Materiality and Audit Risk: Accounting Presentation

advertisement

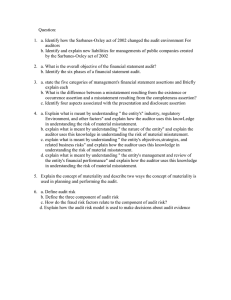

CHAPTER 1 Considering Materiality and Audit Risk Introduction -The auditor`s responsibility section in an audit report includes two important phrases that are directly related to materiality and risk. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatements. Introduction - The phrase obtain reasonable assurance is intended to inform users that auditors do not guarantee or ensure the fair presentation of the financial statements. - The phrase free of material misstatements is intended to inform users that auditor's responsibility is limited to material financial information. Materiality is important because it is impractical for auditors to provide assurances on immaterial amounts. Materiality • Materiality is a major consideration in determining the appropriate audit report to issue. FASB Concept Statement 2 defines Materiality as: • The magnitude of an omission or misstatement of accounting information that, in the light of surrounding circumstances, makes it probable that the judgment of a reasonable person relying on the information would have been changed misstatement. or influenced by the omission or Materiality Auditor Responsibility: Because auditors are responsible for determining whether financial statements are materially misstated, they must, upon discovering a material misstatement, bring it to the client’s attention so that a correction can be made. If the client refuses to correct the statements, the auditor must issue a qualified or an adverse opinion, depending on the materiality of the misstatement. To make such determinations, auditors depend on a thorough knowledge of the application of materiality. Materiality The difficulty that auditors have in applying materiality in practice: 1. While the definition emphasizes reasonable users who rely on the statements to make decisions, auditors must have knowledge of the likely users of the client’s statements and the decisions that are being made. In practice, auditors may not know who all the users are or what decisions they may make based on the financial statements. Materiality Applying Materiality Auditors follow five closely related steps in applying materiality Step 1 Set preliminary judgment about materiality judgment Planning extent about of tests Step 2 Allocate preliminary materiality to segments Step 3 Estimate total misstatement in segment Step 4 Estimate the combined misstatement Step 5 Compare combined estimate with preliminary or revised judgment about materiality . Evaluating results Materiality Step (1) : Set Preliminary Judgment : - Is the maximum amount by which the auditor believes the statements could be misstated and still not affects the decisions of reasonable users. - The reason for setting a preliminary judgment about materiality is to help the auditor plan the appropriate evidence to accumulate . - The auditor will frequently change the preliminary judgment about materiality during the audit. When that is done, the new judgment is called a revised judgment about materiality. Materiality Step (2): Allocate preliminary judgment about materiality to segments (tolerable misstatements) - If auditors have a preliminary judgment about materiality for each segment, it helps them decide the appropriate audit evidence to accumulate segmentation means lower amounts and more evidence. - Most auditors allocate materiality to balance sheet rather than income statement accounts. Because most income statement misstatements have an equal effect on the balance sheet because of the double-entry book-keeping system. Materiality Step (2): Allocate preliminary judgment about materiality to segments (tolerable misstatements) Auditors face three major difficulties in allocating materiality to balance sheet accounts: 1. Auditors expect certain accounts to have more misstatements than others. 2. Both overstatements and understatements must be considered. 3. Relative audit costs affect the allocation. Materiality Step (3): Estimated total misstatement ad preliminary judgment When auditors perform audit procedures for each segment of the audit, they document all misstatements found. Misstatements in an account can be of two types: known misstatements and likely misstatements. 1. Known misstatements are those where the auditor can determine the amount of the misstatement in the account. For example, when auditing property, plant, and equipment, the auditor may identify capitalized leased equipment that should be expensed because it is an operating lease. Step (3): Estimated total misstatement ad preliminary judgment There are two types of likely misstatements. 1. The first are misstatements that arise from differences between management’s and the auditor’s judgment about estimates of account balances. Examples are differences in the estimate for the allowance for uncollectible accounts or for warranty liabilities. 