Controller, Foundation

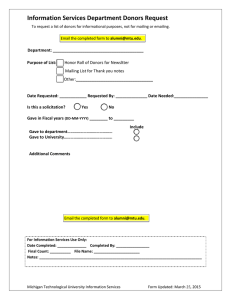

advertisement

Item 9.B-Aug. 20, 2010 ADMINISTRATIVE FACULTY POSITION DESCRIPTION QUESTIONNAIRE To expedite and facilitate the PDQ review process, please send the PDQ and Org Chart electronically to marshag@unr.edu for discussion and for initial review before routing PDQ for approval signatures. Questions - call UNR-HR at 682-6114 ******************************************************************************************************************* INSTRUCTIONS: See http://www.unr.edu/vpaf/hr/compensation/placement.html for complete instructions. ******************************************************************************************************************* Incumbent(s) Name (if applicable): Tamara Koszuth Position #(s): 10802 Current Title: Controller, Foundation Current Range: 4 (JCC:77325;3C;CM3528;CC012;E) Department: Development and Alumni Relations College/Division: Development and Alumni Relations Account #: 1101-103-0001 Action Proposed: (check all that apply) ( ) New position: Proposed Range: Proposed Title: ( ) Title Change, Proposed Title: ( ) Proposed Reassignment from Range to Range (X ) Revised PDQ only (no change in range or title) ( ) Line of Progression (show titles below) Range: JCC (HR assigned): I certify that the statements in this description are accurate and complete to the best of my knowledge. ____________________________________________________________ Employee’s Signature __________________ Date I/we have reviewed the statements in this form and they accurately reflect the job assignments. ____________________________________________________________ Immediate Supervisor’s Signature __________________ Date ____________________________________________________________ Director/Chair/Dean Bruce Mack AVP, Development & Alumni Relations __________________ Date Approved for Salary Placement Committee review. ____________________________________________________________ __________________ Pres / Vice Pres / Vice Prov Signature John Carothers Date Vice President, Development and Alumni Relations Action Approved by the President (Completed by Faculty HR): Position #: 10811 EEO Code: 3C CUPA Code: CM3528 Exempt: Yes or No Census Code: 012 Job Class Code: 77325 Range: 4 Effective Date: Approved Title: CONTROLLER, FOUNDATION ____________________________________________________________ __________________ Employee Signature Date (Employee signs and sends to HR for personnel file after PDQ has been “final” stamped for approval) Rev: 12/1/2008 Position Description – Controller, Foundation Page 2 1. Summary Statement: State the major function(s) of the position and its role in the university. Attach an organizational chart with positions, ranges, and names for the division which reflects the position in it as well as those supervised in the department. (This section is used for advertisement of the position.) The Controller, Foundation, reports to the Director of Finance for Development and Alumni Relations and is responsible for the physical protection of the University and Foundation’s assets which includes cash, checks, stocks, investments, land, and other non-liquid assets. The Controller manages the day to day investments of the foundation and ensures sound fiscal management of the gift receipting process on campus. The individual establishes and enforces policies and procedures for recording all gifts in a timely manner and enforcing sound internal controls over the process. 2. List the major responsibilities, including percentage of time devoted to each. Provide enough detail to enable a person outside the department to understand the job (percentage first with heading and then bulleted information). 25% - Asset Processing Oversight Oversees processing and acknowledging of gifts, pledges, pledge payments, matching claims, memorial gifts, in honor gifts, membership payments, and other contributions to the University of Nevada, Reno (UNR), i.e., Board of Regents, Foundation, and Athletics Association at University of Nevada (AAUN), which may often be of significant dollar values Reviews weekly work assignment schedules to maintain adequate staffing levels, and proper daily and weekly reports to ensure that processing of incoming mail and donations occurs in a timely and efficient manner Oversees the supervision (professional and classified staff) and hiring and training process for all classified positions Coordinates and approves leave requests Maintains a schedule of annual review and merit dates and oversees the timely completion of evaluation forms and personnal action forms Initiates and documents disciplinary actions 20% - Audit Oversight Oversees the year-end and interim audit work with external auditors for 3 separate entities with concurrent audits Schedules work assignments for reconciliations, lists, and other items required for the annual audits Answers questions for external auditors Oversees the year-end closing process to ensure that the Foundation, AAUN and AAUN Endowment accounting records are accurate and complete in preparation for their annual audits Prepares the audited financial statements for 3 separate entities in accordance with Governmental Accounting Standards Board (GASB) Assists the UNR financial staff in rolling the Foundation statements up (prepares schedules and answers staff or auditor questions regarding Foundation, AAUN and AAUN Endowment financial statements) 20% - Daily Cash and investments Management Manages daily cash and investments in excess of $110 million dollars in accordance with the guidelines of the investment committee Monitors and maintains cash flow projections and budgets to include forecasting activity in accounts and projected cash needs on a daily, monthly, quarterly, and annual basis Produces quarterly investment reports to the investment committee Position Description – Controller, Foundation Page 3 20% - Financial Report Generation Generates monthly financial reports for departments on campus to reconcile their university accounts Generates monthly financial statements for the Foundation, AAUN and AAUN Endowment for presentation at board of trustee, executive committee, investment, and finance meetings Acts as the primary contact with campus staff regarding establishing new accounts, processing gifts, and ensuring that contractual agreements with donors are followed Reviews and approves all journal entries Coordinates or performs internal audits on Foundation and University