Final review sheet 201

advertisement

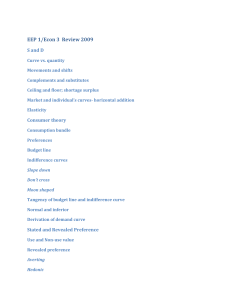

EEP 1/Econ 3 Review 2015 S and D Curve vs. quantity Movements and shifts Complements and substitutes Ceiling and floor; shortage and surplus Market and individual’s curves- horizontal addition for private goods Elasticity Consumer theory Consumption bundle Preferences Budget line Indifference curves Slope down Don’t cross Moon shaped Tangency of budget line and indifference curve Normal and inferior goods Derivation of demand curve Stated and Revealed Preference Use and Non-use value Revealed preference Averting Hedonic Travel cost Stated Preference Steps for a survey: Its real money. 2. Background. 3. Project. 4. Payment Method. 5.Reasons to vote for and agin. 6.Question. 7. Debrief Referendum “would you vote Y/N if it cost you $X” vs. Open ended. Lying possible when open ended (how much…) Hypothetical bias Problems of Scope (big and little project worth same.) Conjoint analysis Question that gets EV vs question that gets CV WTP vs. WTA (pay and accept) Production and the firm: the cost curve Isoquant Isoexpenditure or isocost Chosen inputs Derive cost curve Isopleth, equal pollution lines. TBES Show how pollution charge gets right input bundle TBES and Pollution charge differ in cost Production: choosing Q Opportunity cost Economic v. business profit Marginal cost Area under mc is VC C = fc + vc AC is U shaped drawing and explanation Supply curve: price taker P = mc mc above avc Long and short run supply Long run competitive Equilibrium Profits are zero P = mc S=D Case where polluter pays = consumer pays How standard and tax lead to different long run Q Welfare Total Willingness to Pay Consumer surplus EV and CV For a public and private good. Competition maximizes profits plus surplus Specific Tax Incidence Deadweight loss Farm Programs Loan program Set aside Output tax or quota to solve pollution MC of pollute and total MC DWL from doing nothing Tax revenue and quota rents Regulating Polluting input MCA = MBA or MBemit = MCemit DWL if wrong (could be clean air services itself) TBES defined Tax and standard, compared Cost difference Effect on AC, hence of LR compet equilibrium Pollution tax changes pollution/output and output Public Good TWTP Why competition doesn’t max TWTP – all costs Coase MCA (Marginal cost of abatement) Firm and Consumer MCA = Marginal Benefit of abatement Two firm diagram: why trading good Case where initial allocation doesn’t matter for pollution What to do when transaction costs are high Clean Air Act Clean air act NAAQS National goals State plans CA: Reclaim New source TBES Rules for cars, trucks etc TBES National CA exemption Toxics Acid Rain trading program Clean water act Goals by state (swimmable) TDML NPDES Prior sewage treatment subsidy Interest rate Present value PV = AV/r (starts one period out) PV = FV*(1+r)-nt Real = Nominal – inflation rate Benefit Cost Analysis benefits to whomever they accrue less the costs when to rank projects by B/C rather than B-C Green Accounting (covered but not on final 2015.) GDP. Value of final goods made in a country Leaves out work at home Leaves out env. Goods like clean air Includes intermediate goods like SCR’s Net Domestic Product = GDP – Depreciation (capital consumption) Leaves out using up oil, gas etc Trees are left out of both investment (their growing doesn’t count) and depreciation.