Chapter Seven Introduction to Corporations

advertisement

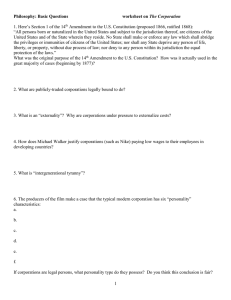

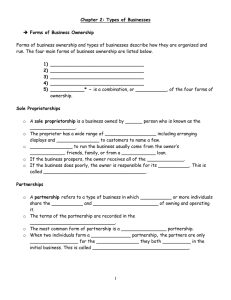

Chapter Seven Introduction to Corporations Corporation Corporation: A legal entity created by a state to carry out business (if a for-profit entity). Model Business Corporation Act MBCA: act on which individual state statutes governing corporations are based Corporate Powers List of activities enumerated by a state in which a corporation can engage Powers Typically Granted to a Corporation By State Law To sue and be sued and to defend in the corporation’s own name To make and amend bylaws for regulating the business of the corporation To purchase, acquire, own, hold, improve, sell, lease, or mortgage real or personal property To enter into contracts, incur liabilities, borrow money, issue bonds, and lend money To elect directors and appoint officers Slide 1 of 3 Powers Typically Granted to a Corporation By State Law To establish pension and other benefit plans for its directors, officers, agents, and employees To make donations for the public welfare To make payments or donations that further the business of the corporation To purchase and hold shares or other interests in entities Slide 2 of 3 Powers Typically Granted to a Corporation By State Law To be a member or manager of a partnership or other entity To have and use a corporate seal To transact any lawful business To exist perpetually Slide 3 of 3 Types of Corporations Domestic corporations Foreign corporations Federal or state corporations Public corporations Privately held corporations Nonprofit corporations Close corporations Professional corporations S corporations C corporations Parent and subsidiary corporations Advantages of a Corporation Limited liability Corporate deductions Continuity of existence Transferability of share ownership Disadvantages of a Corporation Double taxation Formalities of organization and operation Centralized management Double Taxation Concept in corporate law in which money earned by a corporation is taxed; when remainder is distributed to shareholders, they are also taxed Key Features of Corporations Corporations are persons and exist separate and apart from their owner-shareholders Offer limited liability for their shareholders, officers, and directors, because the corporation itself is liable for its own debts and obligations Can exist perpetually Ownership is easily transferred Slide 1 of 2 Key Features of Corporations Corporations are subject to double taxation: the income of a corporation is taxed, and when profits are distributed to shareholders, they also pay tax Can be expensive to form and maintain Management of corporations is centralized in a board of directors; the owner-shareholders do not manage the typical large business corporation Slide 2 of 2