AIC and ATXI 2015 Projected Rate Meeting Presentation

advertisement

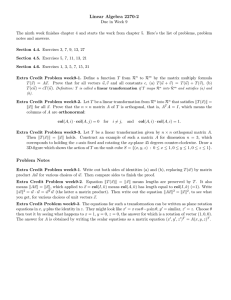

2015 Projected Attachment O Stakeholder Meeting Ameren Transmission Company of Illinois (ATXI) and Ameren Illinois Company (AIC) October 1, 2014 AGENDA Main Purpose is to review ATXI and AIC 2015 Projected Transmission Rate Calculations • • • • Timeline ATXI 2015 Projection AIC 2015 Projection 2015 AMIL Pricing Zone NITS Charge 2 NEW PROTOCOL TIMELINE Proposed Schedule (Forward-Looking) Date June 1 Posting of annual true-up for prior year September 1 Deadline for annual true-up meeting September 1 Posting of net projected revenue requirement for following year October 15 Deadline for annual projected rate meeting November 1 Deadline for joint meeting on regional cost-shared projects March 15 Transmission Owners submit informational filing to the Commission 3 ATXI Revenue Requirement Projected 2014 vs Projected 2015 4 ATXI 2015 PROJECTION ATXI Rate Base Page.Line Jan-14 72,401,000 3,701,000 68,700,000 Jan-15 80,778,000 4,717,000 76,061,000 Change 8,377,000 1,016,000 7,361,000 Percent 12% 27% 11% 2.6 2.12 2.18 Total Gross Plant Total Accum Depreciation TOTAL NET PLANT 2.18a 100% CWIP RECOVERY 166,179,000 471,564,000 305,385,000 184% 2.20 2.21 2.22 2.25 2.26 2.27 2.28 ADJUSTMENTS TO RATE BASE Account No. 282 Account No. 283 Account No. 190 Land Held for Future Use CWC Materials & Supplies Prepayments TOTAL ADJUSTMENTS -15,292,000 -1,009,000 2,877,000 0 395,500 0 0 -13,028,500 -12,824,000 -2,720,000 2,470,000 0 866,625 0 190,000 -12,017,375 2,468,000 -1,711,000 -407,000 0 471,125 0 190,000 1,011,125 -16% 170% -14% N/A 119% N/A N/A -8% 2.30 TOTAL RATE BASE 221,850,500 535,607,625 313,757,125 141% 5 ATXI 2015 PROJECTION ATXI Expenses Jan-14 Page.Line Jan-15 Change Percent 3.1 3.1a 3.2 3.3 3.4 3.5 3.5a 3.8 O&M Transmission Less LSE Expenses Less Account 565 A&G Less FERC Annual Fees Less EPRI, ect. Plus Trans. Reg. Comm. Exp TOTAL O&M 184,000 0 0 2,980,000 0 68,720 68,720 3,164,000 367,000 0 0 6,566,000 0 50,000 50,000 6,933,000 183,000 0 0 3,586,000 0 -18,720 -18,720 3,769,000 99% N/A N/A 120% N/A -27% -27% 119% 3.12 TOTAL DEPRECIATION 1,064,000 1,132,000 68,000 6% 3.13 3.16 3.18 3.27 TAXES Payroll Property Other Income Taxes TOTAL TAXES 0 0 82,000 10,819,901 10,901,901 0 0 155,000 24,806,313 24,961,313 0 0 0 73,000 13,986,412 14,059,412 N/A N/A N/A 89% 129% 129% TOTAL EXPENSES 15,129,901 33,026,313 17,896,412 118% 6 ATXI 2015 PROJECTION ATXI Actual Capital Structure Capital Structure - 2014 Projection Page.Line 4.27 4.28 4.29 4.3 Long Term Debt Preferred Stock Common Stock Total $ 91,077,000 0 121,344,000 212,421,000 % 43% 0% 57% 100% Cost Weighted 0.0386 0.0165 0.0000 0.0000 0.1238 0.0707 0.0873 44% 0% 56% 100% Cost Weighted 0.0427 0.0187 0.0000 0.0000 0.1238 0.0696 0.0883 Capital Structure - 2015 Projection Page.Line 4.27 4.28 4.29 4.3 Long Term Debt Preferred Stock Common Stock Total Change in Return $ 192,308,000 0 247,121,000 439,429,000 % 0.1060% 7 ATXI 2015 PROJECTION Total ATXI Revenue Requirement 2.30 4.30 3.28 TOTAL RATE BASE Rate of Return on ACS Return from ACS Jan-14 221,850,500 8.73% 19,359,229 2.30a 4.30e 3.28a 100% CWIP RECOVERY Incremental Rate of Return on HCS Incremental Return from HCS 166,179,000 -0.10% -159,215 471,564,000 -0.02% -90,541 305,385,000 0.08% 68,674 184% -80% -43% 3.29 Total Return Total Expenses TOTAL GROSS REV. REQ. 19,200,014 15,129,901 34,329,914 47,215,800 33,026,313 80,242,113 28,015,786 17,896,412 45,912,199 146% 118% 134% 3.30 3.30a 3.31 Less ATT. GG Adjustment Less ATT. MM Adjustment GROSS REV. REQ. UNDER ATT. O 0 25,755,419 8,574,496 0 71,386,314 8,855,799 0 45,630,896 281,303 N/A 177% 3% Page.Line Jan-15 535,607,625 8.83% 47,306,341 Change 313,757,125 0.11% 27,947,112 Percent 141% 1% 144% 8 ATXI 2015 PROJECTION ATXI True-up & Net Revenue Requirement Page.Line 1.1 1.6 Gross Revenue Requirement Total Revenue Credits 1.6a 1.6b 1.6c 1.6d 1.6e Historic Year Actual ATRR Projected ATRR from Prior Year Prior Year ATRR True-Up Prior Year Divisor True-Up Interest on Prior Year True-Up 1.7 NET REVENUE REQUIREMENT Jan-14 8,574,496 502,000 Jan-15 8,855,799 423,000 Change 281,303 -79,000 Percent 3% -16% 9,892,717 7,270,263 2,622,454 30,874 35,470 8,860,739 7,406,002 1,454,736 (45,647) 9,706 (1,031,979) 135,740 (1,167,718) (76,521) (25,764) -10% 2% -45% -248% -73% 10,761,294 9,851,594 -909,701 -8% 9 ATXI 2013 TRUE UP – ATTACHMENT O Ameren Transmission Company of Illinois 2013 Attachment O Revenue Requirement True-Up For the Year Ended 12/31/2013 Attachment O Net Actual Revenue Requirement (Attachment O, Pg 1, Line 7) $ 8,860,739 Net Projected Revenue Requirement (2013 Projected Attachment O, Pg 1, Line 7) $ 7,406,002 Under/(Over) Recovery of Net Revenue Requirement $ 1,454,736 Historic Year Actual Divisor for Pricing Zone (AIC Attachment O, Pg 1, Line 15) Projected Year Divisor for Pricing Zone (AIC 2013 Projected Attachment O, Pg 1, Line 15) Difference between Historic & Projected Yr Divisor Prior Year Projected Annual Cost ($ per kw per yr) Prior Year Under/(Over) Divisor True-up $ $ 7,219,264 7,175,041 (44,223) 1.0322 (45,647) Total Under/(Over) Recovery $ 1,409,089 Monthly Interest Rate (updated through July, 2014) Interest For 24 Months $ Total Under/(Over) Recovery Including Interest $ 0.0287% 9,706 1,418,795 10 ATXI 2015 PROJECTION ATXI Attachment MM Calculation - Page 1 (1) (2) Attachment O Page, Line, Col. Line No. Attach O, p 2, line 2 + 18a col 5 (Note A) Attach O, p 2, line 8 col 5 Line 1 minus Line 1a (Note B) (3) (4) Transmission Allocator 1 1a 2 Gross Transmission Plant - Total Transmission Accumulated Depreciation Net Transmission Plant - Total 3 3a 3b 3c 3d O&M TRANSMISSION EXPENSE Total O&M Allocated to Transmission Transmission O&M Less: LSE Expenses included in above, if any Less: Account 565 included in above, if any Adjusted Transmission O&M 4 Annual Allocation Factor for Transmission O&M 4a 4b OTHER O&M EXPENSE Other O&M Allocated to Transmission Annual Allocation Factor for Other O&M 5 6 GENERAL AND COMMON (G&C) DEPRECIATION EXPENSE Total G&C Depreciation Expense Annual Allocation Factor for G&C Depreciation Expense 7 8 TAXES OTHER THAN INCOME TAXES Total Other Taxes Annual Allocation Factor for Other Taxes 9 Annual Allocation Factor for Other Expense 10 11 INCOME TAXES Total Income Taxes Annual Allocation Factor for Income Taxes Attach O, p 3, line 27 col 5 (line 10 divided by line 2 col 3) 24,806,313 4.53% 4.53% 12 13 RETURN Return on Rate Base (Note I) Annual Allocation Factor for Return on Rate Base Attach O, p 3, line 28 col 5 (line 12 divided by line 2 col 3) 47,306,341 8.64% 8.64% 14 Annual Allocation Factor for Return 15 HYPOTHETICAL CAPITAL STRUCTURE (HCS) RETURN Annual Allocation Factor HCS Return (Note J) Attach O, p 3, line 8 col 5 Attach O, p 3, line 1 col 5 Attach O, p 3, line 1a col 5, if any Attach O, p 3, line 2 col 5, if any Line 3a minus Line 3b minus Line 3c (Line 3d divided by line 1a, col 3) Line 3 minus Line 3d Line 4a divided by Line 1, col 3 Attach O, p 3, lines 10 & 11, col 5 (Note H) (line 5 divided by line 1 col 3) Attach O, p 3, line 20 col 5 (line 7 divided by line 1 col 3) 552,342,000 4,717,000 547,625,000 6,933,000 367,000 367,000 7.78% 7.78% 6,566,000 1.19% 1.19% 0.00% 0.00% 155,000 0.03% 0.03% Sum of line 4b, 6, and 8 1.22% Sum of line 11 and 13 Attach O, p 4, line 30e 13.17% -0.02% -0.02% 11 ATXI 2015 PROJECTION ATXI Attachment MM Calculation - Page 2 (1) Line No. Project Name (2) (3) (4) (5) MTEP Project Number Project Gross Plant Project Accumulated Depreciation Page 1 line 4 2237 $ 105,255,753 $ - $ $ $ 10,524 - $ $ - $ $ - $ $ - $ $ - $ $ - $ - 1b 1c 1d 1e 1f 1g 1h 1i 1j 1k 1l 1m Pana-Sugar Creek - Plant in Service - No HCS Pana-Sugar Creek - Land - No HCS Sidney-Rising - CWIP Sidney-Rising - Plant in Service - No HCS Sidney-Rising - Land - No HCS Adair-Ottumwa - CWIP Adair-Ottumwa - Plant in Service - No HCS Adair-Ottumwa - Land - No HCS Palmyra-Pawnee - CWIP Palmyra-Pawnee - Plant in Service - No HCS Palmyra-Pawnee - Land - No HCS Fargo-Galesburg-Oak Grove - CWIP 2237 2237 2239 2239 2239 2248 2248 2248 3017 3017 3017 3022 $ $ $ $ $ $ $ $ $ $ $ $ 4,781,146 2,817,325 50,796,443 1,277,222 1,503,619 657,995 245,733,043 8,177,210 14,347,200 1n 1o 1p 1q 1r 1s 1t 1u Fargo-Galesburg-Oak Grove - Plant in Service - No HCS Fargo-Galesburg-Oak Grove - Land - No HCS Pawnee-Pana - CWIP Pawnee-Pana - Plant in Service - No HCS Pawnee-Pana - Land - No HCS Adair-Palmyra - CWIP Adair-Palmyra - Plant in Service - No HCS Adair-Palmyra - Land - No HCS 3022 3022 3169 3169 3169 3170 3170 3170 $ $ $ $ $ $ $ $ 3,394,372 27,907,386 