RSAI-BIS (presentation) basic.ppt

advertisement

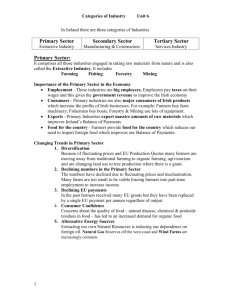

RSAI-BIS 2002 Brighton & Hove (August 21st–23rd) Software and the ‘Celtic Tiger’ Lessons from Ireland for the UK’s Peripheral Regions? MIKE CRONE Northern Ireland Economic Research Centre Today’s paper is a follow-up to the main paper (and in the wrong order!): ERSA 2002 Dortmund The Irish Indigenous Software Industry: Explaining the Development of a Knowledge-intensive Industry Cluster in a Less Favoured Region Rationale • Recent interest of government in clusters and the knowledge economy: 1998 DTI Competitiveness White Paper “Our Competitive Future: Building the Knowledge-driven Economy” August 1999: Lord Sainsbury’s report on “Biotechnology Clusters” February 2001: Trend Business Research study “Business Clusters in the UK - A First Assessment” DTI-DfEE White Paper “Opportunity for all in a World of Change” • However, the DTI cluster mapping exercise shows that many clusters of knowledge-intensive industry (KII) are in South East. • This presents a problem for the devolved administrations in the UK’s peripheral regions, who are tasked with developing clusters of KII. • Examples…. DTI’s UK cluster map for R&D DTI’s UK cluster map for Biotech • Insert map DTI’s UK cluster map for Software A more detailed look at the pattern of software and computer services employment in the UK….. SIC1992: Division 72 ‘Computer and related activities’ Source: Annual Business Inquiry Employment in Division 72 by Government Office Region 140,000 1995 120,000 1999 100,000 80,000 60,000 40,000 20,000 0 South East London East ‘Greater South East’ North West West Midlands South West East Midlands Yorkshire & the Humber Scotland North East Wales The Periphery Northern Ireland Regional Location Quotients for Division 72 200 1995 LQ 1999 LQ 150 100 50 0 South East London East ‘Greater South East’ South West West Midlands North West East Yorkshire Scotland Midlands & Humber North East Northern Ireland The Periphery Wales County Employment in Division 72 in 1999 Employment (000's) 20 to 65 (3) 10 to 20 (6) 7 to 10 (5) 5 to 7 (8) 3 to 5 (11) 1 to 3 (16) 0 to 1 (17) County Location Quotients for Division 72 in 1999 Location Quotients 150 to 500 (6) 125 to 150 (4) 100 to 125 (2) 75 to 100 (13) 50 to 75 (14) 0 to 50 (29) Suggested explanations for uneven development in software/computer services • Research by Neil Coe suggests the following explanations: The process of new firm formation: most new firms originate as localised spin-offs from existing firms, re-enforcing historical dominance of South East in computer industry (dating from 1960s). Market linkages of firms: service industries, which are the major customers for software firms, are concentrated in the South East. Limited local industrial base means Northern firms tend to target manufacturing and public-sector (slower growth). Locational strategies of multinational firms: many foreign firms locate their European HQ in South East. Computer service firms operate offices in London/SouthEast, plus regional offices in Cheshire/Manchester and possibly Birmingham. Difficult to see what policy can do in the face of these forces? Two examples of the ‘cluster development problem’ in peripheral UK regions • The ‘embryonic’ software industries in: – Scotland – Northern Ireland • Neither of these shows up in the DTI cluster mapping exercise • Both are embryonic but already locally significant, with potential • Both have become a focus for regional development agencies Scottish Software Industry Estimated 950 ICT sector SMEs in Scotland (22% software products, 40% services) with total annual revenues of £1.4billion (83% of sales within UK). The Lothians account for a significant proportion of the Scottish software industry (~40%) - said to employ around 9,500 people in about 150 firms. Some major MNCs (e.g. HP) & a few established local players (e.g. KSCL). A few local stars (e.g. Orbital – listed on LSE, US offices; Atlantec) Small computer games cluster centred on Dundee (specialist academia at University of Abertay and several small local companies) Some institutional specialisation and software-specific policies in place (e.g. ScotlandIS, SE target sector, Software Academy, Graduates Into Software, National Software Strategy, Software Incubators). Domestic demand drivers (e.g. Edinburgh financial institutions – especially Royal Bank of Scotland, Scottish Parliament/government, utilities). Some research excellence in 3rd level educational institutions and good supply of computer science graduates from Scottish universities Northern Ireland Software Industry Significant inflow of software FDI starting about 1998 and continuing, mainly from US (but some from GB, Europe and Republic of Ireland). However, we don’t really know what they