over Recovery: (or Plus Under Recovery): (2,453) 0 Total Cost to be recovered: Divide by # Services/yr $11,815 / 28 = Rate per Unit (Break-even) $ 422 per service 43 Review • How often should the fund balance be monitored and when should a new rate be submitted? – Monitored monthly – New rate submitted as soon as it becomes clear that the fund balance will be out of tolerance at the end of the rate year • How do you determine the Break-Even Cost per Unit? – Total Cost to be recovered by the Recharge Center/ Quantity of Units for Rate Year 44 Review • How are external rates calculated? – Break-Even cost per unit X Current University F&A Rate = F&A Cost Recovery – Break-Even cost per unit + F&A Cost Recovery per Unit = External Customer Rate • Determine external rate for Polyclonal Antibody—Rabbits: Break-even rate * F&A Cost Recovery Rate (54%) = F&A Cost Recovery $422 * 54% = $228 Break-even rate + F&A Cost Recovery = External Customer Rate $422 + $228 = $650 45 Break 46 Special Rate Setting Considerations • Subsidies • Purchase & Depreciation of Capital Equipment 47 Special Rate Setting Considerations Rate Subsidies • A subsidized rate may be offered to internal users. – Rates charged to other users may not be inflated to recover the subsidized costs to internal users. • The break-even rate must be charged to external users. 48 Special Rate Setting Considerations Recording a Subsidy • An intramural invoice voucher should be used to process a subsidy. – Intramural invoice vouchers are document types JN. – Debit subsidy account, G/L account 523110 (Recharge Subsidy). – Credit recharge account, G/L account 433080 (Recharge Subsidy Income). 49 Special Rate Setting Considerations Three Ways to Subsidize • 1 – Per Unit Subsidy • 2 – Lump Sum Subsidy • 3 – Salary and Wage Subsidy (very rarely approved) 50 Special Rate Setting Considerations 1. Set Subsidy per Unit – Customer’s account is billed for a portion of the unit cost – Subsidizing account is billed for the subsidy portion of the unit cost 51 Example SUBSIDY PER UNIT 1. Total Costs (TC) $ 120,000 Units 1,000 Subsidy per unit $ 10 Fully Costed Internal Rate $ 120 Internal Rate $110/unit billed to customer's account $10/unit billed to subsidizing account External Rate Internal rate $120/unit recharge center income F&A (54%) $64.80/unit $120 x 54% - deposit to 21010000 4099008000 (G/L 445010) External Rate $184.80/unit billed to customer's account If 650 units are for internal customers receiving the subsidy 650 units x $ 10 subsidy per unit Total subsidy = $ 6,500 LUMP SUM SUBSIDY 52 Example Continued • Internal Customer – Intramural Voucher: • DR 5xxxxx Recharge Expense (customer account fund) $110 • DR 523110 Rchg Subsidy (unrestricted funding source) $10 • CR 4xxxxx Recharge Income (recharge center fund) • CR 433080 Rech Sub Inc (recharge center fund) $110 $10 53 Special Rate Setting Considerations 2. Lump Sum Subsidy – Subsidy account is billed on a periodic basis, not on a per unit basis. – Requires assessment of whom should receive the subsidy and the corresponding rate to be charged. 54 Example Units Subsidy 1,000 $ 10,000 Must make some assessment of your customer base and which ones you might want/need to offer a subsidy If all of your customers should be subsidized, the calculated rate could be based on total costs less the subsidy ($110,000). However, remember you should not subsidize external customers Breakdown of units 350 650 Subsidy per unit $ 15.38 Subsidized Internal Rate $ 104.62 External Rate units to external customers units to subsidized internal customers $10,000/650 units $120 - $15.38 $184.80 $120 x 1.54 68,003 9,997 42,000 120,000 $104.62 * 650 $15.38 * 650 $120 * 350 Total Income to recharge center $ $ $ $ F&A deposit to 21010000 4099008000 $ 22,680 Verification that rates are set correctly: Internal income to recharge center Subsidy to recharge center External income to recharge center $64.80 * 350 (use GL account 445010) 55 Special Rate Setting Considerations 3 Salary and Wage Subsidy (very rarely approved) – Salary and wages relating to the recharge center may be charged to another account. Two categories: 1. Sponsored Program 2. Request to charge individual effort and/or fringes to unrestricted account. – Requires advanced approval from Senior Vice President for Business Services and Assistant Treasurer due to central pool subsidy of fringe benefits (limited as of 07/01/2013). 56 Capital Equipment and Depreciation Depreciation • The process of allocating to expense the cost of capital equipment over its useful life. • Must be a qualifying purchase. – Cost is greater than or equal to $5,000. – Purchased after July 1, 1998. – Fund source is not federal funds. 