Week of: 11/10 ... Subject: Banking & Finance

advertisement

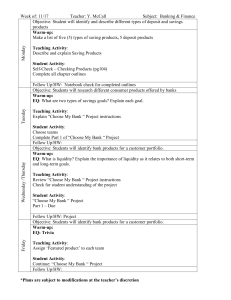

Friday Wednesday /Thursday Tuesday Monday Week of: 11/10 Teacher: Y. McCall Subject: Banking & Finance Objective: Student will identify and describe different types of deposit accounts Warm-up: Make a list of five (5) types of saving products. Teaching Activity: Demonstrate how to outline chapter notes Student Activity: Pre-Test Outline chapter 4 – Deposit Accounts Key Terms Follow Up/HW: Objective: Students will describe types of account ownerships Warm-up: EQ: How can a customer make deposits into their accounts without going to the bank? Explain the deposit process when an actual teller is not involved. Student Activity: Complete Chapter 4 notes and key terms Follow Up/HW: Objective: Students will compare and contrast types of negotiable instruments. Warm-up: EQ: Which type of endorsement the least safe? Explain the reason. Teaching Activity: Review savings products Review deposit accounts Demonstrate how to open and maintain an account Student Activity: Deposit Accounts Project Follow Up/HW: Project Objective: Students will compare and contrast types of negotiable instruments. Warm-up: EQ: What are the four structural elements of the Federal Reserve? Student Activity: Complete Deposit Accounts Project (DUE) Follow Up/HW: *Plans are subject to modifications at the teacher’s discretion