Eskom Holdings SOC Ltd Standard Presentation November 2015

advertisement

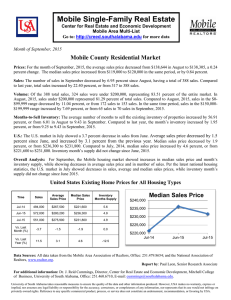

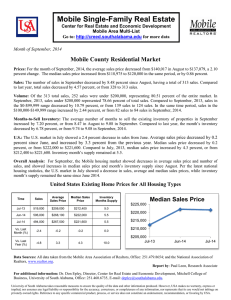

Eskom Holdings SOC Ltd Standard Presentation November 2015 Disclaimer This presentation does not constitute or form part of and should not be construed as, an offer to sell, or the solicitation or invitation of any offer to buy or subscribe for or underwrite or otherwise acquire, securities of Eskom Holdings SOC Limited (“Eskom”), any holding company or any of its subsidiaries in any jurisdiction or any other person, nor an inducement to enter into any investment activity. No part of this presentation, nor the fact of its distribution, should form the basis of, or be relied on in connection with, any contract or commitment or investment decision whatsoever. This presentation does not constitute a recommendation regarding any securities of Eskom or any other person. Certain statements in this presentation regarding Eskom’s business operations may constitute “forward looking statements”. All statements other than statements of historical fact included in this presentation, including, without limitation, those regarding the financial position, business strategy, management plans and objectives for future operations of Eskom are forward looking statements. Forward-looking statements are not intended to be a guarantee of future results, but instead constitute Eskom’s current expectations based on reasonable assumptions. Forecasted financial information is based on certain material assumptions. These assumptions include, but are not limited to continued normal levels of operating performance and electricity demand in the Customer Services, Distribution and Transmission divisions and operational performance in the Generation and Primary Energy divisions consistent with historical levels, and incremental capacity additions through the Group Capital division at investment levels and rates of return consistent with prior experience, as well as achievements of planned productivity improvements throughout the business activities. Actual results could differ materially from those projected in any forward-looking statements due to risks, uncertainties and other factors. Eskom neither intends to nor assumes any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In preparation of this document certain publicly available data was used. While the sources used are generally regarded as reliable the content has not been verified. Eskom does not accept any responsibility for using any such information. 2 Context of this presentation • This presentation consists of a set of slides which provide an overview of Eskom and are based on information contained in the November 2015 Interim Results Report. Users are encouraged to add, delete or adapt slides to suit the requirements of their particular presentation. • Figures are quoted in rands (SA), unless otherwise indicated. The exchange rate applied was that which applied at the end of the financial year (31 March 2015). • The presentation is in a Power Point format and the design and colours have been specifically selected to complement our corporate identity, and for legibility. • Comments, suggestions or requests may be directed to the Corporate Affairs Division. 3 Content of the presentation About Eskom Business performance Financial performance Business update 4 About Eskom • Strategic 100% state-owned electricity utility, strongly supported by the government • Supplies approximately 95% of South Africa’s electricity • Performed 159 853 household electrification connections during the year • As at 31 March 2015: – 5.3 million customers (2014: 5.2 million) – Net maximum generating capacity of 42.0GW – 17.4GW of new generation capacity being built, of which 6.2GW already commissioned – Approximately 368 331 km of cables and power lines – 41 787 employees in the group (2014: 46 919) Generation capacity – 31 March 2015 Hydro Pumped Storage 1.4% 3.4% 4.4% 5.7% Nuclear Gas Coal 42.0GW of nominal capacity 85.1% Sustainability