57 Capital Equipment and Depreciation Depreciation • University Depreciation Method – Straight line – Full month of depreciation taken in month placed in service – No depreciation taken in month of disposal – Must use the same useful life as provided by Property Accounting 58 Capital Equipment and Depreciation Depreciation • Special Notes: – Repair parts in excess of $5,000 are not considered a capital purchase and should be completely expensed at the time of purchase. – Software in excess of $500,000 (vendor cost) is considered capital equipment and is subject to depreciation. – Once the asset’s useful life used by Property Accounting is over, the recharge center can no longer recover depreciation through the rate. 59 Capital Equipment and Depreciation Depreciation • All capital equipment used by the Recharge Center must be purchased through the recharge account, and depreciation must be recovered. • Depreciation cannot be recovered on equipment purchased with sponsored program funds. 60 Capital Equipment and Depreciation Step 1 - Transfer funding for initial purchase of equipment • The department will provide funding for the initial purchase of equipment from an unrestricted account other than the recharge account. • • DR FUND-COST CENTER (OTHER) CR FUND-COST CENTER (RCHG) 59XXXX 49XXXX X.XX X.XX 61 Capital Equipment and Depreciation Step 2 – Purchase of equipment • In FI, the equipment purchase will be processed as follows (entry completed by property accounting): – DR FUND-COST CENTER (RCHG) 155XXX X.XX – CR FUND-COST CENTER (RCHG) 101400 X.XX • In FM, the equipment purchase will be processed against the recharge account on a capital equipment expense G/L Commitment Item: – DR FUND-COST CENTER (RCHG) 537XXX X.XX 62 Capital Equipment and Depreciation Step 3 - Establish depreciation recovery account • Necessary for all recharge centers that have purchased equipment, unless purchased on sponsored project funds. • Equipment must be purchased in the recharge account in order to recover depreciation expense. • Title should be: “DeprRec- XXXXXXXX” where “XXXXXXXX” represents the recharge operating fund that purchased the equipment. 63 Capital Equipment and Depreciation Step 4 - Transfer depreciation expense to depreciation recovery account • Depreciation expense is recorded in the Recharge Center Operating Fund, and the amount can be found by running a GR55 (Report Group ZRCH) for the period of which you are transferring depreciation expense. • Department will transfer depreciation expense to Depreciation Recovery Account by June 30 of each year • DR FUND-COST CENTER (RCHG) 59XXXX • CR FUND-COST CENTER (DEPR REC) 49XXXX X.XX X.XX 64 Capital Equipment and Depreciation Step 5 - Use of funds in depreciation recovery account • The full cost of the asset will have been recovered at the end of equipment life. • Useful life used in recharge center should match the Property Accounting useful life. • Funds should be used for additional equipment . • DR FUND-COST CENTER (DEPR REC) • CR FUND-COST CENTER (RCHG) 59XXXX 49XXXX X.XX X.XX • Funds may also be returned to the department for use at the discretion of the department head. 65 Capital Equipment and Depreciation Why do we need depreciation recovery? • If we do not use a depreciation recovery account, the amount we’ve recovered for depreciation will overstate our operating fund balance. • To know the correct amount of surplus and/or deficit, we need to separately record our depreciation recovery. 66 Capital Equipment and Depreciation Depreciation • Recharge centers are expected to cover any gains or losses on disposal, loss, or destruction of equipment. – If this situation arises or for more information on gains and losses, please contact the Costing Office. 67 Review • How should subsidy transactions be processed? – Using and Intramural Invoice Voucher and designated G/L accounts • Can external customers be subsidized? – No • Why do we depreciate capital equipment? – Reserve of $ to assist with the purchase of new or replacement equipment – Spreads the cost over the expected life of the equipment 68 Review • For recharge centers, how is the initial purchase of capital equipment funded? – Dollars transferred to the recharge account – Equipment purchased from the recharge account • If a piece of equipment currently being depreciated is sold for less than the book value, who covers the loss? – Recharge center 69 Submission Requirements and Routing What Is Required When Submitting a Rate? • Rate memorandum • New Fund Request • Projected income statement • Salary and wage schedule • Rate calculation 70 Submission Requirements and Routing Rate Request Approval Memo • Addressed to the Senior Vice President for Business Services and Assistant Treasurer or delegate per Memo A-18 • From the Business Manager or Fiscal Director • Through the School DFA Date, recharge name, recharge type, and department • Recharge center director & location • Previous approval date • Recharge account number(s) • Rate effective date • Depreciation recovery account, if depreciating • Purpose of activity - Why is the activity needed? 