Auditing & Assurance Services: Financial Report Assertions

advertisement

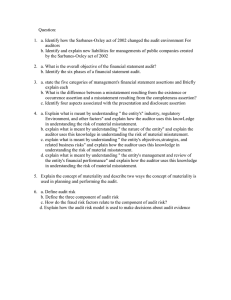

Welcome to… ACCG340 Auditing and Assurance Services Session 4 • Financial report assertions • Internal controls • Tests of controls Learning objectives 1. Explain financial report assertions and relate business risks to specific assertions at risk 2. Outline the relevance of internal control to an auditor 3. Explain types of internal control and design appropriate mitigating controls in response to assessed risks for various scenarios 4. Explain tests of controls and develop appropriate specific practical tests of controls 5. Relate controls (and tests of controls) with specific assertions 2 1. Pre-engagement activities 2. Planning activities 1.1 1.2 1.3 Accept / reject new client Established terms of engagement Engagement letter 2.1 Obtain knowledge of the business 2.1.1 Preliminary analytical procedures Appraisal of risks, including fraud risk, going concern Estimate of materiality Review of control components 2.4.1 Preliminary evaluation of control environment Develop overall audit plan (i.e. develop an audit strategy) in response to risks 2.5.1 Determine reliance on internal controls 2.5.2 Determine extent and nature of testing 2.5.3 Write audit plan Assignment of staff 2.2 2.3 2.4 2.5 2.6 3.1 3.2 3. Audit evidence 3.3 4. Opinion formulation and reporting activities Tests of control 3.1.1 Conducts tests 3.1.2 Make final evaluation of internal control 3.1.3 Modify audit approach Substantive testing activities 3.2.1 Conduct substantive tests of transactions and balances 3.2.2 Conduct substantive analytical procedures 3.2.3 Evaluate results of substantive procedures 3.2.4 Modify audit approach Obtain representations 3.3.1 Management 3.3.2 Solicitors 3.3.3 Bank 4.1 4.2 4.3 4.4 Review financial report Review audit results Subsequent events Fraud and error 5.1 5.2 5.3 5.4 Supervise conduct of examinations Review work of assistants Consider appropriateness of continuing relationship with client Make required special communication 5.4.1 Material weaknesses of internal accounting control 5.4.2 Material errors or irregularities Consult with appropriate persons in connection with special problems Document work performed, findings, and conclusions in appropriate working papers Consider going concern 5. Continuous activities 5.5 5.6 5.7 4.5 Related party transactions 4.6 Formulate audit opinion 4.7 Draft issue reports A U D I T P R O C E S S Financial report assertions Top down audit approach (Business risk analysis and response) Business (external and internal environment factors) Financial Report Account Assertion Representations made by management, explicit or otherwise, that are embodied in the financial report, as used by the auditor to consider different types of potential misstatements that may occur 5 Financial report assertions ASA315.A128 • About classes of transactions and events, and related disclosures for the period under audit (income statement accounts and related disclosures): Assertion Definition Occurrence Transactions and events that have been recorded or disclosed have occurred, and such transactions and events pertain to the entity Completeness All transactions and events that should have been recorded have been recorded, and all related disclosures that should have been included in the financial statements have been included Accuracy Amounts and other data relating to recorded transactions and events have been recorded appropriately, and related disclosures have been appropriately measured and described 6 Financial report assertions ASA315.A128 • About classes of transactions and events, and related disclosures for the period under audit (income statement accounts and related disclosures) (cont’d): Assertion Definition Cut-off Transactions and events have been recorded in the correct accounting period Classification Transactions and events have been recorded in the proper accounts Presentation Transactions and events are appropriately aggregated or disaggregated and clearly described, and related disclosures are relevant and understandable in the context of the requirements of the applicable financial reporting framework. 7 Financial report assertions ASA315.A128 • About account balances, and related disclosures at period end (balance sheet accounts and related disclosures): Assertion Definition Existence assets, liabilities, and equity interests exist. Rights and obligations the entity holds or controls the rights to assets, and liabilities are the obligations of the entity Completeness all assets, liabilities and equity interests that should have been recorded have been recorded, and all related disclosures that should have been included in the financial statements have been included. 8 Financial report assertions ASA315.A128 • About account balances, and related disclosures at period end (balance sheet accounts and related disclosures) (cont’d): Assertion Definition Accuracy, valuation and allocation assets, liabilities, and equity interests have been included in the financial statements at appropriate amounts and any resulting valuation or allocation adjustments have been appropriately recorded, and related disclosures have been appropriately measured and described. Classification assets, liabilities and equity interests have been recorded in the proper accounts. Presentation assets, liabilities and equity interests are appropriately aggregated or disaggregated and clearly described, and related disclosures are relevant and understandable in the context of the requirements of the applicable financial reporting framework. 