dimensions supporting our strategy Our rapidly changing environment requires a response that will stabilise the business and ensure sustainability To execute our strategy and deliver on our mandate, we focus on eight sustainability dimensions: • Core areas revolve around the tension between financial sustainability, operational sustainability, revenue and customer sustainability and sustainable asset creation • Beyond that, we also need to ensure a positive wider impact on the environment, the contribution to a sustainable skills base, as well as to strategic transformation and social sustainability objectives Safety and security are the foundation for all our operations and are key to our performance and sustainability 6 Infrastructure map 7 Electricity value chain 8 Board of Directors Chairman Dr Ben Ngubane Group Chief Executive Brian Molefe Chief Financial Officer Anoj Singh Independent non-executive Dr Pat Naidoo 9 Independent non-executive Chwayita Mabude Independent non-executive Mark Pamensky Board of Directors Independent nonexecutive Venete Klein Independent nonexecutive Nazia Carrim Independent nonexecutive Viroshini Naidoo Independent nonexecutive Romeo Kumalo Independent nonexecutive Mr Zethembe Khoza Independent nonexecutive Ms Mariam Cassim 10 Independent nonexecutive Mr Giovanni Leonardi Executive Management Committee Brian Molefe Group Chief Executive Mongezi Ntsokolo Distribution Anoj Singh Chief Financial Officer Ayanda Noah Customer Services Thava Govender Transmission 11 Executive Management Committee Elsie Pule Human Resources (Acting) Matshela Koko Generation Abram Masango Group Capital Freddy Ndou Strategy Support Brigadier General (Ret.) Tebogo Rakau Security Suzanne Daniels Company Secretary 12 Plant mix Type Coal-fired Number of stations Number of units Nominal capacity (MW) Percentage to total nominal capacity 13 87 35 721 85.1% Hydroelectric 6 16 600 1.4% Pumped storage 2 6 1 400 3.3% Nuclear 1 2 1 860 4.4% Gas 4 20 2 409 5.7% Wind 1 46 100 0.2% 27 124 42 090 100.0% Total nominal capacity 13 Power stations Station Location Coal-fired stations (13) Nominal capacity MW Year fully commissioned 35 721 Arnot Middelburg, Mpumalanga 2 232 1975 Camden Ermelo 1 481 1967, mothballed in 1990, recommissioned in 2008 Duvha Emalahleni 3 450 1984 Grootvlei Balfour 1 120 1969, mothballed in 1990, recommissioned in 2009 Hendrina Emalahleni 1 793 1976 Kendal Emalahleni 3 840 1993 Komati Middelburg, Mpumalanga 904 1966, mothballed in 1990, recommissioned in 2009 Kriel Bethal 2 850 1979 Lethabo Viljoensdrift 3 558 1990 Majuba Volksrust 3 843 1996 Matimba Lephalale 3 690 1993 Matla Bethal 3 450 1983 Tutuka Standerton 3 510 1990 Power stations Station Location Gas/liquid fuel turbine stations (4) Nominal capacity MW Year fully commissioned 2409 Acacia Cape Town 171 1976 Ankerlig Atlantis 1 327 2007 Gourikwa Mossel Bay 740 2007 Port Rex East London 171 1976 Hydroelectric stations (6) 600 Colley Wobbles Mbashe River 42 First Falls Umtata River 6 Gariep Norvalspont 360 Ncora Norvalspont 2 Second Falls Umtata River 11 Vanderkloof Petrusville 15 240 1985 1976 1977 Power stations Station Location Pumped-storage (2) Nominal capacity MW Year fully commissioned 1 400 Drakensberg Bergville 1 000 1981 Palmiet Grabouw 400 1988 Lutzville 100 2015 Melkbosstrand 1 860 1984 Wind energy (2) Sere Nuclear (1) Koeberg 16 Performance review Performance overview 2014/15 • Net profit for the period increased by 22% to R11.3 billion • Achieved 9% increase in EBITDA to R24.9 billion • Cash flow from operations of R23 billion, a 13% year-on-year increase • R46 billion of the R55 billion funding for the year secured which improved the liquidity position • Received first tranche of R10 billion of government equity injection, R13 billion expected by March 2016 • R60 billion Government loan converted to equity • External auditors did not raise going concern issues • Only 2 hours and 20 minutes of load shedding over the last 107 days, since 8 August 2015 18 Sales and revenue • Electricity volumes continue to