Pertemuan 6 Transaksi Dokumen dan pembayaran Elektronik Matakuliah

Matakuliah

Tahun

Versi

: H0292 / E-Business

: 2005

: v0 / Revisi 1

Pertemuan 6

Transaksi Dokumen dan pembayaran Elektronik

1

Learning Outcomes

Pada akhir pertemuan ini, diharapkan mahasiswa akan mampu :

• Menjelaskan cara kerja sistem transaksi pengiriman dokumen dan pembayaran elektronik

2

Outline Materi

• Teknologi EDI (Electronic Data

Interchange)

• Teknologi Pembayaran elektronik

– Electronic / digital cash

– Electronic checks

– Online credit card based systems

– Instrumen financial lain

3

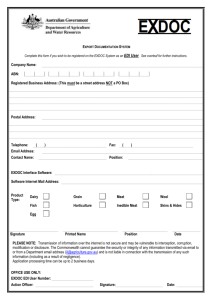

Electronic Data Interchange (EDI)

Computer-to-computer exchange of business information has become an increasingly popular form of electronic commerce.

EDI enables firms to exchange business information faster, more cheaply, and more accurately than using paper-based systems.

EDI used in manufacturing, shipping, warehousing, utilities, pharmaceuticals, construction, petroleum, metals, banking, government, health care, etc.

EDI consists of standardized electronic-message formats

(transaction sets) for business documents such as requests for quotations, purchase orders, purchase change orders, bill of lading, receiving advices, and invoices.

To move to EDI, a company must have computerized accounting records and establish trading partners who agree to exchange EDI transactions.

Benefits of EDI: improved in overall record keeping quality, reduced inventory, better information for mgt decision making.

4

Document Flow without EDI

Buyer Seller

Purchase request initiated in the organization

Finance department

Finance department

Payment Bill

Purchase department

Order delivery

Paper-based mailroom

Paper-based mailroom

Order confirmation

Sales department

Inventory and warehousing

Receiving department

Product delivery

Shipping department

Manufacturing department

5

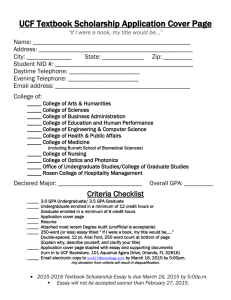

Document Flow with EDI

Purchase request initiated in the organization

Purchase department

Buyer Seller

Finance department

Payment details

EDI-capable computer

Purchase-order delivery

Automatedorder onfirmation

EDI-capable computer

Billing details

Finance department

Sales department

Inventory and warehousing

Receiving department

Product delivery

Shipping department

Manufacturing department

6

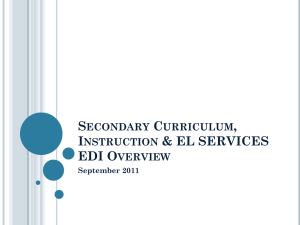

Electronic Credit Card System on the Internet

• The Players

– Cardholder

– Merchant (seller)

– Issuer (your bank)

– Acquirer (merchant’s financial institution, acquires the sales slips)

– Brand (VISA, Master Card)

7

Cardholder credit card

Merchant

Payment authorization, payment data account debit data

Card Brand Company payment data payment data amount transfer

Issuer Bank

Cardholder

Account

Acquirer Bank

Merchant

Account

Credit Card Procedure (offline and online)

© Prentice Hall, 2000

8

8

Electronic Fund Transfer (EFT) on the Internet

Payer

Payee

Internet

Cyber Bank Cyber Bank

Payment

Gateway

Payment

Gateway

Bank Bank

VAN VAN

Automated

Clearinghouse

An Architecture of Electronic Fund Transfer on the Internet 9

Debit Cards

• A delivery vehicle of cash in an electronic form

• Mondex, VisaCash applied this approach

• Either anonymous or onymous

• CyberCash has commercialized a debit card named CyberCoin as a medium of micropayments on the Internet

10

Electronic Cash and Micropayments

• Smart Cards

– The concept of e-cash is used in the non-Internet environment

– Plastic cards with magnetic stripes (old technology)

– Includes IC chips with programmable functions on them which makes cards “smart”

– One e-cash card for one application

– Recharge the card only at designated locations, such as bank office or a kiosk. Future: recharge at your PC

– e.g. Mondex & VisaCash

11

Electronic Money

• DigiCash

– The analogy of paper money or coins

– Expensive, as each payment transaction must be reported to the bank and recorded

– Conflict with the role of central bank’s bill issuance

– Legally, DigiCash is not supposed to issue more than an electronic gift certificate even though it may be accepted by a wide number of member stores

12

Electronic Money

(cont.)

• Stored Value Cards

– No issuance of money

– Debit card — a delivering vehicle of cash in an electronic form

– Either anonymous or onymous

– Advantage of an anonymous card

• the card may be given from one person to another

– Also implemented on the Internet without employment of an IC card

13

Electronic Money

(cont.)

• Smart card-based e-cash

– Can be recharged at home through the Internet

– Can be used on the Internet as well as in a non-

Internet environment

• Ceiling of Stored Values

– To prevent the abuse of stored values in money laundry

– S$500 in Singapore; HK$3,000 in Hong Kong

• Multiple Currencies

– Can be used for cross border payments

14