Section 7: Health Plans (PowerPoint)

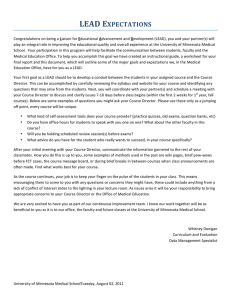

advertisement

1 Section 7: Health Plans • Health plan market shares • Fully-insured market in total • Small group and individual market • HMO financial statistics • Net income & margins • Reserves • Health Plan Medical Loss Ratios • HMO enrollment statistics HEALTH PLAN MARKET SHARES 3 Health Plan Market Shares: Total Fully-Insured Private Market, 2013* (Premium Volume: $6.2 billion) 35% 31.2% 30% 27.6% 26.7% 25% 20% 15% 10% 5.5% 5% 3.6% 1.7% 0.8% 0.8% 0.7% 0.7% 0.6% Federated Mutual Ins. Co. Health Care Services Corp. Cigna 0% Blue Cross HealthPartners Blue Shield of MN Medica PreferredOne United Healthcare Genworth Life Time Ins. Co. (Assurant Health) Companies with common ownership were treated as one entity. For example, Blue Cross Blue Shield of Minnesota includes BCBSM and Blue Plus. Fully insured market only, market share based on premium volume. Source: MDH Health Economics Program, analysis of MCHA Premium Database for 2013. *Contains preliminary unaudited and incomplete data Other (149 Companies) 4 Market Share of Minnesota Non-Profit Health Plans 2005 to 2013 100% 90% 80% 69.9% 70% 65.2% 64.8% 62.1% 60% 59.5% 56.5% 52.1% 50% 50.0% 49.5% 2012 2013 40% 30% 20% 10% 0% 2005 2006 2007 2008 2009 2010 Market share calculated as share of premiums in the fully-insured health insurance market. Source: MDH analysis of the premium assessment base for the Minnesota Comprehensive Health Association. Contains preliminary data 2011 5 Health Plan Market Shares: Small Group Market, 2013 Total Premium Volume in 2013: $1.35 Billion 50% 40.3% 40% 29.5% 30% 22.1% 20% 10% 5.6% 2.4% 0.1% 0% Blue Cross Blue Shield of MN Healthpartners Medica PreferredOne Federated Mut Ins Co Companies with common ownership were treated as one entity. For example, Blue Cross Blue Shield of MN includes Blue Cross Blue Shield of Minnesota and Blue Plus. Market shares based on premium volume; fully insured market only. Source: Minnesota Department of Commerce, "Report of 2013 Loss Ratio Experience in the Individual and Small Employer Health Plan Markets for: Insurance Companies Nonprofit Health Service Plan Corporations and Health Maintenance Organizations," June 2014. Assurant 6 Health Plan Market Shares: Individual Market, 2013 Total Premium Volume in 2013: $710 Million 80% 64.5% 60% 40% 20% 15.8% 9.8% 6.0% 2.8% 0.8% 0.2% 0.0% American Family Mut Ins Co Golden Rule Ins Co American Republic Ins Co 0% Blue Cross Blue Shield of MN Medica HealthPartners Assurant PreferredOne Note: Companies with common ownership were treated as one entity. Market shares based on premium volume; fully insured market only. Source: Minnesota Department of Commerce, "Report of 2013 Loss Ratio Experience in the Individual and Small Employer Health Plan Markets for: Insurance Companies, Nonprofit Health Service Plan Corporations, and Health Maintenance Organizations ," June 2014. HMO FINANCIAL STATISTICS 8 Summary of HMO Financial Trends, 2008 to 2013 In Millions of Dollars 2008 Net Income 2009 2010 2011 2012 2013 $26.0 $175.5 $250.6 $233.7 $250.3 $226.0 Total Revenue $5,786.3 $6,582.9 $6,954.5 $6,971.7 $7,326.8 $7,746.9 Operating Income as % of Revenue 0.5% 1.9% 2.6% 2.3% 2.4% 2.2% Net Income as % of Revenue 0.4% 2.7% 3.6% 3.4% 3.4% 2.9% Minnesota products only. Source: MDH Health Economics Program analysis of HMO annual reports. 