decline (1.7% below prior year), largely caused by: o Sluggish economic growth Electricity volumes by customer type1 Commercial and agricultural Mining 14.4%, [+0.5%] 7.0%, [–] Residential Rail 5.6%, [+0.2%] 1.4%, [–] International 5.6%, [+0.1%] o Warmer winter o Depressed commodity prices Municipalities Industrial 42.7%, [+0.6%] 23.3%, [-1.4%] o Load shedding led to sales of 1 108GWh being foregone Electricity revenue 82.68 Cents/kWh 64.89 1. Percentages reflect the sales proportions for the current period. Percentages in brackets are for the change from the period to 30 September 2014. Sep-12 68.97 Sep-13 74.00 Sep-14 Sep-15 19 Electricity sales (as at 31 March 2015) Electricity sales per customer, GWh Category 2014/15 2013/14 Local Redistributors Residential Commercial Industrial Mining Agricultural Rail 204 274 91 090 11 586 9 644 53 467 29 988 5 401 3 098 205 525 91 262 11 017 9 605 54 658 30 667 5 191 3 125 International Utilities End users across the border 12 000 2 797 9 203 216 274 12 378 3 401 8 977 217 903 20 Electricity output (as at 31 March 2015) 2014/15 2013/14 2012/13 Power sent out by Eskom stations, GWh (net) 226 300 231 129 232 749 Coal-fired stations, GWh (net) 204 838 209 483 214 807 851 1 036 1 077 Pumped storage stations, GWh (net) 3 107 2 881 3 006 Gas turbine stations, GWh (net) 3 709 3 621 1 904 0 2 1 13 794 14 106 11 954 Electricity output Hydroelectric stations, GWh (net) Wind energy, GWh (net) Nuclear power station, GWh (net) 21 Power lines (as at 31 March 2015) Transmission power lines, km 765 kV 533 kV DC (monopolar) 400 kV 275 kV 220 kV 132 kV Distribution power lines, km 132 kV and higher 88-33 kV Reticulation power lines, km 22 kV and lower Underground cables, km 132 kV and higher 33 - 88 kV 22 kV and lower Total all power lines, km 31 107 2 235 1 035 18 377 7 361 1 217 882 48 278 24 929 23 349 281 510 7 436 65 361 7 010 368 331 22 Progress on the new build programme Megawatts MW of capacity 261 120 100 794 7 031 5 756 Transmission km lines 787.1 810.9 318.6 102.2 5 918 3 899 Substations MVAs 3 790 2 090 1 120 3 580 20 195 Inception to Mar-12 30 775 Mar-13 Mar-14 Mar-15 Sep-15 Total to date 23 We remain focused on bringing new capacity online P80 dates CO = commercial operation CO in Mar 2015 CO in Aug 2015 CO by Mar 2017 100 794 333 333 800 Aug 2015 Medupi Unit 6 Mar 2017 Ingula Unit 4 Jul 2017 Ingula Unit 1 Jul 2018 Kusile Unit 1 Mar 2015 Sere Wind Farm CO by Jul 2018 CO by Jul 2017 5 620MW Post MYPD 3 Mar 2015 Majuba recovery Jan 2017 Ingula Unit 3 1200 333 CO by Jan 2017 600MW from Unit 3 gap solution in Feb 2015 600MW from Unit 4 in Mar 2015 Mar 2018 Medupi Unit 5 2019/20 Duvha Unit 3 333 794 600 CO by May 2017 CO by Mar 2018 Fully recovered Project falls outside MYPD3 window May 2017 Ingula Unit 2 24 Environmental compliance is critical to our sustainability • Relative particulate emissions performance has remained stable over the last 4 years Relative particulate emissions kg/MWhSO 0.33 0.31 0.33 0.34 Sep-14 Sep-15 • Specific water consumption improved slightly since prior period and year end • Stations have reported 12 incidents under NEMA Section 30, and operated under the exemption for 5% of the time, highlighting the challenge posed by Atmospheric Emission Licences • Limits on ashing storage space may impact security of supply in future; being addressed in technical plans Sep-12 Sep-13 Specific water consumption l/kWhSO 1.35 1.33 Sep-12 Sep-13 1.40 1.37 Sep-14 Sep-15 25 Environmental performance (as at 31 March 2015) Water Specific water consumption, l/kWh sent out 3 Net raw water consumption, Ml 2014/15 1.38RA 313 078 2013/14 1.35RA 317 052 2012/13 1.42 334 275 Emissions Carbon dioxide (CO2), Mt 4 223.4 233.3RA 227.9 Sulphur dioxide (SO2), kt 4 1 834 1 975RA 1 843 Nitrous oxide (N2O), t 4 2 919 2 969 2 980 Nitrogen oxide (NOx) as NO2, kt 5 Particulate emissions, kt Relative particulate emissions, kg/MWh sent out 4 937 954RA 965 82.34 78.92RA 80.68 0.35RA 0.35 34.97RA 35.30 0.37RA Waste Ash produced, Mt 34.41 Ash sold, Mt 2.5 2.4 2.4 Ash (Recycled), % 7.3 