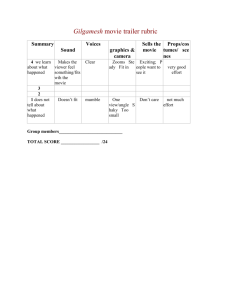

– 2011 Assessment Schedule

advertisement

NCEA Level 1 Accounting (90976) 2011 — page 1 of 6 Assessment Schedule – 2011 Accounting: Demonstrate understanding of accounting concepts for small entities (90976) Evidence Statement Codes used (but not relevant for all questions) and majority of credit there was no code: P – Explain an accounting concept leading to an in-depth understanding F – Apply an accounting concept leading to s comprehensive understanding Question ONE (a) Evidence statement Code (i) Creditors / suppliers / accounts payable Bank / Lender Mele’s Movie Theatre Manager IRD / government Potential owner / Potential lender (ii) (b) Financial or chartered accountant The Income Statement shows Mele the income, expenses and profit for the period / year of Mele’s Movie Theatre. He can use this information to help focus on improving on a specific area, (eg increase sales or decrease expenses) or compare this year’s expenses/income / profit to help decide why they improved / worsened. The income statement will help Mele decide if he should increase the selling price of the movie tickets/find a cheaper electricity supplier (eg) to help improve Mele’s Movie Theatre’s profit for next year Describe: Describes the purpose of the income statement with reference to key components for the time period for Mele’s Movie Theatre (Not money / paid as wrong statement) Explain (P): Explains the purpose of the income statement in terms of the key components for the time period for Mele’s Movie Theatre in relation to making decisions and/or comparison results Applies (F): Explains the purpose of the income statement in terms of the key components for the time period for Mele’s Movie Theatre and applies this by providing a specific decision Mele could make using the income statement (c) P OR F Accrual basis requires transactions (and other events) are recognized when they occur. They are reported in the financial statements in the period to which they relate. As a result Mele’s Movie Theatre will need to report the interest on term deposit which is owed to them in this period’s financial statements. The interest on term deposit will increase in the current year’s Income Statement by $120 because the interest was earned this period so needs to be reported this year. Accrued Income will be reported as at current asset in the Statement of Financial Position for $120. This represents the future inflow of $120 that will be received from the bank in the form of interest (cash) in the next accounting period / because Mele’s Movie Theatre will receive the money / interest next year Describe: Describes accrual basis concept reporting the transaction in the period it relates to for Mele’s Movie Theatre Explain (P): Explains in context how the interest owing on term deposit is reported in each of the income statement and / or the Statement of Financial Position Applies (F): Explaining in detail why the interest on term deposit is reported in the Income Statement and Statement of Financial Position in the context of the accrual basis and reporting the interest in the period it was earned, although it won’t be received until next period P OR F AND P OR F NCEA Level 1 Accounting (90976) 2011 — page 2 of 6 Judgement Statement N1 N2 A3 A4 M5 M6 E7 E8 Recognises one user or specialised area Recognises two of users or specialised area OR describes either the purpose of the income or accrual basis TWO of: recognises two users recognises the specialised area describes what Income Statement shows describes accrual basis OR ONE of: explain income statement OR accrual basis TWO of: recognises two of users/ specialised area describes what Income Statement shows describes accrual basis. Recognises a user or specialised area Recognises a user or specialised area Recognises two users / specialised area Recognises two users / specialised area N0/ = No response; no relevant evidence. AND AND ONE of: explains in general terms how Mele’s income statement can be used to make a financial decision TWO of: explains in general terms that Mele’s income statement can be used to make financial decision explains either interest on term deposit increasing in the Income statement OR accrued income is asset being created in Statement of Financial Position/ $120 explains either interest on term deposit increasing in the Income statement OR accrued income is asset being created in Statement of Financial Position AND Applies ONE and explains ONE other of: how the Income Statement is used to aid decision making OR why increasing interest on term deposit $120 in the Income Statement OR why Accrued Income $120 is an created as an asset in Statement of Financial Position AND Applies TWO of: how the Income Statement is used to aid decision making OR why increasing interest on term deposit $120 in the Income Statement OR why Accrued Income $120 is an created as an asset in Statement of Financial Position NCEA Level 1 Accounting (90976) 2011 — page 3 of 6 