Micro Finance and Linkages

advertisement

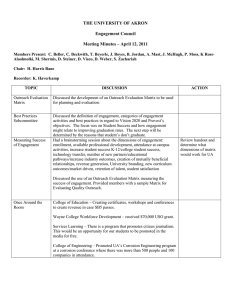

POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA MICROFINANCE IN SOUTH AFRICA Marié Kirsten DBSA Rethinking the Role of National Finance Institutions in Africa The Role of SMEs 23 November 2006 POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA Socio-Economic realities in South Africa 2005 • SA per capita income = $12 000 pa = 52 wealthiest out of 177 countries • HDI declined from 85/177 in 1990 to 120/177 in 2004 • Gap between per capita income and HDI -68 in 2004 • This means that the economy is growing but the benefits of growth is not shared • > 40% of population are unemployed (wide definition) • 25.2 million people live on < $2 a day (>50% of population) • Highest Gini-coefficient in the world POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA Financial Access realities in South Africa 2005 63% financially served Formal Banked 47% Formal - Other 8% 53% without formal bank access 0% Un-Banked 37% 100% 99% Black 16-29 age group Tribal land and urban townships No property or assets POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA SA % NAMIBIA % BOTSWANA % Banked 47 51 43 Formally served 55 53 49 Financially included 63 56 54 Excluded 37 46 46 BRAZIL % COLOMBIA % MEXICO % Banked 43 39 32 Formally served 79 48 36 Financially included 84 51 70 Excluded 16 49 30 POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA What did government do about this? • 1992 – Exemption of the Usury Act • 1995/6 – NHFC and KHULA created • 1999 – Micro Finance Regulatory Council created and new exemption makes registration compulsory • 2002 – National Loans Register - database of all MFRC lenders and loans • 2003 – Financial Sector Charter POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA Financial Sector Charter - Access Targets PERCENTAGE OF LSM 1 – 5 WITH EFFECTIVE ACCESS TO: 2008 ACCESS TARGET 2003 ACTUAL USAGE Transaction Accounts 80% 32% Bank Savings Products 80% 28% Life Insurance Products 23% 5% Collective Investment Savings Products 1% plus 250000 Negligible Short Term Risk Insurance Products 6% Negligible POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA Mzansi Bank Accounts • • • • A Charter Initiative – Introduced October 2004 A valid ID the only condition Deposits, withdrawals, transfers locally, debit card payments ABSA, First National Bank, Standard Bank, Nedbank and the Post Bank • 91.3% Mzansi account holders are first time banked • 62% are between 25 and 54, > 50% women, average balance R300 (US$40) • 1.5 million active accounts POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA FURTHER REGULATIONS… • National Credit Bill – June 2006 • Dedicated Banks Bill • Cooperative Banks Bill and new Apex institutions… • South African Microfinance Apex Fund (SAMAF) – 2006 • Micro Agricultural Finance Schemes SA (MAFISA) - 2005 POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA The Small Enterprise Foundation • Aim of poverty alleviation through microcredit • A section 21 NGO – non-profit • Founded in 1991, started operations in January 1992 • Inspired by Grameen Bank POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA Current Performance • • • • • • • Currently serving over 35 000 active clients % of women clients: 99% Almost 300 000 loans since inception Average loan size: $200 / R1547 Loans since inception: $45 / R330 million Loan losses since inception: 0.5% Attained full break-even in Sept 2004 POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA Annually 35,000 Quarterly Growth and Sustainability Active Clients 30,000 25,000 Financial Sustainability 20,000 15,000 10,000 5,000 '0 2 '0 3 '0 0 '0 1 '9 8 '9 9 '9 6 '9 7 '9 4 '9 5 Ju n Se '04 pt D '04 ec M '04 ar Ju '05 n Se '05 pt D '05 ec Ja '05 n '0 6 Ju n '9 2 '9 3 0 110% 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA Empowerment • • • • • Belief in people’s ability People treated as clients Hold people 100% to their group guarantee Client must decide on the business Client solves all problems – Although there is support from other clients and facilitation from staff POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA SEF vs. MFI Peers Indicator Total Active Clients / Total Staff Loan Officer / Total Staff Portfolio-at-risk > 30 days SEF MFIs by Age MFIs by Region 219 128 162 82% 58% 56% 0.5% 3.0% 2.0% POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA How SEF works … • • • • Clients form groups of 5 Each receives their own loan for their own business All group members guarantee each others loans Groups meet fortnightly in Centres of about 8 groups meeting at a time POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA Key issues…. • SEF is achieving > 25% growth a year currently • SEF achieved break even 12 years after conception • The profitable SEF is growing much faster than the non-profitable SEF • There is absolutely no trade off between impact (reaching the very poor) and profitability • Competent management made all the difference POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA Financial Sector Charter LSM 1-5 in summary • 63% (19m) of adult population • 79% of whom have monthly incomes of less than R1,000 • …but of whom 21% (4m) have incomes of between R1,000 – R6,000 • 94% black • 10,3m living in rural areas • 68% unbanked; 95% uninsured, long or short • 3,1m child grant recipients (total 3,6m) POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA New SEF initiatives • IMAGE RESEARCH – HIV/AIDS and Gender Violence training combined with microfinance – Substantial improvement in the financial performance at participating centres – A significant decline in gender based violence amongst training recipients • SEF is also pioneering life insurance for its clients POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA Sustainability • Attained full break-even in Sept 2004 • Now expanding from 27 000 to 45 000 clients – Now covering 95% of all costs POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA Current Performance … • Write-off policy: 85 days • Current Portfolio at risk 0.7% • Loan losses since inception 0.5% POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA So what does it all mean? • Access targets for banking now seem very distant Accessibility will far exceed active usage by 2008 1% increase in banked 46% “can easily live life without a bank account” – 27% of currently banked people agree with this statement! • • Mzansi clearly not the silver bullet Adherence to cash continues Convenience of cash is compelling Where are the debit cards? • Expectation of price competition Mzansi and cellphone banking • Watch the FSM 3-5s! Many already banked but they are hungry for more products and more knowledge • • Need for cheaper, simpler products, especially in insurance Financial literacy Urgent need for financial literacy support across the industry Convenient access to money advice POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA Access strand of financial services Developmental frontier Formally served (55%) 47 0% 20% Financially excluded 8 40% 8 60% Black Female 30 – 44 years Tribal land LSM 1- 4 Formal - Bank Formal - Other Informal Unbanked 37 80% 100% Black and coloured 16 – 29 years Tribal, rural and urban informal LSM 1 - 6 POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA “The apartheid system severely distorted the South African financial system. A handful of large financial institutions…. centralize most of the country's financial assets. But they prove unable to serve most of the black community, especially women. Nor do they contribute significantly to the development of new sectors of the economy. Small informal-sector institutions meet some of the needs of the black community and micro enterprise. They lack the resources, however, to bring about broad-scale development” (RDP, 1994). POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA First Economy Commercial Banks Commercial Micro Lending Second Economy Industry Middle Class Salaried working class, and self employed (small business) o vel De Economically Active Poor) (Micro Enterprise) Existing State Agencies (Khula) Credit Unions, Cooperatives R 10 000 en pm tal Mic a Fin ro Very Poor (Survivalist Enterprise) e nc ‘Hard Core’ Poor/ Destitute R300 POLICY INITIATIVES TO EXPAND FINANCIAL OUTREACH IN SOUTH AFRICA Awareness of Mzansi (as at July 2005) 551,000 say they have the account 469,000 are using it 193,000 (35%) new to the banking industry 90% of users say Mzansi is more affordable 27% say they don’t know enough about it 68% say it is “not for people with higher incomes” 2% 11% 54% 33% Undercount against BASA’s figures - a study of perceptions N ever h eard o f M z an si H eard b u t n o t co n sid ered o p en in g H eard o f an d co n sid ered o p en in g H ave M z an si