7.0RA 6.8 Asbestos disposed, tons 26 991.0 458.0 374.6 Eskom’s socio-economic contribution 72.50 • Good performance against overall B-BBEE compliant spend, and maintained solid performance spend on certain categories of suppliers (black-owned and black youth-owned suppliers) Sep-12 • Eskom Development Foundation committed R63.1 million which benefited 49 867 beneficiaries B-BBEE compliant spend % 87.80 Sep-13 90.50 Sep-14 87.59 Sep-15 Number of electrification connections Number 53 135 • We electrified a total of 41 778 households during the period 57 534 41 778 32 216 Sep-12 Sep-13 Sep-14 Sep-15 27 Procurement equity (as at 31 March 2015) 2014/15 2013/14 2012/13 Local content contracted (Eskom-wide), % 25.13 40.80 ─ Local content contracted (new build), % 33.62LA 54.60RA 80.20RA BBBEE expenditure, R billion 120.5 125.4RA 103.4RA 8.9 9.6RA 5.7RA 47.5 43.6RA 26.47RA 0.9 1.3RA 1.20RA Black women-owned expenditure, R billion Black-owned expenditure, R billion Black youth-owned expenditure, R billion Procurement from B-BBEE compliant suppliers, % 88.89RA 93.90RA 86.30RA Procurement from black-owned suppliers, % 34.91 32.70RA 22.10 Procurement from black women-owned suppliers, % 6.61 7.20RA 4.70RA Procurement from black youth-owned suppliers, % 0.64LA 1.00RA 1.00 Procurement spend with qualifying small enterprises (QSE) and exempted micro enterprises, % of TMPS 28 11.86 11.90 ─ Financial review Financial recovery continues, on the path to financial sustainability Financial performance Key financial ratios Net profit up 22% to R11.3bn EBITDA up 9% to R24.9bn EBITDA margin sustained at 28% Interest cover declined to 1.31 from 1.40 Revenue up 8% Primary energy cost up 7.7% Debt/equity improved to 1.50 from 1.90 Gearing improved to 60% from 66% BPP savings R8.9bn Cash from operations up 13% to R23bn 30 Financial sustainability Electricity volumes and revenue R million 110 766 Operating performance GWh 110 659 36 109 168 71 878 Sep-12 Sep-13 Revenue 81 318 Sep-14 Sep-12 Sep-15 Sep-14 28 24 927 Sep-15 EBITDA margin 1.74 Sep-15 Debt raised to fund capital % 66% 63% 60% 1.72 16 519 13 369 22 784 1.90 25 382 27 452 29 475 23 440 17 804 26 020 Capital outflows (excl capitalised borrowing costs) 28 Solvency Ratio 64% Sep-14 Sep-13 EBITDA Sales volumes R million Sep-13 24 834 87 876 Funding our capital expenditure Sep-12 32 107 307 26 158 76 924 % R million 1.50 Sep-12 Sep-13 Debt/equity Sep-14 Gearing Sep-15 31 Income statement for period ended 30 September 2015 R million Revenue Other income Primary energy Employee benefit expense Depreciation and amortisation Other operating expenses Profit before net fair value gain and net finance cost Net fair value (loss)/gain on financial instruments Profit before net finance cost * Net finance cost Share of profit of equity-accounted investees, net of tax Profit before tax Income tax Net profit for the period Loss for the period from discontinued operations Profit for the period * EBITDA Reviewed period to 30 Sept 2015 Reviewed period to 30 Sept 2014 YoY % change 87 876 81 318 8% 1 369 642 113% (40 999) (38 065) (8%) (13 806) (13 176) (5%) (7 609) (6 672) (14%) (8 845) (8 696) (2%) 17 986 15 351 17% (668) 761 17 318 16 112 8% (3 498) (3 149) (11%) 28 33 (15%) 13 848 12 996 7% (2 539) (3 675) 31% 11 309 9 321 21% – (34) 11 309 9 287 22% 24 927 22 784 9% 32 Sales and revenue • Electricity volumes continue to decline (1.7% below prior year), largely caused by: o Sluggish economic growth Electricity volumes by customer type1 Commercial and agricultural Mining 14.4%, [+0.5%] 7.0%, [–] Residential Rail 5.6%, [+0.2%] 1.4%, [–] International o Warmer winter 5.6%, [+0.1%] o Depressed commodity prices Municipalities o Load shedding led to sales of 1 108GWh being foregone Industrial 42.7%, [+0.6%] 23.3%, [-1.4%] Electricity revenue 82.68 Cents/kWh 64.89 1. Percentages reflect the sales proportions for the current period. Percentages in brackets are for the change from the period to 30 September 2014. Sep-12 68.97 Sep-13 74.00 Sep-14 Sep-15 33 Operating expenses under control • Overall increase of 7% in operating expenses compared to the previous period Operating expenses R million • Primary energy expenses increased by 7.7% year-on-year • Employee benefit expenses increased by only 4.8% for the period • Maintenance cost increased by 11.2% due to our strategy to perform more planned maintenance • Other operating expenses showed a 4.2% decline, due to cost-savings and efficiency initiatives under the BPP programme • Impairment on arrear debt normalised to 1.15% of revenue (September 2014: 0.92%) 6 031 4 500 4 722 3 293 6 500 5 920 5 356 3 340 6 672 13 176 5 130 3 715 7 609 13 806 12 989 11 628 24 973 Sep-12 31 266 Sep-13 38 065 40 999 Sep-14 Sep-15 Other operating expenses, including impairments (down 4.2%) Repairs and maintenance (up 11.2%) Depreciation and amortisation expense (up 14%) Employee benefit expense (up 4.8%) Primary energy (up 7.7%) 34 Primary energy costs Primary energy cost increased by only 7.7% year-on-year Primary energy cost breakdown Production source R million IPPs Other Imports 3% 2% 4% OCGT fuel 3% Nuclear fuel 5% Environmental levy, 10% Other, 0% IPPs, 16% Coal, 52% Imports, 5% Coal 83% OCGT fuel, 16% Nuclear fuel, 1% 35 Financial position Growth in property, plant and equipment (PPE) funded by debt raised R million Reviewed 30 Sept 2015 Reviewed 30 Sept 2014 YoY % change 486 730 432 375 13% 24 104 22 609 7% 43 753 36 986 18% Other assets 63 534 42 364 50% Total assets 618 121 534 334 16% Equity 1 175 717 128 412 37% Debt securities and borrowings 297 449 264 915 12% Working capital 49 330 44 539 11% Other liabilities 95 625 96 468 (1%) Total liabilities 442 404 405 922 9% Total equity and liabilities 618 121 PPE and intangible assets Liquid assets (including cash and cash equivalents) Working capital 534 334 16% 1. Balance includes the R10 billion equity injection and conversion of the R60 billion shareholder loan to equity. 36 Arrear debt and debtors ageing Arrear municipal debt (excluding interest) • Payment agreements signed with 50 defaulting municipalities, including 15 of the top 20 R billion 12 000 10 000 • Approximately 52% of the amount outstanding from municipalities is within the due date 8 000 6 000 4 000 2 000 - Mar-14 Sep-14 Total municipal debt Mar-15 Sep-15 Total arrear debt Electricity debtors age analysis, R million Total 0-30 days 31-60 days > 60 days 8 164 7 795 96 273 11 660 6 759 2 677 2 224 Small power users 1 669 608 165 896 Soweto 9 761 294 269 9 198 Other customers 1 005 1 002 3 1 32 260 16 458 58% 3 210 4% 12 592 38% Large power users, excluding municipalities Large power users, municipalities Total at 30 September 2015, gross amount % of gross amount 100% 37 Abridged cash flow statement Reviewed 30 Sept 2015 Restated Reviewed 30 Sept 2014 YoY % change 23 040 20 368 13% (26 518) (26 498) – Net cash from/(used in) financing activities 7 430 (625) 1 189% Movement for the period 3 952 (6 755) 8 863* 19 676** (55%) (5) 36 17 15 (129%) 140% 12 846 12 953 (1%) 24 104 22 609 7% R million Net cash from operating activities Net cash used in investing activities Cash and cash equivalents at beginning of the period Foreign currency translation Effect of movements in exchange rates on cash held Cash and cash equivalents at the end of the period Total liquid assets (including cash and cash equivalents) * As at 31 March 2015 ** As at 31 March 2014 38 Through adequate funding, we maintained operations and capital commitments R million 23 040 (5 594) (10 503) 10 000 24 302 (2 298) (24 419) 24 104 17 359 24 104 16 519 8 863 (117) Mar-15 Liquid assets Cash generated from operating activities Debt repaid Interest paid Balance before Capital Balance before investing expenditure funding (incl future fuel) Funding raised Share capital issued Other Sep-15 Liquid assets 39 Operating performance Generation fleet performance starting to stabilise • There has been an increase in planned maintenance and Generation implemented the Tetris maintenance planning tool supporting the execution of more planned maintenance without load shedding Planned