AgVentures Marketing Grain Facilitator’s Notes Determining Cost of Production

advertisement

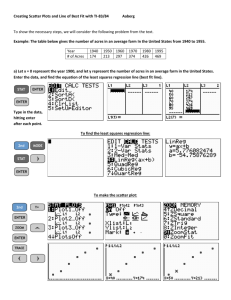

Facilitator’s Notes – COP AgVentures Marketing Grain Facilitator’s Notes Determining Cost of Production TIME ALLOWED: Plan to use approximately 2 hours minimum to work completely through this section with participants. On occasion, this section has been split up into two one-hour presentations with a meal or game in between. OBJECTIVE(S): 1. Demonstrate how producers can utilize available financial data to determine reasonable cost of production estimates for each cropping enterprise. 2. Determine target prices to meet the priority needs of the farm and family. INTRODUCTION: Hour 1 – Determination of your Budget Based Adjusted Cost of Production (BBACOP) using production costs from the Farm Tax Schedule F form. Using the Farm Schedule F in combination with the BBACOP method that adjusts cost of production using established enterprise budgets, producers will be able to calculate their basic costs of production of various crops in their rotation. The basic costs are considered to be the basic target market prices needed for each crop in the rotation. Hour 2 – Determination of market target prices as determined by the farm family goals and priorities. Producers can utilize the basic costs determined in Hour 1 to calculate additional individual target price levels for each crop in the rotation based upon various Schedule F expenses along with various needs and priorities as established by the producer and his/her family. Grain Marketing Facilitator’s Notes – COP Slide 1 This presentation will walk you though one of several methods of determining the cost of production (COP) for each of your cropping enterprises. This method has several advantages over others. The COP estimate provides a “reasoned” base estimate for setting target prices, the method is more accurate than most other methods and the estimate can be determined in a short amount of time. Slide 2 We know that that over time, net farm income has been relatively level with the exception of a few short-term spikes, especially in the late 70’s and early 80’s. Over the years expenses have continued to rise, depressing the gross receipts of the farm. Essentially, it is becoming more and more difficult to remain profitable. Slide 3 In order to manage price risk, we need to use and rely on information to help make better marketing decisions. Slide 4 Knowledge of your Cost of Production is essential for making sound marketing decisions. (At this point you might ask, “December contracts offer you $2.40 per bushel corn. Is that a good price? It’s likely that some producers may say yes, while others say no. Ask what they are basing their decision on. Is their response based on actual costs of production, or what they think the future prices will do?) Slide 5 Like mentioned earlier, there are many ways of arriving at a cost of production. Producer’s knowledge of their cost of production falls along some point of a continuum as illustrated by the diagram at the bottom of this slide with points labeled from A to E. Slide 6 At point A of the continuum, we might expect the producers COP estimate to be an approximated guess. The cost estimate may be based on popular press, University or Industry estimates with little consideration of the actual costs that occur on that producers farm. Grain Marketing Facilitator’s Notes – COP Slide 7 At point B of the continuum, the producer’s COP estimate is based on total crop expenses. Those costs are allocated between crop enterprises and the figures are based on acres and yields from the actual farm. This approximation of COP is likely better than that of a producer at point A, but still is not very accurate. Slide 8 At the next level of improvement illustrated by Point C of the continuum, producers use University and/or industry estimates to determine production costs. Often time this data is derived from pooled information from a variety of sources. However, generally these estimates do not take into account all of the expenses that should be considered for a specific farm. This approximation is accurate for the pooled data, but the producer’s actual costs may be higher or lower than calculated. Slide 9 At the other extreme of the continuum is point E. This level of skill and knowledge usually requires advanced record keeping skills. Producer’s develop detailed budgets for each enterprise of their operation. Point E likely signifies the most accurate COP estimates. However, this method has