2,813,762 26,020,057 769,450 (7) (8) Transmission Other Expense O&M Annual Annual Allocation Annual Annual Allocation for Transmission Allocation Allocation for Factor O&M Expense Factor Other Expense (Note C) Multi-Value Projects (MVP) 1a Pana-Sugar Creek - CWIP (6) (Col 4 * Col 5) 7.78% $ Page 1 line 9 (Col 3 * Col 7) (9) Annual Expense Charge (Col 6 + Col 8) - 1.22% $1,280,771.54 $1,280,771.54 7.78% 7.78% 7.78% 7.78% 7.78% 7.78% 7.78% 7.78% 7.78% 7.78% 7.78% 7.78% $ $ $ $ $ $ $ $ $ $ $ $ 819 - 1.22% 1.22% 1.22% 1.22% 1.22% 1.22% 1.22% 1.22% 1.22% 1.22% 1.22% 1.22% $58,177.87 $34,281.73 $618,100.55 $0.00 $15,541.47 $18,296.31 $0.00 $8,006.61 $2,990,125.28 $0.00 $99,501.81 $174,579.40 $58,996.71 $34,281.73 $618,100.55 $0.00 $15,541.47 $18,296.31 $0.00 $8,006.61 $2,990,125.28 $0.00 $99,501.81 $174,579.40 7.78% 7.78% 7.78% 7.78% 7.78% 7.78% 7.78% 7.78% $ $ $ $ $ $ $ $ - 1.22% 1.22% 1.22% 1.22% 1.22% 1.22% 1.22% 1.22% $0.00 $41,303.35 $339,582.25 $0.00 $34,238.38 $316,616.88 $0.00 $9,362.81 $0.00 $41,303.35 $339,582.25 $0.00 $34,238.38 $316,616.88 $0.00 $9,362.81 12 ATXI 2015 PROJECTION ATXI Attachment MM Calculation - Page 2 (Continued) (1) Line No. Project Name (2) MTEP Project Number (10) (11) (11a) (12) Project Net Plant Annual Allocation Factor for Return Annual Allocation Factor for HCS Return Annual Return Charge (Col 3 - Col 4) (Page 1 line 14) (Page 1 line 15) (Note J) (Col 10 * (Col 11 + 11a)) (13) (14) (15) (16) Project MVP Annual Depreciation Annual Revenue Adjusted Revenue Expense Requirement True-Up Adjustment Requirement (Sum Col. 9, 12 & 13) (Note E) Sum Col. 14 & 15 (Note G) (Note F) Multi-Value Projects (MVP) 1a 1b 1c Pana-Sugar Creek - CWIP Pana-Sugar Creek - Plant in Service - No HCS Pana-Sugar Creek - Land - No HCS 2237 2237 2237 $ $ $ 105,255,753 4,770,621 2,817,325 13.17% 13.17% 13.17% -0.02% $ 0.00% $ 0.00% $ 13,840,136 628,208 370,992 $ $ $ $ $ $ $ $ $ 6,679,252 168,188 197,712 86,646 $ $ $ $ $ $ 13.17% 13.17% 13.17% -0.02% $ 0.00% $ 0.00% $ 32,311,571 1,076,796 14,347,200 13.17% -0.02% $ 3,394,372 27,907,386 2,813,762 26,020,057 769,450 13.17% 13.17% 13.17% 13.17% 13.17% 13.17% 13.17% 13.17% 0.00% 0.00% -0.02% 0.00% 0.00% -0.02% 0.00% 0.00% 1d 1e 1f 1g 1h 1i Sidney-Rising - CWIP Sidney-Rising - Plant in Service - No HCS Sidney-Rising - Land - No HCS Adair-Ottumwa - CWIP Adair-Ottumwa - Plant in Service - No HCS Adair-Ottumwa - Land - No HCS 2239 2239 2239 2248 2248 2248 $ $ $ $ $ $ 50,796,443 1,277,222 1,503,619 657,995 13.17% 13.17% 13.17% 13.17% 13.17% 13.17% -0.02% 0.00% 0.00% -0.02% 0.00% 0.00% 1j 1k 1l Palmyra-Pawnee - CWIP Palmyra-Pawnee - Plant in Service - No HCS Palmyra-Pawnee - Land - No HCS 3017 3017 3017 $ $ $ 245,733,043 8,177,210 1m Fargo-Galesburg-Oak Grove - CWIP 3022 $ 1n 1o 1p 1q 1r 1s 1t 1u Fargo-Galesburg-Oak Grove - Plant in Service - No HCS Fargo-Galesburg-Oak Grove - Land - No HCS Pawnee-Pana - CWIP Pawnee-Pana - Plant in Service - No HCS Pawnee-Pana - Land - No HCS Adair-Palmyra - CWIP Adair-Palmyra - Plant in Service - No HCS Adair-Palmyra - Land - No HCS 3022 3022 3169 3169 3169 3170 3170 3170 $ $ $ $ $ $ $ $ 2 MVP Total Annual Revenue Requirements $71,386,314 3 Rev. Req. Adj For Attachment O $71,386,314 $ $ $ $ $ $ $ $ 91,212 - $ $ $ 15,120,908 778,416 405,274 $ (492,359) $ $ 211,302 $ 14,628,549 778,416 616,576 - $ $ $ $ $ $ 7,297,352 183,729 216,008 94,653 $ (134,662) $ $ 171,241 $ - $ $ - $ 7,162,690 354,971 216,008 94,653 $ $ $ - $ $ $ 35,301,697 1,176,298 $ $ (404,306) $ $ 1,216,042 $ 34,897,391 2,392,340 1,886,521 $ - $ 2,061,101 $ 557 $ 2,061,658 446,980 3,669,557 370,523 3,421,391 101,323 $ $ $ $ $ $ $ $ - $ $ $ $ $ $ $ $ 488,283 4,009,140 404,762 3,738,008 110,686 $ $ $ $ $ $ $ $ 532,626 4,068,452 843,348 4,025,609 229,901 $ $ $ $ $ $ 44,343 59,313 $ $ 438,587 287,601 $ 119,215 $1,516,874 $72,903,188 13 ATXI 2013 TRUE UP – ATTACHMENT MM ATXI 2013 Attachment MM True Up (a) Line No. 1 (b) (c) (d) Project Name MTEP Project Number Actual Attachment MM Revenues Actual Attachment MM revenues for True-Up Year 1 $ 2a Pana-Sugar Creek 2237 2b Pana-Sugar Creek - Land - No HCS 2237 2c Sidney-Rising 2239 2d Sidney-Rising - Land - No HCS 2239 2e Palmyra-Pawnee 3017 2f Palmyra-Pawnee - Land - No HCS 2g Fargo-Galesburg-Oak Grove (e) (f) Actual Attachment MM Revenues Allocated to Projects 1 [Col. (d), line 1 x (Col. (e), line 2x / Col. (e), line 3)]2 Projected Annual Revenue Requirement 1 Projected Attachment MM p 2 of 2, Col. 142 (g) (h) (i) (j) (k) Actual Annual Revenue Requirement 1 Actual Attachment MM p 2 of 2, Col. 142 True-Up Adjustment Principal Under/(Over) Applicable Interest Rate on Under/(Over) True-Up Adjustment Interest Under/(Over) Total True-Up Adjustment Col. (g) - Col. (f) Line 5 Col. (h) x Col. (i) x 24 months 2 Col. (h) + Col. (j) (488,991) 0.03% (3,368) (492,359) 5,146,572 1,813,837 1,670,447 1,181,456 - 209,857 209,857 0.03% 1,445 211,302 380,474 350,396 216,655 (133,741) 0.03% (921) (134,662) - 170,070 170,070 0.03% 1,171 171,241 3,107,372 2,861,723 2,460,183 (401,540) 0.03% (2,766) (404,306) 3017 - 1,207,723 1,207,723 0.03% 8,319 1,216,042 3022 - 553 553 0.03% 4 557 - 44,040 44,040 0.03% 303 44,343 322,913 58,907 2h Fargo-Galesburg-Oak Grove - Land - No HCS 3022 2i Pawnee-Pana 3169 0.03% 406 59,313 2j Pawnee-Pana - Land - No HCS 3169 - 435,587 435,587 0.03% 3,000 438,587 2k Adair-Palmyra 3170 - 285,634 285,634 0.03% 1,967 287,601 2l Adair-Palmyra - Land - No HCS 3170 - 118,399 118,399 0.03% 816 119,215 3 Subtotal 4 Under/(Over) Recovery 5 Applicable Interest rate per month (expressed to four decimal places) 1 Amount excludes True-Up Adjustment, as reported in True-Up Year projected Attachment MM, page 2, column 15. Rounded to whole dollars. 2 286,668 $ 5,588,351 264,006 $ 5,146,572 $ 6,653,070 $ 1,506,498 Interest Rate updated through July 2014 $ 10,376 $ 1,516,874 0.0287% 14 ATXI 2015 MVP SPEND MVPs Ameren Name 2015 CAPEX MTEP #s MTEP Description 2237 2239 3017 3169 3170 Pana - Mt. Zion - Kansas - Sugar Creek 345 kV line Sidney to Rising 345 kV line Palmyra-Quincy-Meredosia - Ipava & Meredosia-Pawnee 345 kV Line Pawnee to Pana - 345 kV Line New Palmyra Substation (Maywood) Illinois Rivers $316.0 million Spoon River $28.2 million 3022 Fargo-Galesburg-Oak Grove 345 kV Line Mark Twain $8.0 million 2248 3170 Adair - Ottumwa 345 kV Line Adair-Palmyra 345 kV Line 15 AIC Revenue Requirement Projected 2014 vs Projected 2015 16 AIC 2015 PROJECTION AIC Rate Base Jan-14 Page.Line 2.6 Total Gross Plant 2.12 Jan-15 Change Percent 1,327,622,018 1,597,243,472 269,621,454 20% Total Accum Depreciation 465,639,921 480,701,771 15,061,849 3% 2.18 TOTAL NET PLANT 861,982,097 1,116,541,701 254,559,605 30% 2.18a 100% CWIP RECOVERY 0 27,739,705 27,739,705 N/A ADJUSTMENTS TO RATE BASE 2.20 Account No. 282 -229,080,460 -285,677,648 -56,597,188 25% 2.21 Account No. 283 -17,757,369 -25,147,591 -7,390,222 42% 2.22 Account No. 190 40,041,062 38,348,097 -1,692,966 -4% 2.23 Account No. 255 0 0 0 N/A 2.25 Land Held for Future Use 425,040 1,209,908 784,868 185% 2.26 CWC 4,767,079 5,525,584 758,504 16% 2.27 Materials & Supplies 8,000,238 10,110,433 2,110,195 26% 2.28 Prepayments 1,049,481 1,538,083 488,602 47% -192,554,928 -254,093,135 -61,538,206 32% 669,427,168 890,188,272 220,761,104 33% TOTAL ADJUSTMENTS 2.30 TOTAL RATE BASE 17 AIC 2015 PROJECTION AIC Expenses Jan-14 Page.Line Jan-15 Change Percent 3.1 3.1a 3.2 3.3 3.4 3.5 3.5a 3.8 O&M Transmission Less LSE Expenses Less Account 565 A&G Less FERC Annual Fees Less EPRI, ect. Plus Trans. Reg. Comm. Exp TOTAL O&M 42,031,093 2,577,054 13,190,160 12,184,795 0 408,626 96,587 38,136,635 41,012,814 1,685,383 9,206,193 14,085,792 0 356,844 354,483 44,204,670 -1,018,279 -891,671 -3,983,967 1,900,997 0 -51,782 257,897 6,068,035 -2% -35% -30% 16% N/A -13% 267% 16% 3.12 TOTAL DEPRECIATION 22,612,545 28,851,740 6,239,195 28% 3.13 3.16 3.18 3.27 TAXES Payroll Property Other Income Taxes TOTAL TAXES 894,566 1,048,910 388,574 31,970,516 34,302,566 944,247 1,132,036 378,748 39,706,388 42,161,419 0 49,681 83,126 -9,825 7,735,872 7,858,853 N/A 6% 8% -3% 24% 23% TOTAL EXPENSES 95,051,746 115,217,829 20,166,083 21% 18 AIC 2015 PROJECTION Total AIC Capital Structure Capital Structure - 2014 Projection Page.Line 4.27 4.28 4.29 4.3 Long Term Debt Preferred Stock Common Stock Total $ 1,972,228,239 61,721,350 2,508,477,417 4,542,427,006 % 43% 1% 55% 100% Cost Weighted 0.0615 0.0267 0.0490 0.0007 0.1238 0.0684 0.0957 45% 1% 54% 100% Cost Weighted 0.0594 0.0267 0.0490 0.0006 0.1238 0.0666 0.0939 Capital Structure - 2015 Projection Page.Line 4.27 4.28 4.29 4.3 Long Term Debt Preferred Stock Common Stock Total Change in Return $ 2,210,270,314 61,721,350 