gift accounts Provides training classes to university staff on how to reconcile and manage accounts 15% - Internal Revenue Service Reporting Oversees the preparation of Internal Revenue Service (IRS) tax forms to include form 990 (return of organizations exempt from income tax), Form 1041 (returns for estates and trusts), Form 5227 (split interest trust return), Form 1099 (miscellaneous income), Form 8283 (noncash charitable contributions appraisal summary), Form 8282 donee information return) 3. Describe the level of freedom to take action and make decisions with or without supervision and how the results of the work performed impact the department, division and/or the university as a whole. Level of Freedom: This position has minimal supervision and is responsible for the financial resources of the Foundation. The decisions and judgments made by this position have an immediate impact on the perception of donors, alumni and the public regarding the fiscal reputation of the university. The reports, analyses, and information generated from the Foundation must be accurate, adhere to Nevada System of Higher Education (NSHE) policies and procedures and the Internal Revenue Code. Impact: The Controller is of significant importance to the success of fundraising on the entire university campus. This position is very visible to the public, potential donors and donors and therefore has a direct impact on the perception of the university in its fundraising efforts. The finance related decisions and judgments made by this position impact the reputation and credibility of the Foundation as well as the entire University. The decisions and judgments made by this position will impact the annual fundraising goals. Adverse information could potentially result in a loss of funding from private sources. 4. Describe the knowledge, skills (to include cognitive requirement and verbal and written communication), and abilities (to include task complexity, problem solving, creativity and innovation) essential to successful performance of this job (in bullet format). Knowledge of: General Accepted Accounting principles (GAAP), government Accounting Standards Board (GASB), and Internal Revenue Code rules and regulations for 501c3 organizations Human resources management procedures and policies Thorough understanding of accounting principles and practices, budgetary process and systems of internal control Federal tax laws for non-profit organizations, trusts and estates AICPA standards for financial statement presentation for non-profit organizations Revenue generation/fundraising techniques Endowment development Position Description – Controller, Foundation Page 4 All aspects of fundraising, including capital campaigns, major gift solicitation and cultivation, planned giving, proposal and grant writing, annual fund solicitations, development events and alumni relations events Fundraising terminology and processes Skills: Proficiency in use of a personal computer and current software applications including but not limited to Microsoft Office Suite (Word, Access, Excel, PowerPoint, and email) and accounting systems Strong leadership Organizational skills Analytical skills Higher level of interpersonal relationship skills Negotiation skills Computer applications and systems Decision making Planning Excellent verbal and written communication Ability to: Establish internal accounting controls Prioritize and complete multiple tasks within time constraints Exercise sound judgment in the decision-making process Identify and resolve problems Allocate resources Work independently and exercise judgment, initiative, creativity, tact and diplomacy Wok productively with faculty, staff, peers, donors, trustees, advisory groups and university administrators 5. Describe the type of personal contacts encountered in performing the duties of the job. Explain the nature and purpose of these contacts: i.e., to provide services, to resolve problems, to negotiate. Internal Vice President for Development and Alumni Relations and Legal Counsel for University and Foundation UNR Controller and staff Campus administrators, faculty and staff AAUN & AAUN Endowment administrators and staff External Donors and recipients of funds Advisory groups on and off campus Investment Institutions External auditors for both Reason for Contact To resolve problems with overdrawn accounts and answer questions regarding appropriate use of gift funds To resolve issues and answer questions To provide direction, establish policies and procedures, initiate change and resolve problems To resolve problems, provide information, clarify issues and explain actions To resolve problems, provide information, establish policies and procedures, initiate change, clarify issues and explain actions Reason for Contact To act as liaison in order to assure that required reports will be prepared and forwarded to them To make presentations regarding investment returns and the policies of the university and Foundation with respect to donor funds To obtain services, open accounts, acquired or sell investments, and resolve problems To resolve issues and supply information Position Description – Controller, Foundation University and Foundation UNR Foundation Investment Committee and Audit Committee Donors and other individuals Page 5 To interpret policy, provide information, resolve problems and initiate change To answer questions, clarify issues, interpret policy and resolve issues 6. Indicate the minimum qualifications which are necessary in filling this position should it become vacant. Please keep in mind the duties/responsibilities of the position rather than the qualifications of the incumbent. a. Minimum educational level, including appropriate field, if any. Bachelor’s Degree from a regionally accredited institution with emphasis or major in accounting, business administration, or finance b. Minimum type and amount of work experience, in addition to the above required education necessary for a person entering this position. Bachelor’s Degree and five years or a Master’s Degree and three years of progressively responsible experience in areas of financial accounting and reporting, management, tax return preparation, cash management and computer systems to include at least three years in public accounting with a CPA firm and two years of supervisory duties Preferred Licenses or Certifications: None c. Indicate any license or certificate required for this position. Certified Public Accountant