2. The second are projections of misstatements based on the auditor’s tests of a sample from a population. For example, assume the auditor finds six client misstatements in a sample of 200 in testing inventory costs. The auditor uses these misstatements to estimate the total likely misstatements in inventory (step 3). The total is called an estimate or a “projection” or “extrapolation” because only a sample, rather than the entire population, was audited. The projected misstatement amounts for each account are combined on the worksheet (step 4), and then the combined likely misstatement is compared with materiality (step 5). Step (3): Estimated total misstatement ad preliminary judgment The calculation of the direct projection estimate of misstatement is: Direct projection estimate of misstatement= (Net misstatements in the sample /Total sampled)× Total recorded population value The calculation of Total estimated misstatement amount is: Total estimated misstatement = Direct projection estimate of misstatement+ Sampling Error Notes : Sampling Error= 50%of direct projection (for simplification) Note: sampling error= $0 if segment is audited 100% -Sampling Error: represents the maximum misstatement in account details not audited. Comparison Between Total Estimated Misstatement Amount of a Segment and Tolerable Misstatement • If total estimated misstatement amount of a segment < tolerable misstatement the segment is accepted. • If total estimated > tolerable misstatements the segment is rejected and adjustments by management are needed. Examples • 1) If an auditor decides to allocate $ 36,000 of a total preliminary judgment about materiality of $ 500,000 to inventory, in auditing inventory, the auditor found $ 3,500 of net overstated amounts in a sample of $ 50,000 of the total population of $ 450,000 Required: Explain the auditor decision towards the acceptance of inventory balance. Solution • Total estimated misstatement amount of the inventory: Direct Projection Direct Projection ($3,5000 ÷ 50,000) × 450,000 + Sampling Error ($31,500 × 50%) $31,500 15,750 $47,250 Where •Tolerable misstatement = $36,000 •*Total estimated misstatement exceeds tolerable misstatement The auditor reject the inventory balance as it appears in the balance • sheet, and requires adjustments made by management. Example (2) : - If an auditor decides to allocate $35,000 of a total preliminary judgment about materiality of $80,000 to accounts receivable, in auditing accounts receivable, the auditor found $4,000 of overstated amounts and $6,000 of understated amounts in a sample of $100,000 of the total population of $1000,000. Required: Explain the auditor decision towards the acceptance of accounts receivable balance. Solution - Net misstatement in accounts receivable = $2,000 understand. -Total estimated misstatement amount of the accounts receivable: Direct projection ($2,000÷100,000)×1,000,000 + Sampling Error ($20,000×50%) $20,000 10,000 Where Tolerable misstatement = $35,000 Total estimated misstatement lesser than tolerable misstatement The auditor accepts the accounts receivable balance as it appears in the balance sheet. Problem: You are evaluating audit results for assets in the audit of El Marwa Manufacturing. You set the preliminary judgment about materiality at $50000. The account balances, tolerable misstatement, and estimated overstatements in the accounts are shown next. Account Account Balance Tolerable Misstatement Estimate of Total Overstatement Cash $ 50000 1200000 2500000 250000 $ 4000000 $ 5000 30000 50000 15000 $ 100000 $ 1000 20000 25000 12000 $58000 Acc. Receivable Inventory Other assets Total Required: •Assume you tested inventory amounts totaling $1000000 and found $10000 in overstatements. Ignoring sampling risk, what is your estimate of the total misstatement in inventory. •Based on the audit of the assets accounts and ignoring other accounts, are the overall financial statements acceptable? Explain. •What do you believe the auditor should do in the circumstances? Solution: • The Direct projection of the total misstatement in inventory = (Net Misstatement in the Sample/Total Sampled)x Total Recorded Population Value ($ 10000/$1000000) x $ 2500000 = $25000 • No. the overall financial statements are not acceptable. Including the projected error for inventory, the total overstatement errors are $58000 which exceeds materiality of $50000. • The auditor should either propose an audit adjustment so that the unadjusted statement amount is less than materiality, and/or perform more testing to obtain a better estimate of the population misstatements. The additional testing will likely focus on receivables and inventory because they have the largest estimated misstatement. Case: • In allocating tolerable misstatement, the auditor of El Marwa company uses judgment in the allocation, subject to the following two arbitrary requirements: 1. Tolerable misstatements for any account cannot exceed 75% of the preliminary judgment. 