2,646,273,821 4,918,265,485 % -0.1785% 19 AIC 2015 PROJECTION Total AIC Revenue Requirement 2.30 4.30 3.28 TOTAL RATE BASE Rate of Return Return Jan-14 669,427,168 9.57% 64,074,874 3.29 Total Expenses TOTAL GROSS REV. REQ. 95,051,746 159,126,620 115,217,829 198,833,985 20,166,083 39,707,365 21% 25% 3.30 3.30a 3.31 Less ATT. GG Adjustment Less ATT. MM Adjustment GROSS REV. REQ. UNDER ATT. O 5,567,662 0 153,558,958 10,393,645 5,819,860 182,620,480 4,825,983 5,819,860 29,061,522 87% N/A 19% Page.Line Jan-15 890,188,272 9.39% 83,616,156 Change 220,761,104 -0.18% 19,541,282 Percent 33% -2% 30% 20 AIC 2015 PROJECTION AIC True-up & Net Revenue Requirement Page.Line 1.1 1.6 Gross Revenue Requirement Total Revenue Credits 1.6a 1.6b 1.6c 1.6d 1.6e Historic Year Actual ATRR Projected ATRR from Prior Year Prior Year ATRR True-Up Prior Year Divisor True-Up Interest on Prior Year True-Up 1.7a 1.7b 1.7 NET REVENUE REQUIREMENT Prairie Power AIC Adjusted Revenue Requirement Jan-14 153,558,958 10,558,034 Jan-15 182,620,480 12,163,781 Change 29,061,522 1,605,747 Percent 19% 15% 0 0 0 0 0 123,689,426 133,507,911 (9,818,485) (822,872) (691,603) 123,689,426 133,507,911 (9,818,485) (822,872) (691,603) N/A N/A N/A N/A N/A 143,000,924 0 143,000,924 159,123,738 0 159,123,738 16,122,814 0 16,122,814 11% N/A 11% 21 AIC 2013 TRUE UP – ATTACHMENT O Ameren Illinois Company - AIC 2013 Attachment O Revenue Requirement True-Up (WP 15) Year Ended December 31, 2013 Attachment O Net Actual Revenue Requirement (Attachment O, Pg 1, Line 7a) $ 123,689,426 Net Projected Revenue Requirement (2013 Projected Attachment O, Pg 1, Line 7a) $ 133,507,911 Under/(Over) Recovery of Net Revenue Requirement $ (9,818,485) Historic Year Actual Divisor for Pricing Zone (Attachment O, Pg 1, Line 15) Projected Year Divisor for Pricing Zone (2013 Projected Attachment O, Pg 1, Line 15) Difference between Historic & Projected Yr Divisor Prior Year Projected Annual Cost ($ per kw per yr) Prior Year Under/(Over) Divisor True-up $ $ Total Under/(Over) Recovery $ Monthly Interest Rate (updated through July, 2014) Interest For 24 Months $ Total Under/(Over) Recovery Including Interest $ 7,219,264 7,175,041 (44,223) 18.6073 (822,872) (10,641,357) 0.2708% (691,603) (11,332,960) 22 AIC 2015 PROJECTION AIC Attachment GG Calculation - Page 1 (1) Line No. 1 2 Gross Transmission Plant - Total Net Transmission Plant - Total 3 4 O&M EXPENSE Total O&M Allocated to Transmission Annual Allocation Factor for O&M 5 6 GENERAL AND COMMON (G&C) DEPRECIATION EXPENSE Total G&C Depreciation Expense Annual Allocation Factor for G&C Depreciation Expense 7 8 (2) Attachment O Page, Line, Col. Attach O, p 2, line 2 col 5 (Note A) Attach O, p 2, line 14 and 23b col 5 (Note B) (3) (4) Transmission Allocator 1,542,816,240 1,079,289,894 Attach O, p 3, line 8 col 5 (line 3 divided by line 1 col 3) 44,204,670 2.87% 2.87% Attach O, p 3, lines 10 & 11, col 5 (Note H) (line 5 divided by line 1 col 3) 2,743,077 0.18% 0.18% TAXES OTHER THAN INCOME TAXES Total Other Taxes Annual Allocation Factor for Other Taxes Attach O, p 3, line 20 col 5 (line 7 divided by line 1 col 3) 2,455,031 0.16% 0.16% 9 Annual Allocation Factor for Expense Sum of line 4, 6, and 8 10 11 INCOME TAXES Total Income Taxes Annual Allocation Factor for Income Taxes Attach O, p 3, line 27 col 5 (line 10 divided by line 2 col 3) 39,706,388 3.68% 3.68% 12 13 RETURN Return on Rate Base Annual Allocation Factor for Return on Rate Base Attach O, p 3, line 28 col 5 (line 12 divided by line 2 col 3) 83,616,156 7.75% 7.75% 14 Annual Allocation Factor for Return Sum of line 11 and 13 3.20% 11.43% 23 AIC 2015 PROJECTION AIC Attachment GG Calculation - Page 2 (1) Line No. 1a 1b 1c 1d 1e Project Name Wood River-Roxford 1502 138kV line Sidney-Paxton 138kV Reconductor 18 miles Coffeen Plant-Coffeen, North - 2nd. Bus tie Latham - Oreana 8.5 mile 345kV line Brokaw - South Bloomington 345/138kV Transformer & line extension (2) MTEP Project Number 728 870 2829 2068 2069 $ $ $ $ $ (3) (4) Project Gross Plant Annual Allocation Factor for Expense (Note C) (Page 1 line 9) 3,424,487 5,994,479 5,592,558 23,646,156 27,401,139 (5) 3.20% 3.20% 3.20% 3.20% 3.20% (6) (7) (8) (9) (10) (11) (12) Annual Expense Charge Project Net Plant Annual Allocation Factor for Return Annual Return Charge Project Depreciation