Question TWO (a) (b) Evidence statement Code To show the assets, liabilities and equity of Mele’s Movie Theatre at a point in time / on balance date Equity = Assets – Liabilities Equity = Assets (Bank 10 000 + Property, Plant and Equipment 170 000) – Liabilities (Accounts Payable 5 000 + Mortgage 80 000) Equity = $95 000 (c) (i) Assets: equipment / movie projectors / fittings increase by $12 000 Liabilities: accounts payable increases by $12 000 (ii) Assets: The movie projector is reported as an asset in the Statement of Financial Position as it meets the characteristics of an asset. The movie projector was purchased on credit from Germany by Mele’s Movie Theatre in the past. Mele’s Movie Theatre has present control over the use of the movie theatre as they decide which movies are showed on it / have it locked in their buildings / have exclusive right to use the projector. Mele’s Movie Theatre will use the projector to show movies to their customers who will pay to buy tickets to see the movies which increases the ticket sales / income which also increases bank as customers pay for the tickets. (NOT because the projector can be sold in the future) P/F (asset) The movie projector will be reported as a non-current asset under the sub-heading Property Plant and Equipment because it will be used to generate income/not be turned into cash beyond the next accounting period, and it is reported as $12 000 in New Zealand dollars The projector is reported in at NZ$12 000 because the monetary measurement concept states that all transactions should be recorded/reported in New Zealand dollar terms / a common currency of NZ$. Therefore even though the movie projector was purchased from Germany, it should be reported as NZ $12 000 in Mele’s Movie Theatre’s financial statements (converted from Euro’s into NZ$), because they are a New Zealand business The movie projector will be reported as $12 000 because this is its original acquisition cost to Mele’s Movie Theatre, and the historical cost concept states that all assets should be reported at their original purchase price, which is $12 000. The projector is reported as a non-current asset which supports the use of the Going Concern concepts which states that the financial statements are prepared under the assumption that the business will continue to operate into the foreseeable future. By reporting as a non-current asset as opposed to a current one, Mele’s Movie Theatre is indicating they intend to continue to operate into the foreseeable future Asset P/F (concept) Describe: Describes the three characteristics of an asset Explain (P): Explains how the reporting the projector meets the asset characteristics of the projector in context Applies (F): Applies how the reporting the projector meets the asset characteristics of the projector, by fully explaining how the projector will generate future economic benefit in the future from the customers paying to watch the movies Relevant Concept Describe: Describes how the reporting of the projector meets an appropriate accounting concept Explain (P): Explains how the reporting of the projector meets the concept in context (eg. NZ$12 000 / classification) Applies (F): Applies the concept(s) to the reporting of the projector, and fully explains how the concept is applied to the situation (eg purchasing from German and reporting in NZ$ / currency) NCEA Level 1 Accounting (90976) 2011 — page 4 of 6 Judgement Statement N1 N2 A3 A4 M5 M6 E7 E8 ONE of: states assets / liabilities / equity in (a) attempts accounting equation recognises that asset increases or liabilities increase in (c) (i) identifies a relevant concept in (c) some of the asset definition correct TWO of: states two of assets / liabilities / equity in (a) attempts accounting equation OR ONE of the following as the only correct evidence: calculates $95000 recognises that asset increases and liabilities increase in (c) (i) correct definition of asset or concept THREE of: describes purpose of statement of financial position accounting equation some correct working in (b) OR equity of $95 000 is shown (no working) recognises that asset increases and / or liabilities increase in (c) (i) definition of an asset definition of either: monetary measurement OR historical cost OR going concern recognises that movie projector is a noncurrent / PPE asset recognises move projector will be reported as $NZ 12 000 OR explains ONE concept/as set and one correct bullet above FOUR of: describes purpose of statement of financial position accounting equation some correct working in (b) OR equity of $95 000 is shown (no working) recognises that asset increases and / or liabilities increase in (c) (i) definition of an asset definition of either: monetary measurement OR historical cost OR going concern recognises that movie projector is a noncurrent / PPE asset recognises move projector will be reported as $NZ 12 000 OR explain asset and one concept only THREE of: assets and liabilities shown in (b) and equity of $95 000 is