Angelina Wong

advertisement

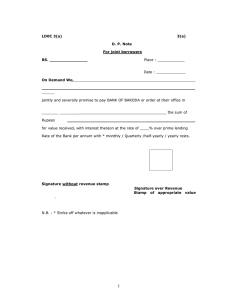

Angelina Wong 4C (34) Peggy Woo 4C (35) Source: South China Morning Post Date: 27th November, 2010 Newspaper Article Stamp duty increase prompts warning of “collateral damage” A war of words has broken out between the government and the representative of major developers over new anti-speculation measures in the property market. Chief Executive Donald Tsang Yam-kuen said yesterday the new stamp duty was working. But Louis Loong Hon-biu, secretary general of the Real Estate Developers Association of Hong Kong (REDA), countered that genuine end-users could suffer "collateral damage" from the new measures. "We understand the government is trying to curb the speculation in the property market," Loong said after meeting developers. "We noticed there is speculation in the market. And the government has to tackle the problem. "But we are concerned about the collateral damage that the measures may cause to people who are forced to sell their properties due to other, unforeseen circumstances." (Explanation 3)He said the measures seemed to be proving effective for now as property sales fell this week. (Explanation 1)The new rules impose an extra 15 per cent on stamp duty for flats bought and sold within six months, 10 per cent for those sold between six months and a year of purchase and 5 per cent for those sold one to two years later. Speaking at the Boao Youth Forum at the Hong Kong Convention and Exhibition Centre, Tsang said the initial effect on the property market was to halt "excessively malicious speculative activities" and to reduce the risk of a bubble forming. (Explanation 2) He said the measures were also designed to help genuine end-users. The Hong Kong Monetary Authority yesterday announced new mortgage loans drawn down in October fell 26 per cent to HK$25.1 billion compared with September. Approval of new loans fell 2.2 per cent to HK$30.8 billion. Property agents believe the fall in new mortgages was due to the cooling measures in August. Financial commentator David Webb criticised the new government measures as possibly breaching the Basic Law and creating unintended victims. "Apart from catching short-term investors, the special stamp duty would catch homeowners who either wish to sell or are forced to sell for whatever reasons, such as the owner who loses her job and cannot pay the mortgage or get a mortgage to complete a home purchase," he wrote on his website. He believed the stamp duty would have a negative impact on liquidity. (Explanation 4)"With reduced liquidity in the property market, there will be less work for estate agents, conveyance lawyers and the related jobs in advertising that are linked to the volume of the secondary property market. Less work, fewer jobs, lower pay.” Separately, Loong, of REDA, said the association had received the letter from the Transport and Housing Bureau regarding remarks made online by Cheung Kong (SEHK: 0001) Real Estate director William Kwok Tze-wai over the sale of the developer's new flats on the day the new stamp duty was announced. Kwok said the flat transactions would not be affected by the new measures. Loong said it had received the reply from Cheung Kong and REDA's supervisory committee would launch a hearing to decide whether a reprimand was warranted. "Our committee members will study the case and reach a conclusion shortly," he said. Description of the issue The new anti-speculation measure in the property market by imposing extra stamp duties on flats sold within a short period of time has aroused public concern especially the representative of major developers. It has become a controversial issue in society. Initially, the government adopted this measure as a means to halt excessively malicious speculation activities and to catch short-term investors. The government intervene the property market in a hope to cease the skyrocketing property prices and to assist the genuine end-users to buy their properties. Yet, it turns out that this measure reduces the liquidity in the property market and people engaging in sectors related to the property market, like estate agents, conveyance lawyers will lose their jobs or get a lower salary. Explanation 1. As an extra stamp duty is imposed on flats sold within a short period of time which means that the cost of short-term property speculation increases, quantity demanded for short-term property speculation decreases, holding other factors constant. It is represented by a movement along the same demand curve. 2. After the implementation of the policy concerning extra stamp duties, people expect future property price to decrease. Therefore, they delay their purchase. The demand for properties decreases. The demand curve will shift left. At the same time, property owners consider stamp duties as the cost of selling their flats in the second-hand market. After the implementation of the policy, cost increases so the supply of flats decreases. Supply of properties decreases. Supply curve will shift left. As stated in the newspaper article, such measure benefits genuine-end users which means that the price of properties decreases. If the decrease in demand for properties is larger than the decrease in supply of properties, the equilibrium price and equilibrium quantity will decrease. Genuine end-users can then purchase properties at a lower price. 3. As stated in the news, in the week following the adoption of extra stamp duties, properties sale, which is known as the total revenue, decreases. Original total revenue = P1 x Q1 New total revenue= P2 x Q2 Decrease in total revenue= P1 x Q1 – P2 x Q2. 4. Estate agents are derived demand of properties. When the demand for properties decreases, demand for estate agents decreases. The demand curve will shift left.