Question: 1. a. Identify how the Sarbanes-Oxley act of 2002... auditors

advertisement

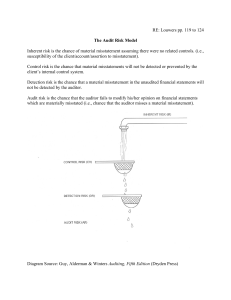

Question: 1. a. Identify how the Sarbanes-Oxley act of 2002 changed the audit environment For auditors b. Identify and explain new liabilities for managements of public companies created by the Sarbanes-Oxley act of 2002 2. a. What is the overall objective of the financial statement audit? b. Identify the six phases of a financial statement audit. 3. a. state the five categories of management's financial statement assertions and Briefly explain each b. What is the difference between a misstatement resulting from the existence or occurrence assertion and a misstatement resulting from the completeness assertion? c. Identify four aspects associated with the presentation and disclosure assertion 4. a. Explain what is meant by understanding " the entity's" industry, regulatory Environment, and other factors" and explain how the auditor uses this knowLedge in understanding the risk of material misstatement. b. explain what is meant by understanding " the nature of the entity" and explain the auditor uses this knowledge in understanding the risk of material misstatement. c. explain what is meant by understanding " the entity's objectives,strategies, and related business risks" and explain how the auditor uses this knowledge in understanding the risk of material misstatement. d. explain what is meant by understanding " the entity's management and review of the entity's financial performance" and explain how the auditor uses this knowledge in understanding the risk of material misstatement. 5. Explain the concept of materiality and describe two ways the concept of materiality is used in planning and performing the audit. 6. a. Define audit risk b. Define the three component of audit risk c. How do the fraud risk factors relate to the component of audit risk? d. Explain how the audit risk model is used to make decisions about audit evidence