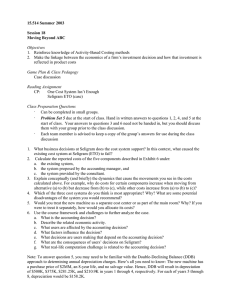

Depreciation and Taxes Course Outline 12 Matakuliah : D0762 – Ekonomi Teknik

advertisement

Matakuliah Tahun : D0762 – Ekonomi Teknik : 2009 Depreciation and Taxes Course Outline 12 Outline • • • • • • Introduction next next Depreciation Example Straight Line Methodnext SOYD next DBD next Switching DBD to SLnext References : - Engineering Economy – Leland T. Blank, Anthoy J. Tarquin p.387-423 - Engineering Economic Analysis, Donald G. Newman, p.261-286 2 Introduction Depreciation is important because it affects the taxes that firms pay. TAXES proportional to TAXABLE INCOME (PROFIT – COSTS) COSTS = Maintenance Cost + Depreciated Initial Cost Roughly speaking, depreciation is a decrease in value of an asset each year. Depreciation is a deduction from taxable income. Thus the greater the depreciation, the less the taxable income – hence taxes. The U. S. Government allows some choice among depreciation methods. Obviously, a well-run firm wants to choose the depreciation method that will minimize its taxable income. To do so, the firm owner/employees must understand how the depreciation methods work. 3 Depreciation: Example A firm has $1,000,000 of taxable income. If its tax rate is 25%, it would pay $250,000 depreciation. in taxes ignoring If it can deduct $50,000 in depreciation charges, its net taxable income is $950,000. Thus, it would pay taxes of 0.25 (950,000) = $237,500. Depreciation saves 250,000 – 237,500 = 12,500 = 0.25(50,000). If it could deduct more than $50,000 it would pay even less taxes. Individual investors encounter similar situations. If you invest $10,000 and get a 10% return, your taxable income is $1,000. If you are in the 25% tax bracket, U.S. takes $250, so your net return is $750 7.5%. 4 If you could have found an 8% investment for your $10,000 that was not Depreciation Depreciation can mean – a decrease in market value, – a decrease in the value to the owner. Important reasons for depreciation include – deterioration, – obsolescence. Market value is the value others would place on the property of interest A machine can begin to wear out and no longer perform its function as well a when it was new. Accountants define depreciation as follows: the systematic allocation of the cost of an asset over its useful, or depreciable, life. The latter definition is used for determining taxable income – hence, income taxes. Thus, this definition is most important to us. 5 Depreciation: Requirements In general business assets can only be depreciated if they meet the following basic requirements: The property must be used for business purposes to produce income The property must have a useful life that can be determined, and this life must be longer than one year The property must be an asset that decays, gets used up, wears out, becomes obsolete, or loses value to the owner from natural causes 6 Depreciation Example: Joe’s Pizza Joe runs a pizza parlor. He classifies some of his cost items as follows. Cost Item Type of Cost Reason Pizza dough, toppings Expensed Life < 1 yr, loses value immediately Delivery van Depreciated Meets 3 depreciation requirements* Employee wages Expensed Life < 1 yr, loses value immediately Furnishings for dining room Depreciated Meets 3 depreciation requirements New baking oven Depreciated Meets 3 depreciation requirements Utilities for refrigerator Expensed Life < 1 yr, loses value immediately Expensed Items: Labor, Utilities, Materials, Insurance Expensed items are (often recurring) expenses in regular business operations. They are consumed over short periods (e.g., monthly or biweekly salaries). Expenses are subtracted from business revenues for tax purposes. Expenses reduce income taxes at the time period when they occur. Req. for Depreciation: 1. The property must be used for business purposes to produce income 2. The property must have a useful life that can be determined, and this life must be longer than one year 3. The property must be an asset that decays, gets used up, wears out, becomes obsolete, or loses value to the owner from natural causes Depreciated Items: van, furniture, baking oven, cash register, computer. Usually you pay for the asset “up front”, but depreciate it over time. 7 Depreciation: Overview Definition. The number of years over which a machine is depreciated is called its depreciable life or recovery period. This period may differ from the useful life - The depreciation method determines the depreciable life. At least six different depreciation methods are available. Depreciation is a non-cash cost. No money changes hands. Depreciation