9 Auditor response to risk of material misstatement • Response at overall (financial report) level • Response at assertion level – Develop and undertake audit procedures related to specific assertions to reduce risk of material misstatement for a specific assertion to an acceptable level Illustrative assertions and audit objectives for inventory Assertion Illustrative audit objectives Existence • • Inventories included in the balance sheet physically exist. Inventories represent items held for sale in normal course of business. Rights and obligations • • Company has legal title or similar rights of ownerships to the inventories Inventories exclude items billed to customers or owned by others. Completeness • Inventory quantities as per the accounting records include all products, materials and supplies owned by the company that are on hand. Inventory quantities include all products, materials and supplies owned by the company that are in transit or storage at all locations. • Accuracy, valuation and allocation • • Inventories are properly stated at cost (except when the net realisable value is lower). Slow-moving, excess, defective and obsolete items included in inventories are properly identified and valued. 11 Lecture discussion question 1 What is the key account and key assertion that is affected by each of the following accounting issues? • Excessive bad debts • Inventory purchased in foreign currencies • Unusual lengthening of the useful lives of assets • Complex payroll calculations • Customers cancelling sales orders • Prepayment of insurance premiums Lecture discussion question 1 (cont.) Response discussion points Issue Excessive bad debts Inventory purchased in foreign currencies Unusual lengthening of the useful lives of assets Complex payroll calculations Customers cancelling sales orders Prepayment of insurance premiums Account: assertion Internal control Steps in the planning process Internal control (IC) IC is the process designed and implemented by management to address (minimise) identified significant business risks that threaten the achievement of entity’s objectives in relation to: • reliability of financial reporting • effectiveness and efficiency of its operations • compliance with applicable laws and regulations. Why auditors study entity’s internal control • Required by standards to obtain an understanding of internal control relevant to the audit (ASA 315.12) • The assessed risk of material misstatement at the financial report level is affected by auditor’s understanding of the control environment (ASA 315.A81) • In making risk assessments, the auditor may identify the controls that are likely to prevent, or detect and correct, material misstatement in specific assertions (ASA 315.A137). • Understanding the entity and its controls provide a basis for designing and implementing responses (audit strategy and audit plan i.e. nature, extent, timing of audit procedures) to the assessed significant risks (ASA 315.3) Components of internal control (IC) ASA315.14-24, A77-A121, APPENDIX 1 ASA 315.14-24 outline the following specific components of IC: • Control environment • Entity’s risk assessment process • Information system, including related business processes • Control activities • Monitoring of controls Top down approach (Internal control) Business Financial Report Control environment and Risk assessment processes Monitoring Account Assertion Information system Control activities/procedures Control environment - ‘Tone at the top’ ASA315.14 & A77-A87 Auditor considers: • communication and enforcement of integrity and ethical values • commitment to competence • participation by those charged with governance • management’s philosophy and operating style • organisational structure • assignment of authority and responsibility • human resource policies and practices The entity’s risk assessment process ASA 215.15-17 & A88-A89 Auditor needs to understand whether entity has processes for: • Identifying business risks relevant to financial reporting • Estimating significant of the risks and assessing likelihood of their occurrence • Deciding about actions to address risks The entity’s risk assessment process (if appropriate) may assist auditor in identifying risks of material misstatement Information system including related business processes ASA315.18-19 & A90-A98 Auditor obtains understanding of: • classes of transactions in operations significant to financial report (FR) • procedures (IT and manual) by which transactions are initiated, recorded, processed, and reported in the FR • related accounting records • how information system captures events/ conditions other than transactions • financial reporting processes used to prepare the FR including significant accounting estimates • controls over journal entries, non-recurring/unusual transactions, adjustments Control activities ASA315.20-21 & A93-A109 Policies and procedures that ensure management’s directives are carried out including: • Authorisation • Performance reviews • Information processing • Physical controls • Segregation of duties Control activities and assertions Control activities can be related to financial report assertions: • occurrence (e.g. authorisation and approval of transactions) • completeness (e.g. accounting for sequence of transactions) • accuracy (e.g. checking dollar amounts back to supporting documentation) • cut-off (e.g. independent