SECI FMPA 2013 OATT Preliminary Challenge Updated:2013-09-24 13:49 CS

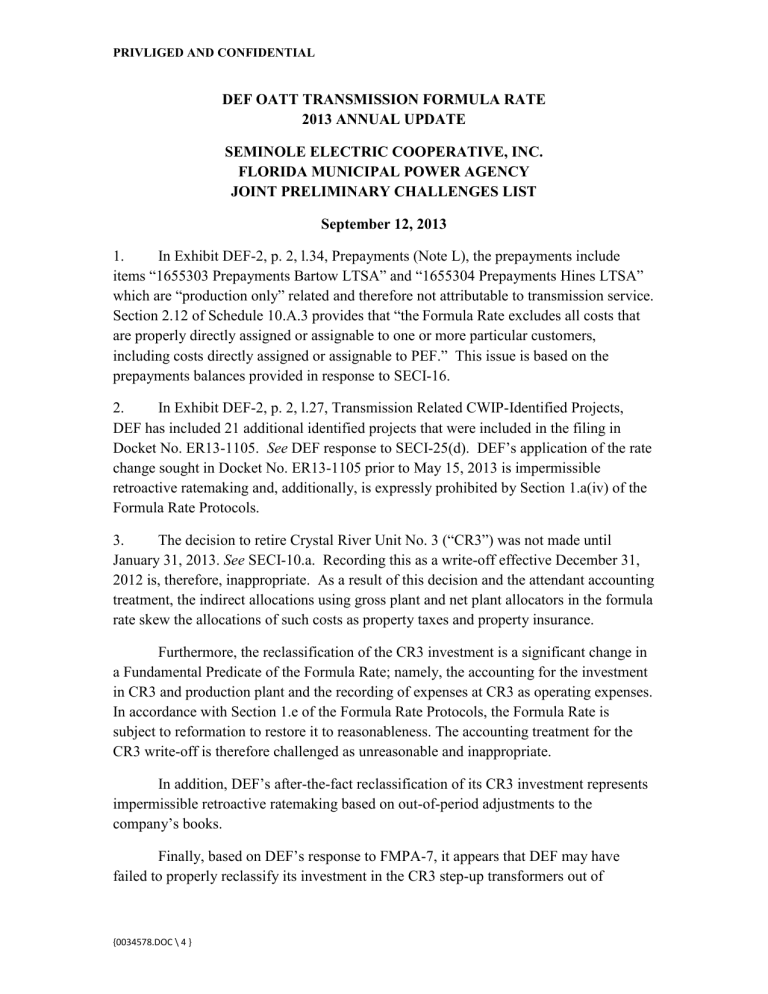

PRIVLIGED AND CONFIDENTIAL

DEF OATT TRANSMISSION FORMULA RATE

2013 ANNUAL UPDATE

SEMINOLE ELECTRIC COOPERATIVE, INC.

FLORIDA MUNICIPAL POWER AGENCY

JOINT PRELIMINARY CHALLENGES LIST

September 12, 2013

1. In Exhibit DEF-2, p. 2, l.34, Prepayments (Note L), the prepayments include items “1655303 Prepayments Bartow LTSA” and “1655304 Prepayments Hines LTSA” which are “production only” related and therefore not attributable to transmission service.

Section 2.12 of Schedule 10.A.3 provides that “the Formula Rate excludes all costs that are properly directly assigned or assignable to one or more particular customers, including costs directly assigned or assignable to PEF.” This issue is based on the prepayments balances provided in response to SECI-16.

2. In Exhibit DEF-2, p. 2, l.27, Transmission Related CWIP-Identified Projects,

DEF has included 21 additional identified projects that were included in the filing in

Docket No. ER13-1105. See DEF response to SECI-25(d). DEF’s application of the rate change sought in Docket No. ER13-1105 prior to May 15, 2013 is impermissible retroactive ratemaking and, additionally, is expressly prohibited by Section 1.a(iv) of the

Formula Rate Protocols.