9 Net Income and Profitability by HMO, 2013 Net Income (millions) Total Revenue (millions) Net Income as % of Revenue Blue Plus $73.2 $1,016.7 7.2% Group Health $43.0 $1,040.2 4.1% HealthPartners $65.6 $1,279.2 5.1% Gundersen $0.0 $2.2 (1.4%) ($3.8) $1,778.4 (0.2%) Metropolitan $4.0 $154.5 2.6% PreferredOne ($2.7) $59.6 (4.5%) Sanford ($0.4) $3.0 (13.0%) UCare $47.2 $2,413.2 2.0% All HMOs $226.0 $7,746.9 2.9% Medica Minnesota products only. Source: MDH Health Economics Program analysis of HMO annual reports. 10 Minnesota HMO Net Income by Product Line, 2008 to 2013 In Millions of Dollars $300 $250 $200 $150 $100 $50 $0 -$50 Commercial PMAP, PGAMC, MNCare Medicare MSHO, MDHO, and SNBC All Other Total 2008 $7.0 $18.7 ($0.1) $13.9 ($13.4) $26.0 2009 $35.2 $108.1 $18.6 $26.5 ($13.0) $175.5 2010 $73.9 $125.1 $1.8 $43.7 $6.0 $250.6 2011 $102.6 $39.1 $37.9 $46.3 $7.8 $233.7 2012 $78.3 $16.6 $53.9 $50.6 $51.0 $250.3 2013 $13.8 $96.1 $58.3 $48.9 $8.9 $226.0 PMAP is Prepaid Medical Assistance Program; PGAMC is Prepaid General Assistance Medical Care; MSHO is Minnesota Senior Health Options; All Other includes: Medicare Supplemental, Dental and Minnesota Disability Health Options. Source: MDH Health Economics Program analysis of HMO annual reports. 11 Minnesota HMO Net Income per Member Month by Product Line, 2008 to 2013 $120 $100 $80 $60 $40 $20 $0 -$20 Commercial PMAP, GAMC, MNCare Medicare MNSHO and MNDHO Minnesota Products Total 2008 $1.52 $4.13 ($0.12) $33.97 $2.46 2009 $8.47 $21.95 $15.79 $60.26 $16.30 2010 $20.35 $23.48 $1.35 $65.09 $22.75 2011 $36.03 $6.67 $25.70 $101.76 $21.84 2012 $34.35 $2.87 $34.90 $67.42 $23.75 2013 $6.91 $15.89 $33.14 $55.08 $21.00 PMAP is Prepaid Medical Assistance Program; PGAMC is Prepaid General Assistance Medical Care; MSHO is Minnesota Senior Health Options; and MDHO is Minnesota Disability Health Options. Source: MDH Health Economics Program analysis of HMO annual reports. 12 Minnesota HMO Net Income by Product Line, 2013 In Millions of Dollars $250 $226.0 $200 $150 $100 $64.30 $58.30 $48.90 $50 $31.70 $13.80 $8.90 $0 Prepaid Medical Assistance Program (PMAP) Medicare MSHO, MDHO, and SNBC MNCare Commercial Other PMAP is Prepaid Medical Assistance Program; MSHO is Minnesota Senior Health Options; MDHO is Minnesota Disability Health Options; SNBC is Special Needs Basic Care; All Other includes: Medicare Supplemental, and Dental. Source: MDH Health Economics Program analysis of HMO annual reports. Total Minnesota Products 13 Minnesota HMO Net Income per Member Month by Product Line, 2013 $140 $132.97 $120 $100 $80 $60 $55.08 $40 $33.14 $21.67 $20 $21.00 $14.04 $6.91 $0 Other MSHO, MDHO, and SNBC Medicare MNCare Prepaid Medical Assistance Program (PMAP) Commercial PMAP is Prepaid Medical Assistance Program; MSHO is Minnesota Senior Health Options; MDHO is Minnesota Disability Health Options; SNBC is Special Needs Basic Care; All Other includes: Medicare Supplemental, and Dental. Source: MDH Health Economics Program analysis of HMO annual reports. Total Minnesota Products 14 Minnesota HMO Profitability by Product Line, 2008 to 2013 Net Income as % of Revenue 20% 15% 10% 5% 0% -5% -10% -15% 2008 2009 2010 2011 2012 2013 Commercial PMAP, PGAMC, MNCare 0.3% 1.6% 3.2% 5.1% 4.1% 0.7% 1.0% 4.8% 5.3% 1.5% 0.7% 3.5% Medicare MSHO, MDHO, and SNBC All Other Total 0.0% 2.1% 0.2% 3.4% 4.4% 4.3% 1.4% 2.4% 3.9% 4.1% 3.6% 3.1% (12.7%) (11.6%) 2.5% 4.7% 16.9% 4.9% 0.4% 2.7% 3.6% 3.4% 3.4% 2.9% PMAP is Prepaid Medical Assistance Program; MSHO is Minnesota Senior Health Options; MDHO is Minnesota Disability Health Options; SNBC is Special Needs Basic Care; All Other includes: Medicare Supplemental, and Dental. Source: MDH Health Economics Program analysis of HMO annual reports. 15 Sources of HMO Net Income, 2008 to 2013 In Millions of Dollars 2008 2009 2010 2011 2012 2013 Sources of Net Income: Net underwriting gain/loss $31.3 $123.1 $181.4 $161.6 $174.9 $173.0 Investment Income ($5.5) $52.4 $69.4 $44.5 $39.9 $39.4 Other $0.2 $0.0 ($0.2) $27.5 $35.5 $13.7 Net Income $26.0 $175.5 $250.6 $233.7 $250.3 $226.0 (21.2%) 29.8% 27.7% 19.1% 16.0% 17.4% Investment income as % of net income Minnesota products only. Source: MDH Health Economics Program analysis of HMO annual reports. 16 Investment Income as a Percent of Net Income by HMO, 2013 Investment Income (millions) Blue Plus Net Income (millions) Investment Income as Pct of Net Income $14.8 $73.2 20.2% Group Health $3.2 $43.0 7.5% HealthPartners $3.6 $65.6 5.5% Gundersen $0.0 ($0.0) 0.0% Medica $11.5 ($3.8) (301.0%) Metropolitan ($0.3) $4.0 (7.1%) $0.2 ($2.7) (6.8%) ($0.0) ($0.4) 0.5% $6.3 $47.2 13.4% $39.4 $226.0 17.4% PreferredOne Sanford UCare All HMOs Source: MDH Health Economics Program analysis of HMO annual reports. 17 Reserves, Medical Expenses, and Regulatory Minimum Level by HMO, 2013 Reserves (millions) Total Expenses (millions) Reserves as % of Total Expenses Reserves as % of Regulatory Level Blue Plus $448.9 $924.7 48.5% 1162% Group Health* $158.8 $405.5 39.1% 737% $1.5 $2.0 74.3% 230% HealthPartners* $846.4 $1,100.5 76.9% 632% Medica $404.5 $1,212.6 33.4% 609% Metropolitan $28.3 $131.3 21.5% 504% PreferredOne $7.7 $53.7 14.3% 278% Sanford $1.3 $3.1 41.0% 395% $443.2 $2,195.6 20.2% 501% $2,340.5 $6,560.4 35.7% 653% Gundersen UCare All HMOs *Fee-for-service revenue earned was subtracted from expenses to approximate member only expenses. “Regulatory level” is the authorized control level; total expenses is from line 16 of HMO Minnesota Supplement Report #1. Minnesota products only. Source: MDH Health Economics Program analysis of HMO annual reports. 