some limitations. Slide 10 There are many challenges with determining an accurate COP estimate. First, an accurate COP estimate takes a great deal of time and effort. Detailed record keeping is essential for the accuracy of the data. Furthermore, accurate data is often difficult to obtain or unavailable. Information from input suppliers may be lacking, combined with other inputs from other enterprises or confusing to separate out. Slide 11 Allocations of resources between enterprises is also difficult. Record keeping needs to track fuel usage by crop, labor hours per crop, capital ownership and use which includes the DIRTI five (depreciation, interest, repairs, taxes and insurance). Grain Marketing Facilitator’s Notes – COP Slide 12 Today we will introduce an easier method to accurately determine your specific COP. The method is called the Budget Based Adjusted Cost of Production (BBACOP) method. Slide 13 What is the Budget Based Adjusted Cost of Production? It is a method that allows you to determine your COP that fits point D of the continuum. It may not be as accurate as detailed enterprise budget analysis but the method far exceeds points A, B, or C on the continuum. Slide 14 The method is based on COP research from Midwestern States data sets that show a relationship between production expenses for corn and soybeans. It also adjusts for individual producers that may have higher or lower than “average” production costs. Slide 15 As we began comparing data sets, an interesting relationship began to emerge. This slide illustrates the cost ratio between corn and soybean using PEPS (Profits Through Efficient Production Systems) data. The average cost ratio was calculated to be 1.244 meaning that it cost that much more to produce corn than soybeans. Slide 16 Although the production costs collected from Illinois Farm Bureau Farm Management appear higher, perhaps because more overhead costs were included, the average cost ratio is 1.238. Slide 17 Likewise, data from an Iowa Farm Costs and Returns report indicate an average cost ratio of 1.231. Overall we see trends in production cost differences between cropping systems. These differences in costs between cropping systems are a component to the success of the BBACOP method. Slide 18 There are several advantages of the BBACOP method. The COP estimate calculated by the BBACOP method is a “reasoned” base estimate for setting target prices. The estimate is more accurate than Most other methods and the estimate can be determined in a short amount of time. Grain Marketing Facilitator’s Notes – COP Slide 19 In addition, the estimate is adjusted for high- and low-cost producers. The amount of financial information and production numbers needed for the BBACOP method is very minimal. Slide 20. What information is needed? For a cash crop producer all that is needed is the Tax Schedule F from last year. This will include the total Schedule F expenses, total interest paid, depreciation claimed and wages and benefits paid. Slide 21 The producer will also need to document change in accounts payable and prepaid expenses (if applicable), acres of each crop in the rotation and finally estimate the yield for next year. Slide 22 In a few moments we will begin to walk through the step-by-step process of determining your COP using the BBACOP method. This method provides a more accurate way to determine COP estimates for setting target prices. You will also notice that once you have worked though the process, this method offers a much faster way of determining your COP. Note: At this point we begin the process which starts on the following page walking the participants through the BBACOP method. Grain Marketing Facilitator’s Notes – COP Able Acres Example Crop Marketing Plan Able Acres Example - Business and Family Situation as of January 1 The Able Acres decision-makers are sitting down on New Years Day to talk business. They want to get an early start by developing a marketing plan for the crops that they plan to grow. They realize that there are many factors that can influence crop prices throughout the year – weather, domestic use, exports and local supply and demand situations to name just a few. Able Acres has done a so-so job of marketing their production in recent years. They believe that part of their problem is a lack of confidence in knowing the prices they need to meet production, business and family goals. Able Acres has decided that one of the first steps in developing a marketing plan is to determine some target prices for the crops they plan to grow. These target