Present Worth Analysis Course Outlined 4 Matakuliah : D0762 – Ekonomi Teknik Tahun

advertisement

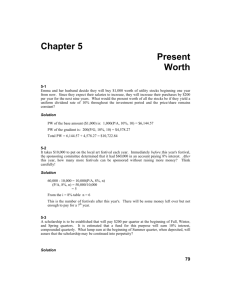

Matakuliah : D0762 – Ekonomi Teknik Tahun : 2009 Present Worth Analysis Course Outlined 4 Outline • Definition next • Present Worth Comparisonnext • Assumption on Using PWA next References : - Engineering Economy – Leland T. Blank, Anthoy J. Tarquin p.152-163 - Engineering Economic Analysis, Donald G. Newman, p. 111-127 - Engineering Economy, William G. Sulivan, p.137-194, p. 212-284 2 Present Worth Analysis (PWA) • • • Present worth analysis (PWA) can resolve alternatives into equivalent present consequences. “Present worth analysis is most frequently used to determine the present value of future money receipts and disbursements.” We can restate the above three criteria in terms of PWA as follows: Case Situation Criterion Fixed input Amount of money or other input resources fixed Maximize PW of benefits or other outputs. Fixed output A fixed task, benefit, or other output must be accomplished. Minimize PW of costs or other inputs Free input & output Amounts of money, other inputs, amounts of benefits, other outputs can vary. Maximize Net PW, which is PW of benefits less PW of costs. 3 Present Worth Analysis • Careful consideration must be given to the time period covered by the analysis.” The time period is usually called the analysis period, or the planning horizon. Three different analysis-period situations occur: 1. 2. 3. The useful life of each alternative equals the analysis period. The alternatives have useful lives different from the analysis period (and from each other). The analysis period is effectively infinite. 4 Present Worth Comparison Same-Length Analysis Periods Example 5-1. GatorCo is considering buying device A or B. Each device can reduce costs. Each device has a useful life of five years, and no salvage value. Device A saves $300 a year, device B saves $400 the first year, but savings in later years decrease by $50 a year. Interest is 7%. Which device should they choose? • • Device A: NPW = 300 (P/A,7%,5) = 300 (4.1000) = $1230 • • Device B: NPW = 400 (P/A,7%,5) - 50 (P/G,7%,5) = 400(4.1000) - 50 (7.647) = $1257.65 • • Device B has the largest NPW of benefits. Device B gives more of its benefits in the earlier years. • Note, If we ignore the time value of money (we should not), both devices have a NPW of benefits of $1500 5 Present Worth Comparison Same-Length Analysis Periods • Example Wayne County plans to build an aqueduct to carry water. The county can: a) spend $300 million now, and enlarge the aqueduct in 25 years for $350 million more, b) construct a full-size aqueduct now for $400 million. The analysis period is 50 years. We ignore maintenance costs. Interest is 6%. There is no salvage value. a) NPW = $300 million + $350 million (P/F,6%,25) = $381.6 million b) NPW = $400 million This is an example of stage construction. The two-stage construction appears preferable. 6 Present Worth Comparison Different-Length Analysis Periods Sometimes the useful lives of projects differ from the analysis period. Example The mailroom needs new equipment. Alternative choices are as follows: Make Cost Useful life EOL salvage value Speedy $1500 5 years $200 Allied $1600 10 years $325 We no longer have a situation where either choice will provide the same desired level of (fixed) output. Speedy equipment for five years is not equivalent to Allied equipment for ten years. 7 Present Worth Comparison Different-Length Analysis Periods Allied 200 200 Allied 5 years 10 years 1500 1500 Speedy 5 years 200 1500 325 325 5 years Speedy 10 years 1600 1600 8 Present Worth Comparison Different-Length Analysis Periods • • Solution : Compare one Allied with two Speedy’s We buy a Speedy for $1500, use it for 5 years, get $200 salvage, buy a second Speedy for $1500, use it for the second 5 years, and again get $200 salvage. Two Speedy’s: PW = 1500 + (1500 – 200) (P/F,7%,5) – 200 (P/F,7%,10) = 1500 + 1300 (0.7130) – 200 (0.508) = 1500 + 927 – 102 = $2325. • Allied for 10 years: PW = 1600 – 325 (P/F,7%,10) = 1600 – 325 (0.5083) = 1600 – 165 = $1435. 9 Present Worth Analysis Different-Length Analysis Periods Generalization. “The analysis period for an economy study should be determined from the situation.” The period can be: • short: PC manufacture, • intermediate length: steel manufacture • indefinite length: national government “Least common multiple” idea. In the above example, it made some sense to use 10 years as the analysis period. If one piece of equipment had a life of 7 years, and the other a life of 13 years, and we followed the same approach, we would need to use 7 (13) = 91 years. But an analysis period of 91 years is not too realistic. Terminal Value Idea. We estimate terminal values for the alternatives at some point prior to the end of their useful lives. 