review of transaction recording around balance date) • classification (e.g. independent checking of account coding). Monitoring of controls ASA315.22-24 & A110-A121 Auditor obtains understanding of: • major activities entity uses to monitor internal control over financial reporting, including corrective actions to address deficiencies in controls • e.g. activities such as management’s review of whether bank reconciliations are prepared on a timely basis Types of internal controls PREVENTIVE CONTROLS • controls used to prevent undesirable events or errors. DETECTIVE CONTROLS • controls used to identify/detect events or errors if they have occurred and prompt correction. Limitations of internal control (IC) • Internal control, no matter how effective, can provide an entity with only reasonable assurance about achieving the entity’s financial reporting objectives. • Inherent limitations of controls: – Poor human judgement in decision-making – Human error – Controls can be circumvented through collusion or inappropriate management override – Management discretion in designing and implementing controls and nature and extent of risks assumed 27 Understanding internal control (IC) Audit procedures in gaining understanding of IC include: – Enquiries of management and appropriate client personnel – Inspection of documented policies and procedures – Observation of activities, operations and procedures The auditor’s evaluation of IC must be documented e.g. through: – Flowcharts – Internal control questionnaires and checklists – Narratives (e.g. descriptions of IC policies and procedures) 28 Phases of internal control (IC) evaluation • Obtain an understanding of IC – evaluating design of IC – evaluating implementation of IC • In relation to significant risks evaluate likelihood of material errors not being prevented or detected (i.e. existence of mitigating ICs) • Determine audit approach based on presence/ absence of mitigating controls (ASA 330) • Communicate weaknesses in design and implementation of ICs to those charged with governance or management (ASA 265) Internal controls and assertions Determine the key assertion for the internal controls listed below with regard to sales and/or accounts receivable as appropriate. A. B. C. D. E. Recorded sales are for shipments actually made to non-fictitious customers. 1. The recording of sales is supported by authorised shipping documents and approved customer orders. Sales transactions are properly authorised. 1. The customer’s credit is approved by a responsible official. 2. An authorised price list is used. Existing sales transactions are recorded. 1. A record of shipments is maintained. 2. The shipping document is controlled from the office in a manner that helps ensure that all shipments are billed. 3. Shipping documents are prenumbered and accounted for. 4. Sales invoices are prenumbered and accounted for. Recorded sales are for the amount of goods ordered and are correctly billed and recorded. 1. There is independent comparison of the quantity on the shipping document to sales. 2. There is internal checking, pricing, and additions of sales invoices. Sales transactions are properly classified on a timely basis. 1. There is independent comparison of dates on shipping documents to dates recorded. Lecture discussion question 2 For the following business risks outline preventive and detective internal controls that would address the risk: (i) risk that payment is made to suppliers prior to goods being received (ii) risk of non-collectibility of individual customers’ balances Lecture discussion question 2 (i) Risk that payment is made prior to goods being received Preventive control: Detective control: (ii) Risk of non-collectibility of individual customers’ balances Preventive control : Detective control : Assessing control risk • After obtaining an understanding of the five components of internal control, the auditor assesses control risk for the assertions related to account balances, class of transactions or disclosures. – Control risk is the risk that a material misstatement could occur in an assertion and not be prevented or detected on a timely basis by the entity’s internal control. • The auditor must decide whether to assess control risk for a particular assertion as high or as less than high. Assessment of control risk as high • The auditor may assess control risk as high because the entity’s internal control policies and procedures in the area: – are poor (unlikely to be effective) and do not support less than a high assessment – may be effective, but the audit tests would be more time-consuming than performing direct substantive tests – do not pertain to the particular assertion. Assessing control risk at less than high • The auditor may decide to assess control risk as less than high when it improves audit efficiency. • If the auditor assesses control risk as less than high, the auditor must obtain sufficient appropriate evidence to support that level. – First, the auditor identifies specific control activities that are likely to prevent or detect material misstatements. – Next, the auditor performs tests of controls to evaluate the effectiveness of these control activities. • This process is followed for each account balance or transaction class that is material to the financial report. Tests of controls Tests of controls • Used to obtain evidence needed to support the conclusion that specific controls that are likely to prevent or detect misstatements are effective. • The evidence should demonstrate both: – Design effectiveness of the policies and procedures and their ability to prevent or detect and correct misstatement – Operating effectiveness of the policies and procedures i.e. their proper and consistent application. • Evidence necessary to support a specific level of control risk is a matter of professional judgment. 