do: How complex is the work? How significant are these operations within their parent companies? Some established indigenous firms (e.g. SX3, Kainos) and some emerging start-ups (e.g. Lagan Technologies, mineIT). But indigenous firms are mainly small and none have gone public yet. Some institutional specialisation and software-specific policies in place (e.g. targeted sector for FDI and company development, software incubators, industry association – but questionable influence so far). Plentiful and growing supply of 3rd level computer science graduates but shortage of experienced managers and project leaders. Generally weak local demand for software and IT services. The Irish Indigenous Software Industry (IISI): a possible role model for the UK periphery? • Over the last decade, the Republic of Ireland has emerged as a hotbed of software development activity. • Software has been one of the leading sources of employment growth in Ireland’s ‘Celtic Tiger’ economy (growth of 16% p.a. during 1990s). • By 2000, the Irish software industry comprised 900 companies, with up to 30,000 employees and a combined annual turnover of €10 billion. • One ingredient has been a major influx of software FDI since the mid1980s (see work of Neil Coe, for example). • The ‘overseas’ software industry currently employs 16,000 people. It includes leading software multinationals (but some doubts over quality). • More interesting, is the parallel emergence of a vibrant ‘indigenous’ software industry…. The Irish Indigeneous Software Industry in 2000 (Source: National Software Directorate and HotOrigin Ltd) TURNOVER €1,400 million 1.4% of GDP 770 companies Software Sector 14,000 jobs EXPORTS €870 million 62%of T/O Seven publicly listed companies: SmartForce, IONA, Baltimore, Trintech, Datalex, Parthus and Riverdeep (4,900 employees worldwide/annual turnover €835m) Software Industry Employment in Ireland (Source: National Software Directorate) 30,000 25,000 Irish Takeovers Overseas 20,000 15,000 10,000 5,000 0 1991 1992 1993 1994 1995 1996 1997 1998 1999 Revenues and Exports for Indigenous Software Industry (Source: National Software Directorate) 1400 Revenues (IR£ million) 1200 Revenues (IR£m) Exports (IR£m) 1000 800 600 400 200 0 1991 1992 1993 1994 1995 1996 1997 1998 1999 Size Analysis of Indigenous Software Industry in 1998 (Source: National Software Directorate) 11–24 1-10 316 No. of companies 1445 Employment Revenue (IR£m) Exports (IR£m) 0% 25–49 77 28 112 1769 99 40 20% 2057 137 75 50–100 58 1814 40% 24 10 2107 143 90 100+ 263 213 60% 80% 100% Irish Indigenous Software: Geography of Exports (Source: National Software Directorate) Far East 1% North America 43% Pacific Rim 3% Other 4% UK 21% Western Europe 28% Geography of Irish Indigenous Software Industry (Source: author’s analysis of company database) Employment Companies 0% 10% Dublin 20% Cork 30% 40% 50% Limerick/Shannon 60% 70% Galway 80% Other 90% 100% Unknown The leading Irish indigenous software firms • Publicly listed: competing and winning at international level [SmartForce, IONA, Baltimore, Trintech, Datalex, Parthus, Riverdeep] • Second tier: on brink of breaking through to international level [e.g. FINEOS, CR2, Eontec, cardBASE, Norkom, WBT Systems] • Latest fast-growth start-ups: intent to internationalise from outset [e.g. Cape Clear, Macalla, Orbiscom, Network365, Xiam] Specialisms of leading indigenous firms financial services applications/solutions [e.g. Kindle (Misys), Fineos, Eontec, CR2, Norkom] e-security/secure payment solutions [e.g. Baltimore, Eurologic, Trintech, cardBASE] e-learning/computer-based training [e.g. SmartForce, Riverdeep, WBT Systems] open systems-based middleware [e.g. IONA Technologies, Cape Clear, Macalla] telecommunications software [e.g. Aldiscon (Logica), Euristix (Marconi), Network365, Xiam] [Note that nearly all of the leading firms are software product firms] Regional Comparison of Software Industry Employment (Source: National Software Directorate and Annual Business Inquiry, ONS) UK South East region Berkshire county Scotland North East Wales Northern Ireland ROI total software ROI indigenous 1995 1999 increase CAGR 237,839 434,431 196,592 16.3% 60,492 14,726 114,359 33,453 53,867 18,727 17.3% 22.8% 9,354 3,864 3,635 1,380 18,248 7,320 7,066 3,970 8,894 3,456 3,431 2,590 18.2% 17.3% 18.1% 30.2% 11,784 5,773 24,891 13,176 13,107 7,403 20.6% 22.9% Two Phase Explanatory Framework Sustaining Cluster Development Origins & Initial Establishment Window of opportunity Favourable factor conditions Spark of entrepreneurship Firm-building and marketbuilding strategies Supporting role of State and semi-State institutions Improved environment for entrepreneurship/firm-building... Agglomeration economies: Local pool of skilled labour Specialised supply industries (e.g. VC, support