maintenance (PCLF) % 13.33 7.86 8.73 8.96 Sep-13 Sep-14 • Plant availability (EAF) has improved to 74.4% as on 16 November 2015 due to the positive impact of planned maintenance • Balancing supply and demand remained a challenge for the first quarter of the financial period. The second quarter showed significant improvement with only 2 hours and 20 minutes of load shedding from 8 August until 30 September 2015 Sep-12 Sep-15 Plant availability (EAF) % 81.18 78.42 76.77 Sep-13* Sep-14* 70.39 74.40 • System stability has improved since August 2015 • Partial load losses have reduced easing pressure on the constrained power system Sep-12* • Plant utilisation remains high at 84.77% * = average for the period Sep-15* on 16-Nov 41 Securing Eskom’s resource requirements Coal stock days 57 53 Sep-12 • The interim solution after the collapse of the main coal silo at Majuba Power Station has been completed; work has commenced on a permanent solution 46 44 Sep-13 Sep-14 • A total of 57.27Mt of coal burnt during the period Sep-15 • Migration of coal deliveries from road to rail slightly below prior year due to tippler problems at Majuba Road-to-rail migration Mt 6.57 5.00 Sep-12 6.21 5.40 Sep-13 Sep-14 Sep-15 42 Supplementary supply adds to generation capacity Energy purchases from IPPs GWh 3 998 2 665 1 685 Sep-12 • A total of 5 817MW contracted with IPPs, of which 3 900MW under DoE’s RE-IPP programme 1 866 Sep-13 • 3 267MW of independent power producers (IPPs) (2 021MW RE-IPPs and 1 246MW other) connected to the grid at an average load factor of 28.5% Sep-14 Sep-15 OCGT production GWh 2 961 • Bid quotes for window 3.5 and 4.1 bid issued to IPPs • Dispatchable load of 1 463MW is available under the demand response programme, assisting in balancing supply and demand • Open-cycle gas turbine (OCGT - diesel) is still being used to supplement generation capacity 1 206 1 164 Sep-13 Sep-14 417 Sep-12 Sep-15 • Balancing supply and demand remained a challenge for the first quarter of the financial period. The second quarter showed significant improvement with only 2 hours and 20 minutes of load shedding from 8 August until 30 September 2015 43 Safety and security are central to our overall performance LTIR performance • Lost-time injury rate (LTIR) performance worsened slightly compared to the prior period 0.40 0.35 Sep-12 Sep-13 0.36 0.32 Sep-14 Sep-15 2 8 2 1 10 23 7 Sep-12 Sep-13 Public Contractors • Public fatalities, mainly from electrical contact and motor vehicle accidents, remain a key focus area • Implementation of a strategic response to the 2014 Construction Regulations, which imposed additional safety compliance responsibilities, is in progress Fatalities 1 • The number of fatalities – employee, contractor and public – have increased against the prior period, and remain unacceptably high 6 9 10 10 Sep-14 Sep-15 Employees 44 Internal transformation and skills development • 783 temporary employees were permanently appointed in line with the requirements of the Labour Relations Act amendments • Racial and gender equity at senior, middle management and professional levels show significant progress over the past five years • We continue to contribute to building skills in South Africa, through our learner pipeline, job creation under the new build programme and other skills development initiatives Headcount (including FTCs) Number 46 624 46 370 46 687 Sep-13 Sep-14 Sep-15 44 913 Sep-12 Number of learners 2 518 2 040 733 2 000 822 2 042 808 908 2 052 2 269 1 817 Sep-12 Sep-13 Sep-14 Engineering learners Technician learners 1 268 Sep-15 Artisan learners 45 Conclusion The way forward… • Eskom is driving several initiatives to ensure its turnaround • Cost efficiencies are targeted, particularly through lower coal cost escalation • Our liquidity position improved, through funding raised and the equity injection by the shareholder • We remain focused on delivering on our capital expansion programme • We will continue to supply the country’s electricity and maintain our plant – no load shedding is anticipated 47 Thank you