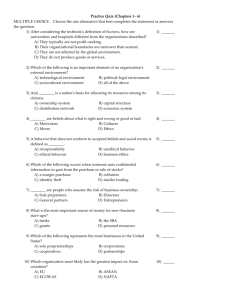

Chapter Two Sole Proprietorships

advertisement

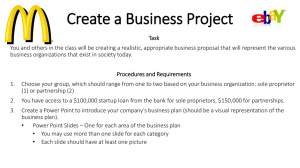

Chapter Two Sole Proprietorships Sole Proprietorship A business owned and operated by one person Sole Proprietorships ADVANTAGES Easy to form and maintain Inexpensive to form Owner is sole decisionmaker Managerial discretion All profits are retained by owner Pass-through tax status DISADVANTAGES Unlimited personal liability Lack of continuity Difficulties in raising capital Possible lack of expertise in management Personal Liability Liability extending beyond what is invested in a business to an individual’s personal assets (also called unlimited liability) Capital Money used to form and operate a business or other venture Name Considerations Fictitious name: a name that must be registered with state or local officials because it does not disclose the surname of the business owner DBA: ‘‘Doing business as’’; another name for a fictitious business name statement Fictitious business name statement: record filed with public officials to identify the owner of a business operating under a name other than the owner’s surname Key Features of Sole Proprietorships Business is owned and managed by one person Sole proprietor retains all profits and bears all losses Sole proprietor’s personal assets can be reached to satisfy business obligations Business is easily and inexpensively formed All income earned (and loss incurred) is passed through to sole proprietor, who pays tax at appropriate individual tax bracket