prices will help them evaluate prices available to them from the market. Able Acres does not know the cost of production for the crops they grow. They have decided to use Budget Based Adjusted Cost of Production estimates to determine target prices they can use in the development of their marketing plan. Information for Worksheet 1A: Determination of Basic Cost of Production First, the Able Acres decision-makers pull out copies of their Schedule F tax returns and end of the year balance sheets for the last 4 years. They have operated about 2000 acres for the past several years. For the coming year they plan to grow 1200 acres of corn, 700 acres of soybeans and 100 acres of hay. For the coming year Able Acres projects the following: Total Schedule F Expenses: Able Acres has gone through their Schedule F tax returns for the past several years and have made projections for each of the expense categories. They are projecting total Schedule F expenses to be $561,500. Accounts Payable: There has been $4,700 in accounts payable at the end of each of the past two years. No change is anticipated in accounts payable at the end of the coming year. Prepaid Expenses: For tax planning purposes and to take advantage of year-end discounts, Able Acres has tended to increase their year-end prepaid expense purchases. For the coming year-end prepaid expenses are projected to increase $5500 Livestock Expenses: Able Acres does not plan to raise any livestock in the coming year. Grain Marketing Facilitator’s Notes – COP Total Interest Paid: Able Acres has been trying to pay down their debt and total farm liabilities have been decreasing. Interest rates are also expected to be lower in the coming year. Interest expense is projected to be $41,500. Wages and Benefits Paid: For the past three years, wages and benefits paid have been $33,000, $24,950 and $32,700. Hired labor expenses are expected to be considerably higher this year with a projected total of $41,500 ($33,000 labor hired and $7,500 employee program benefits). Depreciation Claimed: Able Acres has purchased additional farm machinery and equipment over the past few years. They expect to claim roughly $30,000 of depreciation in the coming year. [Worksheet 1A Can Now Be Completed] From Worksheet 1A, Able Acres’ total projected Basic Cost of Production is $444,000 Information for Worksheet 1B: Calculation of Adjusted Basic Crop Production Costs Able Acres will use Worksheet 1B to determine a Budget Based Adjusted Cost of Production estimate for each of the crops they plan to grow in the coming year. Able Acres is planning to raise 2000 acres of crops in the coming year – 1200 acres of corn, 700 acres of soybeans and 100 acres of hay. Of the total 2000 acres, Able Acres determines that 60% of their planned crop rotation will be in corn (1200 divided by 2000), 35% in soybeans (700 divided by 2000) and 5% in hay (100 divided by 2000). The list of crops to be raised, planned acres and percent of each crop in the rotation are written in columns a, b and c. UW-Extension has developed estimated crop budgets for Central Wisconsin, Southern Wisconsin and a Wisconsin Dairy Farm. These crop budget figures are shown in the table below Worksheet 1B. Detailed information about these estimated crop budgets is presented in the Appendix. Able Acres is located in Southern Wisconsin. Using the budget figures, Able Acres multiplies the acres of crops in the planned rotation (column b) by the crop budget figure for each crop in the planned rotation. These figures are placed in column d. For example, 1200 acres of corn multiplied by $259.75 per acre for corn in Southern Wisconsin provides a cost of $311,700 that is placed in column d. Based on the crop budget figures, Able Acres’ total basic cost of production would be $460,231 based on Southern Wisconsin data. This figure is $16,231 higher than the predetermined basic cost of production value of $444,000 that Able Acres determined in Worksheet 1A. In other words, Able Acres has a cost of production that is lower than average for Southern Wisconsin. Able Acres now determines the percent of the total $460,231 budget based cost that would be attributed to each of the crops Able Acres plans to grow. To do this Able Acres divides the total expected cost for each crop (column d, $311,700 for corn for example) by the total expected cost of all crops ($460,231) and enters the figure for each crop in column e. 67.7% of total Grain Marketing Facilitator’s Notes – COP expected crop expense would come from corn, 27.7% of total expected crop expense would