is a business expense the government allows to offset the loss in value of business assets. Usually you pay for the asset “up front”, but depreciate it over time (e.g., a new truck). Depreciation deductions reduce the taxable income of businesses and thus reduce the amount of tax paid. 8 Classes of Business Property Classes of Business Property Almost all tangible properties can be depreciated as business assets • Tangible property can be seen, touched, and felt. (It is “tangible.”) – Real property (think “real estate”) includes land, buildings, and all things growing on, built on, constructed on, or attached to the land. – Personal property includes equipment, furnishing, vehicles, office machinery, and anything that is tangible excluding those assets defined as real property. (Note “personal” does not refer to being owned by a person or being private.) • Intangible property is all property that has value to the owner but cannot be directly seen or touched. Examples include patents, trademarks, trade names, and franchises. Examples of depreciable business assets: – Copy machines, Helicopters, Buildings, Interior furnishing, Production equipment, Computer networks Many different types of properties that wear out, decay, or lose value can be depreciated as business assets. Examples of nondepreciable business assets: Land: it does not wear out, lose value, or have a determinable useful life. Indeed, often it increases in value. Leased property: only the owner of property may claim depreciation expenses. Sometimes tangible property is used for both business and personal activities, such as a home office. The depreciation deduction can be taken only in proportion to the use for business expenses. 9 Depreciation Calculation Fundamentals Example. A PC costs $1,800. Its annual depreciation charges are $800, $600, and $350 for three years. Year Depreciation 0 Book Value $1,800 1 $800 $1,000 2 $600 $400 3 $350 $50 $1,800 is called the cost, initial cost, or cost basis. dt denotes the depreciation deduction in year t. Thus d1 = $800, d2 = $600, d3 = $350. BVt denotes the book value at the end of year t. BV0 = cost basis (e.g., $1,800) BV1 = BV0 – d1 = cost basis – d1 BV2 = BV1 – d2 = cost basis – (d1 + d2) BV3 = BV2 – d3 = cost basis – (d1 + d2 + d3) (e.g., $1,000) (e.g., $400) (e.g., $50) 10 Depreciation Calculation Fundamentals BVt = cost basis – (d1 + d2 + … + dt) This equation is used to compute the book value of an asset at the end of any time t. Book value can be viewed as the remaining unallocated cost of an asset: Book value = Cost – Depreciation charges made to date Note: If the item has a salvage value then the final book value will be the salvage value. Example: The book value of the PC declines during the useful life from a value of B = $1,800 at time 0 in the recovery period, to a value of S = $50 at time 3. Numerous depreciation methods are possible. 11 Straight Line (SL) Depreciation Year Initial Book Value Depr. Charge EOY Book Value 0 Example An asset has a cost of B = $900, a useful life of N = 5 years, and an EOL salvage value of S = $70. 1 Cost = $900 $166 734 2 $734 $166 568 3 568 $166 402 4 402 $166 236 5 236 $166 Total Depr.: With straight line depreciation, we would compute the following: Annual depreciation charge: di = (B-S)/N = 830/5 = $166. $900 Salvage Value 70 $830 Book Value Initial Cost 900 The book value of the asset decreases by $166 each year Salvage Value 70 1 N 2 Useful Life 3 4 5 12 Straight Line (SL) Depreciation Example. Depreciation to Intangible Property Veronica’s firm bought a patent in April. It was not acquired as part of acquiring a business. The firm paid $6,800 for the patent. They must depreciate it using SL depreciation over 17 years, with no salvage value. Annual depreciation is $400 = $6,800/17. The firm bought the patent in April. This means the depreciation for the first year must be prorated over the 9 months of ownership. Therefore the first year depreciation is (9/12) 400 = $300. In later years the depreciation can be $400. Straight line depreciation is the simplest and best known: C = Annual depreciation charge = (B-S)/N. 13 Sum-Of-Years Digits (SOYD) Depreciation Example An asset has a cost of B = $900, a useful life of N = 5 years, and an EOL salvage value of S = $70. With SOYD depreciation, we would compute the following Year 0 1 2 3 4 5 15 Life, FOY Multiplier 5 4 3 2 1 5/15 4/15 3/15 2/15 1/15 1 B-S $830 830 830 830 830 Depreciation Charge $277 221 166 111 55 EOY Book Value $900 623 402 236 125 70 $830 The product of the multiplier and B-S for the year is the depreciation charge for the year. Note the multipliers add to 1. 