71 Submission Requirements and Routing • • • Rate Request Approval Memo Clients or Customers • Descriptive information Including external customers within the body of the if anticipated memo, including: Accounting procedures and controls in place If new operation handling cash, provide a copy of the cash handling plan Present and proposed rates Include external rates, if applicable Any assumptions made Significant changes from the previous approval Any other special circumstances or situations 72 Submission Requirements and Routing Rate Request Approval Memo • Approval recommended signature blocks for Dept Head, Dean/ Director and Comptroller/Costing. • Approval signature block for the Senior Director of Business Managers or delegates. - • - As designated in the routing and Approval Memorandum A18. Copies Distributed to all signatories 73 Submission Requirements and Routing New Fund Request • Most new recharge funds should be 2204 - 22 – Income Producing - 2204 – Organized Activities/Support Inst. & Res. • All General Service Centers should be 2406 - 24 – Auxiliary & Service Enterprises - 2406 – Service & Other Enterprises 74 Submission Requirements and Routing Supporting Documentation • Projected Income Statement, which includes a projected fund balance • Salary and Wage Schedule • Rate Calculation • Other Supporting Documentation Note: Individuals are encouraged to send drafts through Costing before securing signatures 75 Submission Requirements and Routing Routing and Approval • Recharge Activities – New and continuing rates involving academic areas, academic support areas and recharge activities. • Reviewed by Costing Office/Comptroller and approved by the Senior Director for Business Managers. 76 Submission Requirements and Routing Routing and Approval • General Service Centers and Specialized Service Facilities (SSF). – New and continuing rates originating from a General Service Center or SSF. • Reviewed by the Costing Office and approved by the Comptroller. 77 Submission Requirements and Routing Routing and Approval • Exceptions – Any exceptions to policy will require the approval of the Senior Vice President for Business Services & Assistant Treasurer. • May include, but not limited to – Variances in F&A rate – Use of University facilities by external users – Salary and Wage Subsidies – Fringe Benefit Subsidies 78 Review • Should a draft of the rate request be sent through to Costing prior to obtaining signatures? – New rate – yes – Existing rate with significant changes – yes – Existing rate with minimal changes – not necessary • True or False – A rate containing a general fund subsidy of salaries and wages fits within the guidelines of the recharge policy and may be approved by the Senior Director of Business Managers? – FALSE – It is an exception to policy and will require approval of the SVPBS&AT 79 Break 80 Unique Situations • • • • • Addendums Flow-through activities One-time activities Market rates Use of University Resources for Non-University Business What are they? What is required to be submitted for approval? 81 Addendums • What are they? – Minor rate modifications • When are they appropriate? – Only used to make additions to current rates – Not a substitute for a full rate request • Submission Requirements? – – – – – Brief description of changes New calculated rate(s) Changes to Statement of Income Follow normal submission approval routes Clearly state that this request is an Addendum 82 Unique Situations Flow-through Activities • The term “flow through costs” describes the transfer of the actual cost of the goods or services to the user (i.e. copy services, postage). • There is no mark up involved to recover any cost other than the cost of the good or service initially provided. • No rate calculations are conducted at the operating unit level to determine the cost of the good or service. • Costs of these activities will be incurred in the department’s operating account and recharges treated as reduction of expense. 83 Unique Situations Flow-through Activities • Expense recovery for flow-through activities: • Example: Chemistry purchased $5K worth of chemicals in bulk, but only needs $2K of the chemicals. They decide to sell the remaining $3K of chemicals to the Biology department. – Credit appropriate expense G/L account for selling department • On a Journal Voucher (doc type SA) or Intramural Invoice Voucher (doc type JN) when recovering from other university accounts DR (Biology-purchaser) 523020 $3,000 CR (Chemistry-seller) 523020 $3,000 • On a Cash Receipts Voucher when payment is received by cash or check CR (Chemistry-seller) 523020 $3,000 84 Unique Situations Flow-through Activities Intramural (JN) or JV (SA)?