IB1005 DEPOSITS AND FINANCING PRACTICES OF ISLAMIC FINANCIAL INSTITUTIONS

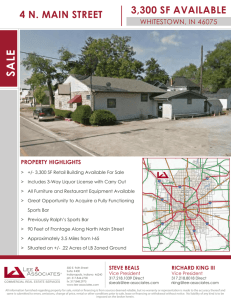

advertisement

IB1005 DEPOSITS AND FINANCING PRACTICES OF ISLAMIC FINANCIAL INSTITUTIONS CHAPTER 6 : AL-MURABAHAH / BAIBITHAMAN AJIL PROPERTY FINANCING COMPILED BY HAMDAN HJ IDRIS, BSc Econs, MBA (Islamic Banking & Finance) Certified Professional Trainer (MIM) Industry Expert INCEIF PRESENTED BY HJ MAHMUD HJ BUNTAT, MBA (AUOL, UK), DBM (Swansea Inst., UK), CIL (UIA) Part-time Lecturer (INCEIF) Former Head of Islamic Banking Division, OCBC Bank (Malaysia) Bhd Chapter 6: Finacing - Al-Murabahah/ Bai-Bithaman Ajil Property Financing In principle, murabahah means mark-up sale. It is a sale contract (ie. it is not a loan contract) in which the object of sale is sold to the buyer at a selling price equivalent to the cost price and profit margin. There are two types of murabahah, namely:1. Cash murabahah i.e. a sale contract where the seller sells a commodity with a price equal to the cost price and a profit margin. The purchase is settled on cash basis. . 2. Credit murabahah i.e. a credit sale with purchases settled by installment payments. The price is equal to cash murabahah prices but a premium is added over the profit margin to reflect deferment in payment which basically translates to time value of money. Al Bai Bithaman Ajil Financing (BBA) BBA means sale with deferred payments i.e. Albai’ = sale, thaman = price, ajil= deferment. BBA is a sale. It is not a loan. It is not a spot sale. Still it constitutes one form of trading and commerce. The Quran says, “ Allah has allowed trade and commerce (al-bay’) but prohibits riba” (Al-Baqarah verse 2; 275). Hence profit from sale (al-bay’) is lawful, while profit from loan i.e. riba, is unlawful. Al Bai Bithaman Ajil concept 1. Refers to the sale of goods on deferred payment basis at a price that includes a profit margin agreed by both parties. Final price should be contractually agreed and known to both parties. 2. The Bank may finance a customer who wishes to acquire a given asset for a specific period and to repay by instalment (i.e payment of price is deferred) Al Bai Bithaman Ajil concept 3. Time and mode of payment will be ascertained and the cost price and amount of mark-up need not be stated. 4. Sale and Purchase is the transfer of ownership between the parties. Products : House or Term Financing-i (financing for the acquisition of assets), Working capital-i, Share financing-i, Vehicle financing-i & Equipment Financing-i) Al-Bai Bithaman Ajil (BBA) (Sales with deferred Payments) (3) Bank sells the asset to the customer at a selling price = RM 50,000 + profit margin BANK (2) Bank purchases the asset from owner (e.g at RM 50,000) CUSTOMER (4) The customer repays the bank by Installments If n = 60 month and profit margin = RM 25,000 Monthly installment = RM 75,000 / 60 = RM 1,250 OWNER OF ASSET (1) Owner identifies the asset to be acquired To summarise, BBA sale consists of three contracts, namely: Property Purchase Agreement (PPA): Bank buys property from customer. Property Sale Agreement (PSA): Bank sells property to customer at BBA price. Deeds of Assignment/Charge: Bank A holds property as collateral. House Financing (Al- Bai Bithaman Ajil) The packaging involves a combination of sales, profit margin and deferment, conducted between two parties. The sales between the customer and the bank (bai’); a cost plus sale including a:• • • • stated profit margin (murabahah); a deferred payment (al-ajal); and involves one party selling an asset at a higher deferred price, but buys it immediately for a lower cash price (bai’ al `inah) as reflected in the financing of a new home Al Bai Bithaman Ajil structure (1) Developer sells house & home-buyer pays a deposit to seller Customer Seller Home-buyer Developer (4) Pays balance to seller who then transfer title to buyer (2) Customer sells house to IFI for the cost of financing (Selling Price) To settle the balance with developer IFI (3) Customer immediately Buys the house back from the IFI Including the IFI’s financing and it’s profit Margin (Purchase Price) as a deferred credit price In Malaysia, short-term credit murabahah is simply called murabahah with payment payable lumpsum. A long-term credit murabahah is known as albai-bithaman ajil (BBA). BBA is also known as bay’muajjal and murabahah in Pakistan and the Middle-east countries. Thus, al-bay’, does not have to imply BBA alone but also other lawful sales as well. Murabahah Asset Financing A cost plus sale (bai’ al-murabahah) involves the asset sold at the price at which it was obtained, plus a stated profit margin. Murabahah to order involves a contract whereby a bank purchases an asset upon the request of a customer, and then re-sells that asset to the customer in a murabahah. The contract may be decomposed into two promises. A promise by the customer to purchase the asset, and a promise by the bank to sell the asset to the customer in a murabahah. Some may interpret that the OIC Fiqh Academy requires that promises are binding in commerce where the promise is induced incurring liabilities, and subject to enforcement as well as actual damages broken. (Ref: Structuring Islamic Finance Transactions, A.Thomas / S.Cox, / B.Kraty, (Euromoney 2005), p..65) AAOIFI does not deem a promise as binding, and that title has to pass from seller to bank first to establish legal ownership and risk Shari’a Standards (2004-2005), Shari’a Standard No.8, Appendix (D), p.128 AAOIFI clarifies that, “the condition that possession of an item must be taken by the institution (before its onward sale to the customer) has a specific purpose: that the institution must assume the risk of the item it intends to sell...” Murabahah without ownership and risk is thus loan with interest (qard bi al fai’dah). (Ref: Shari’ah Standards 2004-2005, Shari’ah Standard No.8, 3/2/2, p.118) • In practice, a form of down payment is often taken by the bank, upon the customer’s promise to buy the asset, in the form of security deposit (hamish jidiyyah) or earnest money (arbun), and often deemed non-refundable where a bank itself deems the promise as binding, and the bank always enters into a contractual commitment with the home-purchaser prior releasing funds to the home-seller as the OCC discovered. Musharakah concept 1. Refers to a partnership agreement or jointventure for a specific business with a profit motive. 