Annual Worth Analysis Course Outline 5 Matakuliah : D0762 – Ekonomi Teknik

advertisement

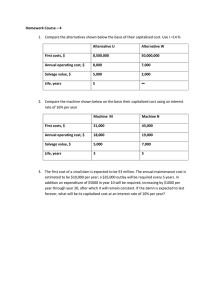

Matakuliah Tahun : D0762 – Ekonomi Teknik : 2009 Annual Worth Analysis Course Outline 5 Outline • • • • • • • Principle and Benefit next Equivalent Annual Worthnext Capital Ownership Cost next AW by salvage sinking-fund method next AW by Salvage present-worth method next AW by Capital recovery plus interest method next next Spreadsheet next Refererences - Engineering Economy – Leland T. Blank, Anthoy J. Tarquin p.180199 - Engineering Economic Analysis, Donald G. Newman, p. 141-163 -- Engineering Economy, William G. Sulivan, p.137-194, p. 212-284 http://www.cs.wright.edu/~snarayan/hfeeconomics/ise481_07_files/v3_document.htm 2 Annual Worth Analysis • Principle: Measure investment worth on annual basis • Benefit: By knowing annual equivalent worth, we can: • Seek consistency of report format • Determine unit cost (or unit profit) • Facilitate unequal project life comparison 3 Computing Equivalent Annual Worth $120 $80 0 $70 1 2 3 4 5 6 $50 $189.43 $100 A = $46.07 0 PW(12%) = $189.43 1 2 3 4 5 6 AE(12%) = $189.43(A/P, 12%, 6) = $46.07 http://www.cs.wright.edu/~snarayan/hfeeconomics/ise481_07_files/v3_document.htm 4 Annual Equivalent Worth • Repeating Cash Flow Cycles $700 $500 $1,000 $800 $700 $400 $400 $500 $800 $400 $400 $1,000 Repeating cycle http://www.cs.wright.edu/~snarayan/hfeeconomics/ise481_07_files/v3_document.htm 5 Annual Equivalent Worth • First Cycle: PW(10%) = -$1,000 + $500 (P/F, 10%, 1) + . . . + $400 (P/F, 10%, 5) = $1,155.68 AE(10%) = $1,155.68 (A/P, 10%, 5) = $304.87 • Both Cycles: PW(10%) = $1,155.68 + $1,155.68 (P/F, 10%, 5) + . . . + $400 (P/F, 10%, 5) = $1,873.27 AE(10%) = $1,873.27 (A/P, 10%,10) = $304.87 http://www.cs.wright.edu/~snarayan/hfeeconomics/ise481_07_files/v3_document.htm 6 • When only costs are involved, the AE method is called the annual equivalent cost. • Revenues must cover two kinds of costs: Operating costs and capital costs. Annual Worth Costs Annual Equivalent Cost Capital costs + Operating costs http://www.cs.wright.edu/~snarayan/hfeeconomics/ise481_07_files/v3_document.htm 7 Capital (Ownership) Costs • Definition: The cost of owning an equipment is associated with two transactions— (1)its initial cost (I) and (2) its salvage value (S). Capital costs: Taking into these sums, we calculate the capital costs as: S 0 N I 0 1 2 3 N CR(i) CR(i) I ( A / P, i, N ) S( A / F, i, N ) ( I S)( A / P, i, N ) iS http://www.cs.wright.edu/~snarayan/hfeeconomics/ise481_07_files/v3_document.htm 8 Example - Capital Cost Calculation $50,000 • • Given: I = $200,000 N = 5 years S = $50,000 i = 20% Find: CR(20%) 0 5 $ 200,000 CRi I S A / P, i, N iS CR20% $200.000 $50.000 A / P,20%,5 0,20 $50.000 $60.157 http://www.cs.wright.edu/~snarayan/hfeeconomics/ise481_07_files/v3_document.htm 9 Justifying an investment based on AE Method • • • • Given: I = $20,000, S = $4,000, N = 5 years, i = 10% Find: see if an annual revenue of $4,400 is enough to cover the capital costs. Solution: CR(10%) = $4,620.76 Conclusion: Need an additional annual revenue in the amount of $220.76. http://www.cs.wright.edu/~snarayan/hfeeconomics/ise481_07_files/v3_document.htm 10 Salvage -Sinking Fund Method AW P A / P, i, n S A / F , i, n • General Equation • Example 6.1 Calculate the AW of a tractor attachment that has an initial cost of $8000 and a salvage value of $500 after 8 years. Annual operating cost for the machine are estimated to be $900 and an interest rate of 20% per year is applicable. Solution The problem indicates there are 2 cashflow AW = A1 + A2 Where A1 = annual cost of initial investment with salvage value considered Equation above = -8000(A/P,20%8) + 500(A/F,20%,8) = $2055 A2 = annual operating cist = $-900 The Annual worth for the attachment is : AW = -2055 – 900 = $-2955 11 Salvage Present-Worth Method • General Equation AW [P S P / F , i, n] A / P, i, n • The Steps to determine the complete asset AW are 1. Calculate the present worth of the salvage value via the P/F factor 2. Combine the value obtained in step 1 with the investment cost P 3. Annualize the resulting difference over the life of the asset using the A/P factor 4. Combine any uniform annual worth with the value from step 3 5. Convert any other cash flows into an equivalent uniform annual worth and combine with the value obtained in step 4 12 Example 6.2 • Compute the AW of the attachment detailed in Example 6.1 using the salvage present worth method Solution Using the steps outline and equation before AW = [-8000+500(P/F,20%,8)(A/P,20%,8) – 900 = $-2955 13 Capital Recovery Plus Interest Method • General equation AW ( P S ) A / P, i, n S i • The steps to be followed for this method are : 1. 2. 3. 4. 5. 6. Reduce the initial cost by the amount of the salvage value Annualize the value in step 1 using A/P factor Multiply the salvage value by the interest rate Combine the values obtained in steps 2 and 3 Combine any uniform annual amounts Convert all other cash flows into equivalent uniform amount and combine them with the value from step 5 Step 1 through 4 are accomplished bya pplying equation before 14 Example 6.1 • Use the value of Example 6.1 to compute the AW using the capital recovery plus interest Solution From equation and steps before : AW =-(8000-500)(A/P,20%,8)-500(0,20) – 900 = $-2955 15 Comparing Alternatives • • Following costs are estimated for two equal service tomato peeling machines to evaluated by a canning plant manager’ if the minimum required rate of return is 15% per year, help the manager decide which machine to select ! Machine A Machine B First Cost 26,000 36,000 Annual maintenance cost,$ 800 300 Annual Labor cost, $ 11,000 7000 Extra annual income taxes, $ - 2,600 Salvage Value 2,000 3,000 Life, years 6 10 Solution AW A = -26,000(A/P,15%,6) + 2000(A/F,15%,6)-11800 = $-18,442 AW B = -36,000(A/P,15%,10)+3000(A/F,15%,10) = $-16,925 16 Spreadsheet Example 6.10 If Ms.Kaw Deposits $10,000 now at an interest rate of 7% per year, hom many year s must the money accumulate before she can withdraw $1400 per year forever 17