10 Present Worth Analysis Different-Length Analysis Periods Alternative 1 C1 = initial cost S1 = salvage value R1 = replacement cost T1 = terminal value at the end of 10th year Alternative 2 C2 = initial cost T2 = terminal value at the end of 10th year S1 C1 T1 S1 R1 S2 T2 C2 7 years 3 years 3 years 1 year 11 Present Worth Analysis Infinite-Length Analysis Periods – Capitalized Cost Present worth of costs with 10-yr. analysis period: PW1 = C1 + (R1 – S1) (P/F,i%,7) – T1 (P/F,i%,10) PW2 = C2 – T2 (P/F,i%, 10) Infinite Analysis Period – Capitalized Cost. Sometimes the analysis period is of indefinite length. The need for roads, dams, pipelines, etc. is sometimes considered permanent. The authors refer to this situation as an infinite analysis period. Present worth analysis in this case is called capitalized cost. Capitalized cost is the present sum of money that would need to be set aside now, at some know interest rate, to yield the funds needed to provide a service indefinitely. 12 Present Worth Analysis Infinite-Length Analysis Periods – Capitalized Cost Example LA plans a pipeline to transport water from a distant watershed area to the city. The pipeline will cost $8 million and have an expected life of 70 years. The water line needs to be kept in service indefinitely. We estimate we need $8 million every 70 years. Compute capitalized cost (compounding 7% yearly). 8M 8M 8M P=? To find the capitalized cost, we first compute an annual disbursement A that is equivalent to $8 million every seventy years. 8M A A A A A A A = F (A/F,i,n) = 8 million (A/F,7%,70) = 8 million (0.00062) = $4960 13 Present Worth Analysis Infinite-Length Analysis Periods – Capitalized Cost Motivating Example. Ima Rich wants to set up a scholarship fund to provide $20,000 yearly to deserving undergraduate women engineering students at UF. UF will invest her donation, and expects it to earn 10% a year. How much will Ima need to donate in one lump sum so that $20,000 is available every year? Observation. If Ima donates $200,000, 10% of it is $20,000. The money grows in one year to $220,000, a scholarship is funded, $200,000 remains, and grows in another year again to $220,000, another scholarship is funded, etc. With P = $200,000, i = 10%, A = $20,000, we see that: P=A/i A=Pi In fact this approach works generally. To make an amount A available every year beginning with an initial present sum P and given an interest rate i, just take P = A/i. P is called the capitalized cost. Go Back 14 Example. Spreadsheet • A City engineer is consideration two alternatives for the local water supply. The first alternative involves construction of an earthen dam on a nearby river, which has a highly variable flow. The dam will form a reservoir so the city may have a dependable source of water. The initial cost of the dam is expected to be $8 million and will require annual upkeep cost of $25,000. The dam Is expected to last indefinitely • Alternatively the city can drill wells as needed and construct pipelines for transportation the water to the city. The engineer estimates that an average 10 wells will be required initially at a cost of $45,000 per well, including the pipelines. The average life of a well is expected to be 5 years with an annual operating cost of $12,000 per well. If the City uses an interest rate of 15% per year, determine which alternative should be selected on the basis of their 15 capitalized cost Solution - Spreadsheet 16 Concepts and Assumptions End-of-Year Convention Textbooks in this area usually follow an end-of-year convention. For each time period, all the series of receipts and disbursements occur at the end of the time period. If, in fact, they do not, you can replace them by their equivalent values at the end of the year. Multiply each by the appropriate factor (F/P,i %,n) to move it to the end of the year. Viewpoint of Economic Analysis Studies. Usually we take the point of view of an entire firm when doing an industrial economic analysis. What is best for the entire firm may not be best for smaller groups in the firm. It is easy to make a bad decision if we ignore part of the problem. Sunk Costs It is the differences between alternatives that are relevant to economic analysis. Events that have occurred in the past have no bearing on what we should do in the future. What is important are the current and future differences between alternatives. Past costs, like past events, have no bearing on deciding between alternatives unless the past costs somehow actually affect the present or future costs. Usually, past costs do not affect the present or the future costs, so we call them sunk costs and disregard them. 17 Concepts and Assumptions Borrowed Money Viewpoint Economic analysis involve spending money. It is thus natural to ask the source of the money. There are two aspects of money to determine: Financing – obtaining the money Investment – spending the money Experience shows it is important to distinguish between these two aspects. Failure to separate them sometimes leads to confusing results and poor decision making. The conventional assumption in economic analysis is that the money required to finance alternatives and/or solutions in problem solving is considered to be borrowed at interest rate i. 18 Concepts and Assumptions Effect of Inflation and Deflation For the time being we assume prices are stable. We deal with inflation and deflation later in the course. Income Taxes We defer our introduction of income taxes into economic analyses until later. Stability The economic situation is stable. Determinism (This is a strong assumption. It is almost never satisfied.) All data of interest are known deterministically (no randomness) and can be accurately predicted. 19