(Public Joint Stock Company)

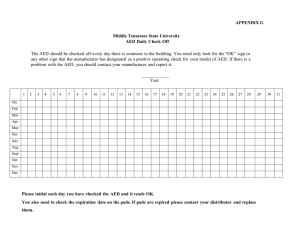

advertisement