calculated (or correct working with minor error) explains that equipment / fittings / projectors increase by $12000 OR accounts payable increase by $12000 (not negated in asset answer) explains projector purchase in terms of asset explains projector purchase in terms of monetary measurement OR historical cost OR going concern explain that projector is a noncurrent asset and reported at NZ$12 000 (If asset & concept not explained but applied allow higher level credit) FOUR of: assets and liabilities shown in (b) and equity of $95 000 is calculated (or correct working with minor error) explains that equipment / fittings / projectors increase by $12000 OR accounts payable increase by $12000 (not negated in asset answer) explains projector purchase in terms of asset explains projector purchase in terms of monetary measurement OR historical cost OR going concern explain that projector is a noncurrent asset and reported at NZ$12 000. (If asset & concept not explained but applied allow higher level credit) ONE of: assets and liabilities forming the accounting equation in (b) and equity of $95000 is calculated OR explains that equipment increase by $12000 and accounts payable increase by $12000 AND applies ONE of the following and explains a second from: asset OR monetary measurement OR going concern to explain how the movie projector should be reported. no significant errors assets and liabilities forming the accounting equation in (b) and equity of $95000 is calculated OR explains that equipment increase by $12000 and accounts payable increase by $12000 AND applies how the movie projector should be reported in terms of meeting criteria of an asset AND ONE of: applies how the movie projector should be reported in terms of meeting ONE of the concepts of: monetary measurement going concern OR TWO explained no significant errors N0/ = No response; no relevant evidence. NCEA Level 1 Accounting (90976) 2011 — page 5 of 6 Question Evidence statement THREE (i) (a) Dividends received Interest received Rent received Code Popcorn sales (ii) Interest on loan Purchases Electricity Cleaning No credit if same account in both classifications (b) Movie ticket sales are income for Mele’s Movie Theatre because ticket sales will increase the economic benefits in the form of inflows of cash from the customers buying movie tickets to watch the movie. This increases Mele’s Movie Theatre’s assets by increasing the bank account. The movie ticket sales increase profit which leads to an increase in Mele’s equity in Mele’s Movie Theatre and it is not Mele making a contribution to Mele’s Movie Theatre Describe: Describes the characteristics of income Explain (P): Explains that the ticket sales will increase assets by increasing the bank account and equity by increasing profit for Mele’s Movie Theatre, and not a contribution by Mele Applies (F): Applies the characteristics of an income to the movie ticket sales by detailing the reasoning behind HOW the bank and / or profit will increase, in addition to explain expectations (c) P OR F Till paper is an expense for Mele’s Movie Theatre because purchasing the till paper causes an outflow of cash when Mele’s Movie Theatre pays for the till paper from their supplier. This decreases Mele’s Movie Theatre’s assets by decreasing the bank account (or increases accounts payable when it is purchased on credit). The purchase of the till paper decrease the movie theatre’s profit which leads to a decrease in Mele’s equity in Mele’s Movie Theatre, and it is not Mele taking home drawings Describe: Describes the characteristics of explain Explain (P): Explains that the till paper will decrease assets by decreasing the bank account (or increases liabilities by increasing accounts payable) and equity by decreasing profit for Mele’s Movie Theatre and is distribution to Mele. Applies (F): Applies the characteristics of an expense to the till paper by detailing the reasoning behind HOW the bank will decrease / accounts payable increase and / or profit will decrease, in addition to explain expectations. P OR F NCEA Level 1 Accounting (90976) 2011 — page 6 of 6 Judgement Statement N1 N2 A3 A4 M5 M6 E7 E8 recognises one income OR one expense. recognises two incomes AND / OR expenses. recognises THREE incomes and THREE expenses Maximum 1 foreign item OR describes either income or expenses AND recognises FOUR incomes or expenses All of: recognises four incomes or expenses describes income describes expense FOUR incomes and / or expenses recognised, AND ONE of: explains that ticket sales is income explains that till paper is an expense FOUR incomes and / or expenses recognised, AND explains ONE and describes the other of: ticket sales is income till paper is an expense FIVE incomes and expenses recognised, AND ONE of : applies how ticket sales are income applies how till paper is an expense FIVE incomes and expenses recognised, AND BOTH of: applies how ticket sales are income applies how till paper is an expense N0/ = No response; no relevant evidence.