Development After Redevelopment

advertisement

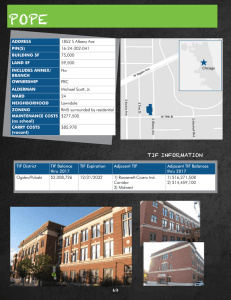

Development After Redevelopment 2013 Riverside/San Bernardino Economic Forecast Conference October 29, 2013 Professor Rob Wassmer Chairperson Department of Public Policy and Administration Posted at Citizens Fighting Eminent Domain Abuse Website Cartoon Illustrating End of California RDA from the California Political Review Posted at City of La Mirada Website 2 Gone As We Knew It in California Tax Increment Financing (TIF) Used to Finance Redevelopment Authorities (RDA) http://www.lao.ca.gov/analysis/2011/realignment/redevelopment_020911.aspx 3 My Purpose Today • Robert Swayze (next) – short-term alternatives • The “Professor” – Academic and long-term perspective • How? – Simple framework • Four policy concerns in need of new/better solutions • Suggest solutions based upon observation and research Ben Stein, Economics Ph.D., from Ferris Bueller’s Day Off 4 Policy Analysis Framework • Step one in Bardach’s eight step guide – Properly identify the policy problem – Do not state a “solution” as a “problem” • Policy problem the State faces is not the need to reinstate California TIF/RDA • California TIF/RDA circa last decade – Cobbled together solution to multiple policy problems (four) still faced – Let’s unbundle each of these problems • Consider possible different/better policy solutions • May or may not contain elements of RDA 5 Policy Concern One “Blight” Discourages Economic Activity From Where Most “Socially” Desirable • “Blight” broadly defined: structural, fiscal, demographic • Drives down property (land) value, but still not profitable • “Central” neighborhoods where social benefits generated if developed – High unemployment, high poverty, affordable housing lacking, gentrification to reduce commutes, some existing public infrastructure viable, etc. • Intra-metropolitan only evidence that this case – Location theory – Statistical evidence – Retail/Housing different than manufacturing http://archpaper.com/news/articles.asp?id=6190 6 • 1945 CA Community Redev Act / 1952 Tax Increment Financing – “Blight” eradication the goal, $s to match Federal redevelopment grants • Very limited use till Serrano v. Priest (1972) / Proposition 13 (1978) – 2% statewide property tax revenues in 1977 • AB 1290 (1993) defined “blight”, limit time, non-negotiated local agency payment • SB 1206 (2006) further definition of blight – 12% statewide property tax revenues in 2008 • ABX1 26 and 27 (2011) dissolved CA RDAs 2004 blight declarations in Two CA Counties: http://nextcity.org/forefront/view/out-of-cash 7 Policy Solution One Tool to Encourage Economic Activity Where Most “Socially” Desirable • Lost an important tool to accomplish this • Furthermore – AB32 requires CA green house gas emission in 2020 at 1990 level • Transportation GHG emissions about 30% of all GHG emissions • Only reduced if attack all legs of ‘three legged stool’ — vehicles, fuels and vehicle miles traveled (VMT) • More dense and mixed land use than market is delivering • Suggest – Re-imagined, more limited, TIF program bundled with CEQA reform to achieve SB 375 goals • Either strict specifications on density/mixed use/affordability requirements • Or applications approved by statewide comm (because GF loss) 8 Policy Concern Two Prop 13 / AB 8 Unintended Consequences • Prop 13 (1978) freezes CA’s ad valorem property tax rate at 1% • AB 8 (1978) archaic distribution of countywide prop taxes • Redevelopment becomes a municipal revenue generator – Chapman (PPIC, 1997) • TIF used to alleviate fiscal stress • Easy to define as blighted • Capture full pie • RDA spending without voter approval http://www.lao.ca.gov/reports/2012/tax/property-tax-primer-112912.aspx 9 Policy Solution Two Touch the 3rd Rail of Prop13 / AB 8? • Reconsidering AB 8: Exploring Alternative Ways to Allocate Property Taxes (LAO, 2000) • Alternative I: Set Uniform Rates – Each jurisdiction allocated property tax share based on services provided • Alternative II: Local Control Over ERAF – City/county authority over rate and allocation of a share of the property tax • Alternative III: Property Taxes for Municipal Services and Schools – Allocation of every property's tax bill identical (e.g., half to local municipal services and half to schools) • Alternative IV: Re-Balance Tax Burden – Local revenue sources changed to provide a sales tax reduction and create local control over property tax rates • Alternative V: Making Government Make Sense – Realign the responsibilities of the state and local governments to create more efficient program coordination 10 Policy Concern Three Housing Affordability • Why a public policy concern? – Equity – Efficiency • AB 32 goals • Original goal of 1945 CA Community Redev Act – But increasingly moved toward “blight” fight – 1976 Legislation directed redevelopment agencies to set aside 20% of the tax increment to Low/Moderate Income Housing Fund • $2 B annually generated in late 2000s • Mixed reviews on overall success, but specific success stories 11 Policy Solution Three Metropolitan Wide Solution for Metropolitan Wide Problem • California’s housing element law requires cities and counties to make “adequate provision for the existing and projected housing needs of all economic segments of the community” (Government Code Section 65583, 1969) – Plan for, but not necessarily build • Suggest – Housing affordability solution divorced entirely from redevelopment – Metropolitan-wide (statewide?) funding source • Real estate transfer fee (progressive?), Linkage fee on new construction – Expanded inclusionary zoning • Perhaps as a requirement for use of re-imagined TIF program use 12 Policy Concern Four California High Tax / High Regulation • Many view as a concern – Though magnitude of impact on statewide economic activity anecdotal and not statistically proven • Patterns and Trends in the Location Decisions of California Businesses (PPIC, Neumark, 2007) – RDA/TIF use became extensive in CA, took the edge off of business/developers call for statewide tax reductions • Getting more than their “fair share” of property tax increment – Poor substitute for tackling “real” problem 13 http://flazatron.blogspot.com/2009_05_01_archive.html http://taxfoundation.org/tax-topics/state-business-tax-climate-index • Overall ranking based upon ranking of corporate, individual income, sales tax, unemp insurance, and property tax rates 14 Policy Solution Four Cut/Reallocate Burden of Business Tax • Let reformulated TIF Program serve its designated duty • Suggest – Revenue neutral tax/expenditure proposals • Oil severance tax • High fee/high aid in CSU and Community Colleges – Regulatory reform • CEQA – Other suggestions? 15 http://intorightfield.com/california-bad-for-business Thanks for your attention! Turn the floor over to Robert Swayze who will discuss available redevelopment finance options that still exist 16