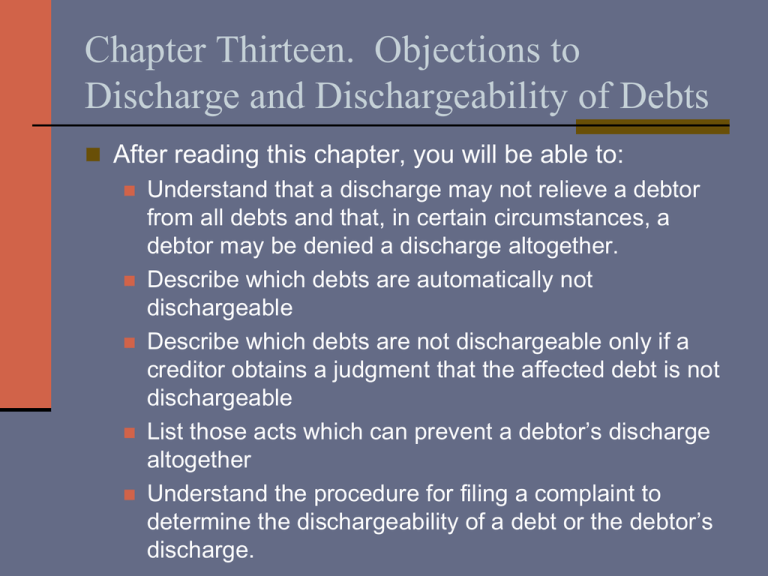

Chapter Thirteen. Objections to Discharge and Dischargeability of Debts

advertisement

Chapter Thirteen. Objections to Discharge and Dischargeability of Debts After reading this chapter, you will be able to: Understand that a discharge may not relieve a debtor from all debts and that, in certain circumstances, a debtor may be denied a discharge altogether. Describe which debts are automatically not dischargeable Describe which debts are not dischargeable only if a creditor obtains a judgment that the affected debt is not dischargeable List those acts which can prevent a debtor’s discharge altogether Understand the procedure for filing a complaint to determine the dischargeability of a debt or the debtor’s discharge. Practice Pointer Even if the creditor takes no action, the debtor will normally not be discharged of most debts relating to taxes, domestic support obligations, governmental fines or penalties, and death or personal injury caused by drunk driving. Nondischargeable Debts A debt not subject to a debtor’s discharge. A debtor is not relieved from legal liability for the affected debt. Some types of nondischargeable debts require the filing of a Complaint to Determine Dischargeability of Debt for the debt to become nondischargeable. Nondischargeable debts are described in Bankruptcy Code Section 523(a). Nondischargeable Debts The following debts are nondischargeable without an affected creditor being required to take any affirmative action: Priority tax claims Unlisted debts Domestic support obligations Certain fines and penalties Guaranteed student loans Damages from DWI conviction Debt nondischarged in prior bankruptcy Financial institution fraud Restitution award Loans obtained to pay nondischargeable taxes Postpetition homeowner’s assessments Prisoner court costs Pension plan loans Debts arising from federal or state securities law violations Complaint to Avoid Dischargeability of a Debt An adversary proceeding initiated by a creditor or debtor to determine the dischargeability of a specific debt pursuant to Bankruptcy Code Section 523(c). A creditor must initiate such a complaint within 60 days of the date first set for the creditors’ meeting. A debtor may initiate such a complaint at any time. Time limitations are found int Fed. R. Bankr. P. 4007 Complaint to Avoid Discharge An adversary proceeding initiated by a trustee or an interested party to entirely avoid a debtor’s discharge. Time limitations are found in Fed. R. Bankr. P. 4004. A Creditor May Object to Discharge of the Following Debts Fraud Intentional fraud False written financial statement Limited prepetition credit transactions Defalcation, larceny, embezzlement Willful and malicious injury Fresh Cash Rule The fresh cash rule covers the portion of a debt incurred by use of a false written financial statement.