services) Collective learning/knowledge dissemination processes: Movement of key individuals through the cluster Spin-offs/new firm formation Formal/informal networking Favourable factor conditions in Ireland 1. Single most important factor: early abundance of skilled labour From 1970s onwards Irish State invested heavily to expand the thirdlevel education system (initially intending to attract FDI); Ireland’s 3rd level education system rates highly in international comparisons (particularly strong in engineering/computer science); Ireland had a surplus of computing graduates until the mid-1990s; In mid-1990s: producing over 1,500 computing graduates per year Also: multinationals in Ireland acted as training ground for graduates; Also: possible role of return migration from US (‘brain circulation’). 2. Upgrading of telecoms infrastructure in 1980s (EU funded) 3. English language (in common with US market) Spark of entrepreneurship Where did the pioneering entrepreneurs/firms of the cluster come from? Early software product firms emerged by 3 main routes (Ó Riain, 1997): 1. Services to products - began providing ‘bespoke’ services to serve emerging local demand for IT services from large organisations in Ireland (later developed into products/exports). 2. Spin-outs from larger firms - created when firms in other industries (e.g. telecoms, computer hardware, banking/finance) or public sector bodies spun off their IT divisions. [e.g. Datalex from work of in-house IT team at Aer Lingus] 3. Firms based on academic research - set up by professors and graduate students based on on-campus research (among the most technically-sophisticated firms). [e.g. IONA Technologies, Baltimore, Trintech] Note: software multinationals in Ireland not a major source of spin-offs. Firm- and marketing-building strategies Key strategies of leading Irish indigenous software firms: 1 Focus on developing software products for niche markets (rather than providing bespoke services). Aim to compete on basis of innovation rather than low-cost (contrast with India). 2 Emphasis on exporting from an early stage, especially to US market (often positioned in product spaces that are complementary to US expertise rather than competing directly with them). 3 Internationalised operations from an early stage (e.g. overseas offices in US). More recently some overseas M&A activity. 4 Used international strategic alliances to access the marketing and distribution networks of larger, established firms (e.g. IONA with Sun). 5 Use of initial public offering (IPO) on Nasdaq to raise capital to finance growth and also to building profile/reputation in the US market. Support of State and semi-State institutions • The Irish State substituted for the absence of specialised suppliers, service providers and supporting institutions in the initial phase. • In early/mid-1990s, there was no private VC industry in Ireland State agencies were dominant supplier of early-stage finance (grants, equity). • State agencies also provided ‘softer’ forms of assistance (e.g. help with marketing, management development and training). • The State also created a specialised set of supporting institutions (e.g. National Software Directorate, Centre for Software Engineering). • These institutions helped to develop a common sense of purpose between the State agencies and the ‘pioneers’ of the industry • They also promoted business and technical learning within the industry. Two Phase Explanatory Framework Sustaining Cluster Development Origins & Initial Establishment Window of opportunity Favourable factor conditions Spark of entrepreneurship Firm-building and marketbuilding strategies Supporting role of State and semi-State institutions Improved environment for entrepreneurship/firm-building... Agglomeration economies: Local pool of skilled labour Specialised supply industries (e.g. VC, support services) Collective learning/knowledge dissemination processes: Movement of key individuals through the cluster Spin-offs/new firm formation Formal/informal networking Agglomeration economies (1): a local pool of specialised skilled labour • • Ireland has now developed a thick technical labour market in softwarerelevant skills, especially in Dublin. Hence, there is now a much greater range of experienced managerial and technical labour available to growing firms than in the early 1990s. Agglomeration economies (2): specialised supply industries (e.g. venture capital) • • • Clear evidence of development of specialised supply industries in response to increasing local demand from software firms. Example: the emergence of a sizeable venture capital industry in Ireland, primarily since 1998/1999. Also: emergence of various service firms with a specific focus on the software/technology sector (e.g. incubators, consultants, IPR