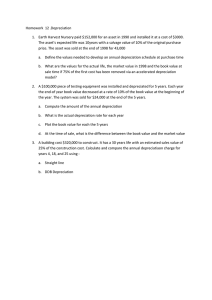

Exercise 1

advertisement

Exercise 1 E.11.5, Robert Parish Co purchased a new machine for its assembly process on August 1, 2004. The cost of this machine was $ 117,900. The company estimated that the machine would have a trade in value of $ 12,900 at the end of its service life. Its life is estimated at 5 years and its working hours are estimated at 21,000 hours. Year end is December 31. Instructions : Compute the depreciation under the following methods. Each of the following should be considered unrelated. a. Straight line depreciation for 2004 b. Activity method for 2004, assuming that machine usage was 800 hours. c. Sum of the years’ digits for 2005. d. Double declining balance for 2005. Answer of Exercise 1 (a) ($ 117,900 – $ 12,900) : 5 = $ 21,000/thn, $ 21,000 x 5/12 = $ 8,750 2004 Depreciation : Straight line = $ 8,750 (b) ($ 117,900 – $ 12,900) : 21,000 = $ 5.00/hr 2004 Depreciation : Machine Usage = 800 x $ 5.00 = $ 4,000 (c.)Machine Total Year 1 5/15 x $ 105,000 = $ 35,000 2 4/15 x $ 105,000 = $ 28,000 Allocated to 2004 2005 $ 14,583 $ 20,417 ______ $ 11,667 $ 14,583 $ 32,084 2005 Depreciation : Sum of the year’s digits = $ 32,084 * $ 35,000 x 5/12 = $ 14,583 ** $ 35,000 x 7/12 = $ 20,417 *** $ 28,000 x 5/12 = $ 11,667 Answer of Exercise 1 (d) 2004 : 40 % x ($ 117,900) x 5/12 = $ 19,650 2005 : 40% x ($ 117,900 – $ 19,650) = $ 39,300 Atau 1st full year (40% x $ 117,900) = $ 47,160 2nd full year [40% x ($ 117,900 – $ 47,160)] = $ 28,296 2004 Depreciation : 5/12 x $ 47,160 = $ 19,650 2005 Depreciation : 7/12 x $ 47,160 = $ 27,510 5/12 x $ 28,296 = $ 11,790 $ 39,300 Exercise 2 E.11.11, Machinery purchased for $ 60,000 by Joe Montana Co, in 2000 was originally estimated to have a life of 8 years with a salvage value of $ 4,000 at the end of that time. Depreciation has been entered for 5 years on this basis. In 2005, it is determined that the total estimated life (including 2005) should be 10 years with a salvage value of $ 4,500 at the end of that time. Assume straight line depreciation. Instructions : a.Prepare the entry to correct the prior years’ depreciation, if necessary. b.Prepare the entry to record depreciation for 2005. Answer of Exercise 2 (a) Tidak dibutuhkan jurnal koreksi karena perubahan estimasi merupakan periode berjalan (b) Revisi annual charge Book value per 1/1/2005 [$ 60,000 - ($ 7,000 x 5)] = $ 25,000 Remaining useful life, 5 years (10 years – 5 years) Revisi salvage value, $ 4,500 ($ 25,000 – $ 4,500) 5 = $ 4,100 Depreciation Expense—Equipment 4,100 Accumulated Depreciation—Equipment 4,100 Exercise 3 P.11.9, Olsson Company uses specials strapping equipment in its packaging business. The equipment was purchased in January 2004 for $ 8,000,000 and had an estimated useful life of 8 years with no salvage value. At December 31, 2005, new technology was introduced that would accelerate the obsolescence of Olsson’s equipment. Olsson’s controller estimates that expected future net cash flows on the equipment will be $ 5,300,000 and that the fair value of the equipment is $ 4,400,000. Olsson intends to continue using the equipment, but it is estimated that the remaining useful life is 4 years. Olsson uses straight line depreciation. Instructions : a.Prepare the journal entry (if any) to record the impairment at December 31, 2005. b.Prepare any journal entries for the equipment at December 31, 2006. The fair value of the equipment at December 31, 2006, is estimated to be $ 4,600,000. c.Repeat the requirements for (a) and (b), assuming that Olsson intends to dispose of the equipment and that it has not been disposed of as of December 31, 2006. Answer of Exercise 3 (a) Carrying value of asset: $ 8,000,000 – $ 2,000,000 = $ 6,000,000. Future cash flows ($ 5,300,000) < Carrying value ($ 6,000,000) Impairment entry: Loss on Impairment Accumulated Depreciation 1,600,000* 1,600,000 *($ 6,000,000 – $ 4,400,000 = $ 1,600,000) (b) Depreciation Expense Accumulated Depreciation 1,100,000** 1,100,000 **($ 4,400,000 4 = $ 1,100,000) (c) No depreciation is recorded on impaired assets to be disposed of. Recovery of impairment losses are recorded. Accumulated Depreciation Recovery of Impairment Loss 200,000 200,000