18 Total Minnesota HMO Reserves Relative to Regulatory Minimum Levels, 2003 to 2013 800% Reserves as a Percent of Regulatory Minimum 700% 600% 500% 400% 300% 200% 100% 0% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Fee-for-service revenue earned was subtracted from expenses to approximate member only expenses. “Regulatory minimum level” is the authorized control level. Source: MDH Health Economics Program analysis of HMO annual reports. HEALTH PLAN MEDICAL LOSS RATIOS 20 Medical Loss Ratio in the Individual Market, 2013 (Carriers with $2 million or more in Premium Revenue) Claims Expense Net American Family Mutual Premium1 Incurred Claims MLR2 Quality Improvement Fraud Total 5,917,850 5,686,970 0 0 445,433,947 410,826,000 2,682,963 52,655 HealthPartners Inc. 15,979,000 17,283,000 145,000 0 17,428,000 114.2% HealthPartners IC 53,738,000 45,452,000 1,335,000 0 46,787,000 90.8% John Alden Life IC 2,514,806 1,571,953 15,086 973 1,588,012 70.1% Medica Health Plans 5,560,982 8,456,183 17,060 0 8,473,243 52.7% 106,802,111 102,155,810 900,156 0 103,055,966 90.5% PreferredOne IC 19,924,470 14,363,661 376,987 0 14,740,648 78.0% Time IC 38,664,498 30,125,280 298,233 19,589 30,443,102 80.4% 694,535,664 635,920,857 5,770,485 73,217 641,764,559 90.8% BCBSM Medica IC Total Source: MDH Health Economics Program analysis of data from National Association of Insurance Commissioners (NAIC), Supplementary Health Care Exhibit—Part 1; Note 1: premiums exclude taxes and fees. Note 2: Beginning in 2012, federal law requires insurance companies that don’t include certain small and new companies to issue rebates to consumers for an MLR under 80% in the individual market for the prior year. 5,686,970 102.5% 413,561,618 92.8% 21 Medical Loss Ratio in the Small Group Market, 2013 (Carriers with $2 million or more in Premium Revenue) Claims Expense Net BCBSM Premium1 Incurred Claims MLR2 Quality Improvement Fraud Total 529,674,020 476,362,000 3,545,565 51,205 479,958,770 91.3% Federated Mutual IC 31,932,465 26,461,065 0 0 26,461,065 86.7% Healthpartners Inc. 323,110,000 277,786,000 3,880,000 0 281,666,000 91.3% 76,514,000 71,263,000 903,000 0 72,166,000 98.7% 299,272,020 267,717,416 2,715,508 0 270,432,924 90.9% PreferredOne Health Plan 36,264,677 32,094,820 363,256 30,196 32,488,272 93.9% PreferredOne IC 39,155,657 37,352,947 424,368 0 37,777,315 96.9% 1,335,922,839 1,189,037,248 11,831,697 81,401 Healthpartners IC Medica IC Total Source: MDH Health Economics Program analysis of data from National Association of Insurance Commissioners (NAIC), Supplementary Health Care Exhibit—Part 1 ; Note 1: premiums exclude taxes and fees. Note 2: Beginning in 2012, federal law requires insurance companies that don’t include certain small and new companies to issue rebates to consumers for an MLR under 80% in the small group market for the prior year. 2,536,873,185 91.7% 22 Medical Loss Ratio in the Group Market, 2013 (Carriers with $2 million or more in Premium Revenue) Claims Expense Net Premium1 BCBSM Incurred