2. The sum of all tolerable misstatements cannot exceed twice the preliminary judgment about materiality. After the auditor completed the audit, he prepared the following table which includes a comparison of estimated total misstatement for preliminary judgment about materiality: Comparison of Estimated Total Misstatement to Preliminary Judgment about Materiality Estimated Misstatement Amount Account Tolerable Known Misstatement Sampling Misstatement And Direct Error Projection Cash $4000 $2000 $ NA Acc. Receivable 20000 12000 6000 Inventory 36000 31500 15750 Total estimated misstatement amount Preliminary judgment about materiality $50000 NA=NOT applicable. Cash audited 100 % $45500 $16800 Total $2000 18000 47250 $62300 • Required: 1. What is the auditor's decision regarding the acceptability of the financial statements? 2. What are the alternative actions that the auditor will take before he issues the audit report? • Solution: 1. The total estimate misstatement of $62300 exceeds the preliminary judgment about materiality of $50000. Because the estimated combined misstatement exceeds the preliminary judgment, the financial statements are not acceptable. 2. The auditor can either: Determine whether the estimated likely misstatement actually exceeds $50000 by performing additional audit procedures. If the auditor decides to perform additional audit procedures, they will concentrated in the inventory area, because it is the major are of difficulty, where estimated misstatement of $47250 is significantly greater than tolerable misstatement of $36000. Require the client to make an adjustment for estimated misstatement. Audit Risk • It is level of uncertainty in performing the audit process. • Auditors accept some level of risk in performing the audit. • An effective auditor recognizes that risks exist, are difficult to measure, and require careful thought to respond. • Responding to risks properly is critical for achieving a high-quality audit. Example of Audit Risks • Uncertainty about the competence of evidence. • Uncertainty about the effectiveness of a client ICs. • Uncertainty about the fairness of F.S when the audit is completed. Risk and Evidence • Auditors gain an understanding of the client`s business and industry and assess client business risk. • Auditors use the audit risk model to identify the potential for misstatements and where they are most likely to occur. Audit Risk Model For Planning • A formal model reflecting the relationship between acceptable audit risk (AAR) , inherent risk (IR), control risk (CR) and planned detection risk (PDR). • The audit risk model is used for planning in deciding how much evidence to accumulate in each cycle. It is usually stated as follows. • PDR=AAR/IR×CR OR AAR=IR× CR × PDR Ex: IR= 100% CR=100% AAR=5% PDR= 0.05/1×1=0.05 or 5% 1- planned detection risk (PDR) Is a measure of the risk that audit evidence for a segment will fail to detect misstatements exceeding a tolerable amount. This type of risk Is dependent on other three factors in the model. Determines the amount of substantive elements that the auditor plans to accumulate. • If PDR is reduced, the auditor needs to accumulate more evidence to achieve the reduced planned risk. • PDR= 0.05, the auditor plans to accumulate evidence until the risk misstatement exceeding tolerable misstatement reduced to 5% 2- Inherent Risk • Is a measure of the auditor assessment of the likelihood that there are material misstatements (errors or frauds) in a segment before considering the effectiveness of internal controls? • The assumption depends on discussion with management, knowledge of the company, and results of past years. • IR is the sensitivity to material misstatement assuming no material control. • Inherent Risk related inversely to PDR but directly relates to evidence. High inherent risk low PDR more evidence Example Study the effect of IR in PDR and according to the amount of evidence that should be accumulated. AAR = 5% IR = 20%, 60%, 80%, 95% CR = 100% PDR = ?? PDR = AAR / (IR X CR) INHERENT RISK Low HIGH IR 20% IR 60% IR 80% IR 95% PDR = PDR = PDR = PDR = 0.05/(0.2X1) = 0.05/(0.6X1) = 0.05/(0.8X1) = 0.05/(0.95X1) 0.25 0.08 0.06 = 0.05 PDR = 25% PDR = 8% PDR = 6% PDR = 5% Less planned More planned evidence evidence Less planned More staff experiences staff Assessing IR: The auditor should consider several major factors when assessing inherent risk: • Nature of the client's business. • Results of previous audits. • Initial versus repeat engagement. • Related parties. • Non-routine transactions. • Judgment required to correctly record account balances and transactions • Makeup of the population. 