Matakuliah : J0434/EKONOMI MANAJERIAL

Tahun

: 2008

The Fundamentals of Managerial

Economics

Pertemuan 1-2

Chapter 1

The Fundamentals of Managerial Economics

McGraw-Hill/Irwin

Michael R. Baye, Managerial Economics and

Business Strategy

Michael ©R.2008

Baye,

Copyright

by the McGraw-Hill Companies, Inc. All rights reserved.

1-4

Overview

I. Introduction

II. The Economics of Effective Management

–

–

–

–

–

–

–

Identify Goals and Constraints

Recognize the Role of Profits

Five Forces Model

Understand Incentives

Understand Markets

Recognize the Time Value of Money

Use Marginal Analysis

Michael R. Baye,

1-5

Managerial Economics

• Manager

– A person who directs resources to achieve a stated goal.

• Economics

– The science of making decisions in the presence of scare

resources.

• Managerial Economics

– The study of how to direct scarce resources in the way that most

efficiently achieves a managerial goal.

Michael R. Baye,

1-6

Identify Goals and Constraints

• Sound decision making involves having well-defined

goals.

– Leads to making the “right” decisions.

• In striking to achieve a goal, we often face constraints.

– Constraints are an artifact of scarcity.

Michael R. Baye,

1-7

Economic vs. Accounting Profits

• Accounting Profits

– Total revenue (sales) minus dollar cost of producing goods

or services.

– Reported on the firm’s income statement.

• Economic Profits

– Total revenue minus total opportunity cost.

Michael R. Baye,

1-8

Opportunity Cost

• Accounting Costs

– The explicit costs of the resources needed to produce

produce goods or services.

– Reported on the firm’s income statement.

•

Opportunity Cost

– The cost of the explicit and implicit resources that are

foregone when a decision is made.

• Economic Profits

– Total revenue minus total opportunity cost.

Michael R. Baye,

1-9

Profits as a Signal

• Profits signal to resource holders where resources are

most highly valued by society.

– Resources will flow into industries that are most highly valued by

society.

Michael R. Baye,

1-10

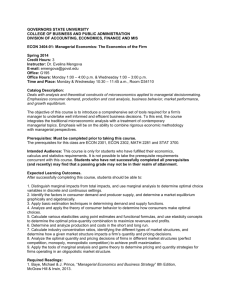

The Five Forces Framework

Entry Costs

Speed of Adjustment

Sunk Costs

Economies of Scale

Entry

Network Effects

Reputation

Switching Costs

Government Restraints

Power of

Input Suppliers

Power of

Buyers

Supplier Concentration

Price/Productivity of

Alternative Inputs

Relationship-Specific

Investments

Supplier Switching Costs

Government Restraints

Buyer Concentration

Price/Value of Substitute

Products or Services

Relationship-Specific

Investments

Customer Switching Costs

Government Restraints

Sustainabl

e Industry

Profits

Industry Rivalry

Concentration

Price, Quantity, Quality, or

Service Competition

Degree of Differentiation

Substitutes & Complements

Switching Costs

Timing of Decisions

Information

Government Restraints

Price/Value of Surrogate Products

or Services

Price/Value of Complementary

Products or Services

Michael R. Baye,

Network Effects

Government

Restraints

1-11

Understanding Firms’ Incentives

• Incentives play an important role within the firm.

• Incentives determine:

– How resources are utilized.

– How hard individuals work.

• Managers must understand the role incentives play in

the organization.

• Constructing proper incentives will enhance productivity

and profitability.

Michael R. Baye,

1-12

Market Interactions

• Consumer-Producer Rivalry

– Consumers attempt to locate low prices, while producers

attempt to charge high prices.

• Consumer-Consumer Rivalry

– Scarcity of goods reduces the negotiating power of

consumers as they compete for the right to those goods.

• Producer-Producer Rivalry

– Scarcity of consumers causes producers to compete with one

another for the right to service customers.

• The Role of Government

– Disciplines the market process.

Michael R. Baye,

1-13

The Time Value of Money

• Present value (PV) of a future value (FV) lump-sum

amount to be received at the end of “n” periods in the

future when the per-period interest rate is “i”:

PV

FV

1 i

n

Examples:

Lotto winner choosing between a single lump-sum payout of $104

million or $198 million over 25 years.