Claims Quality Improvement Fraud Total MLR2 1,051,092,006 947,944,693 6,809,048 124,978 954,878,719 91.6% 16,872,124 14,626,747 131,027 1,749 14,759,523 90.6% 7,073,857 6,709,178 35,229 0 6,744,407 100.0% Federated Mut IC 14,543,933 14,277,854 0 0 14,277,854 102.7% Group Health Inc. 45,669,000 44,185,000 952,000 0 45,137,000 99.0% Healthpartners Inc. 313,632,000 250,539,000 2,434,000 0 252,973,000 84.4% Healthpartners IC 564,402,000 471,256,000 6,406,000 0 477,662,000 89.1% 3,931,079 4,976,761 28,948 0 691,482,013 587,524,258 5,751,170 0 593,275,428 90.4% PreferredOne Health Plan 23,426,313 21,640,519 289,090 20,367 21,949,976 98.3% PreferredOne IC 91,261,807 79,169,535 896,600 0 80,066,135 92.3% 2,477,302 2,500,574 22,738 0 2,825,863,434 2,445,350,119 23,755,850 Blue Plus Connecticut Gen Life IC Medica Health Plans Medica IC Sanford Health Plan Total 5,005,709 351.2% 2,523,312 109.0% 147,094 2,469,253,063 No data available. Source: MDH Health Economics Program analysis of data from National Association of Insurance Commissioners (NAIC), Supplementary Health Care Exhibit—Part 1; Note 1: premiums exclude taxes and fees. Note 2: Beginning in 2012, federal law requires insurance companies that don’t include certain small and new companies to issue rebates to consumers for an MLR under 85% in the large group market for the prior year. 90.4% HMO ENROLLMENT STATISTICS 24 Minnesota HMO Member Months by Product Line, 2008 to 2013 12,000,000 10,000,000 8,000,000 6,000,000 4,000,000 2,000,000 0 Commercial PMAP, PGAMC, MNCare Medicare MSHO, MDHO, and SNBC Other Total Minnesota Products 2008 4,574,441 4,529,156 1,011,580 408,493 46,427 10,570,097 2009 4,157,413 4,926,689 1,179,530 440,547 63,699 10,767,878 2010 3,633,053 5,327,847 1,340,216 671,741 44,805 11,017,662 2011 2,846,525 5,860,173 1,476,138 454,917 62,959 10,700,712 2012 2,279,126 5,761,840 1,543,457 750,187 203,202 10,537,812 2013 2,004,348 6,046,694 1,760,333 888,181 66,746 10,766,302 PMAP is Prepaid Medical Assistance Program; MSHO is Minnesota Senior Health Options; MDHO is Minnesota Disability Health Options; SNBC is Special Needs Basic Care; All Other includes: Medicare Supplemental, and Dental. Source: MDH Health Economics Program analysis of HMO annual reports. 25 Distribution of Minnesota HMO Enrollment by Region, 2012 Northwest BluePlus Northeast West Central Central Southwest Southeast Twin Cities Statewide 14,213 16,431 16,294 40,343 25,745 43,383 50,687 207,096 186 721 368 4,431 291 1,929 43,471 51,397 0 0 0 0 0 33 0 33 160 435 349 28,090 2,735 3,182 190,470 225,421 2,015 20,788 7,729 24,165 107 1,056 82,666 138,526 Metropolitan 1 3 0 3 1 1 10,096 10,105 PreferredOne 99 362 630 2,863 985 1,535 8,955 15,429 0 0 0 0 735 15 0 750 3,420 14,614 3,628 27,272 9,632 36,221 207,230 302,017 20,094 53,354 28,998 127,167 40,231 87,355 593,575 950,744 GroupHealth Gundersen HealthPartners Medica Sanford Ucare All HMOs Source: MDH Health Economics Program analysis of HMO annual reports 26 Minnesota HMO Enrollment