PERTEMUAN 9 a. By disaggregating data by line of business.

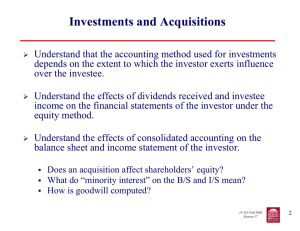

advertisement

PERTEMUAN 9 1. The best means of accounting for business combinations in most of the world is a. By disaggregating data by line of business. b. By disaggregating data by geographic area. c. Consolidation of financial information. d. Through parent company statements only, except in Anglo-Saxon countries. 2. 2. Proportional consolidation involves a. including a proportion of the firm's income and equity. b. using the cost but not the equity method. c. consolidating the ownership share of assets and liabilities on a pro-rata basis. d. having a proportion of companies in a country (usually the internationallytraded companies) consolidate their financial statements. 3. 3. Parent company balance sheets a. Are not permitted for U.K. companies. b. Usually accompany consolidated statements in the United States. c. Are always provided by U.K. companies in addition to a consolidated balance sheet and income statement. d. Are not common in continental Europe. 4. 4. An alternative to line-by-line consolidation is a. Proportional consolidation b. Minority interest accounting c. Joint-venture accounting d. The cost method 5. Multinational enterprises differ from strictly domestic enterprises in what way from an accountability and disclosure perspective? a. MNEs typically don't pay taxes. b. MNEs usually are in conflict with the objectives of host countries, whereas domestic firms tend to be compatible with home country objectives. c. Strictly domestic companies do not operate on an arms-length basis with customers abroad. d. With MNEs, there is usually a significant volume of intercompany transactions in foreign operations. 6. With respect to business combinations resulting from mergers and acquisitions, a. British firms tend to use the purchase method, whereby assets are revalued to "fair values" at the date of acquisition. b. Merger accounting (pooling of interests) requires that firms revalue assets to "fair value." c. The purchase method allows the acquiring firm to include prior years' profits from the acquired firm. d. The pooling of interests method is widely used outside of the United States, especially in Japan and other Asian countries. 7. According to purchase accounting, a. Assets are revalued to book value upon acquisition. b. Assets are revalued to fair market value upon acquisition. c. Earnings are usually enhanced due to the amortization of goodwill. d. There is no resulting goodwill since the purchase price of the assets must equal their fair value. 8. In the UK merger accounting means a. Purchase accounting b. Joint-venture accounting c. Pooling accounting d. Goodwill accounting 9. All of the following are MNE consolidation methods except a. Full consolidation b. Proportional consolidation c. Equity method d. Intangible elimination method 10. Where pooling-of-interest accounting is used a. Accounts must be adjusted to fair value after the merger b. There is no goodwill c. The companies have no comparative earnings advantages over companies that use purchase accounting d. Goodwill must be examined annually for impairment