Document 14940467

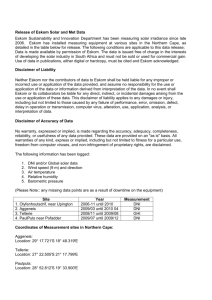

advertisement