as Percent of Regional Population, 2012 Northwest Northeast West Central Central Southwest BluePlus 8.4% 5.0% 7.3% 5.5% 9.2% 5.9% 1.7% 3.8% GroupHealth 0.1% 0.2% 0.2% 0.6% 0.1% 0.3% 1.5% 1.0% Gundersen 0.0% 0.0% 0.0% 0.0% 0.0% 0.005% 0.0% 0.001% HealthPartners 0.1% 0.1% 0.2% 3.8% 1.0% 0.4% 6.5% 4.2% Medica 1.2% 6.4% 3.5% 3.3% 0.0% 0.1% 2.8% 2.6% Metropolitan 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.3% 0.2% PreferredOne 0.1% 0.1% 0.3% 0.4% 0.4% 0.2% 0.3% 0.3% Sanford 0.0% 0.0% 0.0% 0.0% 0.3% 0.0% 0.0% 0.0% Ucare 2.0% 4.5% 1.6% 3.7% 3.5% 5.0% 7.1% 5.6% All HMOs 11.9% 16.4% 13.0% 17.4% 14.4% 12.0% 20.3% 17.7% Gundersen Luthern Health Plan is new to the Minnesota market as of 2012. Source: MDH Health Economics Program analysis of HMO annual reports Southeast Twin Cities State-wide 27 Minnesota HMO Enrollment as Percent of Regional Population, 2012 11.9% 16.4% 13.0% 17.4% 20.3% 14.4% 12.0% Source: MDH Health Economics Program analysis of HMO annual reports; U.S. Census Bureau. 28 Minnesota HMO Enrollment by Firm, 2013 Blue Plus 16.3% UCare 34.0% Group Health 6.0% Sanford 0.1% HealthPartners 24.8% PreferredOne 1.8% Metropolitan Medica 1.1% 15.9% Source: MDH Health Economics Program analysis of Minnesota Supplement # 1 available April 1st of the following calendar year. Gundersen 0.042% 29 Minnesota HMO Enrollment by Product Line, 2013 MN Seniors Health Options, MN Disability Health Options, and SNBC 8.2% Other 0.6% Commercial 18.6% MinnesotaCare 13.6% Medicare 16.4% Prepaid Medical Assistance Program 42.6% Source: MDH Health Economics Program analysis of Minnesota Supplement # 1 available April 1st of the following calendar year. 30 Total Minnesota HMO Enrollment, 2006 to 2012 960 951 934 940 915 In Thousands 920 900 894 887 880 870 864 860 840 820 2006 2007 2008 Source: MDH Health Economics Program analysis of HMO annual reports. 2009 2010 2011 2012 31 Minnesota HMO Market Penetration, 2006 to 2012 Source: MDH Health Economics Program analysis of HMO annual report, U.S. Census Bureau. 32 HMO Enrollment in Minnesota by Product Line, 2006 to 2012 Source: MDH Health Economics Program analysis of HMO annual reports. 33 Rates of Enrollment Growth for Minnesota HMOs by Product Line, 2007 to 2012 Source: MDH Health Economics Program analysis of HMO annual reports. 34 HMO Enrollment in Minnesota by Firm, 2006 to 2012 2006 2007 2008 2009 2010 2011 2012 Blue Plus 151,751 136,204 132,279 136,210 176,357 201,754 207,096 First Plan 10,347 15,573 16,057 11,130 0 Group Health 26,047 23,986 21,634 51,334 48,626 50,827 51,397 Gundersen - - - - - - 33 HealthPartners 334,938 320,734 328,621 286,953 265,930 227,872 225,421 Medica 183,884 179,045 157,957 171,445 192,087 176,692 138,526 MHP 16,941 17,861 21,624 18,662 18,112 19,009 10,105 PreferredOne 48,187 50,022 46,301 37,596 37,440 21,633 15,429 459 419 521 965 813 899 750 UCare 121,875 126,062 139,125 172,259 194,251 215,915 302,017 All HMOs 894,429 869,906 864,119 886,554 933,616 914,601 950,774 (8.8%) (2.7%) (0.7%) 