Derivative Securities Forwards and Options 381 Computational Finance PERTEMUAN 19-20

advertisement

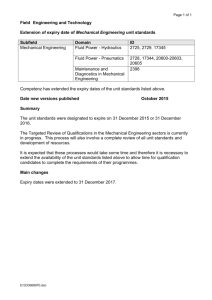

Derivative Securities Forwards and Options PERTEMUAN 19-20 381 Computational Finance Imperial College London Computational Finance 1/47 Topics Covered Derivatives: Forward Contracts, Options Valuation Option techniques Pricing Models Binomial Option Pricing Computational Finance 2/47 Introduction to Derivatives security whose payoff is explicitly tied to value or price of other financial security that determines value of derivative is called underlying security derivatives arise when individuals or companies wish to buy asset or commodity in advance to insure against adverse market movements; effective tools for hedging risks – designed to enable market participants to eliminate risk. business dealing with a good faces risk associated with price fluctuations. control that risk through use of derivative securities. Example: farmer can fix price for crop even before planting, eliminating price risk an exporter can fix a foreign exchange rate even before beginning to manufacture product, eliminating foreign exchange risk. Computational Finance 3/47 Example 1: Derivatives A forward contract to purchase 2000 pounds of sugar at 12 cents per pound in 6 weeks. The contract is a derivative security because its value is derived from the price of sugar. No reference to payoff - contract only guarantees purchase of sugar. The payoff is implied and determined by the price of sugar in 6 weeks. If price of sugar was 13 cents per pound, then contract would have a value of 1 cent per pound, Strategy: the owner of contract could buy sugar at 12 cents according to the contract then sell that sugar in the sugar market at 13 cents. Computational Finance 4/47 Example 2: Derivatives Assume that a contract gives one the right, but not the obligation to purchase 100 shares of GM stock for $60 per share in exactly 3 months. This is an option to buy GM. Payoff of option will be determined in 3 months by the price of GM stock at that time. If GM is selling then for $70, the option will be worth $1000 The owner of option could at that time purchase 100 shares of GM for $60 per share according to option contract, immediately sell those shares for $70 each Computational Finance 5/47 Forward Contracts Forward contract is specified by a legal document, the terms of which bind two parties involved to a specific transaction in the future. on a priced asset is a financial instrument, since it has an intrinsic value determined by the market for underlying asset on a commodity is a contract to purchase or sell a specific amount of commodity at specific time in future at a specific price agreed upon today Contract is between two parties, buyer and seller. buyer (long ): obligated to take delivery of asset & pay agreed-upon price at maturity seller (short): obligated to deliver asset & accept agreed-upon price at maturity Claims are settled at defined future date; both parties must carry out their side of agreement at that time. Forward price applies at delivery, negotiated so that initial payment is zero. Computational Finance 6/47 Commodity Forwards owner of commodities has to maintain their value, requires storage (wheat, gold), feeding (live hogs), or security (gold) cost is called cost of carry expressed as an annual percentage rate q It is treated as a negative dividend. the valuation formula for commodity forwards is obtained as F S 0 e ( r q )T Computational Finance 7/47 Options Holder of forward contract is obliged to trade at maturity of contract Unless the position is closed before maturity, the holder must take possession of the commodity, currency or whatever is the subject of the contract, regardless of whether the price of the underlying asset has risen or fallen. An option gives holder a right to trade in the future at a previously agreed price but takes away the obligations. If stock falls, we do not have to buy it after all. An option is a privilege sold by one party to another that offers the buyer the right to buy or sell a security at an agreed-upon price during a certain period of time or on a specific date. Option holder has the right to chose to purchase a stock at a set-price within a certain period Option writer has the obligation to fulfil the choice of the holder: deliver the asset (for call option ) OR buy the asset (for put option ) receives the premium Computational Finance 8/47 Vanilla Options: Call and Put Call option – right to buy particular asset for an agreed amount at specified time in future Put option – right to sell a particular asset for an agreed amount at a specified time in future Example: Consider a call option on IBM stock which gives the holder the right to buy IBM stock for an amount of $25 in one month. Today's stock price is $24.5. amount date $25 which we can pay for stock is called exercise or strike price on which we must exercise our option, if we decide to, is called expiry or expiration date stock (IBM ) on which option is based is known as underlying asset premium Let’s is the amount paid for the contract initially see what may happen over the next month until expiry! Case 1: Suppose that nothing happens – stock price remains at $24.5. What do we do at expiry? - exercise the option, handing over $25 to receive the stock. - !!!! This is not a sensible decision since the stock is only worth $24.5. - not exercise option or if really wanted the stock we would buy it in the stock market for the $24.5. Case 2: What happens if the stock price rises to $29? - exercise the option, paying $25 for a stock, worth $29, and get a profit of $4 Computational Finance 9/47 Types of Options Vanilla Options – simplest ones Call and Put European Options – exercise only at expiry American Options – exercise at any time before expiry Asian Options – payoff depend on average price of underlying asset over a certain period of time Bermudan options – exercise on specific days, periods Exotic Options –more complex cash flow structures Barrier, Digital, Lookback so on Computational Finance 10/47 Options Valuation procedure for assigning a market value to an option market value of an asset is the value for which it could be sold in the market today. – how much is the contract worth now, at expiry, before expiry? – no idea on stock price is between now & expiry but contract has value at least there is no downside to owning option – contract gives you specific rights but no obligations – value of contract before expiry depends on 2 things: – how high asset price is today – the higher asset today the higher we expect the asset to be at expiry, more valuable we expect a call option – how long there is before expiry – the longer time to expiry, the more time for the asset to rise or fall Computational Finance 11/47 Payoff Diagram value of an option at expiry as function of underlying stock price explains what happens at expiry, how much money option contract is worth •right to buy asset at certain price within specific time •buyers of calls hope that stock will increase before expiry •buy and then sell amount of stock specified in contract •right to sell asset at certain price within specific time •buyers of puts hope that stock will decrease before expiry •sell it at a price higher than its current market value Computational Finance 12/47 Call Option Value at Expiry Consider a call option with stock price ST and the exercise price E at the expiry date T Value of a call option is zero or the difference between the value of the underlying and strike price, whichever is greater. C max ST E,0 If ST E holder can purchase a share more cheaply in market than by exercising option If ST E holder receives one share from writer of the call option for price of E then make a profit of ST E Computational Finance 13/47 Put Option Value at Expiry Consider a put option with stock price ST and the exercise price E at expiry date T Value of a put option is zero or the difference between strike price and value of the underlying, whichever is greater. P max E ST ,0 ST E holder sells share to the writer of the put option at price E and makes a profit of E ST If If ST E holder prefers not to exercise the option Computational Finance 14/47 Example What are the payoffs of a call and put option at expiry if the exercise price is £50 and the stock prices are £20, 40, 60, 80? Stock price Buy Call Write Call Buy Put Write Put 20 Max(20-50,0) = 0 0 Max(50-20,0) = 30 -30 40 0 0 10 -10 60 10 -10 0 0 80 30 -30 0 0 Write an option Sell an option Buy call : C max ST E ,0 Write call : - C max ST E ,0 Buy put : P max E ST ,0 Write put : - P max E ST ,0 Computational Finance 15/47 Example Suppose the price of IBM is $666 now. The cost of a 680 call option with expiry in 3 months is $39. You expect the stock to rise between now and expiry. How can you profit if your prediction is right? Suppose that you buy the stock for $666. Assume that just before expiry, the stock has risen to $730. Profit is $64 and the investment rises by Suppose that you 730 666 100 9.6% 666 buy the call option for $39. At expiry, you can exercise the call : pay $680 to receive something worth $730. You have paid $39 and gain $50. Profit is $11 per option. In percentage the profit is value of asset at expiry - strike - cost of call 100 cost of call 730 680 39 100 28% 39 Computational Finance 16/47 Profit Put-Call Parity Suppose that you buy one European call option with strike price of E and you write one European put option with the same strike. Both options expire at T and today’s date is t. At T, payoff of portfolio of call and put options is sum of individual payoffs. Computational Finance 17/47 Put-Call Parity at T payoff of portfolio of call & put options max ST E ,0 max E ST ,0 ST E C P ST E Type Call Option Put Option Portfolio Value ST E ST E C max ST E, 0 0 ST E P max E ST , 0 ( E ST ) 0 ST E ST E Option Value C-P Computational Finance 18/47 Option Pricing Models Approaches to option pricing problem based on different assumptions about market, dynamics of stock price behaviour Theories based on the arbitrage principle, applied The when dynamics of underlying stock take certain forms simplest of these theories is based on binomial model of stock price fluctuations widely used in practice since it is simple and easy to calculate approximation to movement of real prices generalizes one period “up-down” model to multi-period setting Computational Finance 19/47