Expense Annual Revenue Requirement True-Up Adjustment Network Upgrade Charge (Col. 3 * Col. 4) (Note D) (Page 1 line 14) (Col. 6 * Col. 7) (Note E) (Sum Col. 5, 8 & 9) (Note F) Sum Col. 10 & 11 (Note G) $109,656.07 $191,950.22 $179,080.24 $757,177.53 $877,416.47 $ $ $ $ $ 2,993,930 5,195,138 5,145,653 23,120,897 27,164,639 11.43% 11.43% 11.43% 11.43% 11.43% $342,094.43 $593,610.34 $587,956.05 $2,641,855.37 $3,103,904.17 $52,500 $99,720 $97,896 $350,082 $408,746 $504,250.51 $885,280.55 $864,932.29 $3,749,114.90 $4,390,067.05 2 Annual Totals $10,393,645 3 Rev. Req. Adj For Attachment O $10,393,645 $ $ $ $ $ 6,549 5,886 26,307 610,422 - $649,164 510,800 891,167 891,239 4,359,537 4,390,067 $11,042,809 24 AIC 2013 TRUE UP – ATTACHMENT GG AIC 2013 Attachment GG True Up (a) (b) (c) (d) (e) Line Project MTEP Project Actual Attachment GG No. Name Number Revenues 1 Actual Attachment GG revenues for True-Up Year 1 (g) (h) (i) (j) (k) Projected Annual Revenue (f) Actual Attachment GG Revenues Allocated Actual Annual Revenue True-Up Adjustment Principal Applicable Interest Rate on True-Up Adjustment Interest Total True-Up Requirement 1 Projected Attachment GG to Projects 1 [Col. (d), line 1 x (Col. (e), line 2x / Requirement 1 Actual Attachment GG Under/(Over) Under/(Over) Under/(Over) Adjustment p 2 of 2, Col. 102 Col. (e), line 3)]2 p 2 of 2, Col. 102 Col. (g) - Col. (f) Line 5 x 24 months 2 Col. (h) + Col. (j) $2,517,438 2a 2b 2c 2d Wood River-Roxford 1502 138kV line Sidney-Paxton 138kV Reconductor 18 miles Coffeen Plant-Coffeen, North - 2nd. Bus tie Latham - Oreana 8.5 mile 345kV line 3 Subtotal 4 Under/(Over) Recovery 5 Applicable Interest rate per month (expressed to four decimal places) 1 Amount excludes True-Up Adjustment, as reported in True-Up Year projected Attachment GG, page 2, column 11. Rounded to whole dollars. 2 Col. (h) x Col. (i) 728 870 2829 2068 536,385 949,603 907,302 564,209 998,862 954,367 570,714 1,004,708 980,495 606,275 $2,393,290 $2,517,438 $3,162,192 6,505 5,846 26,128 606,275 0.03% 0.03% 0.03% 0.03% $644,754 Interest Rate updated through July 2014 44 40 179 4,147 6,549 5,886 26,307 610,422 $4,410 $649,164 0.0285% 25 AIC 2015 PROJECTION AIC Attachment MM Calculation - Page 1 (1) Line No. (2) Attachment O Page, Line, Col. Attach O, p 2, line 2 col 5 (Note A) Attach O, p 2, line 8 col 5 Line 1 minus Line 1a (Note B) (3) (4) Transmission Allocator 1 1a 2 Gross Transmission Plant - Total Transmission Accumulated Depreciation Net Transmission Plant - Total 3 3a 3b 3c 3d O&M TRANSMISSION EXPENSE Total O&M Allocated to Transmission Transmission O&M Less: LSE Expenses included in above, if any Less: Account 565 included in above, if any Adjusted Transmission O&M 4 Annual Allocation Factor for Transmission O&M 4a 4b OTHER O&M EXPENSE Other O&M Allocated to Transmission Annual Allocation Factor for Other O&M 5 6 GENERAL AND COMMON (G&C) DEPRECIATION EXPENSE Total G&C Depreciation Expense Annual Allocation Factor for G&C Depreciation Expense 7 8 TAXES OTHER THAN INCOME TAXES Total Other Taxes Annual Allocation Factor for Other Taxes 9 Annual Allocation Factor for Other Expense 10 11 INCOME TAXES Total Income Taxes Annual Allocation Factor for Income Taxes Attach O, p 3, line 27 col 5 (line 10 divided by line 2 col 3) 39,706,388 12 13 RETURN Return on Rate Base Annual Allocation Factor for Return on Rate Base Attach O, p 3, line 28 col 5 (line 12 divided by line 2 col 3) 83,616,156 14 Annual Allocation Factor for Return Attach O, p 3, line 8 col 5 Attach O, p 3, line 1 col 5 Attach O, p 3, line 1a col 5, if any Attach O, p 3, line 2 col 5, if any Line 3a minus Line 3b minus Line 3c 1,542,816,240 463,526,346 1,079,289,894 44,204,670 41,012,814 1,685,383 9,206,193 30,121,238 (Line 3d divided by line 1a, col 3) Line 3 minus Line 3d Line 4a divided by Line 1, col 3 14,083,432 Attach O, p 3, lines 10 & 11, col 5 (Note H) (line 5 divided by line 1 col 3) 2,743,077 Attach O, p 3, line 20 col 5 (line 7 divided by line 1 col 3) 2,455,031 Sum of line 4b, 6, and 8 Sum of line 11 and 13 6.50% 6.50% 0.91% 0.91% 0.18% 0.18% 0.16% 0.16% 1.25% 1.25% 3.68% 3.68% 7.75% 7.75% 11.43% 26 AIC 2015 PROJECTION AIC Attachment MM Calculation - Page 2 Line No. (1) (2) (3) (4) (5) Project Name MTEP Project Number Project Gross Plant Project Accumulated Depreciation (Note C) 2237 