….that is the question… • Postage Charges and Copy Charges - Intramural Invoice Voucher (JN) • Other examples of Flow Through Activities - Journal Voucher (SA) 85 Unique Situations Flow-through Activities • Rate Approval Memorandum is not required. • No rate calculation is needed. 86 Unique Situations One-time Activities • Activities that are non-recurring or occur on a periodic or irregular basis. • Require approval of both the activity and the corresponding rates . • Budgeting and accounting requirements will be evaluated on a case by case basis. • Very rare 87 Unique Situations One-time Activities • Items required for submission – Rate Approval Memorandum – Rate calculation • Depending on the nature of the activity, may also include: – Projected income statement – Salary and wage schedule – Projected fund balance 88 Unique Situations Market Rates • In instances where services are provided on a market price basis (not a calculated rate basis) the normal market price may be charged to external customers only • Include with the request to establish Market Rates: – – Justification of the need to use market prices Sufficient evidence of market research to validate the price requested • The rate charged must cover the full cost of the goods or services – Includes F&A costs for external customers 89 Unique Situations Market Rates • Items required for submission – Rate Approval Memorandum – Salary and Wage schedule – Projected Income Statement, including the Projected Fund Balance – Rate Calculation (to provide documentation of break-even rate) – Justification for use of market rate – Evidence of market research 90 Unique Situations Use of University Resources for Non-University Business • Policy set forth in Senior Vice President for Business Services and Assistant Treasurer Memo No.88 “Special research facilities, services, supplies and equipment unique to a university and not readily obtainable commercially are available to outside users for purposes related to research and development on a priority basis after all needs of the university are met. Users are, of course, required to pay full cost including charges to reimburse the University for indirect expenditure, use of specialized personnel, and other appropriate items.” One common example: Use of equipment 91 Unique Situations Use of University Resources for Non-University Business • Applying Memo No.88 for use of equipment – Identify the equipment being used. – Set parameters around the use of the equipment: • Use of this equipment can occur only after all needs of the University are met. • Purpose must be defined, for example: – Consulting for xyz company – Use benefiting a faculty member’s start-up company • Usually requires a contractual agreement. 92 Unique Situations Use of University Resources for Non-University Business • Calculating Rate for Equipment Use – Consider the following: • Original cost of the equipment • Account of acquisition • Age of equipment • Expected useful life • Type of equipment • Use requirements • Length of time equipment will be used • Recovery of F&A costs 93 Unique Situations Use of University Resources for Non-University Business • Items required for submission – Rate Approval Memorandum and justification • Include specific parameters – Rate calculation – Accounting treatment 94 Closing Comments Key Concepts • All sales of goods and services must have approval to engage in the activity as well as approval of the rate to be charged. • Rates should be fully costed. • External customers should be charged the fully costed rate + F&A. 95 Closing Comments Key Concepts • Facilities and administrative costs must be included for external customers. • Rates should not discriminate between federal and non-federal customers. 96 Closing Comments Recharge Center Resources • Managerial Accounting Services Website – Recharge Center https://www.purdue.edu/business/costing/BPM/Recharge_Ce nter/index.html • • • • Recharge Center Policy Recharge Center Procedure Manual Questions & Answers Forms, Spreadsheets & Queries 97 Resources- Mangerial Accounting Services Website 98 Resources – Recharge Center Tab 99 Resources – Forms, Transactions and Tools 100 Closing Comments Recharge Center Resources • Rate Request Preparation and Management Questions Andy McManus Cost & Rate Accountant - Costing Office 6-6188 amcmanus@purdue.edu Jamaal L. Smith Cost & Rate Accountant - Costing Office 4-8053 smith42@purdue.edu 101 Closing Comments Recharge Center Resources • Depreciation/Equipment Questions Lisa Geisler Property Accounting Manager 4-7376 lgeisler@purdue.edu • Account Set-up Questions Master Data cmdt@purdue.edu 102 Questions or Comments? Session evaluations will be e-mailed. 103