Determining damages in a patent infringement case.

Michael R. Baye,

1-14

Present Value vs. Future Value

• The present value (PV) reflects the difference between

the future value and the opportunity cost of waiting

(OCW).

• Succinctly,

PV = FV – OCW

• If i = 0, note PV = FV.

• As i increases, the higher is the OCW and the lower the

PV.

Michael R. Baye,

1-15

Present Value of a Series

• Present value of a stream of future amounts (FVt) received at the

end of each period for “n” periods:

PV

• Equivalently,

FV1

1 i

FV2

...

1 i

FV

PV

1 i

1

2

n

t

t 1

Michael R. Baye,

t

FVn

1 i

n

1-16

Net Present Value

• Suppose a manager can purchase a stream of future receipts (FVt

) by spending “C0” dollars today. The NPV of such a decision is

NPV

FV1

1 i

If

1

FV2

1 i

2

...

FVn

1 i

Decision Rule:

NPV < 0: Reject project

NPV > 0: Accept project

Michael R. Baye,

n

C0

Present Value of a Perpetuity

• An asset that perpetually generates a stream of cash flows (CFi)

at the end of each period is called a perpetuity.

• The present value (PV) of a perpetuity of cash flows paying the

same amount (CF = CF1 = CF2 = …) at the end of each period is

CF

CF

CF

PVPerpetuity

...

2

3

1 i 1 i 1 i

CF

i

Michael R. Baye,

1-17

1-18

Firm Valuation and Profit Maximization

• The value of a firm equals the present value of current and future

profits (cash flows).

PVFirm 0

1

2

1 i 1 i

...

t 1

t

1 i t

• A common assumption among economist is that it is the firm’s

goal to maximization profits.

– This means the present value of current and future profits, so the firm

is maximizing its value.

Michael R. Baye,

1-19

Firm Valuation With Profit Growth

• If profits grow at a constant rate (g < i) and current period profits

are o, before and after dividends are:

1 i

before current profits have been paid out as dividends;

ig

1 g

Ex Dividend

PVFirm

0 that g immediately

after current profits are paid out as dividends.

• Provided

< i.

ig

PVFirm 0

– That is, the growth rate in profits is less than the interest rate and both

remain constant.

Michael R. Baye,

1-20

Marginal (Incremental) Analysis

• Control Variable Examples:

–

–

–

–

–

Output

Price

Product Quality

Advertising

R&D

• Basic Managerial Question: How much of the control

variable should be used to maximize net benefits?

Michael R. Baye,

1-21

Net Benefits

• Net Benefits = Total Benefits - Total Costs

• Profits = Revenue - Costs

Michael R. Baye,

1-22

Marginal Benefit (MB)

• Change in total benefits arising from a change in the

control variable, Q:

B

MB

Q

• Slope (calculus derivative) of the total benefit curve.

Michael R. Baye,

1-23

Marginal Cost (MC)

• Change in total costs arising from a change in the

control variable, Q:

C

MC

Q

• Slope (calculus derivative) of the total cost curve

Michael R. Baye,

1-24

Marginal Principle

• To maximize net benefits, the managerial control

variable should be increased up to the point where

MB = MC.

• MB > MC means the last unit of the control variable

increased benefits more than it increased costs.

• MB < MC means the last unit of the control variable

increased costs more than it increased benefits.

Michael R. Baye,

The Geometry of Optimization:

Total Benefit and Cost

Total Benefits

& Total Costs

Costs

Slope =MB

Benefits

B

Slope = MC

C

Q*

Michael R. Baye,

Q

1-25

1-26

The Geometry of Optimization: Net Benefits

Net Benefits

Maximum net benefits

Slope = MNB

Q*

Michael R. Baye,

Q

1-27

Conclusion

• Make sure you include all costs and benefits when

making decisions (opportunity cost).

• When decisions span time, make sure you are

comparing apples to apples (PV analysis).

• Optimal economic decisions are made at the margin

(marginal analysis).

Michael R. Baye,