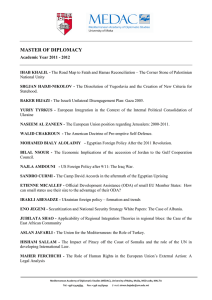

Terry McKinley, The Macroeconomics of Financing Basic Utilities for All

advertisement

The Macroeconomics of Financing Basic Utilities for All Terry McKinley Director, International Poverty Centre “Financing Access to Basic Utilities for All” Multi-Stakeholder Consultation, Lusaka, 23-25 April 2007 1 Some Research Background UNDP has supported 25 national reports on Economic Policies for Growth, Employment and Poverty Reduction since 2002 The motivation has been to promote greater policy dialogue and provide policy alternatives on economic policies www.undp-povertycentre.org/reports.htm 1. 2. 3. Coverage: Asia-Pacific, Eastern Europe and the CIS, Middle East, and sub-Saharan Africa Focus: a) fiscal, monetary and exchange-rate policies and b) financial liberalization, trade liberalization and privatization UNDP has also supported a global project on “Privatization and Poverty Reduction” (most studies are in low-income countries in Africa) 2 The Conclusion of the Studies Privatisation and commercialisation of public services are often not compatible in low-income countries with achieving the Millennium Development Goals See Working Paper #22 of the International Poverty Centre: “Can Privatisation and Commercialisation of Public Services Help Achieve the MDGs: An Assessment?” www.undp-povertycentre.org Also see the IPC Policy Research Brief #3: “Privatising Basic Utilities in Sub-Saharan Africa: the MDG Impact” and the ensuing debate in One Pagers Central Questions: How will access to public services—such as water, sanitation and electricity—be financed? What are the Macroeconomic Implications? 3 Access to Electricity: Percentage of Population Region Africa 1970 1990 2000 Total Total Total 14 25 34 2000 Urban 2000 Rural 63 17 S. Asia 17 32 41 68 30 E. Asia 30 56 87 98 81 Latin America 45 70 87 98 51 All Developing 25 46 64 86 51 4 Access to Electricity: The Need for Public Investment How to reach households without electricity? Two-thirds of households in Africa—83% in rural areas? 59% of households in South Asia—70% in rural areas? We have to dramatically ‘scale up’ public investment in order to expand the electrical grid or provide alternative cheaper sources of energy Costing the public investment needed to reach the MDGs has provided a stronger impetus for a change in strategy A greater need for Economic Policies that support Rapid Growth and Economic Development, not just Macroeconomic Stabilization 5 The Need for Public Investment-Led Economic Policies According to conservative economists, increased Public Investment will: 1. ‘Crowd out’ (displace) private investment 2. Cause accelerating inflation and appreciation of the exchange rate 3. Increase the Fiscal Deficit and the Public Debt Public Investment Has Been in Long-Term Decline (See graph): From 10% to 7% of GDP 6 Public Investment in Developing Countries, 1970-2000 (as a share of GDP) 11 10 9 8 7 6 5 4 Simple average Weighted average 7 Why Is Increasing Public Investment Justified? It will stimulate private investment, not dampen it (example: electricity) It will increase the productive capacity of the economy so that inflation is contained Governments should borrow to finance public investment (deficit financing) It creates future revenue and welfare benefits Current revenue should cover current expenditures So incurring deficits is normal for investment purposes (ODA finances larger deficits) 8 The Macroeconomic Implications of Expanding Basic Utilities Fiscal policies need to be more expansionary (investment focused) Monetary policies should be consistent with fiscal expansion Low inflation targets (3-5%) can be counterproductive Achieving such targets can drive up real rates of interest Such interest rates slow private investment and make public borrowing more expensive: the result is a vicious circle 9 What Are the Alternative Sources of Financing? For low-income countries, a dramatic scaling up of Official Development Assistance is needed Such a scaling up need not endanger macroeconomic stability (e.g., accelerating inflation and causing a ‘Dutch Disease’ appreciation) Refer to the Conference Papers from the IPC-supported Global Conference on “Gearing Macroeconomic Policies to Reverse the HIV/AIDS Epidemic” www.undp-povertycentre.org/aids.htm Conclusions: 1) concerns about instability are inflated and 2) if there are such problems, they can be managed. 10 Investment-Focused ODA See the New IMF Analytical Framework: ODA should be ‘SPENT’: the Government should spend more based on ODA financing of a larger deficit ODA should be ‘ABSORBED’: the Central Bank should sell the ODA-supplied foreign exchange in order to finance imports Otherwise the purpose of ODA is defeated 11 Investment-Focused ODA The recent 2007 Evaluation of PRGF countries in sub-Saharan Africa by IMF’s Independent Evaluation Office found: Governments spent only 28% of ODA (72% was saved) So almost three-quarters of ODA was not used for development purposes!!! Worse still, if the inflation rate exceeded 5% in a country, only 15% of ODA, on average, was spent by governments 12 Monetary Policies and Inflation But IMF now recognizes that inflation rates of 5-10% need not be harmful to growth Maintaining inflation rates of 3-5%, as in the past, can often be unduly restrictive Empirical evidence suggests that even inflation rates up to 15% are not likely to be harmful Supply shocks (oil; food) can temporarily drive inflation rates above 10% 13 Inflation Has Declined in Africa It has been 5-10% since 1997 14 The Impact of ODA Central Banks ‘Absorbed’ only 63% of ODA (i.e., sold foreign exchange) 37% of ODA was used to build up International Reserves There are three possible uses of ODA: 1. Central Bank Reserves 2. Private Capital Outflow 3. Financing of Imports (a transfer of real resources: widening the current account) 15 Using ODA Effectively Is it justifiable to use ODA to build up reserves? Reserves substitute for the transfer of real resources into the country A modest build-up could be warranted as a means to address Aid Volatility The Problem: Central Banks ‘sterilize’ the monetary impact of ODA, driving up interest rates in order to contain inflation 16 A Danger of Exchange-Rate Appreciation?? The IMF hypothesis: More government spending domestically (on non-tradables) increases inflation 2. Inflation appreciates the exchange rate 3. Appreciation damages the international competitiveness of exports 1. But in sub-Saharan Africa (as in Asia) aid surges have been associated with Depreciation (See Graph) 17 The Size of Aid Is Correlated with Depreciation in Africa 250 COG CMR EGY SLE MRT CIV NGA NER 200 SDN DZA ZWE GAB BFA TCD BDI SEN ZAR KEN BWA MAR RWA TZA GMB CAF TGO LSO TUN 150 GHA MDG MWI GIN ETH UGA ZAF 100 50 Real Overvaluation ZMB MOZ 0 10 20 30 40 Foreign Aid %GNI overvalue Fitted values 18 A Danger of Exchange-Rate Appreciation?? The danger of inflation depends on the supply response to increased demand Fiscal policies (that increase government spending) and monetary policies (that sell foreign exchange) need to be coordinated (see IPC Working Paper #10 & Conference Papers) But coordination of policies on whose terms? Fiscal policies have to be consistent with the restrictive monetary policies of the Central Bank??? 19 Policy Coordination for Scaling Up Choose the opposite: monetary policies should be supportive of expansionary fiscal policies Short-term inflation and even some appreciation could be part of the adjustment process 1. Relative prices need to adjust in order to transfer resources domestically and facilitate their import into the country The exchange rate can be managed to deal with such short-term problems (along with coordinating fiscal and monetary policies) 20 The Problem of Aid Volatility The volatility of aid is the chief problem, not so much domestic macroeconomic instability ODA needs not only to be scaled up but also made predictable Otherwise it imparts instability to the budgeting process and contributes to macroeconomic instability 21