come from soybeans and 4.6% of total expected expense would come from hay. Using the $444,000 total basic costs determined in Worksheet 1A, Able Acres now uses the budget based percentage of total costs to determine the basic costs they can expect for each of the crops they plan to grow in the coming year. To do this Able Acres multiplies the projected $444,000 total basic costs by the percentage of total costs for each crop listed in column e. These figures are placed in column f. Able Acres determines that they can expect the basic costs for corn to be $300,707, the basic costs for soybeans to be $123,069 and the basic costs for hay to be $20,224. The expected cost per acre for each crop is now determined. This is accomplished by dividing the total expected costs for each crop (column f) by the acres of each crop Able Acres plan to grow in the coming year. These figures are entered in column g. Able Acres’ basic cost to raise an acre of corn, soybeans and hay is $250.59, $175.81 and $202.24 respectively. In column h, Able Acres enters its estimated yields, 150 bushels of corn, 50 bushels of soybeans and 5 tons of hay. Using the total basic cost per acre for each crop and the estimated yield for each crop, Able Acres is now able to determine the basic cost per unit of yield for each of the crops they plan to grow - $1.67 per bushel for corn, $3.52 per bushel for soybeans and $40.45 per ton for hay. Able Acres understands that these are estimates for prices to cover only the basic costs of production for each crop, that is, Schedule F Expenses excluding projected interest, wages and benefits and depreciation. [Worksheet 1B Can Now Be Completed] Determining and Prioritizing Farm Business and Family Goals List of Farm Business and Family Goals: The Able Acres decision-makers and other family members sat down and discussed what farm business and family goals they want the crop enterprises to pay for. They did not try to hold themselves to reality at this point. Rather, they let their minds wonder and dream about what their crop business would pay for in a perfect world so to speak. Setting Priorities: Finally, the family came to the difficult decision of prioritizing what they are going to pay for first, second, third, etc. Table 1 summarizes their results. They took into consideration what absolutely had to be paid for to stay in business and those family goals that are a must. One of their tractors needs to be replaced as soon as possible. They, of course, want to keep the bank happy and some minimal level of family living has to be a priority. Of utmost importance for them is paying the basic costs of production – seed, fertilizer, chemicals, land rent and other production expenses. They enjoyed a good reputation in the county and very much desired to maintain that. Paying their hired help (family and non-family) was also right up there at the top of their priority list. The far-left column of Table 1 gives the final priority Grain Marketing Facilitator’s Notes – COP ranking results. Able Acres is surprised to know that to meet all of the identified business and family goals they need $645,500. TABLE 1 Able Acres Production Costs and Farm Business and Family Goals To Be Paid By Crops in the Coming Year Priority For Payment 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Cost/Goal Basic Costs Interest Wages & Benefits Term Debt Service Minimum Family Living Draw Additional Family Living Draw Tractor Replacement Field Cultivator Grain Storage Bin Winter Vacation College Fund Replace Pickup Truck Savings Savings Price to Meet All Goals Estimated Total Dollar Needs This Coming Year $444,000 41,500 40,500 32,000 18,000 12,000 8,500 9,500 18,000 3,500 2,500 5,500 5,000 5,000 $645,500 Information for Worksheets 2A, 2B and 2C: Estimating, Prioritizing, and Determining Price Targets To Meet Production, Business and Family Goals Able Acres now has the task of determining some target prices for the three different crops they plan to grow – corn, soybeans and hay. They do this by completing a Worksheet 2 for each crop they plan to grow. To begin, the costs to meet production, business and family goals are arranged in prioritized order, starting with the $444,000 needed to cover the total basic production costs and ending with their second $5000 goal for savings. Previously, in Worksheet 1A Able Acres determined that the percent of total costs by crop is 67.7% for corn, 27.7% for soybeans and 4.6% for hay. In worksheets 2A for corn, 2B for soybeans and 2C for hay, they use these same percentages to determine