3. The decision to retire Crystal River Unit No. 3 (“CR3”) was not made until

January 31, 2013. See SECI-10.a. Recording this as a write-off effective December 31,

2012 is, therefore, inappropriate. As a result of this decision and the attendant accounting treatment, the indirect allocations using gross plant and net plant allocators in the formula rate skew the allocations of such costs as property taxes and property insurance.

Furthermore, the reclassification of the CR3 investment is a significant change in a Fundamental Predicate of the Formula Rate; namely, the accounting for the investment in CR3 and production plant and the recording of expenses at CR3 as operating expenses.

In accordance with Section 1.e of the Formula Rate Protocols, the Formula Rate is subject to reformation to restore it to reasonableness. The accounting treatment for the

CR3 write-off is therefore challenged as unreasonable and inappropriate.

In addition, DEF’s after-the-fact reclassification of its CR3 investment represents impermissible retroactive ratemaking based on out-of-period adjustments to the company’s books.

Finally, based on DEF’s response to FMPA-7, it appears that DEF may have failed to properly reclassify its investment in the CR3 step-up transformers out of

{0034578.DOC \ 4 }

PRIVLIGED AND CONFIDENTIAL transmission plant in service, even though DEF did eliminate the credit for those transformers from the formula.

4. DEF has included $327,505 of interest expense on the intercompany Money Pool transactions in Account 430, which is included in the calculation of the Long-Term Debt cost for the cost of capital. DEF’s response in SECI-40 does not justify the inclusion of the Intercompany Money Pool interest in the calculation of the Long-Term Debt cost.

The intercompany Money Pool interest expense is not related to Long-Term Debt and it should not be included in the calculation of the Long-Term Debt cost even if DEF’s assertion that the Money Pool interest expense meets the guidelines of 18 CFR Part 101 were correct.

5. The Company admitted changes in its accounting practices for (i) vacation pay accruals (see response to SECI-17 and SECI-21), (ii) insurance expenses (see response to

SECI-20), and (iii) healthcare and pension costs (see response to SECI-21). The effects of these accounting changes appear inconsistent with the formula rate for the following reasons:

These accounting changes comprise changes in Fundamental Predicates that are subject to Section 1.e of the Formula Rate Protocols;

Certain of these expenses appear to be merger-related expenses. (See the

Company’s response to FMPA-3.c(iv).); and

The associated increases in expenses comprise “Extraordinary Transmission

O&M Expenses” that are subject to normalization and/or amortization pursuant to

Section 2.18 of Schedule 10.A.3 (Notes for Formula Rate).

6. The Company improperly included in allocable A&G expenses its NERC assessments, which are solely related to the Company’s retail and wholesale load, rather than transmission customers’ loads. In accordance with Section 2.12 of Schedule 10.A.3, such expenses should be excluded from the Formula Rate. Also, the portion of the

Company’s payments to FRCC that have been recorded as A&G expenses should be excluded on the same basis.

7. The loads that DEF included in the rate denominator include an error: Whereas, in DEF’s response to SECI-6, DEF indicated that it include a load of 355 MW for FMPA for August, 2012; FMPA’s bill from DEF for that month shows a network load of 367

MW, the difference evidently being that DEF failed to include FMPA load at distribution level.

{0034578.DOC \ 4 }

2

PRIVLIGED AND CONFIDENTIAL

SECI and FMPA understand that DEF agrees with the need to make the following changes. They are included on this Preliminary Challenges List only to the extent that

DEF has not agreed.

8. Exhibit DEF-2, P. 2 of 6, L.2, Transmission Plant (Note V) Beginning Balance –

The beginning balance was incorrectly recorded as $2,029,729,761 and should be corrected to $2,026,495,261. DEF agreed to this correction in DEF’s response to SECI-2.

9. Exhibit DEF-2, P. 2 of 6, L.8, Transmission Depr. Reserve (Note V) Beginning

Balance – The beginning balance was incorrectly recorded as $525,044,666 and should be corrected to $524,844,895. DEF agreed to this correction in DEF’s response to SECI-

3.

{0034578.DOC \ 4 }

3