2237 2239 2239 3017 3017 3022 3022 3169 $ $ $ $ $ $ $ $ $ 13,000,509 1,688,470 3,321,345 6,465,961 14,548,742 619,451 4,332,438 $ $ $ $ $ $ $ $ $ 11,269 109,575 - 1q 3169 $ 147,399 $ 166 (1) Line No. Project Name Multi-Value Projects (MVP) 1a Pana-Sugar Creek - CWIP 1b Pana-Sugar Creek - Plant in Service 1d Sidney-Rising - CWIP 1e Sidney-Rising - Plant in Service 1j Palmyra-Pawnee - CWIP 1k Palmyra-Pawnee - Plant in Service 1m Fargo-Galesburg-Oak Grove - CWIP 1n Fargo-Galesburg-Oak Grove - Plant in Service 1p Pawnee-Pana - CWIP 1q Pawnee-Pana - Plant in Service 2 MVP Total Annual Revenue Requirements 3 Rev. Req. Adj For Attachment O (2) (10) MTEP Project Number 2237 2237 2239 2239 3017 3017 3022 3022 3169 3169 $ $ $ $ $ $ $ $ $ $ (Col 4 * Col 5) 6.50% 6.50% 6.50% 6.50% 6.50% 6.50% 6.50% 6.50% 6.50% (11) (9) (Col 3 * Col 7) (Col 6 + Col 8) 1.25% 1.25% 1.25% 1.25% 1.25% 1.25% 1.25% 1.25% 1.25% $162,475.50 $21,101.86 $41,508.93 $0.00 $80,809.16 $181,824.73 $7,741.67 $0.00 $54,145.19 $162,475.50 $21,834.14 $41,508.93 $0.00 $80,809.16 $188,945.22 $7,741.67 $0.00 $54,145.19 6.50% $ 11 1.25% $1,842.14 $1,852.92 Annual Allocation Factor for Return Annual Return Charge (Col 3 - Col 4) (Page 1 line 14) (Col 10 * Col 11) $ $ $ $ $ $ $ $ $ $ Page 1 line 9 732 7,120 - (12) 11.43% 11.43% 11.43% 11.43% 11.43% 11.43% 11.43% 11.43% 11.43% 11.43% (8) $ $ $ $ $ $ $ $ $ Project Net Plant 13,000,509 1,677,201 3,321,345 6,465,961 14,439,167 619,451 4,332,438 147,233 (7) Transmission O&M Annual Allocation Other Expense Annual Allocation for Transmission Annual Annual Allocation Annual Expense Factor O&M Expense Allocation Factor for Other Expense Charge Page 1 line 4 Multi-Value Projects (MVP) 1a Pana-Sugar Creek - CWIP 1b Pana-Sugar Creek - Plant in Service 1d Sidney-Rising - CWIP 1e Sidney-Rising - Plant in Service 1j Palmyra-Pawnee - CWIP 1k Palmyra-Pawnee - Plant in Service 1m Fargo-Galesburg-Oak Grove - CWIP 1n Fargo-Galesburg-Oak Grove - Plant in Service 1p Pawnee-Pana - CWIP Pawnee-Pana - Plant in Service (6) 1,485,473 191,641 379,506 738,818 1,649,858 70,780 495,036 16,823 (13) (14) (15) (16) Project Depreciation Annual Revenue Expense Requirement True-Up Adjustment MVP Annual Adjusted Revenue Requirement (Sum Col. 9, 12 & 13) Sum Col. 14 & 15 (Note G) (Note E) $ $ $ $ $ $ $ $ $ $ 32,574 197,883 2,156 $ $ $ $ $ $ $ $ $ $ 1,647,948 246,049 421,015 819,627 2,036,686 78,522 549,181 20,832 $5,819,860 (Note F) $ $ $ $ $ $ $ $ $ $ - $ 1,647,948 $ 246,049 $ 421,015 $ $ 819,627 $ 2,036,686 $ 78,522 $ $ 549,181 $ 20,832 $0 $5,819,860 27 AIC 2015 MVP SPEND MVPs Ameren Name 2015 CAPEX Illinois Rivers $46.4 million Spoon River $1.7 million MTEP #s MTEP Description 2237 2239 3017 3169 3170 Pana - Mt. Zion - Kansas - Sugar Creek 345 kV line Sidney to Rising 345 kV line Palmyra-Quincy-Meredosia - Ipava & Meredosia-Pawnee 345 kV Line Pawnee to Pana - 345 kV Line New Palmyra Substation (Maywood) 3022 Fargo-Galesburg-Oak Grove 345 kV Line 28 AIC PROJECTIONS FOR 2015 Significant Line Expansion Projects (> $25 Million) Project Name Latham-Oreana (Attach GG) Brokaw-S Bloomington (Attach GG) Total Cost $24 M $28 M ISD MTEP 2013/ MTEP08 2014 2014 MTEP08 MISO ID# MTEP Description 2068 Convert Oreana 345 kV Bus to 6-Position Ring Bus with 3000 A Capability; Construct 8.5 miles of 345 kV line (2-954 kcmil ACSR conductor or equivalent capability) from Oreana Substation to 345 kV Line 4571 tap to Latham Substation. 3-345 kV PCB's at Oreana Substation. 2069 South Bloomington Area 345/138 kV Substation - Install 345/138 kV, 560 MVA Transformer. Extend new 345 kV line approximately 5 miles from Brokaw Substation to South Bloomington Substation. Install 1-138 kV PCB at South Bloomington Substation, and 2-345 kV PCB's at Brokaw Substation. Fargo-Mapleridge (Attach GG) $47 M 2016 MTEP09 2472 Tap existing 345kV line from Duck Creek to Tazewell and create new Mapleridge Substation. Build a new supply line to the Fargo Substation by extending 20 miles of 345kV from the new Mapleridge Substation. Install 560 MVA 345/138kV Transformer at Fargo. Bondville-SW Campus $38 M 2014 MTEP10 2992 Bondville-S.W. Campus 138 kV - Construct 8 miles of new 138 kV line. Construct 138 kV Ring Bus at Bondville (2 new PCB's) and a 138 kV Ring Bus at Champaign S.W. Campus (4 new PCB's). Edwards Substation $29M 2015 MTEP14 4315 