Victor Flatt

Climate Change Gets Specific –

Evolution of Legislation and ACES

Victor B. Flatt,

Tom and

Elizabeth Taft Distinguished

Professor of Environmental Law,

UNC-Chapel Hill; Distinguished

Scholar GEMI

Evolution of Cap and Trade Bills

McCain-Lieberman

Lieberman-Warner

Dingell-Boucher

Waxman-Markey (ACES), passed out of house in June.

Important Issues in Federal Cap &

Trade

Target, and target timeline

How will GHG allowances be allocated

How much of the economy covered

Adaptation funding

Offset definition and restrictions

“Safety” Valve

Who will Administer

Pre-emption and Benefits of Early Action

Senate Timeline and Politics

Originally scheduled vote before August recess – now September

Looking for Republican co-sponsors

– Snowe, Collins, Murkowski, McCain, Graham

– Alexander seems to be out

60 votes possible (3 democratic defections predicted with high certainty – Nelson, Landrieu,

Byrd)

Compromises necessary?

Alaska funding; possible natural gas role?

U.S. Federal Legislation

Waxman- Markey (now ACES) voted out of house

Important Details

– Coverage

– Target Reduction

– Allocation

– Administrative Oversight and Market

– Offsets

Target Goals

(G-8 agrees to 2 C rise limit)

83% reduction of 2005 levels by 2050

17% reduction of 2005 levels by 2020

– Initial draft had 20% by 2020

– New draft claims with additional controls outside cap, will still reach 20%

– IPCC recommends 25-40% below 1990 levels by

2020, but goal is only about 7% below 1990 levels by

2020.

– EU looking at 25%

Large Coverage

– Over 85% of emissions

ACES How Allocated

15 % auctioned per year

Initially, other percentage given away

Approx. 59% to industry; 25% for needs/interest of public- adaptation, enviro, etc…

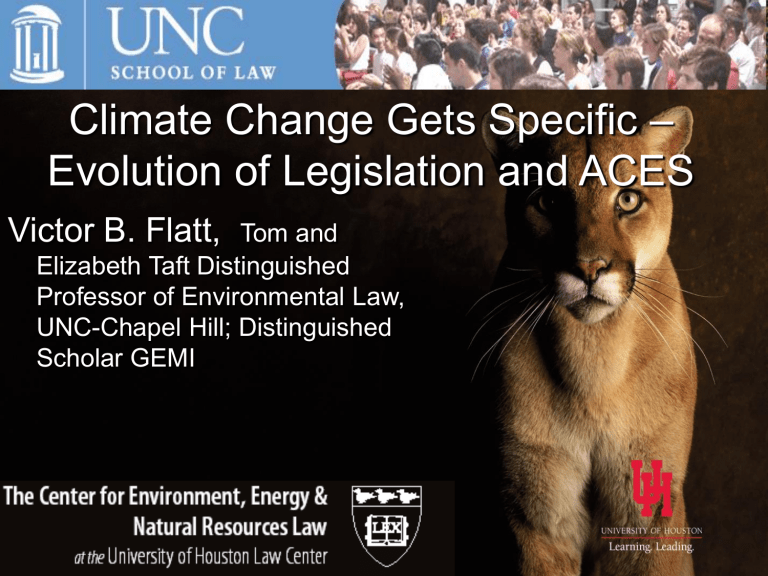

2019

2020

2021

2022

2023

2024

2025

2026

YEAR

2012

2013

2014

2015

2016

2017

2018

2027

2028

2029

2030

Annual allowances (in millions)

(sec. 721)

5,162

5,056

4,903

4,751

4,599

4,446

4,294

4,142

ALLOWANCES

4,627

4,544

5,099 *INC COVERAGE

5,003

5,482*INC COVERAGE

5,375

5,269

3,990

3,837

3,685

3,533

YEAR ALLOWANCES

2031 3,408

2032 3,283

2033 3,158

2034 3,033

2035 2,908

2036 2,784

2037 2,659

2038 2,534

2039 2,409

2040 2,284

2041 2,159

2042 2,034

2043 1,910

2044 1,785

2045 1,660

2046 1,535

2047 1,410

2048 1,285

2049 1,160

2050 and each year thereafter 1,035

Allowance allocation to Regulated Entities

35% for electric utility sector;

– Last version gives percentage to rural electric cooperatives; fight over allocation

15% for carbon-intensive industries, such as steel and cement, in 2014 (reduced by 2% every year)

9% for local natural gas distribution companies, in

2016 (reduced to zero between 2026 and 2030)

3% for automakers toward advanced technologies through 2017 (reduced to 1% from 2018 and 2025)

2% for oil refineries from 2014 to 2026

2% for carbon capture and storage technology from

2014 to 2017 (increases to 5% after 2018)

Allowance allocation (cont.)

To states and other funds:

10% for states for renewable energy and efficiency investment from 2012 to 2015 (reduced to 5% between

2016 to 2022)

5% for tropical deforestation prevention projects

2% for domestic adaptation to climate change between

2012 and 2021 (increases to 4% between 2022 to 2026, to

8% in 2027)

2% for international adaptation and clean technology transfer from 2012 to 2021 (increases to 4% between 2022 to 2026, to 8% in 2027)

1.5% for programs helping home heating oil and propane users (reduced to zero between 2026 and 2030)

1% for Clean Energy Innovation Centers for R&D funding

0.5% for job training from 2012 to 2021 (increases to 1% after 2022)

Modified Formula in passed bill

Emission Allowance Rebate Program

For Carbon Intensive Industry declining through 2035

Read in Conjunction with prior authorized distributions

Offsets

Larger amount available than prior proposals – usually 2 billion tons of CO2 equivalent per year

Varies between 15% and 70% of total over life of bill

Split between domestic and foreign

Foreign subject to 25% penalty

When Passed – set up list of existing offsets

Offsets Cont.

Domestic offset sequestration reversals that are “unintentional” may not be made fully whole (statute calls for 50% replacement)

Possibility of offset failure could infect the secondary markets

Complexity and Controversy – Expect to see changes with offsets

Offsets to USDA

Major Change – USDA jurisdiction over all land based offsets and sequestration – most

Also “term” offsets

Positive – USDA has more staffing worked with farmers

Negatives – role of watchdog? Loopholes?

Negative – no environmental review; complication with pre-emption – California

EPA oversight role? Senate compromise

Market Details

FERC in charge of initial allocation/auction

Might be transferred to CFTC

CFTC in charge of regulating “secondary” markets, i.e. markets in all financial or other contractual, risk-hedging instruments containing carbon allocations or offsets (regulated like other commodities)

Initial offset contracting exempt from this

Looking at a restriction in all commodity trading from financial crisis.

All OTC WILL have to be “cleared.”

Safety Valve