37 Tests of controls (Procedures) ASA330.8 & A20-A24 Tests of controls include: • Enquiries of client personnel • Observing activities and procedures e.g. observation of counting during a stock take • Inspection of documents and records • Re-performance of procedures 38 Lecture discussion question 3 You are the auditor on the MBI Limited (MBI) engagement. MBI manufactures and sells electronic products to the consumer and corporate market. During the year MBI has embarked on a strategy to expand its market share in the corporate market. The number of corporate customers on the books have increased substantially and management has informed you that they have had issues managing the expansion and there have been instances where recorded sales were not accompanied by shipments of goods. Lecture discussion question 3 Based on the above information and for the Sales account, (i) identify the key assertion at risk (ii) provide a brief explanation of why this represents a risk to the auditor (iii) for the assertion listed in (i) above, describe a specific practical preventive control that would appropriately address the risk in (ii) above (iv) For the control identified in (vii) above, describe a specific practical test of control 40 Lecture discussion question 3 Key assertion Explanation of risk Preventive control Test of control Supplementary material SLIDES IN THIS SECTION PROVIDE GREATER DEPTH TO THIS WEEK’S SEMINAR LECTURE CONTENT. THEY WILL NOT BE COVERED DURING SEMINARS BUT ARE EXAMINABLE. Examples of basic types of internal control activities/procedures CONTROL EXAMPLES Independent approval, review, checking or recalculation Authorisation of purchase or sales invoices Matching of independently generated documents Matching of sales invoices and shipping documents Pre-numbering and sequence checking of key documents Pre-numbered shipping documents, sales invoices, cheques, vouchers, etc. Recalculation of arithmetic on vouchers Subsequent review of individual transactions Matching of purchase invoices and receiving reports Examples of basic types of internal control activities/procedures (cont.) CONTROL EXAMPLES Maintenance of independent control totals Recording of cash receipts total before banking Use of batch controls Use of control accounts Bank reconciliations Comparison with independent 3rd party Reconciling suppliers’ statements information Independent 3rd party Sending statements to customers confirmation Requests for confirmation of recorded data Examples of basic types of internal control activities/procedures (cont.) CONTROL EXAMPLES Cancellation of documentation Immediate endorsement of incoming cheques Defacing spoiled or cancelled cheques Segregation of Segregation of duties among transactions personnel, operations initiation, approval and recording and assets Function segregation Timeliness of operation Prompt deposit of cash receipts Prompt processing of transactions Example internal control questionnaire (partial) for Sales Client_________________________________________________________________Audit Date _________________________ Auditor ______________ Date Completed____________ Reviewed by ___________ Date Completed______________________ Objective (italic) and question Sales A. Recorded sales are for shipments actually made to non-fictitious customers 1. Is the recording of sales supported by authorised shipping documents and approved customer orders? B. Sales transactions are properly authorised. 1. Is the customer's credit approved by a responsible official? 2. Is a prenumbered written shipping order required for any merchandise to leave the premises? 3. Is an authorised price list used? C. Existing sales transactions are recorded. 1. Is a recoed of shipments maintained? 2. Is the shipping document controlled from the office in a manner that helps ensure that all shipments are billed? 3. Are shipping documents prenumbered and accounted for? 4. Are sales invoices prenumbered and accounted for? D. Recorded sales are for the amount of goods ordered and are correctly billed and recorded. 1. Is there independent comparison of the quantity on the shipping document to sales 2. IS there internal verification, extensions, pricing, and footing of sales invoices? 3. Are monthly statements sent to customers? E. Sales transactions are properly classified. 1. Is there independent comparison of dates on shipping documents to dates recorded? F. Sales are recorded on a timely basis. 1. Is there independent comparison of dates on shipping documents to dates recorded? G. Sales transactions are properly included in the subsidiary records and correctly summarised. 1. Are journals independently footed and traced to the general ledger and subsidiary records? 2. Is there a monthly reconciliation of the accounts receivable subsidiary records to the general ledger? Yes Answer No N/A Remarks Pam Dilley examines underlying documentation By Chulick Prenumbered but not accounted for additional substantive testing required By Pam Dilley, controlled by Chulick By Pam Dilley All sales are on account and there is only one sales account There is a weakness in the system and additional substantive testing required