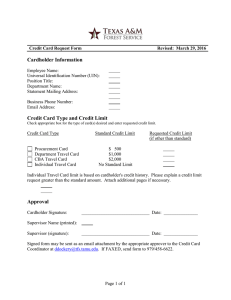

Corporate Card - Cardholder Responsibilities

advertisement

Corporate Card - Responsibilities of the Card Holder Responsibilities are: All Cardholders must complete and sign a “Cardholder Agreement” form and forward to the Finance Manager Systems at Wagga Wagga for filing. Cards are to be signed immediately upon receipt. Loss of card is to be reported immediately to the ANZ Bank on 1800 033 844 and to the Finance Manager Systems on 02 6933 2894 (internal extension 32894) or by email at: finmgr@csu.edu.au Ensure that the total monthly expenditure limit, for the card, is not exceeded. Documentation in support of payments is obtained (prior to payment) and maintained. Cards are not to be left in an accessible place where they may be taken and used by unauthorised personnel. Cardholder’s must not, under any circumstances, make unauthorised deposits to the Credit Card account. Records are maintained at FOAPAL level. This will involve the maintenance of a spreadsheet (Payables & Business Cardholders) detailing all transactions on an ongoing basis. The status of the card (ie. debit or credit) must be identified and reconciled on a monthly basis and any abnormal items reported to the Director, Department of Finance. The certification and authorisation of expenditure should where possible, be performed by an officer, other than the cardholder. A review of the credit limit should be undertaken by the Executive Director, Division of Financial Services at least annually, or where a change in the operation of Financial Services would impact on the card usage. Advance payments should be monitored to ensure that the goods and/or services are received. Use of the Credit Card The use of the Credit Cards is subject to the University’s purchasing and payment policies, procedures and regulations. All regulations pertaining to the security of the Credit Cards, as advised by the ANZ Bank, are to be adhered to at all times. Under no circumstances is the card to be loaned for use by another person. The card is not to be used: - to procure cash at any time, - for private or personal purposes, - pay fines which were incurred while on University business, and Page 1 of 2 - travel expenses (with the exception of the Travel & Payroll Card). Cardholders who misuse their card will be brought to account with appropriate severity. In all instances (except for direct internet purchases) the signature of the card holder must be included as a part of any transaction. On receipt of the monthly statement, the card holder will attach all tax invoices and documentation, reconcile with the spreadsheet (if applicable) and arrange for the payments to be charged to appropriate Banner Account Codes. All documentation should then be forwarded to Accounts Payable or Travel Office within 15 days of the statement being issued, for processing. Where a card holder has a dispute with a transaction on their statement they are required to contact the Accounts Payable Supervisor on 02-6933 2628 (internal extension 32628) or by email at: accountspayable@csu.edu.au , who will arrange a trace to be done on the disputed transaction. Internet Purchases Payments via the web for purchases of goods (eg. software) are not permitted unless all alternate forms of payment have been explored. If there are no alternates then: The cardholder is satisfied as to the validity and integrity of the supplier, The web site is confirmed as a secure encrypted site that does not maintain files of credit card details in any other format (to be confirmed by Division of Information Technology), Credit card details are not to be disclosed for authorised use to any other person. Account Reconciliation and Payments The original statements are to be retained by the Finance Clerk Ledger for reconciliation to the bank Account. Copies of the statements will be forwarded to the cardholder’s for individual reconciliations. A copy of all documentation is to be retained for each use of the credit card and raised on a spreadsheet (if applicable) for use in the monthly statement reconciliation. At the end of the month the ANZ Bank will provide a statement of expenses for the card. The statement will set out details of each transaction for the month and will be forwarded to the Cardholder. The statement must be personally authorised and reconciled by the Cardholder as follows: Ensure that each expenditure transaction is legitimate, authorised and accurately reflects the use of the card for the month Reconcile the spreadsheet (if applicable) and documentation with the statement ensuring that all FOAPAL codes for payment are correct. Forward all details to Accounts Payable Supervisor at the Finance Office in Wagga Wagga for payment processing. Page 2 of 2