Chapter 6 International Transparency and Disclosure

advertisement

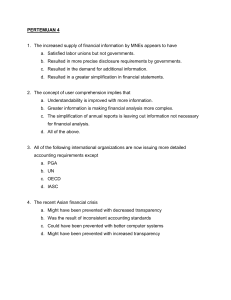

Chapter 6 International Transparency and Disclosure Introduction to Transparency Lack of “transparency” is a major concern in raising international capital for MNEs Concerns with transparency arose with the Asian Crisis, Enron, WorldCom, Parmalat, Achieving greater transparency is a goal of regulators around the world Greater transparency can restore confidence in and expand capital markets International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black Levitt and Greenspan on Transparency Arthur Leavitt “The significance of transparent, timely and reliable financial statements and its importance to investor protection has never been more apparent. The current financial situations in Asia…are stark examples of this new reality. These markets are learning a painful lesson taught many times before: investors panic as a result of unexpected or unquantifiable bad news.” Alan Greenspan “A major improvement in transparency, including both accounting and public disclosure, is essential.” International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black The Meaning of Transparency Bushman and Smith measure transparency by looking at Corporate financial reporting Governance disclosures Availability of annual reports in English Penetration and ownership of the media Ease of gaining private information on a firm International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black The Meaning of Transparency PricewaterhouseCoopers’ Opacity Index at the country level considers Corruption levels Legal and judicial opacity Economic/political opacity Accounting/corporate governance opacity Impact of regulatory opacity and uncertainty/arbitrariness International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black The Meaning of Transparency Bushman, Piotrosk and Smith identify two kinds of corporate transparency at the country level Financial transparency Corporate disclosure intensity Timeliness of disclosures Number of analysts and media development Governance transparency International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black Pressures for Disclosure More groups want information Financial community desires more disclosure Result has been increasing disclosure requirements UN, OECD, EU, and IASB are issuing more detailed regulations Globalization increases the need for further disclosure by MNEs Some groups gain “tailor-made” reports (trade unions, etc.) Trend shows that greater disclosure increases the demand for more information International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black Communicating to Users The audience determines the range and depth of information disclosed Many users do not understand the information given them Few use annual reports directly MNE reports tend to be more complex than domestic reports International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black Communicating to Users and the Importance of Disclosure Simplified reports may omit important information useful to direct users (experts) Greater disclosure serves experts AND those they serve MNEs are disclosing more information about future prospects and policies and are using the Internet extensively As Future-Oriented, Specific Info MNE Sensitivity To Info Provision International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black Managerial Incentives to Disclose Information Management provides information voluntarily and because of regulation International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black Costs of Information Production Benefits > Costs Direct cost of disclosure is made up of Indirect costs include The value of resources used in gathering and processing the information The cost of auditing and communicating the information Competitive disadvantage Costs of government interference Internal and external information needs will always differ International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black Competitive Disadvantage of Disclosure The more specific or future-oriented the information, the more potential for competitive disadvantage Competition through disclosure Vigor in the economy In business incentives International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black The Net Costs and Benefits of Disclosure of Specific Items International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black The Net Costs and Benefits of Specific Disclosure Items International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black Corporate Disclosure Practices Meek, Roberts, and Gray MNEs tend to disclose more information voluntarily than domestic corps. Factors influencing voluntary disclosure are Size International listing status Country or region of origin Industry Non-financial information is a European phenomenon International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black Corporate Disclosure Practices Cultural values influence disclosure (Gray) Archambault and Archambault (2003) findings Companies disclose more if they are in common law countries Illiteracy, religion, inflation, market cap., number of foreign listings, dividends, and using a Big 6 auditor all affect disclosure Corruption acts as a hindrance to disclosure International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black International Disclosure Regulation Fourth and Seventh Directives (EU) require “Fair review of the development of the business” Any “likely future development” Report activities in research and development International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black International Disclosure Regulation U.S. - SEC Requires “management discussion and analysis” This entails results of operations, liquidity and capital resources, and the impact of inflation Future-oriented information is desirable U.K. – ASB gives guidance for an “Operating and Financial Review” Similar to U.S. requirements International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black Corporate Review Reviews business activities as a whole Includes the following Chairperson’s Statement Chief executive comments on his role Review of Corporate Strategy and Results See Unilever and DaimlerChrylser in Exhibits 6.7, 6.8 Comments on External and Unusual Events Includes comments on exchange rates and company fraud Acquisitions and Disposals Information High disclosure in U.S., U.K. Human Resources Information Disclosure is high in this area in France, U.S. International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black Corporate Review Includes the following Value-Added Information See BMW in Exhibit 6.9 Social Responsibility Information See GlaxoSmithKline in Exhibit 6.10 Research and Development Information Disclosure is high in this area in U.S., U.K., Germany Investment Program Information Disclosure is high in Australia, NZ, Holland, U.K. Future Prospects Information Disclosure is high in Germany, Hong Kong, Holland International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black Operations Review A more detailed review of business operations is given, including segment info Includes the following Review of Business Segments Includes quantitative data and narrative commentary Review of International Operations and Geographical Segments Becoming increasingly important with globalization International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black Financial Review Includes a discussion and analysis of financial results and financial position Includes the following An Analysis of Results An Analysis of Liquidity and Capital Resources Discussion of events and impact on earnings High disclosure in France, Italy, Holland, U.S., U.K. An Analysis of Asset Values and Inflation High disclosure in Holland, Sweden, Switzerland, U.K. International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black Frequency and Timeliness of Reporting Globalization increases the need for more frequent reporting U.S. and Canada require quarterly reporting Biannual reports are required if local requirements are used for an MNE Europe - EU Directive on Interim Reports Requires biannual reports on income and operations Some companies disclosure quarterly (Volvo, ICI) International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black Frequency and Timeliness of Reporting IASB – IAS 34 – Interim Financial Reporting Does not provide for frequency of reports, only minimum content of reports Publication of annual report is usually set at a limit of 6 months from the financial year-end International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black Growing Pressures for Transparency Pressures are increasing because of Cross-border capital raisings Growth of world trade and investment A lack of transparency exists in emerging economies Nature of disclosure depends on international and domestic factors and traditions IASB is working to increase to disclosure, especially in segmental disclosure International Accounting and Multinational Enterprises – Chapter 6 – Radebaugh, Gray, Black