the amount each crop should contribute to pay for the basic financial costs & goals to be achieved. To do this, Able Acres multiplies the amount needed for each item of the basic financial costs & goals to be Grain Marketing Facilitator’s Notes – COP achieved by the percent of total costs to be paid by each crop. For example total basic costs are projected to be $444,000. As a minimum, Able Acres would like their 1200 acres of corn to pay for 67.7% ($300,707) of that cost. Likewise, for the final $5,000 Able Acres would like to save, $3,386 would come from the corn enterprise ($5,000 multiplied by 67.7%). Finally, to determine the price per unit of yield needed for each cost/goal item, Able Acres divides the amount each crop should contribute by the total yield projected for each crop. For example, the $300,707 amount that corn should contribute to pay for total basic production costs translates to $1.67 for each unit of the estimated yield of 180,000 units (in this case bushels). Likewise, for the final $5,000 Able Acres would like to save, an additional $.02 per unit (bushel) will be needed. [Worksheet 2A, 2B, 2C and 2DCan Now Be Completed] Information for Worksheet 3: Summary of Cumulative Crop Price Needs to Meet Target_ Worksheet 3 carries the price per unit of yield needed for each crop (Worksheet 2A, 2B and 2C) one-step further. In Worksheet 3 Able Acres sees the cumulative price needed for each crop to pay its share of the total basic financial costs & goals to be achieved. As we found in Worksheet 1B the basic cost per unit of yield stays the same for all three crops - $1.67 per bushel for corn, $3.52 for soybeans and $40.45 per ton of hay. [Worksheet 3 Can Now Be Completed] Information for Worksheet 4: Finally, the Able Acres decision-makers determine some price targets. They know that they can always go back to Worksheet 3 for more detailed information. They start by looking back over Worksheet 3 to determine what costs/goals can be grouped together in common categories of priority. They follow the four suggested descriptions of priority categories as shown on worksheet 4 to determine a Red, Blue, and Purple Ribbon price target. For Able Acres the Red Ribbon Target Price is a “breakeven plus” price goal. This target price would cover total basic costs, interest costs and wages and benefits. To achieve this cost/goal Able Acres has target prices of $1.98 per bushel for corn, $4.17 per bushel for soybeans and $47.92 per ton for hay. The Blue Ribbon Target Prices are at a level that Able Acres believes their farm business will be successful. In addition to covering all the costs/goals of the Red Ribbon Price, the Blue Ribbon Target Price pays for the term debt service, the minimum family living draw, the additional family living draw and the tractor replacement. To achieve this cost/goal Able Acres has target prices of $2.24 per bushel for corn, $4.72 per bushel for soybeans and $54.34 per ton for hay. The Purple Ribbon Target Prices are above expectations. The Purple Ribbon Target Prices pay for all of the costs/goals of the Blue Ribbon Price as well as $9,500 for the field cultivator, Grain Marketing Facilitator’s Notes – COP $18,000 for the grain storage bin, $3,500 for the winter vacation, $2,500 for the college fund, $5,500 for a pickup truck replacement and $5,000 for savings. . To achieve this cost/goal Able Acres has target prices of $2.41 per bushel for corn, $5.07 per bushel for soybeans and $58.35 per ton for hay. Grand Champion Target Prices reflect an exceptional market. At these prices Able Acres will be able to put even more money ($5,000) into savings. To achieve this cost/goal Able Acres has target prices of $2.43 per bushel for corn, $5.11 per bushel for soybeans and $58.80 per ton for hay. Finally however, Able Acres decides they should add a fifth category that describes for them a “drop dead” price that just covers production costs. Paying their bills is very important to them. Even in the toughest of times, the family has made sure the bills got paid. If they have to borrow money for family living, etc. then so be it, but they all agree that one major price target for them is one that allows the production costs to be paid. They title this their “drop dead” price. It’s the prices needed to cover just the basic costs of production; $1.67 per bushel for corn, $3.52 per bushel for soybeans and $40.45 per ton for hay. In addition to Worksheet 4, Able Acres highlights the 4 target price levels they have determined on Worksheet 3. [Worksheet 4 Can Now Be Completed] Grain Marketing