Rebuild 138 kV switchyard at Edwards Plant. Arrange as breaker-and-a-half scheme. Replace 15-138 kV Breakers. Cahokia-Turkey Hill $34M 2014/ MTEP13 2015 3013 Havana-Danvers-1352 138 kV Rebuild $32M 2015 MTEP14 4493 Convert the Turkey Hill-Cahokia 138kV line 1492 line to 345kV operation (approximately 19 miles). Install a new 345kV breaker position at both Turkey Hill and Cahokia to accommodate this new line. Rebuild the Havana-Danvers 138 kV line 1352 from Powerton Tap to Danvers (29.8 miles) and install conductor having a minimum summer emergency capability of 1200 A. Rebuild Danvers-West Washington line 1364 from Danvers to Diamond Star Tap for 1200 A capability. 29 AIC PROJECTIONS FOR 2014 - 2015 Modifications to Existing Facilities Category Reliability/aging infrastructure replacement Clearance for planned line rating 2014-2015 CAPEX Projects $416 million $143 million 366 148 Right of way expansion $19 million 34 Improved Reliability $3 million 12 Description These projects are primarily driven by the need to upgrade the transmission system based on meeting NERC standards or Ameren Planning Criteria and Guidelines. The NERC TPL standards set forth a set of tests that a transmission system must meet for a list of plausible scenarios, including contingent scenarios. Ameren Planning Criteria and Guidelines (C&G) are filed each year at FERC and constitute an additional, or complementary, set of tests that the transmission system must meet. These projects are primarily driven by the need to upgrade the transmission system to support expected flows on the transmission circuits. Load growth, plant additions/retirements, and flow changes due to future system expansions are primary inputs into the decision to either increase ground clearances using existing wire or in some cases, increasing ground clearances with wire replacement, in order to achieve higher circuit ratings. These projects are driven by the need to increase the rights and rights-of-way associated with 40 transmission corridors. The primary benefit of this set of projects is increased reliability of the system in the area of vegetation. In many cases, the existing rights-of-way are much narrower than the widths specified in Ameren's Planning Criteria and Guidelines for reliable circuit operation. The 2003 blackout and the recent 2011 Northeast US major outage event had vegetation as an incipient cause. After both events, and with the adoption of the FAC-003 standard, FERC has emphasized the need for increased vegetation management efforts which these projects support. These projects are driven by the need to address reliability concerns driven by system topology, configuration, or condition. Operating issues, including outages, usually identify these kinds of projects. The majority of these projects involve additions of equipment in substations, e.g. relaying and/or circuit breakers. 30 SCHEDULE 9 NITS RATE FOR 2015 Page.Line 1.7 1.7 1.7 1.15 . . AIC Adjusted Revenue Requirement ATXI Adjusted Revenue Requirement PPI Adjusted Revenue Requirement * Total Revenue Requirement Ameren Illinois Divisor Annual Cost ($/kW/Yr) Network & P-to-P Rate ($/kW/Mo) Jan-14 143,000,924 10,761,294 2,734,142 156,496,360 7,045,000 22.214 1.851 Jan-15 159,123,738 9,851,594 3,863,037 172,838,369 7,095,335 24.359 2.030 Change 16,122,814 -909,701 1,128,895 16,342,009 50,335 2.146 0.179 Percent 11% -8% 41% 10% 1% 10% 10% * PPI has a historical Attachment O so their rates changes each June 1st. The amount shown for 2014 is the ATRR revised in March 14. The amount shown for 2015 is the ATRR effective 6/1/14 - 5/31/15 31 QUESTIONS? APPENDIX - MISO WEB LINKS • Transmission Pricing - Attachments O, GG & MM Information • https://www.misoenergy.org/MarketsOperations/TransmissionSettlement s/Pages/TransmissionPricing.aspx • Ameren OASIS • http://www.oasis.oati.com/AMRN/index.html • MTEP 13 • https://www.misoenergy.org/Planning/TransmissionExpansionPlanning/ Pages/MTEP13.aspx • MTEP 14 • https://www.misoenergy.org/Planning/TransmissionExpansionPlanning/ Pages/MTEP14.aspx • Schedule 26 & 26-A Indicative Charges • https://www.misoenergy.org/Planning/TransmissionExpansionPlanning/ Pages/MTEPStudies.aspx 33 APPENDIX - AIC AND ATXI • Additional questions can be sent to Ameren’s Formula Rates email address – MISOFormulaRates@ameren.com 34