R D by Foreign-Invested Enterprises in China: Myth and Reality

advertisement

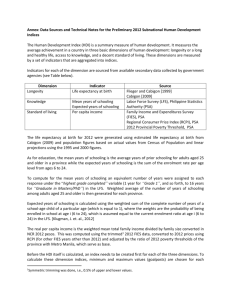

S&T/R&D ACTIVITIES BY FOREIGN INVESTED ENTERPRISES IN CHINA 在华三资企业的科技/研发活动 Cong Cao University of Oregon Outline Introduction Basic Information of Large- and MediumSized FIEs Performance Measurement of S&T Activities Current S&T Activities at FIEs Trends of S&T Activities at FIEs Discussion Introduction In 2003, China invested RMB154 billion, or 1.31% of its GDP, on R&D. – – – Of the expenditure, 62.4% was spent by enterprises with three-quarters (RMB72.1 billion) at LMEs. Of the R&D spending by LMEs, 23.1% was from FIEs (三资企业), including those from Hong Kong, Macau, Taiwan (8.1%), and those from foreign countries (15.0%). In other words, R&D spending by LM FIEs contributed to 11.3% of the total enterprise R&D spending in China. Introduction Questions: – – – What does this expenditure tell us about the general picture of the R&D activities and more generally S&T activities of FIEs in China? What are the trends by which FIEs have carried out R&D and S&T activities in China? How have FIEs in China been doing compared to their domestic counterparts in R&D and S&T activities? FIEs: Basic Information They have seen their share in China’s LMEs increased Composition of LMEs in China (% ) 60 57.11 49.80 50 40 29.58 30 27.25 22.95 2003 20 13.31 10 0 State-owned 1998 Non state-owned Foreign invested FIEs: Basic Information … and employment among LMEs increased Employees at Chinese LMEs (%) 80 74.31 70 60 50 40 41.76 37.53 1998 2003 30 20.72 19.65 20 6.03 10 0 State-owned Non state-owned Foreign invested FIEs: Basic Information Per FIE employment had been constant until 2003 Average employees per LME (persons) 2500 2277 2000 1500 1000 500 1892 1454 1934 1408 1824 1332 966 963 1009 659 644 659 1732 1742 1224 1030 1173 991 651 670 SOEs 1393 1168 1059 1999 2000 2001 2002 FIEs All LMEs 0 1998 NSOEs 2003 FIEs: Basic Information Their revenue has been climbing Sales revenue per LM employee (RMB10,000) 60 50 SOEs 40 NSOEs 30 FIEs 20 All LMEs 10 0 1998 1999 2000 2001 2002 2003 FIEs: Basic Information … so has been their profits Profits per LM employee (RMB10,000) 7 6 6.3 5.7 5 4 3 3.5 2.8 2 1.8 4.0 3.4 4.9 4.4 4.0 SOEs 3.0 FIEs 2.3 All LMEs 1 0 2001 2002 NSOEs 2003 Performance Measurement Input – Organizational – Personnel – Enterprises with S&T institutes Enterprises with S&T activities Tech personnel, S&T personnel, R&D personnel, S&Es Financial Funds from enterprises S&T expenditure R&D expenditure New product development expenditure Performance Measurement Output – – – – New product sales in total sales Profits from new products in total profits Patent applications and especially inventive patent applications Inventive patents owned FIEs: Current S&T Activities They have less S&T institutes and activities With S&T institutes (%) With S&T activities (%) Technical personnel (%) FIEs SOEs 14.94 30.78 31.09 52.18 6.09 11.86 NSOEs 27.62 44.66 10.16 All LMEs 24.89 42.69 10.08 FIEs: Current S&T Activities … and fewer S&T personnel S&T R&D Personnel in personnel personnel S&T (%) (%) institutes (%) FIEs 2.68 1.06 1.02 SOEs 5.15 1.58 1.61 NSOEs 4.96 1.75 2.14 All LMEs 4.55 1.54 1.71 FIEs: Current S&T Activities FIEs may be – – – – not that interested in S&T activities. mainly manufacturing facilities. dependent upon their parents for technology. less likely to be engaged in innovation within the confine of a formal research setting as innovation has become a day-to-day and conscious activity at the shop level (do this suggest that FIEs and Chinese enterprises have different innovation culture?) FIEs: Current S&T Activities FIEs spend less on S&T activities S&T R&D expenditure/Sales expenditure/Sales revenue (%) revenue (%) FIEs SOEs NSOEs 1.11 1.69 1.72 0.56 0.81 0.84 All LMEs 1.52 0.75 FIEs: Current S&T Activities … but more on new product development FIEs SOEs NSOEs All LMEs New product New product development development expenditure/Sales expenditure/S&T revenue (%) expenditure (%) 0.57 51.29 0.68 0.72 0.66 40.37 41.91 43.53 FIEs: Current S&T Activities They also have significantly higher per capita spending S&T expenditure per S&T personnel (RMB10,000) 25 19.17 20 15 10.55 10 10.40 7.72 5 0 State-owned Non state-owned Foreign invested All LMEs FIEs: Current S&T Activities FIEs get more from new products New product sales/Total sales (%) New product profits/Total profits (%) FIEs SOEs 18.60 11.34 18.60 11.70 NSOEs All LMEs 13.88 14.61 10.46 13.03 FIEs: Current S&T Activities They do well in inventive patenting FIEs SOEs NSOEs All LMEs Patent applications (items) 9,144 Inventive patent applications (%) 5,360 16,878 31,382 20.80 27.23 29.94 40.29 FIEs: Current S&T Activities … and are more cost effective FIEs SOEs NSOEs All LMEs S&T personnel per patent applications (persons/item) 19 112 38 45 S&T expenditure per patent application (RMB10,000/item) 360.9 863.4 399.9 467.7 FIEs: Current S&T Activities FIEs are more efficient and cost effective in their S&T activities. – – – In spite of fewer S&T personnel and less spending on S&T/R&D activities, FIEs do well with higher sales revenue and profits from new products. S&T personnel and expenditure per patent application are low. These may be associated with significantly higher level of S&T expenditure per S&T personnel, higher percentage of S&T expenditure devoted to new product development, among others. FIEs: Trends LMEs with S&T institutes (%) 40 35 30 SOEs 25 NSOEs 20 FIEs 15 All LMEs 10 5 0 1998 1999 2000 2001 2002 2003 FIEs: Trends Sales revenue devoted to S&T activities (%) 2.5 2.0 SOEs 1.5 NSOEs FIEs 1.0 All LMEs 0.5 0.0 1998 1999 2000 2001 2002 2003 FIEs: Trends New product sales in total sales (%) 30 25 SOEs 20 NSOEs 15 FIEs 10 All LMEs 5 0 1998 1999 2000 2001 2002 2003 FIEs: Trends S&T personnel per patent application (persons/item) 250 200 SOEs 150 NSOEs FIEs 100 All LMEs 50 0 1999 2000 2001 2002 2003 FIEs: Trends Patent application (items) 18000 16000 14000 12000 SOEs 10000 NSOEs 8000 FIEs 6000 4000 2000 0 1998 1999 2000 2001 2002 2003 2004 Discussion The analysis is not about R&D/S&T activities by foreign corporations per se. It is about LM FIEs in China as a whole. But these are likely to set up R&D centers/S&T institutes and engage in S&T activities as they have resources. Many of these centers/institutes are not separate units. Their registration with governments is mainly intended to take advantage of the preferable policies. Therefore, the analysis is a proxy to the current situation of FIEs’ R&D/S&T activities in China.