2.6% 5.3% (2.0%) 4.0% Sanford (Sioux Valley) Change from previous year Source: MDH Health Economics Program analysis of HMO annual reports 35 Commercial Enrollment in Minnesota HMOs, 2006 to 2012 2006 2007 2008 2009 2010 Blue Plus 42,649 32,268 26,289 16,302 11,114 9,661 4,998 First Plan 1,285 1,810 1,580 618 0 0 0 23,172 - 22,210 - 16,088 - 15,030 - 11,121 - 10,151 - 8,884 250,881 234,995 245,219 226,436 201,758 157,709 141,152 50,472 50,024 24,615 21,620 16,585 13,160 1,257 0 0 0 0 0 0 0 48,187 50,022 46,301 37,596 37,440 21,633 15,429 438 388 472 683 467 591 473 0 0 0 0 0 0 0 All HMOs 417,084 391,717 360,564 318,285 278,485 212,905 172,226 Change from previous year (15.3%) (6.1%) (8.0%) (11.7%) (12.5%) (23.5%) (19.1%) Group Health Gundersen HealthPartners Medica MHP PreferredOne Sanford (Sioux Valley) UCare Source: MDH Health Economics Program analysis of HMO annual reports 2011 2012 33 36 Medicare Advantage Enrollment in Minnesota HMOs, 2006 to 2012 2006 2007 2008 2009 2010 2011 2012 Blue Plus 0 0 0 0 0 0 0 First Plan 0 0 0 0 0 0 0 Group Health 2,875 1,776 1,549 0 0 0 0 Gundersen - - - - - - 0 HealthPartners 0 0 0 839 503 16 31 Medica 0 0 0 0 0 0 0 15 1,018 4,567 218 46 0 0 PreferredOne 0 0 0 0 0 0 0 Sanford (Sioux Valley) 0 0 0 0 0 308 0 UCare 33,827 37,189 44,672 61,960 74,022 82,620 86,237 All HMOs 36,717 39,983 50,788 63,017 74,571 82,944 86,268 Change from previous year (7.9%) 8.9% 27.0% 24.1% 18.3% 11.2% 4.0% MHP Source: MDH Health Economics Program analysis of HMO annual reports 37 Other Medicare Enrollment in Minnesota HMOs, 2006 to 2012 2006 2007 2008 2009 2010 2011 2012 Blue Plus 12,060 9,520 10,885 10,934 40,406 62,704 82,792 First Plan 838 1,077 1,160 1,263 0 0 0 0 0 3,997 36,304 37,505 40,676 42,513 Group Health Gundersen - - - - - - 0 HealthPartners 35,574 37,186 35,049 4,424 4,611 4,604 4,769 Medica 11,629 11,194 13,137 14,341 30,462 12,562 25,686 931 836 824 1,015 1,161 1,286 3,373 0 0 0 0 0 0 0 21 31 49 282 346 0 277 8,764 9,437 10,079 10,703 9,526 9,310 24,827 All HMOs 69,817 69,281 75,180 79,266 124,017 131,142 184,237 Change from previous year 68.3% (0.8%) 8.5% 5.4% 56.5% 5.7% 40.5% MHP PreferredOne Sanford (Sioux Valley) UCare *Other Medicare includes Medicare Cost, Minnesota Senior Health Options, Minnesota Disability Health Options MN Senior Care Plus, and Special Needs Basic Care Source: MDH Health Economics Program analysis of HMO annual reports 38 Prepaid Medical Assistance Program Enrollment in Minnesota HMOs, 2006 to 2012 2006 2007 2008 2009 2010 2011 2012 Blue Plus 48,242 49,873 52,162 61,445 66,983 82,200 78,279 First Plan 4,338 7,055 7,692 5,334 0 0 0 0 0 0 0 0 0 0 Group Health Gundersen - - - - - - 0 HealthPartners 30,616 31,653 32,282 36,325 38,933 49,508 60,953 Medica 86,618 85,891 87,680 97,039 103,288 117,697 86,521 MHP 12,209 12,567 12,851 13,537 14,176 16,207 6.732 PreferredOne 0 0 0 0 0 0 0 Sanford (Sioux Valley) 0 0 0 0 0 0 0 56,230 58,040 62,462 73,064 82,198 101,678 157,011 238,253 245,079 255,129 286,744 305,578 