3- Control Risk ( CR ): • Control risk is a measure of the auditor's assessment of the likelihood that misstatements exceeding a tolerable amount in a segment will not be prevented or detected by the client's ICs. • The more effective the ICs the lower the risk factor that could be assigned to control risk. • Relationship between PDR and CR is inverse. • Relationship between evidence and CR is direct. • Effective ICs Increase PDR decrease evidence • Ineffective ICs decrease PDR increase evidence 4 – Acceptable Audit Risk ( AAR ): • Is a measure of how will the auditor is to accept that the F.S may be materiality misstated after the audit is completed and an unqualified opinion has been issued. • Zero risk the auditor is certain that no misstatement is F.S, or willing to have complete assurance. • 100% risk would be complete uncertainty. • Audit assurance, over all assurance, level of assurance = 1-AAR. • AAR have direct relationship with PDR. • AAR have inverse relationship with evidence. • LOW AAR low PDR, high evidence. • HIFH AAR high PDR, low evidence. Assessing AAR ( changing AAR for business ) Business risk (engagement risk): • Auditors must decide the appropriate acceptable audit risk for an audit, preferred during audit planning. First, auditors decide engagement risk and then use engagement risk to modify acceptable audit risk. • Engagement risk is the risk that the auditor will suffer harm because of a client relationship, even though the audit report rendered for the client was correct. • Ex. If a client declares bankruptcy after an audit completed, the likelihood of lawsuit against CPA firm is reasonably high even if the quality the audit was good. • Engagement risk closely relates to client business risk. Factors affecting Acceptable Audit Risk: • The first category of factors that determine acceptable audit risk is the degree to which users rely on the financial statements. • The following factors are indicators of this: – Client's sized – Distribution of ownership – Nature and amount of liabilities • The second category of factors is the likelihood that a client will have financial difficulties after the audit report is issued. • Factors affecting this are: – – – – – Liquidity position Profits (losses) in previous years Method of financing growth Nature of the client's operations Competence of management • The third category of factors is the auditor's evaluation of management's integrity. • Factors that may affect this are: – Relationship with current or previous auditors – Frequency of turnover of key financial or internal audit personnel – Relationship with employees and labor unions. Table: Methods Practitioners Use to Asses Acceptable Audit Risk Factors External users' reliance on financial statements Methods used to Assess Acceptable Audit Risk 1. Examine the financial statements, including footnote. 2. Read minutes of board of directors meetings to determine future plans 3. Discuss financing plans with management. Likelihood of 1. Analyze the financial statements for financial difficulties financial difficulties using ratios and other analytical procedures. 2. Examine historical and projected as flow statements for the growth of cash inflows and outflows. Management integrity 1. Relationship with current or previous auditors 2. Frequency of turnover of key financial or internal audit personnel 3. Relationship with employees and labor unions. Evaluating Results: • After the auditor plans the engagement and accumulates audit evidence, results can also be stated in terms of the evaluation version of the audit risk model. • The audit risk model for evaluation is: ACAR = IR X CR X ACDR Where: • ACAR = achieved audit risk. A measure of the risk the auditor has taken that an account in the financial statements is materiality misstated after the auditor has accumulated audit evidence. • IR = inherent risk. It is the same inherent risk factor discussed in planning unless it has been revised as a result of new information. • Cr = control risk. It is also the same control risk discussed previously unless it has been revised during the audit. • ACDR = achieved detection risk. A measure of the risk that audit evidence for a segment did not detect misstatements exceeding a tolerable amount, if such misstatement existed. The auditor can reduce achieved detection risk only by accumulating substantive evidence. Ex: • • • • • IR= 100% CR= 100% ACDR= 4% AAR= 5% ACAR= IR×CR ×ACDR = 1 ×1 ×0.04=4% Comment • The auditor compares ACAR (4%) with AAR (5%) and concludes that sufficient evidence has been accumulated the auditor is satisfied that achieved risk is less than or equal to AAR. • If AAR is 3% more evidence accumulated. Risk and Evidence: Table : Relationships of risk evidence Situation Acceptable audit risk Inherent risk 1 High Low 2 low Low 3 Low 4 5 Control risk Planned detection risk Amount of evidence required High Low Low Medium Medium High High Low High Medium Medium Medium Medium Medium High Low Medium Medium Medium Low