2. Any profit arising will be shared between the Bank and customers according to predetermined ratios and in the event of losses, both parties will share the losses on the basis of their equity participation. Products : Project or Equity Financing-i, Investment in shares. Workflow of Musharakah FINANCIER / BANK • Profit : Shared according to agreed ratio or according to ratio of capital Contribution • Loss shared according to ratio of capital contribution COMPANY X% CAPITAL Y% Project Revenue Invests in project Declining Co-Ownership (Musharakah Mutanakissa) The facility combines both musharakah and ijarah and involves the bank and the customer entering into a joint venture (musharakah) with both parties contributing capital (financing and deposit). Musharakah Mutanakissa (Modus Operandi) – Step 1 Financier Provides most of financing e.g 90% STEP 1 Customer Asset to be acquired Both financier + customer become partners in the ownershhip of asset (Shirkah al Milk) Provides most of financing e.g 10% Musharakah Mutanakissa (Modus Operandi) – Step 2 Financier 90% Financier’s Share Decreasing Customer Pay monthly installment partly as rental and partly as gradual purchase proce of part of financier’s share in Asset Customer’s share increasing 10% 0% Asset STEP 2 100% The home is acquired by the joint-venture, and the bank gives the sole right of occupancy to the customer, for which the customer agrees to pay rent under a rental agreement (ijarah) over the tenor of the financing to the IFI. • Whether rental payments are fixed or floating as a result of the pricing benchmarking, the mechanism for the profit rate and the nature of the reducing participation of the bank, is reflected in the constant rate of return calculation and monthly re-payments “are similar to the payments made under a typical mortgage agreement.” • The customer's share in the ownership increases until the property is paid for and owned in full. • The IFI’s profit payments may be adjustable and (in the U.S.) is typically linked to an interest rate index (subject to certain caps). Hence the diminishing equity of the IFI mirrors the declining principal under a monthly reducing balance amortization. However, in the MMP contract, the capital contribution ratio (CCP) is not fixed as it can be adjusted based on negotiation and the nature of contractual relationship between the partnering agents. For example, in the government’s 100% financing housing scheme, CCR can be based on a fraction, say 1:99. Therefore, if the house costs $100,000, the initial capital contributed by the customer is only $1,000. This amount will not pose a great burden to public servants, who have rights to enjoy 100% financing. • The objective of MMP is to make profits from the investment while the object of investment is the ownership of property, say a house. An al-ijarah contract will be applied as a mechanism to earn rental income. • The monthly rental paid to the partnership shall be equivalent to the monthly payment that banks will receive on term financing. As rentals are paid, it will be distributed as profits to the bank and customer using the contractual profit sharing ratio. The customer can use the profits to purchase shares from the bank. In this way, ownership claims by customer increases over time, while bank’s ownership decreases. • To accelerate the share-purchasing process, a premium is added onto the true rental value of the property. This is to ensure that rental payments are able to reflect market value. • As an example, assuming identical cost of financing and maturities, traditional financing requires a customer to pay $800 monthly. But in MMP, rental is valued at $500.To make up the difference, the customer pays an additional $300 as a share purchase transaction. Total rental is, therefore, $800 Soon after the first rental payment is made, the customer will secure $50 profit (that is, 10% x $500) from rental, plus $300 to buy a portion of shares that the bank holds. The customer now owns $10,000 + $350 = $10,350 as share capital after making the first payment ($800) while the bank holds a decreasing $89,650. (MMP) FOR HOME FINANCING USING AL-IJARAH AS THE INCOME GENERATING ENGINE Customer Share Capital $ 10,000 10% Bank Share Capital $90,000 90% MUSYARAKAH MUTANAQISAH PARTNERSHIP (MMP) Reduces Bank’s shareholding Increases Customer’s shareholding The MMP invests the $100,000 Capital in the Al-ijarah-rental business Customer – 10% Profit - $50 HOUSE Monthly Ijarah Payment $800 Actual rental Value $ 500 Share purchase Bank – 90% Profit - $450 Customer share Purchase $300 • The musharakah mutanaqisah contract is terminated when total sale of shares is concluded. The way an Islamic bank responds to interest rate volatility will now depend on the periodic lease renewal agreement, usually made every two or three years. This practice is normal in the rental business. If money is tight, the bank can direct the customer to increase the true rental value while keeping the added premium constant. The opposite is true when interest rates decline. This rental adjustment technique, although not thoroughly transparent from the Shariah viewpoint, requires more research in order to gain public acceptance. • To apply MMP in banking, one must identify who owns the asset sold - the bank or the customer? Theoretically, both hold legal claim on the house. But kind of business entity MMP should adopt? In what way BAFIA will recognize the new company since it has strictly prohibits banks to participate in joint-ventures? • Here, it is the partnership and not the bank alone who made the purchase. The pricing of rentals and changes in premium payments for share buy-back require meticulous care so that periodic adjustment to market movement in property and rental prices reflects a “winwin”deal. Have a good day May God bless you Thank you & Wassalam