367,290 389,496 (7.8%) 2.9% 4.1% 12.4% 6.6% 20.2% 6.0% UCare All HMOs Change from previous year Source: MDH Health Economics Program Analysis of HMO Annual Report 39 Prepaid General Assistance Medical Care Enrollment in Minnesota HMOs, 2006 to 2012 2006 2007 2008 2009 2010 2011 2012 Blue Plus 2,992 1,816 1,962 2,365 0 0 0 First Plan 572 749 755 498 0 0 0 0 0 0 0 0 0 0 Group Health Gundersen - - - - HealthPartners 3,737 2,718 3,020 3,738 0 0 0 Medica 7,081 4,886 5,240 6,342 0 0 0 MHP 2,004 1,484 1,524 1,690 0 0 0 PreferredOne 0 0 0 0 0 0 0 Sanford (Sioux Valley) 0 0 0 0 0 0 0 4,341 3,166 3,711 4,773 0 0 0 All HMOs 20,727 14,819 16,212 19,406 0 0 0 Change from previous year (7.7%) (28.5%) 9.4% 19.7% (100.0%) 0.0% 0.0% UCare - *The Prepaid General Assistance Medical Care program has been discontinued, and this slide will not be included in subsequent years. Source: MDH Health Economics Program analysis of HMO annual reports - 0 40 MinnesotaCare Enrollment in Minnesota HMOs, 2006 to 2012 2006 2007 2008 2009 2010 2011 2012 Blue Plus 45,808 42,727 40,981 45,164 57,854 47,189 41,027 First Plan 3,314 4,882 4,870 3,417 0 0 0 0 0 0 0 0 0 0 Group Health Gundersen - - - - - - 0 HealthPartners 14,130 14,182 13,051 15,191 20,125 16,035 18,516 Medica 28,083 27,050 27,285 32,103 41,752 33,273 25,062 1,782 1,956 1,858 2,202 2,729 1,516 0 PreferredOne 0 0 0 0 0 0 0 Sanford (Sioux Valley) 0 0 0 0 0 0 0 18,713 18,230 18,201 21,759 28,505 22,307 33,942 111,830 109,027 106,246 119,836 150,965 120,320 118,547 (9.0%) (2.5%) (2.6%) 12.8% 26.0% (20.3%) (1.5%) MHP UCare All HMOs Change from previous year Source: MDH Health Economics Program analysis of HMO annual reports 41 Minnesota HMO Enrollment* by Firm and Age, 2012 <15 BluePlus 15-29 30-44 45-54 55-64 65+ Total 20.0% 17.9% 16.2% 14.8% 14.6% 33.4% 21.6% Group Health 0.3% 0.9% 0.7% 2.3% 8.8% 17.1% 5.5% Gundersen 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% HealthPartners 25.1% 31.2% 36.5% 39.4% 36.5% 2.8% 24.3% Medica 19.3% 16.9% 16.4% 16.1% 14.5% 5.8% 14.4% Metropolitan 0.0% 1.3% 1.9% 2.8% 2.1% 0.6% 1.0% PreferredOne 1.2% 2.2% 2.9% 3.4% 2.9% 0.1% 1.7% Sanford 0.0% 0.1% 0.1% 0.1% 0.2% 0.1% 0.1% 34.1% 29.6% 25.4% 21.3% 20.3% 40.1% 31.4% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% UCare All HMOs *Includes health plan members that are non-Minnesota residents. Source: MDH Health Economics Program analysis of HMO annual reports. 42 Distribution of Minnesota HMO Enrollment* by Product Line and Age, 2012 *Includes health plan members that are non-Minnesota residents. Source: MDH Health Economics Program analysis of HMO annual reports. 43 Additional Information from the Health Economics Program Available Online • Health Economics Program Home Page • Health Economics Program Home Page • Publications • Health Economics Program Publications • Health Care Market Statistics (Presentation Slide Decks) • Health Economics Program Chartbook Homepage • Interactive Health Insurance Statistics • Interactive Health Insurance Statistics