14 Sum-Of-Years Digits (SOYD) Depreciation dt=(N+1-t)/SOYD(B-S)= 2(N+1-t)/[N(N+1)](B-S) Book Value SOYD depreciation causes larger decreases in book value in earlier years than in later years. SOYD Depreciation looks like this. Question. If you were a firm, would you prefer SOYD or SL depreciation? $S N 15 Declining Depreciation Balance For straight line depreciation with N years, the rate of decrease each year is 1/N. Declining balance depreciation uses a rate of either 150% or 200% of the straight-line rate. Since 200% is twice the straight-line rate, it is called double declining balance (DDB). The DDB equation for any year is DDB depreciation dt = (2/N) ( Book value) Book value = Initial cost – total charges to date, So, DDB deprec. dt = (2/N) (Initial cost – total charges to date) It can be shown for DDB, that the depreciation schedule in year t is given by: DDB depreciation in year t = (2B/N)(1 – 2/N)t-1 For 150% declining balance depreciation, the depreciation in year t is given by: DDB depreciation in year t =(1.5 B/N)(1 – 1.5/N)t-1. we just replace each “2” in the DDB formula by “1.5”. 16 Declining Balance Depreciation: Example Example An asset has a cost of B = $900, a useful life of N = 5 years, and an EOL salvage value of S = $70. With DDB depreciation, we would compute the following Year Multiplier Cost – depreciation Depreciation Charge EOY Book 0 $900 1 2/5 900 360 540 2 2/5 540 216 324 3 2/5 324 130 194 4 2/5 194 78 116 5 2/5 116 46 70 $830 If the salvage value of this example had not been $70, a modification of DDB would be necessary. Several possibilities exist: • stop further depreciation when the book value equals the salvage value; 17 • “switch over” from DB depreciation to straight line. We can skip these modifications because MACRS is now the legally appropriate system, and it incorporates the switch from DB to SL. Switching DBD to SL • General rules – Switching recommended when the depreciation for year t by the currently used model is less than that for a new model. The selected depreciation Dt is the larger amount – BV can never go below estimated SV – We assume the estimated SV = 0 in all cases – The underappreciated amount BV is used as new adjusted basis to select the larger Dt, for the next switching decision – Switching from a DB model, SV (not the DB-implied SV) used to compute the depreciation for the new method – Only one switch can take place during the recovery period 18 Procedure of Switching • For each year t, compute the two depreciation charges For DDB : DDDB = (d)BVt-1 For SL • • : DSL= BVt-1 n-t+1 Select the larger deprecation value so that te depreciatiaon for each year t = 1,2,3,…n, is Dt = Dmax [DDDB, DSL} Compute the present worth of total depreciation, PWD, using equation : t n PWD Dt P / F , i, t t 1 19 Example 13.5 • M-E cyberspace, Inc., has purchased a $100,000 computer-controlled on line document imaging system with estimated imaging system with and estimated useful life of 8 years. Compute the annual capital recovery and compare the present worth for a)SL method, b) DDB method, c) DDB to SL switching. i= 15% Use recovery period = 5years Solution a) Compute Depreciation charges Straight line Dt = 1000,000-0 = $20,000 Since Dt is the same for all years t = 1,2,3…., t the P/A factor P/F in equation to compute PWD PWD = 20,0005(P/A,15%,5) = 20,000(3,3522) = $67,044 20 • DDB d= 2/5 =0,40 Year t Example 13.5 Dt 0 BVt (P/F,15%,t) PW of Dt 100,000 1 40,000 60,000 0,8696 34,784 2 24,000 36,000 0,76561 18,146 3 14,400 21,600 0,6575 9,468 4 8,640 12,960 0,5718 4,940 5 5,184 7,776 0,4972 2,577 $92,224 21 Switching SL-DDB Year DDB Model SL Depr, Selected Dt P/F Factor PW of Dt DDDS BVt 1 40,000 60,000 20,000 40,000 0,8696 34,784 2 24,000 36,000 15,000 24,000 0,76561 18,146 3 14,400 21,600 12,000 14,400 0,6575 9,468 4 8,640 12,960 10,800 10,800* 0,5718 6,175 5 5,184 7,776 12,960 10,800 0,4972 5,370 * Indicate switch from DDB to SL Depreciation Note : DSL values change each year since the adjusted BVt-1 is different. Only I year t=1 is DSL = 20,000 Example for t =4, BV3 = $21,600 by the DDB method, and DSL = 21,600-0 = $10,800 5-4+1 22 Calculating Income Taxes • Equation Taxable income = Gross income – Expenses – Depreciation deduction Example Suppose that a firm for a tax has a gross income of $5,270,000 expenses (excluding capital) of $2,927,500 and depreciation deduction of $1,874,300. What would be its taxable income? If tax =15% what would be income tax ? Solution Taxable income Income tax = $5,270,000 - $2,927,500 – $1,874,300 = $468,200 = $468,200 x 15% = 7,0230 23