lawyers). Localised Collective Learning Processes • Knowledge circulation due to movement of key individuals • Localised spin-offs from existing businesses • Reconfiguration of staff in new firms • Formal and informal networking by managers and professionals Knowledge circulation due to movement of key individuals: example of Dr Chris Horn Sept 2000: Appointed chairman of ITEQ advisory committee Chaired<‘Commision fill > on Future Skills’ Prominent role in industry affairs 1984-89: EU Esprit research Comp Sci Trinity CD 1991: Co-founder of IONA Technologies 1991-2000: Chairman and CEO of IONA Technologies 1997: IONA floats on Nasdaq May 2000: Resigns as IONA CEO (stays on as Chairman) Sept 2001: appointed nonexec. director by Sepro Nov 2001: appointed nonexec. director by CR2 Knowledge circulation due to movement of key individuals: example of Barry Murphy Early 1970s: University College Cork B.E. Electrical Engineering & M.Eng.Sc. 1980s: Managing Director of Insight (leading Irish software co) 1988: Insight acquired by Hoskyns (CapGemini) 1988-96: First head of Ireland’s National Software Directorate 1996-99: CEO of Cullinane Group Ireland Involved in writing strategy document for Irish Software Association Since 1996: CEO of Openet Telecom Argument: Through their involvement with numerous private firms, State agencies and commissions, and supporting institutions these individuals (and others like them) accumulate ‘embodied knowledge’ (about technologies, ways of doing business, key markets) and disseminate it through the cluster. Some general lessons from the IISI story 1. The role of the State in cluster development 2. The relationship between FDI and indigenous development 3. The role of international / global ties in cluster development 4. The origins of entrepreneurial firms within clusters 1. Role of the State in cluster development • The State (Irish government departments, development agencies, semi-State institutions and the EU) has played an important role in the development of the Irish indigenous software industry: invested in and expanded relevant third-level education upgraded telecoms infrastructure financed start-ups/emerging firms (grants and equity) provided non-financial assistance to emerging firms established and funded sector-specific institutions kick-started the local VC industry through public-private funds • Suggests the devolved governments in Scotland and Northern Ireland can do a lot to support the emergence of embryonic software clusters. • Both are now doing many of these things (but to varying degrees). 2. FDI and indigenous development • The relationship between the software MNCs operating in Ireland and the indigenous software industry is less important than one might expect. Few direct trading linkages between the two sectors Relatively few indigenous spin-offs from software MNCs • But indirect spillovers relating to the labour market: MNCs helped develop labour skills for the indigenous industry Many indigenous entrepreneurs have worked in MNCs at some time • Suggests regions like Northern Ireland, which are attracting software FDI, should be realistic about the likely knock-on effects. • Also one potential negative: competition for scarce skilled labour. 3. Role of global ties in cluster development • Local dynamics are a major part of the Irish indigenous software story. • However, we must not overlook the important role played by various international or global ties in the development of the cluster: Demand from export markets = the major driver of growth International strategic alliances used to distribute products Floatation of leading firms on international stock markets Increasing involvement of international VCs in Ireland Possible role of emigration and return migration • Suggests regions like Scotland & NI must embrace and engage with the global economy, encourage firms to be more outward looking, and support the building of globally significant indigenous firms • Some encouraging noises in recent programmes for government (but the proof of the pudding will be in the eating) 4. The origins of entrepreneurial start-ups • In the early stages of cluster development, the majority of Irish software product firms originated as: spin-offs from larger firms in other sectors start-ups targeting emerging demand for IT services spin-offs from academic research • More recently firms have emerged: mainly as spin-offs from established indigenous software firms (continuing role for spin-offs from academic research) • • Suggests importance of adequate government funding for academic R&D and promoting/assisting its commercialisation. NI has very low HERD expenditure compared with other UK regions. • Commercialisation of HERD is hap-hazzard in both Scotland and NI. Web-site: www.qub.ac.uk/nierc E-mail: m.crone@qub.ac.uk