The Foreign Exchange Reserves Buildup: Business as Usual? Charles Wyplosz

advertisement

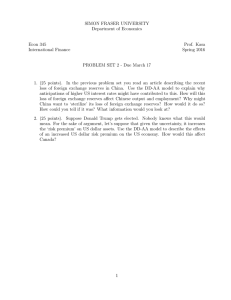

The Foreign Exchange Reserves Buildup: Business as Usual? Charles Wyplosz Graduate Institute of International Economics and CEPR Workshop on Debt, Finance and Emerging Issues in Financial Integration, 6-7 March 2007 The issue Reserves (US $ bn.) 4000 3500 3000 Excessive? 2500 2000 World 1500 1000 500 Emerging 0 1970 1975 1980 1985 1990 1995 2000 2005 Need to answer two questions • Measurement • Criteria • Both related to motive Measurement • Nominal reserve stocks • Usual scale variables GDP World Foreign Exchange Reserves Trade (imports, exports) 0.40 0.10 Reserves/GDP Reserves/trade 0.35 0.08 0.30 0.06 0.25 0.04 0.20 0.02 0.15 1980 1985 1990 1995 2000 2005 Measurement • Nominal reserve stocks • Usual scale variables GDP Trade (imports, exports) • Popular rules 3 months of imports Stock of short-term external liabilities • Greenspan-Guidotti-Fischer rule A different picture Reserves/External liabilities (unweighted averages) 0.6 0.5 World Excessive? 0.4 Emerging 0.3 0.2 0.1 1970 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 The impact of financial globalization External liabilities (US $ mn.) 350000 300000 250000 200000 World 150000 100000 Emerging 50000 0 1970 1974 1978 1982 1986 1990 1994 1998 2002 More details: Who does it? Reserves/External liabilities Reserves/External liabilities 0.8 0.8 South-East Asia 0.6 0.6 Non-EU Europe Oil exporters 0.4 0.4 Africa 0.2 0.2 Emerging Latin America 0 0 1970 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 1970 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 More details: Who does it and why? External liabilities 350000 300000 250000 South East Asia 200000 150000 100000 Oil exporters 50000 Latin America Africa 0 1970 1974 1978 1982 1986 1990 1994 1998 2002 And some outliers Reserves/External Liabilities 1.4 1.2 Greenspan-Guidotti-Fischer 1 0.8 0.6 China 0.4 0.2 Korea 0 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 Excessive? • The motives approach • The cost-benefit approach Motives • Self-insurance Shifting risks • from trade balance to capital account • from 3 months of imports to Greenspan-GuidottiFischer rule • Mercantilism Variant 1: Export-led growth strategy Variant 2: Keep savings home Variant 3: Hold reserves for the sake of it Variant 4: Directed credit Testing motives • Aizenman and Lee (2006) Strong effect of variables related to selfinsurance • Capital account liberalization • Crisis dummies Some effect of variables related to mercantlism, but much weaker • Undervaluation • Export growth Testing motives • Aizenman and Lee (2006) • Jeanne and Rancière (2006) Model of self-insurance Reserve build-up well explained But some outliers in South-East Asia Testing motives • Aizenman and Lee (2006) • Jeanne and Rancière (2006) • Official and unofficial statements • Conclusion: self-insurance and fear of IMF Costs and benefits • Costs Direct costs • Rodrik (2006): 1% of GDP for reserves =30% of GDP Opportunity costs • Better returns at home (private and public) • The case of China Costs and benefits • Costs • Benefits Export-led growth Self-insurance Export-led growth • Apparently successful, so a benefit? • Only if systematic undervaluation works No evidence that it does No theory • • • • Nominal vs. real exchange rate Strong foreign demand inflation Unless domestic demand is weak High saving is the key success factor • But then what to do with the savings? • Invest at home or abroad Self-insurance • Currency crises can be very expensive • A good reason to buy insurance • Do high reserve stocks provide insurance? Not really an insurance Reduce the odds of crisis Unlikely to eliminate the threat False sense of immunity • Could discourage reforms • Could encourage imprudent policies Wrap-up • Limited evidence of excessive accumulation Some prominent exceptions • Little evidence of mercantilist motive • Mostly self insurance • Recent build-up is business as usual What has been unusual is financial gloablization